Welcome back to The Node Ahead, a cryptocurrency and digital asset resource for financial advisors. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we’ll review the top 4 stories of the year:

- The collapse of several major crypto companies

- Ethereum’s merge to Proof-of-Stake

- Adoption expanded globally

- Bitcoiners prove they have diamond hands

The 4 most important stories of 2022

Even by crypto standards, 2022 was a wild year. For veterans of the industry who have lived through multiple bubbles and crashes, this was one of, if not the most chaotic years anyone has experienced. There was no shortage of stories that were worthy of making our top four list in any other year. Remember the unbelievable story of the DOJ recovering $3.2 billion originally stolen from the Bitfinex hack back in 2016, from a Forbes contributor, influencer, and hilariously bad rapper that went by the name of Razzlekhan? Yeah, I forgot that happened, too—in crypto-years, it feels like a lifetime ago.

Honorable mentions

We spent numerous issues (here, here, here, here, and here) not only dispelling the myth that bitcoin mining is bad for the environment but showing how it might be one of our best tools for incentivizing the growth of clean and renewable energy technology. We dissected why many of the collapses this year can be traced back to GBTC flipping from a premium to a discount, covered FASB’s change in crypto accounting rules which should make it easier for corporations to hold digital assets (here and here), broke down the impact Ripple’s lawsuit with the SEC could have on the entire industry (here and here), and explained why the economics of bitcoin miners have deteriorated over the course of the year. Bitcoin was used to provide financial resources to protestors in Canada when the government imposed sweeping financial sanctions on its own citizens, NFTs were used to raise money for charities, and crypto became a lifeboat for Ukrainian citizens who lost access to the traditional banking system during the Russian invasion. We had an executive order issued by president Biden calling for studies on the industry, the most comprehensive regulation put forth in the Responsible Financial Innovation Act, and a drastic increase in the number of politicians embracing crypto many of which recently got elected. We saw Bitcoin 2022 become the largest crypto conference ever, creators of Bored Ape Yacht Club acquire the rights to CryptoPunks, thus consolidating the two largest NFT collections under one brand, and witnessed the launch of the Taro Network on Bitcoin.

And yet, none of that made it into our top four. I told you it was a wild year. So, without further ado, let’s recap the most important stories from the past year.

1. The collapse of several major crypto companies

Prior to this year, the crypto industry endured the Silk Road in 2013, the Mount Gox hack in 2014, the DAO hack in 2016, and the Bitfinex hack in 2016. Those were arguably four of the most painful events in crypto’s first 12 years, but at least they were relatively spread out. In contrast, 2022 saw the collapse of LUNA, Three Arrows Capital, Celsius, Voyager, Blockfi, and FTX—all within seven months. All of this comes along with the precarious positions Genesis and DCG currently find themselves in. Frankly, we could have easily dedicated this entire issue to recapping all the various crashes, but instead, we decided to bundle the biggest collapses into one mega story from 2022.

Terra / LUNA – On May 7, the algorithmic stablecoin terraUSD (UST), which was supposed to maintain a constant price of $1, lost its peg and fell to 30 cents. Its companion token, LUNA, which was meant to stabilize UST’s price, fell from $80 per token to a few cents. All in all, roughly $40 billion worth of value was vaporized in a matter of three days. In our May 17th issue, we chronicled what went wrong and how LUNA collapsed so quickly.

Celsius – At the start of the year, Celsius was one of the largest “crypto banks” with over $11 billion in cryptoassets under custody. However, Celsius never disclosed to its customers how they were generating yield or what risks they were taking. As it turned out, the rates they were offering their customers were being generated from some of the riskiest parts of the crypto market (including the aforementioned LUNA). In our June 28th issue, we highlighted some of the risky bets that blew up. As a result, Celsius was forced to halt withdrawals, and in July, the company filed for bankruptcy.

