Welcome back to The Node Ahead, a cryptocurrency and digital asset resource for financial advisors. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we’ll review:

- Brazil’s new crypto regulatory framework

- Increasing use of self-custody

- Why miners have been hit particularly hard

- Bitcoin mining becoming increasingly eco-friendly

Former FTX CEO Sam Bankman-Fried is supposed to testify in front of the House Financial Services Committee today. While we won’t be able to cover that in today’s issue, FTX is just one of many things happening in the robust crypto market. With that, let’s jump right in.

Brazil takes the lead (in crypto, that is)

Although Brazil lost in the World Cup last week, the country is becoming a global leader in crypto. At the end of November, Brazilian lawmakers approved a regulatory crypto framework, officially recognizing bitcoin as a digital representation of value that can be used as a means of payment and as an investment asset. The regulation provides a legal definition for digital assets and their service providers, as well as guards against money laundering and fraud. Following the collapse of FTX, there is also a provision that would require exchanges to follow rules surrounding segregating client funds. The bill was voted through the Brazilian Congress and only needs the President’s signature to become law.

This is significant because Brazil is by far the largest country to take such a step. Just for context, Brazil is the world’s 7th most populous country, 12th largest economy globally, and the biggest economy in South America. This bill legitimizes bitcoin as a legal payment method in a country with 214 million people. More importantly, a significant portion of the population participates in the crypto economy as more Brazilian citizens invest in bitcoin and other cryptoassets than they do in the stock market. It’s an encouraging sign that a country of that size and adoption will become one of the first nations to create a comprehensive crypto regulatory regime.

Self-custody accelerates following FTX collapse

One of the greatest benefits of decentralization is the ability to engage with financial services without having to rely on third-party intermediaries. Rather than handing over assets to a centralized entity, users of digital assets have the option to retain full control and ownership of their assets when storing, trading, borrowing, or lending if they so choose. The ability to self-custody cryptoassets eliminates counterparty risk when storing assets and significantly reduces it when transacting.

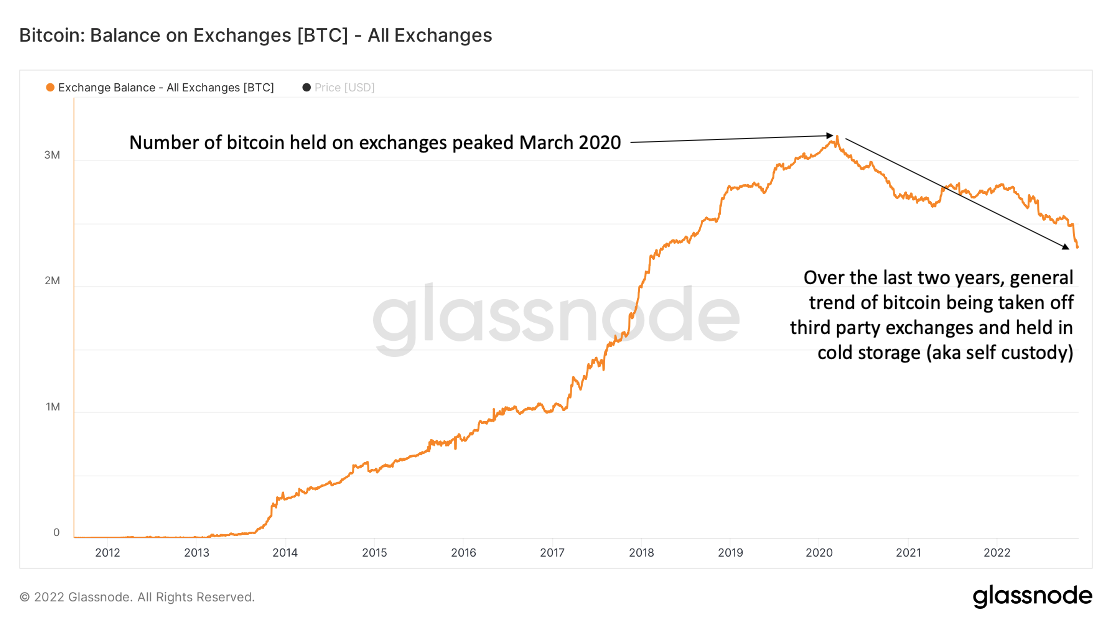

For most of bitcoin’s existence, the general trend was an ever-increasing number of bitcoin held on exchanges. This made sense because as more and more bitcoin were mined and released into the market, more and more bitcoin would be available to be traded. However, in March 2020, something changed (March 2020 was also the release of the $2.2 trillion stimulus bill, but I will leave that up to you to decide if there is a connection or simply a coincidence) – the total number of bitcoin held on third party exchanges has been steadily decreasing since that point. Note that the number of newly issued bitcoin has remained constant, so the total supply of bitcoin has increased over the last two years. And yet, the amount held on exchanges during this time has been going down.

