Welcome back to The Node Ahead, a cryptoasset resource for financial advisers.

Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we will review:

- On-Chain Analysis

- Canada Highlights the Importance of Self-Sovereignty

- Ukraine Turns to Crypto

- Russian Sanctions Could Spur Crypto Adoption

- In Other News

On-Chain Analysis

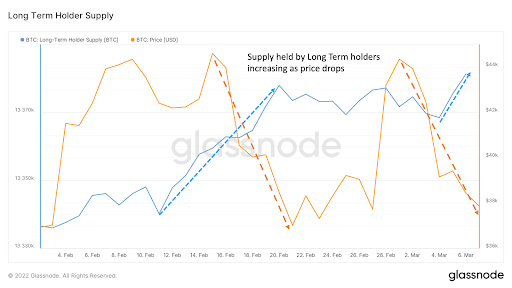

In past newsletters, we have highlighted two opposing forces that have kept bitcoin trading in a range between $32k – $47k since the start of the year. On one hand, we have long-term holders stepping in to buy whenever the price dips to the lower end of this range. This group of market participants has been repeatedly willing to step in and accumulate coins at these lower prices, thus setting a floor for bitcoin over the past couple of months.

However, as we have discussed in previous editions of The Node Ahead, the cost basis (average price paid) for short-term holders is around $47,000. As a result, most short-term holders are still holding their coins at a loss. Every time we start to approach that mark, there appears to be increased sell pressure likely caused by those investors excited to simply recoup their initial investment. The result? Bitcoin and the broader crypto markets have been range-bound since the start of the year.

Here’s the thing: long-term holders can outlast short-term holders. Eventually, the short-term holders who want to cash out will run out of bitcoin to sell. In contrast, the long-term holders appear to have extreme conviction and can keep accumulating every time price falls to attractive price levels. While it is impossible to know exactly when that resistance to the top will dissipate, when it does, it could set the stage for a potential larger move upward later this year. However, until we break through this resistance level, it’s likely we could see bitcoin’s price continue to fluctuate within this banded range.

As always, the on-chain data is provided by Glassnode. If you would like to have access to the data yourself, you can sign up here: Glassnode Sign Up Link

Importance of Self-Sovereignty

Living in the US, it’s easy to take for granted the freedom we typically have to store assets and transact within the legacy financial system. Many of us forget that most of the traditional financial world operates on a custodial model. A custodial service means that the end-user does not have full control over their funds. For example, when you deposit cash in a bank or any other financial institution, the bank takes custody of that cash meaning legally, the bank controls access to and use of that money.

Crypto and DeFi aim to flip this paradigm on its head by allowing users to engage with financial services but always retain full control over their assets. This is known as non-custodial. Non-custodial platforms provide greater freedom because the users retain ownership of their assets rather than handing them over to a third party. We bring this all up because recent geopolitical events are highlighting the importance of self-custody, which crypto enables.

We begin in Canada, but before diving in it’s worth stating upfront that we are not experts on the Ottawa protests nor are we citizens of the country. We will leave it to people far more qualified than us to discuss the country’s COVID policies and whether the protests are right or wrong. Instead, what we are interested in is the Canadian government’s response and what it means for crypto.

In response to Canadian truck drivers blocking much of the city of Ottawa, Prime Minister Justin Trudeau invoked the Emergencies Act in an attempt to end the protests. Among other things, the Emergencies Act gives the Canadian government the power to freeze the bank accounts of protestors. With protestors unable to access the money in their own bank accounts, supporters of the protests started a GoFundMe campaign that raised $10 million. However, the money never made it to the protestors because GoFundMe blocked the donations from being distributed. Organizers of the protest then turned to another fundraising platform GiveSendGo, raising another $10M before the funds were once again frozen.