Three Arrows Capital (aka 3AC) – At one point, 3AC was one of the most highly regarded investment funds in the crypto industry but after getting caught on the wrong side of the GBTC trade and losing even more in LUNA, the fund quickly collapsed. The firm’s implosion was a result of both recklessness and fraudulent behavior, as the founders routinely misrepresented their assets and solvency to lenders. Making matters worse, a wide swath of players, including many of the industry’s largest lenders, lent capital to 3AC based on falsified information. Thus, when the fund imploded, not only did it destroy $10 billion of firm capital, but it also triggered a domino effect that wiped out many other companies and forced a drastic sell-off in bitcoin and other tokens. The firm filed for bankruptcy, and liquidators still do not know the whereabouts of the two founders, who are believed to have fled to a non-extradition country.

FTX – In a matter of 72 hours, FTX went from the second largest crypto exchange in the world to insolvent, all because of a single Coindesk article and one well-timed tweet. We chronicled the series of events that caused FTX to collapse in our November 15 issue. In that article, we theorized that based on the on-chain data, the trouble first stemmed from losses earlier this year, which Sam Bankman-Fried then used customer funds to cover up. Turns out it was much worse than that because, according to official allegation filings against SBF, he was apparently stealing customer assets from the inception of FTX back in 2019. Sam Bankman-Fried has since been arrested and charged with wire fraud, securities fraud, and money laundering, which could mean up to 115 years in prison.

All in all, the various collapses over the course of the year totaled over $100 billion in value destroyed, and that is before you consider the impact these collapses had on the price of other tokens. The silver lining here is that the industry has flushed out an incredible amount of fraud and hidden leverage in this ecosystem, providing a much more solid foundation from which to grow.

2. Ethereum’s merge to proof of stake

At 2:45 am ET on Thursday, September 15th, Ethereum successfully transitioned its consensus mechanism for validating transactions from proof of work to proof of stake. Whereas proof of work blockchains such as bitcoin rely on miners contributing computing power to validate and secure the network, proof of stake is operated by validators who deposit cryptoassets (otherwise known as “staking”). This transition was one of the most impressive engineering feats ever accomplished and will likely be remembered as one of the most historic events in crypto’s history.

Thanks to years of planning, rigorous testing, and numerous trial runs on separate test nets, Ethereum developers accomplished this feat without a hitch. Block production was successfully passed over to validators on the consensus layer without any disruption to transactions or coordination issues. Validator uptime was near perfect, and the network has remained steady ever since.

In our August 23rd issue, we did an in-depth breakdown of the merge and the implications moving forward. Then in our November 1st issue, we analyzed the data on the post-merge Ethereum network. In case you do not want to revisit those articles, the quick overview is that the merge paves the way for numerous protocol-level upgrades that will be far easier to implement in a proof of stake system. In time, this should lead to much greater scalability and cheaper transactions. The Merge also drastically reduced the issuance of new ETH, as many anticipated. However, since activity volumes have been down due to bear market conditions since the Merge, the ETH burn rate hasn’t been high enough to turn ETH deflationary yet. This will be an interesting metric to watch heading into 2023.

3. Adoption expanded globally

Humor me for a second, will you? Imagine if I told you that over the course of 2022, major corporate brand names began implementing crypto, nearly every bank, firm, and service provider on Wall Street started providing crypto services, numerous countries passed laws legalizing crypto and the usage of crypto for everyday transactions grew exponentially in many emerging markets. Imagine if studies showed that nearly two-thirds of institutional investors expect to increase their exposure to cryptoassets, 90% of retailer investors are expected to invest in crypto in the next few years, and 75% of retailers planned to accept crypto or stablecoin payments within the next two years. Does that sound like a year in which prices would fall 75% or more off their all-time highs?

And yet, that is exactly what happened. The truth is adoption grew tremendously in 2022, but that was easy to miss, given the headlines and price action throughout the year. However, it’s important to realize prices fell not because the technology didn’t work or people stopped using crypto. Prices tumbled for reasons that had nothing to do with the underlying fundamentals of many of the most prominent networks. One of the recurring themes in this newsletter is the concept that because the crypto market is still young and inefficient, token prices are a poor indicator of the long-term trajectory of this industry. For that, we need to revisit all the signals that point to growing adoption throughout 2022.

