Welcome back to The Node Ahead, a cryptoasset resource for financial advisors.

Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we will review:

- On-Chain Analysis

- Biden’s Executive Order

- Other Regulatory Good News

- In Other News

On-Chain Analysis

In past issues of this newsletter, we have tried to highlight the fact that a large percentage of bitcoin investors have a strong propensity to accumulate and a general unwillingness to sell. The last newsletter we made the argument that, over the last three months, this group of HODLers has been willing to step in and buy bitcoin every time the price drops to the mid to low $30k range, thus establishing a floor. This week, our team would like to showcase a metric that illustrates just how strong this HODLing behavior is.

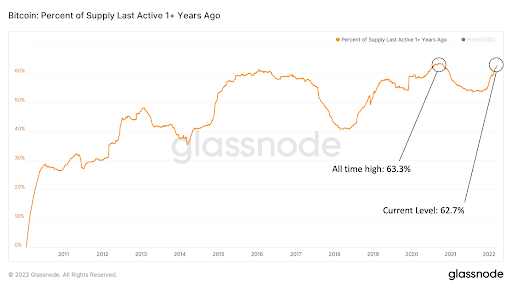

The chart below illustrates the percentage of the total bitcoin supply that has not moved in over a year. These are bitcoin that have sat dormant, held by their owners, for at least 365 days. That percentage is now approaching all-time highs, and the rate at which the percentage is growing is much faster than the last time we were at these levels. We anticipate this number to set new all-time highs in the coming weeks and months because it is the same cohort that stepped in and aggressively bought in April and May of last year when bitcoin’s price fell.

Next, we examine bitcoin’s price chart over the past 365 days. Despite price drops of 54%, 23%, and 48% in the last year, a majority of the total bitcoin supply never sold during this time. In other words, a greater number of people and a greater percentage of bitcoin holders believe in the long-term viability of the asset they are holding and remain largely unfazed by short-term volatility.

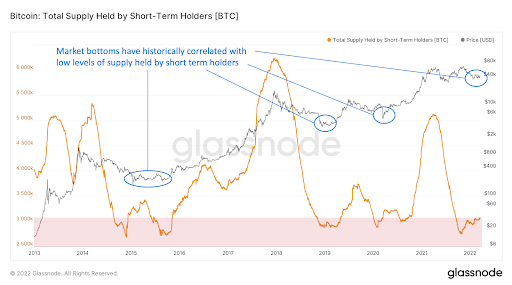

Now, let’s look at the flip side of this coin: the short-term holders. Below is a chart of supply held by short-term holders (defined as less than 155 days since bitcoin was last moved) since the start of 2013. When the supply held by this cohort bottoms out, it has historically correlated with market bottoms. This would make sense; as short-term holders own less bitcoin there is less available supply to be traded, thus putting upward pressure on price.

There continues to be a gradual shift of coins from short term-oriented investors to long term-oriented investors. This trend reduces the supply of bitcoin available to trade, causing bitcoin to become more and more scarce. As we have hypothesized in recent newsletters, signals continue to indicate that the end of January was the market bottom, we are currently in a consolidation phase, and will see a breakout to the upside sometime later this year.

As always, the on-chain data is provided by Glassnode. If you would like to have access to the data yourself, you can sign up here: Glassnode Sign Up Link

Regulators, Mount Up!

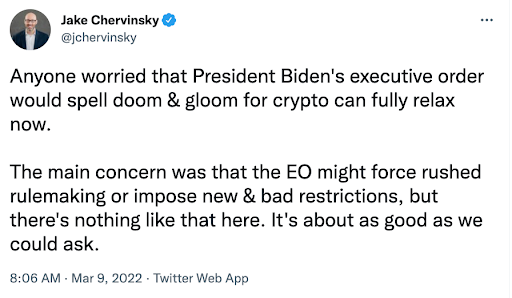

On Wednesday, March 9th, President Biden signed an executive order directing various federal agencies to study the state of the crypto industry with the goal of working towards the first unified federal strategy around cryptoassets. This long-awaited directive did not specify any positions the administration wants agencies to adopt, nor did it impose any new regulations on the sector. Instead, the executive order laid out six priorities for different agencies to address. These areas include consumer and investor protection, financial stability, illicit activity, U.S. leadership in global finance, financial inclusion, and responsible innovation. Each agency will have 3-6 months to conduct the review and prepare a public report with recommendations regarding the federal government’s approach to cryptoassets.