The Canadian government then took its power a step further. The Canadian government broadened the Terrorist Financing Act rules giving them the power to require every single financial system provider, including banks, credit card companies, investment firms, crowdfunding platforms and insurance companies, to freeze the accounts of anyone directly or indirectly supporting the protests. They not only froze the accounts of the protestors, but they also froze the accounts of those who donated to the protestors. Keep in mind that this was enacted after the donations were already made, meaning those who donated had their financial accounts frozen for an act that was not illegal at the time they donated. Canada, a western democracy known for being peaceful, imposed sweeping financial sanctions. These sanctions were not on a terrorist group or a rogue state, but on its own citizens, and for political reasons without due process.

What does bitcoin have to do with all of this? A Canadian bitcoin group known as “HonkHonkHodl” started a campaign that raised more than $900k worth of bitcoin which was distributed to the protestors. This was possible because bitcoin is decentralized (not controlled by anyone entity) and censorship-resistant. The Canadian government could not freeze or seize any bitcoin held by the protestors or their supporters nor could they prevent bitcoin from being sent from one wallet to the next as they could with GoFundMe. That is the power of self-custody and self-sovereignty.

And if you are thinking “Yeah that’s Canada, the freezing of accounts for political reasons would never happen in the US,” then we have some news for you. There is already a historical precedent in our country for the confiscation of assets. On April 5, 1933, President Roosevelt signed Executive Order 6102 which forbade the “hoarding of gold coin, gold bullion, and gold certificates” and required all citizens to sell their gold at prices well below market rates. This was done to remove the constraint on the Federal Reserve preventing it from increasing the money supply during the depression. Gold ownership remained illegal until the 1970s.

If you are now thinking “yeah, but that was a long time ago and this is now,” then we have more bad news for you. While the First Amendment prevents the government from banning legal industries, it can encourage banks and by extension, payment processors, not to support those industries effectively giving the government the ability to make policy through banks without passing laws. Known as “Operation Choke Point,” several high-ranking individuals took it upon themselves in 2017 and 2018 to go after certain industries based on personal disdain by shutting those industries out of the banking system. In 2021, OnlyFans temporarily banned sexual content from its site because of pressure exerted on banks and credit card companies not to process payments for OnlyFans. Although marijuana is legal to some degree in most states, marijuana-related businesses currently have extremely limited access to banking services, as many banks are wary of potentially violating federal laws. Regardless of what you think about these businesses, the bottom line is that the payments and banking industry is already politicized in the US.

We truly hope that these kinds of measures are never imposed on US citizens like they were in Canada. However, we are witnessing in real-time how important it is for individuals to maintain the ability to freely store and move their holdings via self-managed wallets.

Why this matters for RIAs and their advisors – It’s very likely that in the future, clients will want to understand the benefits and risks associated with self-custodying assets versus storing them with a third-party custodian. Financial advisors need to be able to understand and explain the pros and cons of both options.

Ukraine Turns to Crypto

Amid the ongoing invasion from Russia, crypto is quickly becoming a lifeboat for Ukrainian citizens who have lost access to the traditional banking system.

As of February 24, the Ukrainian central bank suspended electronic cash transfers on platforms such as Venmo and PayPal, suspended the foreign exchange market, put limits on cash withdrawals and prohibited the issuance of foreign currency from retail bank accounts. As a result, ATMs have been overrun by citizens trying to get whatever cash they can out of their accounts. The situation has been made worse by the fact that the hryvnia, Ukraine’s local currency, has lost more than 8% of its value.

In an interview with CoinDesk, Michael Chobanian, founder of the Ukrainian crypto exchange Kuna, explained “There is nothing you can do with the cash right now. We don’t trust the banking system. We don’t trust the local currency.”

As a result, Ukrainian citizens are turning to crypto. According to CoinMetrics, the trading volume of crypto markets quoted in Ukraine’s local currency has spiked recently as more and more Ukrainian citizens are turning to crypto as a solution. As we previously highlighted, bitcoin and other cryptoassets can be self-custodied, which removes reliance on banks and is important when access to the traditional financial system is compromised.