Corporations

2022 saw many major brands make their foray into the crypto industry. Google signaled a major crypto push this year with support for web3 infrastructure, including integrations with Ethereum and Solana, a hiring spree to expand its blockchain business, and a partnership with Coinbase to accept cryptocurrency payments for cloud services. YouTube is looking at how it can support the creator economy through the use of crypto and web3, Salesforce is planning an NFT Cloud, and Intel is getting into bitcoin mining, announcing they will unveil an ultra-low voltage bitcoin mining ASIC. Trading app Robinhood wants cryptocurrencies to be a central part of its business strategy and is developing a standalone crypto wallet compatible with NFTs so that users can store their digital assets, withdraw crypto, and link to NFT marketplaces. Over 400 million PayPal users can now send tokens to external addresses, Cash App users can now send and receive bitcoin via the Lightning Network, and payments giant Stripe now supports payments in bitcoin and crypto. Strike, the company that helped facilitate bitcoin payments in El Salvador, launched bitcoin payment services in Argentina as well as enabled remittance payments to Africa over the lightning network.

But it wasn’t just tech companies. Apparel giant Nike has launched a new Web3 platform called Swoosh to sell NFTs. Other brands that are selling NFTs include Adidas, Disney, Walmart, Coca-Cola, Anheuser-Busch, Gamestop, Taco Bell, and Pizza Hut. McDonald’s now accepts bitcoin in Switzerland and other countries. Starbucks now offers an NFT-based loyalty program, and Warner Music partnered with Sandbox to create a combination of a virtual musical theme park and music venue. Mastercard is looking to get in on the adoption as well by launching a new service called Crypto Source which will make it easier for banks to offer cryptoasset trading to their clients. Earlier in the year, Mastercard also partnered with Coinbase so that users of the crypto exchange would be able to make purchases with Mastercard credit and debit cards. Not to be outdone, Visa partnered with more than 65 crypto platforms meaning 100 million vendors worldwide are now accepting crypto payments, and American Express partnered with Abra to offer crypto reward credit cards. The largest U.S. oil and gas company, Exxon Mobil, is using excess natural gas to mine bitcoin and is considering expanding to four more countries. And if you are thinking about your taxes for the end of the year, TurboTax is now offering customers the ability to receive their tax refunds in cryptoassets.

State Adoption within the US

While the federal government has largely been reluctant to pass any national legislation, crypto is quickly being embraced by numerous states. Wyoming has some of the most crypto-friendly regulations in the world, with over 20 laws to make it easier for crypto businesses to operate, and became the first state to adopt an entirely new legal framework for Decentralized Autonomous Organizations (DAOs). Beyond its crypto initiatives, Wyoming also has no state income tax and no state bitcoin tax.

Texas has done an amazing job of attracting bitcoin miners with tax credits, training, and other incentives to become the bitcoin mining capital of the US, if not the world. In fact, Fort Worth became the first city government in the U.S. to mine bitcoin. In addition, the state has passed several bills to improve its crypto regulatory framework, including a bill that recognizes the legal status of cryptocurrencies and paves the way for banks to provide custody services for cryptoassets.

On May 4th, California Governor Gavin Newsom issued an executive order to begin creating a comprehensive regulatory framework for crypto with the goal of “creating a transparent and consistent business environment for companies operating in blockchain.” Then later in the year, California Assemblyman Jordan Cunningham introduced a bill that would make cryptoassets an acceptable form of tender for goods and services in the state of California. This now makes California the second state, the other being Arizona, attempting to make cryptoassets legal tender in this country.

Florida has not only become home to the largest bitcoin conference in the world, but the Governor of Florida also proposed accepting crypto for state tax payments. Hawaii began the process of passing pro-crypto regulations. The state of Tennessee is preparing to hold cryptoassets in its treasury, Colorado now accepts crypto payments for state taxes, and both Georgia and Illinois lawmakers want to attract bitcoin miners to their states with tax incentives. Many other states, eager to attract the jobs they think the industry will bring, are rushing to pass favorable legislation for crypto companies.

With the exception of New York, nearly every state is beginning to embrace crypto. It’s fitting that an industry that initially grew in a bottom-up manner is being embraced by the states first rather than top-down.