So far, the executive order has been met with praise by many in the crypto industry. Jeremy Allaire, the CEO of Circle (the company behind the second largest stablecoin USDC), called this a watershed moment equivalent to “the government wakeup to the commercial internet” in the mid-1990s. Kristin Smith of the Blockchain Association (one of the largest crypto lobbying organizations) wrote that it’s a “huge step forward for the industry.” Kathryn Haun, a prominent venture capitalist in crypto, said the order is “a step in the right direction…and could bring order to what’s become a sorely fragmented regulatory landscape.”

Before we get into the good and bad of this executive order, let’s look at each of the six priorities President Biden laid out.

- Consumer Protection – The Biden administration has asked the Department of the Treasury to assess and develop policy recommendations specifically aimed at protecting consumers from scams and market volatility which have caused significant losses for some consumers. This is likely to mean a greater focus on KYC/AML practices for exchanges and determining how best to store assets given that this is where most scams and hacks occur.

- Financial Stability – The Order tasks the Financial Stability Oversight Council to identify and recommend measures to mitigate systemic financial risks posed by cryptoassets. Most people are interpreting this as a directive to focus on stablecoins, which have grown to over $180 billion worth of supply. Several government officials have expressed concerns about the impact stablecoins may have on the economy, most notably Treasury Secretary Janet Yellen who has made it clear she wants to see Congress introduce stablecoin regulation.

- Illicit Activity – President Biden has called for coordinated action across all relevant U.S. government agencies in mitigating illicit finance and national security risks. He is also urging collaboration with international regulators on the issue. As we have written in the past, bitcoin and crypto are used far less than cash for illicit activity on both a total and percentage basis. Due to the fact that all transactions are immutably recorded and viewable, it is a lot harder to get away with a crime using bitcoin than using the legacy financial infrastructure.

- US Leadership – Biden’s announcement specifically put a focus on giving the U.S. a competitive edge over other countries when it comes to crypto development. This is an incredibly positive tone coming from the White House. Biden has tasked the Department of Commerce with “establishing a framework to drive U.S. competitiveness and leadership in and leveraging of digital asset technologies.” A large focus will undoubtedly be placed on attracting and keeping top crypto companies in the US.

- Financial Inclusion – The Order asks the Secretary of the Treasury to ensure that there is safe access to cryptoassets, especially for communities that have long had insufficient access to financial services. Biden specifically called out the need for safe, affordable, and accessible financial services, especially for those communities.

- Responsible Innovation – The last and likely most controversial category in President Biden’s Executive Order calls for the U.S. Government to “take concrete steps to study and support technological advances in the responsible development, design, and implementation of digital asset systems.” As of now, we know that this encompasses at least two main objectives: climate change and central bank digital currencies (CBDCs).

Climate change was a major talking point during Biden’s campaign and, given the misleading narrative about crypto mining’s impact on the environment in the mainstream press, it’s unsurprising that this is a point of emphasis in his order. As we have written about in the past, crypto’s environmental impact is not only much smaller than the traditional financial system and many other energy uses (including clothes dryers), but is also a potential driver of clean and renewable energy. In theory, this is an area in which the Biden administration should embrace crypto.

The second clear objective is to assess the technological infrastructure and capacity needs for a U.S. central bank digital currency (CBDC). Though Biden stopped short of declaring that the U.S. will launch its own CBDC, he is calling for increased urgency on the research and development of one. In other words, expect the timeline for a dollar based CBDC to be accelerated.

Overall, President Biden’s executive order is a positive development for the crypto industry. First off, the order did not contain any broad proclamations or anti-crypto orders that some feared it might. In fact, the opposite seems to be true; the administration appears to be taking a very measured and thoughtful approach. Without any outright bans or even strong restrictions, the order has largely been perceived as a logical way to provide clarity within a growing industry.

According to the order, the Biden Administration is looking to establish a clear, unified approach and regulatory regime for the crypto industry. This is exactly what many within the crypto community have been clamoring for. The biggest challenge to crypto regulation within the US has not been harmful or anti-crypto regulation, but rather a lack of clarity. Hopefully this order is the first step in achieving that much needed specificity.