Source: https://coinmetrics.substack.com/p/state-of-the-network-issue-144?utm_source=url

In an interview with Bitcoin Magazine, a Ukrainian refugee tells the story of how he was able to escape the country hours before the government closed the borders. At the time, all ATMs were blocked so he was not able to take any of his savings with him. However, he did have bitcoin stored on a hardware wallet and was able to cross the border with enough value to sustain him and his girlfriend. “With Bitcoin, [this refugee] was able to flee to a foreign country with the wealth that he was able to save from his job, with multiple options to be able to convert that to the local currency, if necessary, as opposed to fleeing with nothing but the clothes on his back and counting entirely on the charity of the people around him when he arrived.” This refugee isn’t the only one, several Ukrainian citizens have shared how crypto is providing a lifeline.

Source: https://twitter.com/usleepwalker/status/1497255981851496449?s=12

It’s not just individuals: two weeks ago the Ukrainian government listed bitcoin and Ethereum wallet addresses on Twitter to receive donations.

That’s right – a nation state undergoing military invasion is posting crypto addresses on Twitter to raise funds, and it’s working. Crypto donations to Ukraine have exceeded $50m thus far. In addition, an NFT of the Ukrainian flag raised $6.7 million and various DAOs have popped up to coordinate additional fundraising efforts. Most of the funds raised have already been spent on basic necessities and military supplies. In many ways, using crypto for donations is far superior to using fiat currencies because unlike cash, the transparent nature of blockchain technology allows anyone to verify that the money reached its intended destination. Furthermore, because blockchain technology provides an immutable record that is resistant to tampering, the Ukrainian government and citizens are also storing documents such as land registries and medical records on the blockchain to prevent losing them to physical destruction or cyber warfare. The Ukrainian government is using blockchain, crypto and web3 tools to mobilize capital during the middle of a military crisis and doing so successfully. Though this is the first time crypto has been used this way, don’t be surprised to see crypto used in future complex humanitarian situations. It’s precisely because cryptoassets can be self-custodied, easily transported, and used without the need for a third party or bank that people turn to cryptoassets when the banking system fails them.

Why this matters for RIAs and their advisors – This is yet another example of crypto adoption accelerating throughout the world. In the future, donations to a variety of causes are likely to be done with cryptoassets given the increased transparency and verifiability. Financial advisors should be aware of this growing trend as it may have tax unique implications.

Financial Sanctions Are Likely to Lead to Greater Crypto Adoption

While Ukrainians are using bitcoin to transfer value across borders and raise defense funds, Russian citizens are turning to bitcoin to protect themselves from a currency collapse.

On February 26th, the US and its allies announced that select Russian banks would be removed from SWIFT, the global messaging system used by more than 11,000 financial institutions worldwide. The last country to be kicked out of SWIFT was Iran which lost half of its oil export revenues and 30% of its foreign trade as a result of the financial sanctions. However, unlike Iran, Russia is the 12th largest economy in the world and the third-largest oil producer. European countries, most notably Germany, have historically relied on Russian gas and have had strong business ties with Russia. It’s one thing to cut Iran off from SWIFT, it’s an entirely different thing to do it to Russia.

Though sanctions hurt the government in charge, it is often the average citizen that feels the effects the most. The Russian currency plunged about 30% against the U.S. dollar after Western nations announced they were removing certain Russian banks from SWIFT. Russia relies heavily on imported goods, meaning the prices for groceries and electronics have risen sharply in the last week. Fearful of a currency collapse, many citizens are now flocking to banks and ATMs, with reports of long lines and machines running out. Making matters worse, electronic payment methods are currently not usable because Apple Pay, Google Pay, and Samsung Pay rely on VTB, another Russian bank facing sanctions. The result is millions of people locked out of legacy financial rails and forced to use cash that they may not be able to access to buy goods that have become significantly more expensive.

Source: https://coinmetrics.substack.com/p/state-of-the-network-issue-144?utm_source=url

We bet you can guess what happened next: Russian citizens turned to crypto to protect themselves against ruble hyperinflation.

The average trading volumes of ruble pairs on Binance have surged, increasing to an average of $35.8 million per day compared to $11 million per day before the invasion began. Crypto is one of the few viable options Russians have to move rubles.