Citizens and governments globally embrace crypto

As exciting as the adoption of crypto by many US states is, it paled in comparison to what happened globally. Crypto became a lifeboat for Ukrainian citizens who lost access to the traditional banking system during the Russian invasion, which ultimately led to Ukrainian President Volodymyr Zelenskyy signing a virtual assets bill into law that recognizes cryptocurrency as an asset. By May, over $135 million in crypto was raised for Ukraine, and even the UN began sending stablecoins rather than cash to displaced Ukrainians. Crypto’s humanitarian impacts stretched far beyond just Ukraine. Argentina’s adoption of crypto is increasing due to an unstable financial system, crypto has become a lifeline for many Cuban citizens amid heavy financial sanctions, and in bankrupt Lebanon, locals mine bitcoin and buy groceries with stablecoins.

Earlier this year, an $87 billion Italian bank with more than 300,000 customers began allowing customers to buy bitcoin. Argentina’s largest private bank started offering bitcoin and Ethereum trading. BTG Pactual, which is the largest investment bank in Latin America, has launched a Bitcoin and cryptocurrency exchange in Brazil called Mynt, and France’s third largest bank announced it is now offering cryptoasset custody and trading services. The Bank of Russia agreed to allow cross-border settlements in cryptocurrencies and later legalized crypto for cross-border payments. Iran also approved bitcoin payments for imports, the Central African Republic passed a new law allowing the use of crypto as a form of payment for businesses, and Spain’s central bank approved the first crypto services provider in the country.

Both Russia and Ukraine are making bitcoin a legal currency in their respective countries, but they aren’t the only countries doing so. Tonga is expected to copy El Salvador’s bill making Bitcoin legal tender, and so are Mexico, Malaysia, and the Swiss city of Lugano. France may change its cryptocurrency laws next year as the country aims to become a leader in blockchain technology, and Costa Rica could be one of the next countries to adopt bitcoin as a regulated payment method.

But arguably, Brazil did the most in 2022, which approved a regulatory framework for crypto, including officially recognizing bitcoin as a legal payment method. In 2022, Brazil became one of the first nations to create a comprehensive crypto regulatory regime. Not only is Brazil the world’s 7th most populous country, but more Brazilian citizens also invest in bitcoin and other cryptoassets than in the stock market.

Wall Street continues its adoption

In 2022, the world’s largest custodian bank, BNY Mellon, announced it plans to allow institutional clients to hold bitcoin and ether. BNY Mellon has set up a digital asset division and has publicly said it expects digital assets to be a meaningful source of revenue for the firm by as early as 2023. The second largest custodian bank in the world, State Street, also announced it will offer crypto custodial services for institutions by year-end. So did French banking giant BNP Paribas. Nasdaq is also reportedly preparing crypto custody services for financial institutions.

Charles Schwab said that it wants to offer crypto to its clients. Schwab Asset Management launched a crypto product this year, the Schwab Crypto Thematic EFT (STCE), after receiving increasing demand from its customers. Fidelity had a string of announcements in 2022, including the launch of Fidelity Crypto, which allows traders to invest in bitcoin and Ether commission free. Fidelity also became the first major retirement plan administrator to allow investors to put bitcoin in their 401k plans. Franklin Templeton, which manages $1.4 trillion, is now offering institutional crypto accounts to its clients and digital bank Revolut received approval to offer bitcoin and crypto to its 17 million customers in Europe.

Blackrock, with over $10T in assets, is preparing to enter the digital asset space in a massive way by reportedly planning to offer crypto trading. Blackrock also partnered with Coinbase to provide institutional investors access to crypto trading, custody, prime brokerage, and reporting capabilities. Goldman Sachs unveiled its digital asset platform with a European Investment Bank €100m blockchain bond. Big-name hedge funds such as Coatue Management and Tiger Global Management are increasingly investing in crypto. Ray Dalio’s Bridgewater, the world’s largest hedge fund, is creating a dedicated crypto fund, and Citadel founder and CEO Ken Griffin revealed that his firm will provide market-making services to the cryptoasset industry. KKR, a global investment manager with $490 billion under management, has decided to tokenize one of its healthcare funds on the Avalanche blockchain. Hamilton Lane also announced it will tokenize three of its funds.