Americans now have a more clear indication of Biden’s views on crypto and his priorities for the next three years. As we have discussed in the past, the crypto industry’s lobbying efforts have increased substantially in the past couple of years. Those organizations now have a clear roadmap to focus areas and parties to educate. The infrastructure bill was a clear example of the political clout this industry can wield when pointed in a specific direction. We now have that, and expect a lot of progress to be made throughout the rest of this year as a result.

Finally, what might be the most positive takeaway was simply the White House’s recognition of how important the crypto industry is. The White House acknowledged on its own that 40 million Americans have invested in, traded, or used cryptoassets. In a press briefing on the subject, a senior administration official said “This is not a niche issue anymore.” One of Biden’s explicit priorities is to maintain US leadership in this industry. The administration appears to be embracing the fact that crypto is here to stay and has the potential to have an enormously positive impact on the US. Rather than trying to curtail the industry, the approach seems to be much more focused on fostering innovation while at the same time protecting consumers.

However, that doesn’t mean the executive order is all sunshine and rainbows.

One of the most disappointing aspects isn’t what is in the order, but rather what isn’t. There was no mention of creating a federal definition of exactly what a digital asset is. The SEC thinks every cryptoasset other than bitcoin and Ethereum is a security, the CFTC thinks the majority are commodities, and the IRS views them as property; at face value, this order does nothing to address that confusion.

The other item missing from the order, as US Congressman Tom Emmer astutely pointed out, is any mention of decentralization. The executive order gives no reason to assume that the government won’t try to consolidate power in this industry through regulation, which would go directly against the ethos of an open, permissionless network. While many may view the vagueness of the order as a positive because it didn’t directly crack down on the industry, the flip side to that argument is that it leaves room for regulatory agencies, specifically the Treasury Department, to issue recommendations that may undermine this burgeoning space.

Finally, the most troubling aspect of the order is the explicit interest in developing a CBDC. In January, The Federal Reserve released a report on a US CBDC which outlined several potential benefits and drawbacks. The Fed said it could be a “highly significant innovation in American money,” but stopped short of taking a position on its implementation without the help of lawmakers. Biden is looking to take this a step further and increase the urgency for development of a dollar based CBDC. As explained in the January 25th edition of The Node Ahead, a CBDC would likely give the US government insight into every retail transaction down to an individual level, providing it with surveillance capabilities never possible before. Potentially even more problematic is that, unlike fiat currencies, cryptocurrencies are programmable. This means that the government would, in theory, have the power to program what its citizens can and cannot do with their money.

Even accounting for the downsides to President Biden’s executive order, it remains a largely positive signal from the White House. It is further proof that as politicians start to become more educated and spend serious time understanding the industry, more often than not the result is a realization that crypto is an innovation the US is better off fostering than cracking down on. Though President Biden’s order isn’t perfect, it is a balanced approach that recognizes crypto’s importance to the US’s position as a global technological leader and centers on conducting research on how to enable innovation while at the same time protecting US citizens.

Why this matters for RIAs and their advisors – President Biden’s executive order provides a good glimpse into how this administration views the crypto industry. The results from the commissioned reports will likely have a large impact on what regulations are proposed and passed in the future. Financial professionals hoping to provide advice and services within the crypto industry now or in the future must remain abreast of all material regulatory updates as this young asset class continues to mature.

More Crypto Regulatory Good News

While Biden’s executive order is a potential watershed moment for crypto, it might not even be the most important regulatory news of the last couple weeks. Back in our January 11th edition of the Node Ahead, we discussed a major crypto bill that was in the works. The Responsible Financial Innovation Act drafted by Cynthia Lummis and other prominent pro-crypto advocates within Washington is now almost done. Thanks to an interview on the Decrypt Daily podcast, we also know what is in the bill.