Furthermore, bitcoin is once again the wealth storage option of choice for citizens living in a country with a rapidly depreciating currency. The trading activity for BTC/UAH and BTC/RUB was “magnitudes greater” than the BTC/USD pair. The divergence from fiat pairs including the dollar and euro implies bitcoin is currently the more attractive option in those markets.

The SWIFT sanctions are causing a rise in bitcoin adoption among Russian and Ukrainian citizens but it’s not likely to stop there. Any wire transfer that involves US dollars, which is 88% of them worldwide, eventually must be cleared by a US bank, which the US government can mandate to freeze if it so chooses. Countries around the world are acutely aware that using the current global financial infrastructure, which is powered by the US dollar, leaves countries in the precarious position of having to maintain a good relationship with the US to ensure the health of their local economies. Very few countries disagree with the sanctions against Russia but that doesn’t mean countries aren’t also thinking about how to reduce their dependence on the US dollar system.

To be clear, it’s not just America’s enemies that are wary. In 2019, the Governor of the Bank of England, Mark Carney, gave a speech to other central bankers specifically calling out the disproportionate amount of power the dollar gives to the US. In 2018, longtime ally Germany called for the creation of a new payment system independent of the US. The European Union has been in the development of an alternative settlement system to SWIFT that is independent of US influence and allows it to bypass any sanctions imposed by the US.

Remember, Russia is the third-largest oil exporter in the world and much of Europe, especially Germany and Italy, is dependent on Russian oil. Those countries can’t simply stop transacting with Russia even after sanctions are imposed. Thus, taking Russia off SWIFT all but guarantees countries will turn to a competitive infrastructure and bitcoin and crypto is an increasingly popular option.

Sanctioning Russia could be the catalyst that steers many more countries away from SWIFT to reduce the reliance on the U.S.-centric international monetary system. All it took was a few phone calls to cut off one of the world’s largest economies from the global payment system. In contrast, it would require shutting off all internet access to an entire country to do the same with bitcoin. As a result, countries may start adopting crypto, which provides much greater sovereignty than the current antiquated payment rails built-in 1973.

Banning Russia from SWIFT could prove to be a watershed moment for bitcoin in which the narrative flips from governments around the world claiming “crypto is subverting their power” to “crypto is a necessary tool on a global stage.”

Why this matters for RIAs and their advisors – The financial infrastructure that powers the movement of money throughout the world is beginning to change. Financial advisors need to understand those changes and the implications of them as they plan for the future of their business.

In Other News

California lawmaker files bill to let state agencies accept Bitcoin.

Indira Kempis, a senator representing the Nuevo León state in Mexico, is working on a crypto bill that would make bitcoin legal tender in Mexico.

Crypto companies continue to steal top talent from traditional tech companies.

New draft resolution aims to make crypto deregulation part of the Republican platform for next Congress.

Coinbase beat analyst expectations in its latest earnings report and Block saw its stock jump 40% primarily due to the fact that crypto trading has become a huge revenue driver.

World’s largest custodian bank, BNY Mellon, plans to allow institutional clients to hold bitcoin and ether.

Wall Street continues to increase their involvement in crypto.

eBay is considering accepting crypto as payment.

Crypto lobbyist Kristin Smith discusses Biden’s expected executive order on crypto.

Citadel founder and CEO Ken Griffin revealed that his firm will provide market-making services to the cryptoasset industry in the coming months. Griffin, a long-time critic of the cryptocurrency industry, finally admitted he was wrong.

Charles Schwab is the latest financial heavyweight to propose crypto fund.

Swiss city Lugano is making bitcoin legal tender.

In a Twitter thread, Ryan Petersen, CEO of digital freight forwarder Flexport, hinted that the company’s $1.6B balance sheet held bitcoin.

Mining exec explains how bitcoin is converging with the oil and gas industry.

Shake Shack tests bitcoin rewards to lure younger consumers.

Disclaimer: This is not investment advice. This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.