Vanguard and State Street partnered with blockchain provider Symbiont to bring smart contracts to Wall Street, S&P Global has launched a DeFi strategy group with the goal of institutionalizing DeFi, and a group of 300 community banks announced they will allow customers to buy and sell bitcoin on mobile banking apps. In September, JP Morgan released a report in which it predicted that bitcoin would have the highest expected returns of any asset class in the coming years. The bottom line is that throughout 2022, Wall Street continued to increase its involvement in crypto.

Talent continues to flock to crypto

Despite the price drawdowns, talent continued to migrate to the crypto industry in record numbers in 2022. According to a recent report of on-chain and GitHub data, the number of developers in the crypto space is bigger than ever, and the number of smart contracts, blockchain decentralized apps (dApps), and software developer packages being deployed have all gone up. In fact, many crypto networks saw record developer growth in Q3.

But it’s not just engineers and developers, many top executives moved to the crypto industry in 2022. A trio of JP Morgan executives left for crypto jobs earlier this year, and Citibank lost a number of its top executives to crypto as well. The number of employees in the digital asset industry jumped over 351% as crypto companies continue to steal top talent from traditional tech companies.

3. Bitcoiners prove they have diamond hands

“Diamond hands” is a popular expression used on social media that refers to holding a volatile asset even when there is pressure to sell. If you have diamond hands, it means you’re the type of investor who doesn’t sell off your holdings during big price fluctuations. This leads me to one of the wildest stats from 2022:

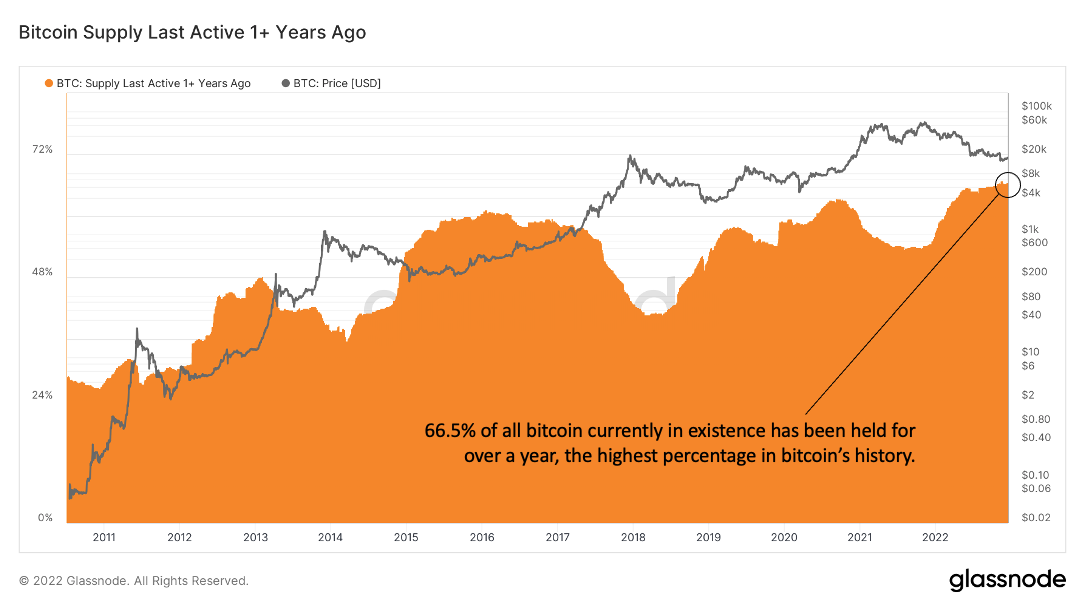

66.5% of all bitcoin currently in existence has not moved in over a year.

Think about that for a second. This year saw bitcoin’s price fall by as much as 76% off the all-time-high set in November 2021. Since May, the industry has experienced multiple multi-billion-dollar collapses, numerous bankruptcies, and outright fraud in the case of FTX and Three Arrows Capital. The result has been wide-scale, massive deleveraging in the system and significant credit contraction. And yet, two-thirds of all bitcoin in existence just held steady through it all.