One of the bill’s biggest goals is to clear up capital gains tax rules for crypto spending, mining, and staking. The bill would provide the ability for users to spend up to $600 using crypto without being taxed thus making it much easier to buy everyday goods and services. Second, the bill aims to clarify that capital gains tax doesn’t apply to “productive” activities such as mining or staking because these users are not getting rid of the asset. Third, the bill would allow people to move money from retirement plans, IRAs, and 401(k)s so they could reinvest the money into cryptoassets without being taxed. Lastly, the bill tries to clarify the term “broker” in the infrastructure bill so that only exchanges and custodians are considered brokers rather than everyone who receives a cryptoasset.

This bill, if passed, would be a giant step in the right direction for the treatment of cryptoassets in this country. However, that wasn’t the only crypto-friendly bill released recently.

Two bills have been introduced in California that would make bitcoin legal tender in the state. Last month senator Sydney K. Kamlager (D-Los Angeles) introduced a bill that would authorize state agencies to accept crypto for government services. Then California Assemblyman Jordan Cunningham (R-San Luis Obispo) introduced a bill that would make cryptoassets an acceptable form of tender for goods and services in both private and public entities. This now makes California the second state, the other being Arizona, attempting to make cryptoassets legal tender in this country.

In addition to California and Arizona, there are a number of other states taking incremental steps to adopting crypto. Lawmakers in Wyoming have proposed legislation to accept tax payments in the form of cryptoassets. Jared Polis, the Governor of Colorado has pushed to accept bitcoin as payment for taxes, as well as other state related fees. New Hampshire has established a commission for bitcoin and cryptocurrency to research ways to incorporate cryptoassets into its economy. Missouri has introduced a bill to exempt bitcoin from property taxes at the state, county, and local levels and Tennessee has recently introduced a bill that would allow both the state and municipalities to invest in bitcoin.

Then there is the growing desire at a national level to introduce favorable crypto regulation. Washington’s Bryan Solstin announced his candidacy for the U.S. Senate saying his number one priority would be to make bitcoin legal tender in the US. In an interview with Financial Times, Ron Wyden, one of the most powerful Democratic senators, came out vocally in support of crypto. Most recently, eight US Congressman from both parties sent SEC Chair Gary Gensler a bipartisan letter accusing the SEC’s crypto reporting requests as being too onerous and “stifling innovation.” These developments highlight the fact that cryptoassets are an attractive political issue for Democrats and Republicans.

While many of the regulatory efforts around crypto are still in the early stages, the attention and favorable tone is very encouraging. The simple fact that multiple states, mayors, governors, congressmen, and senators are pushing pro-crypto legislation highlights the influence this asset class is beginning to wield. The more politicians and lawmakers learn about crypto, the more favorable they generally become.

Why this matters for RIAs and their advisors – Regulation continues to be one of the biggest concerns for most clients entering the space for the first time. Its important to stay up to date on the latest regulatory developments in order to provide an informed view to clients interested in cryptoassets.

In Other News

Legendary investor Bill Gross recently announced he now holds bitcoin after previously criticizing BTC. Same for founder of Citadel Securities Ken Griffin.

Credit Suisse laid out an argument for a new monetary order emerging that could greatly benefit bitcoin.

2nd largest custodian bank in the world, State Street, to offer crypto custodial services for institutions by year-end.

Crypto industry aims to boost its influence in Washington by hiring advisers and lawyers familiar with Capitol Hill

Official fact sheet for President Biden’s Executive Order.

A recent study showed that more than a third of those invested in crypto said they believed in its long-term value as “a transformative asset class”.

Global payments giant stripe now supports payments in bitcoin and crypto.

Binance, the largest cryptocurrency exchange, set up its own fiat-to-crypto payments provider, Bifinity, to help businesses become “crypto-ready.” Bifinity will support 50 cryptocurrencies and all major payment methods including Visa and Mastercard.

South Korea elected a pro bitcoin and pro crypto president.

EU Committee votes down anti-proof-of-work clause in crypto bill.

Ukraine’s President Zelensky signs legal framework for crypto.

The second fastest-growing city in Texas, Austin, will begin exploring policy capabilities to accept Bitcoin as a payment option and integrate other Web3 applications to improve residents’ lives.

In 2021, Ethereum moved more in payments volume ($11.6 trillion) than Visa ($10.4 trillion).

2020 presidential candidate and 2021 New York City mayoral candidate Andrew Yang wants to use DAOs to bolster American democracy.

Disclaimer: This is not investment advice. This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.