In fact, the percentage has been setting new all-time highs throughout 2022 and appears to still be increasing. That means that many of the people that bought bitcoin in the second half of last year, when prices were at their highest, are still holding onto those coins now, even though they are likely worth much less today than when they originally bought them.

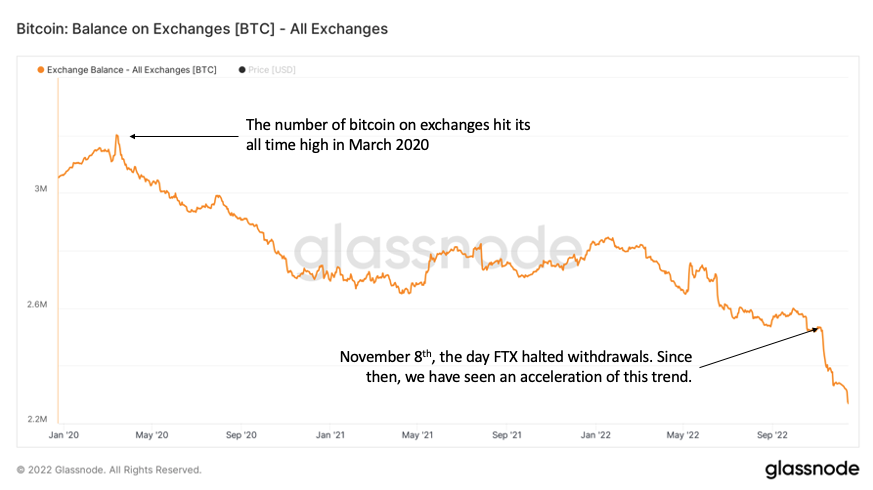

And there is no sign that this trend will slow down anytime soon. Last newsletter, we explained that for years, an increasing number of people have been taking their assets off exchanges and choosing to self-custody those assets themselves. This behavior is indicative of an intent to hold for the long term because when assets are held in cold storage, they can’t be traded. The recent halting of withdrawals from multiple exchanges has only accelerated this trend.

Holding assets in cold storage lowers the quantity of liquid supply in the market. As of writing this newsletter, there are about 2.3 million bitcoin held across all exchanges. That means only 11.9% of all bitcoin in existence is currently available to be traded. Unless we have some unforeseen supply of bitcoin come back onto exchanges, we could be witnessing the buildup of one of the largest supply squeezes in bitcoin’s history.

Conclusion

Like we said, it’s been a wild year. Through it all, our hope is that this newsletter was a valuable resource that helped make all the craziness over the course of the year easier to understand, even if many of the stories were technical, nuanced, and complicated. We hope you have a wonderful New Year and look forward to covering all the major developments in 2023.

In other news

It’s never too early to get your crypto taxes in order.

Messari released its annual 2023 crypto thesis report.

Research and news company The Block put out a 199-page outlook on the industry for 2023.

Sam Bankman-Fried was extradited to the U.S. last week as news that his two former close allies, Gary Wang and Caroline Ellison, have been cooperating with federal investigators and have pleaded guilty to yet-to-be-named “fraud” charges.

U.S. federal prosecutors are probing Bankman-Fried’s political donations to Democrat and Republican lawmakers. Already, three major Democratic political committees said they will return more than $1 million in political donations from SBF.

U.S. Department of Justice prosecutors are split over charging Binance for money laundering.

Binance, the world’s largest crypto exchange by trading volume, saw $902 million of net outflows amid rising concerns about solvency.

Senators Elizabeth Warren and Roger Marshall introduced a bill they claim is designed to crack down on money laundering. However, many who have reviewed the bill say it is unconstitutional and would do more harm than good.

Binance.US agrees to buy Voyager’s assets for $1.02 billion.

One of the bitcoin mining industry’s biggest companies, Core Scientific, has filed for Chapter 11 bankruptcy.

As one of his last acts in office, Pat Toomey introduces a bill to legitimize the use of stablecoins in payment systems.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.