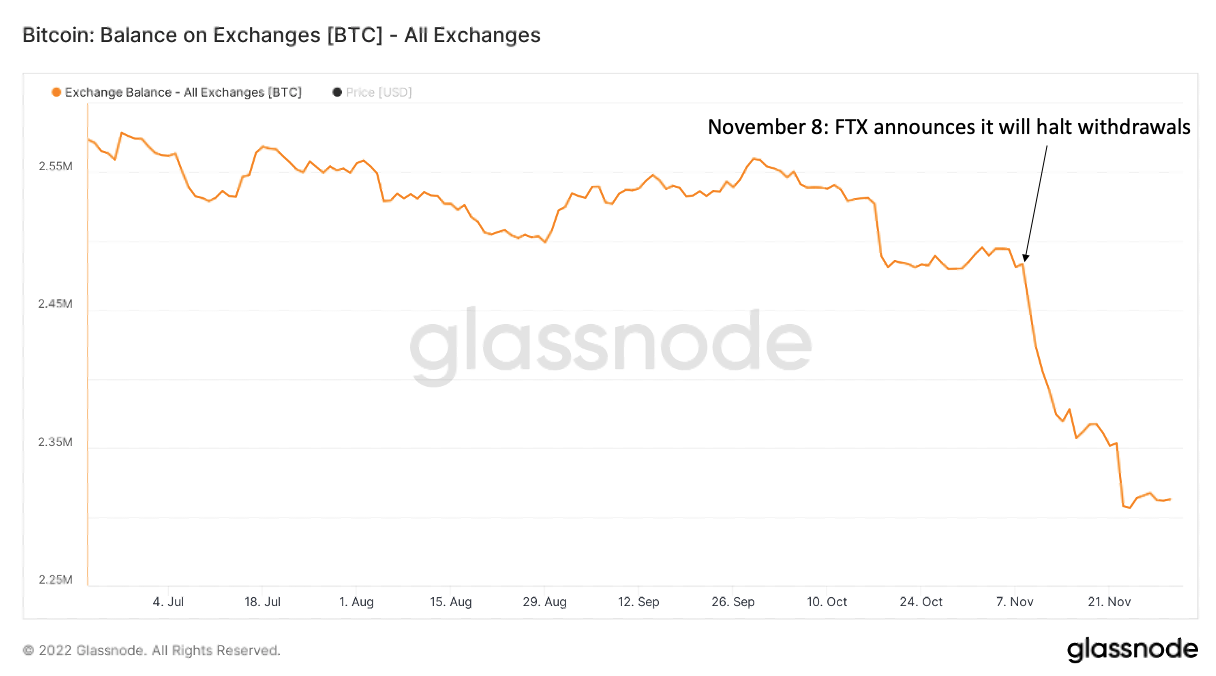

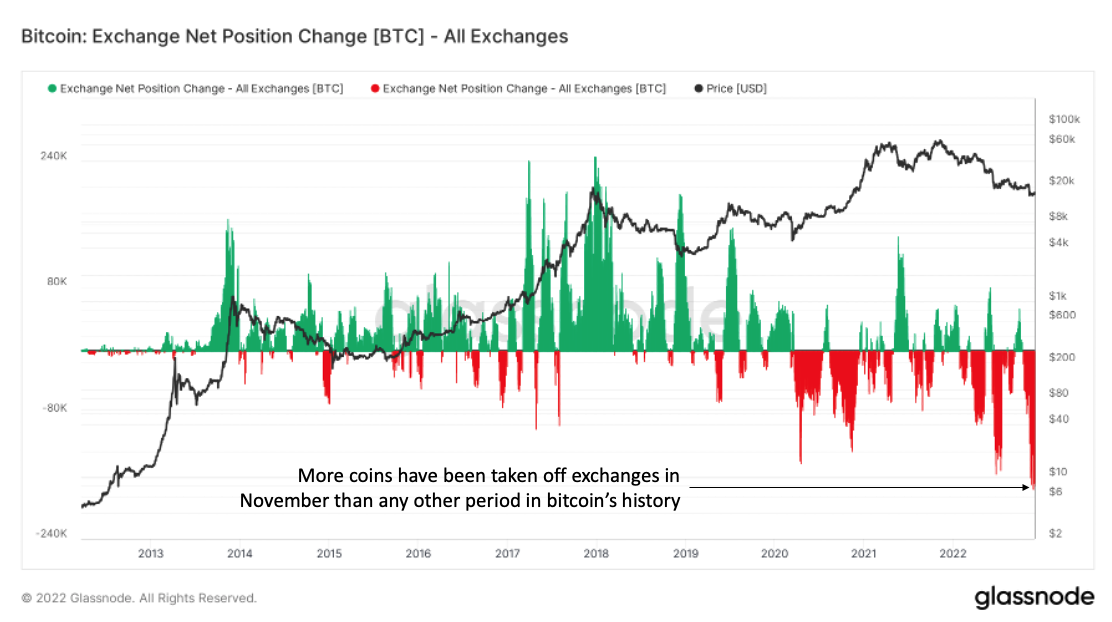

Though the trend of taking bitcoin off exchanges in favor of self-custody has been going on for the last two years, the trend seems to have accelerated since the collapse of FTX. Since the exchange announced it was halting withdrawals on November 8th, over 100,000 BTC have been taken out of exchanges and held in cold storage.

To put that in context, the past month saw the largest volumes of coins taken off exchanges in bitcoin’s history.

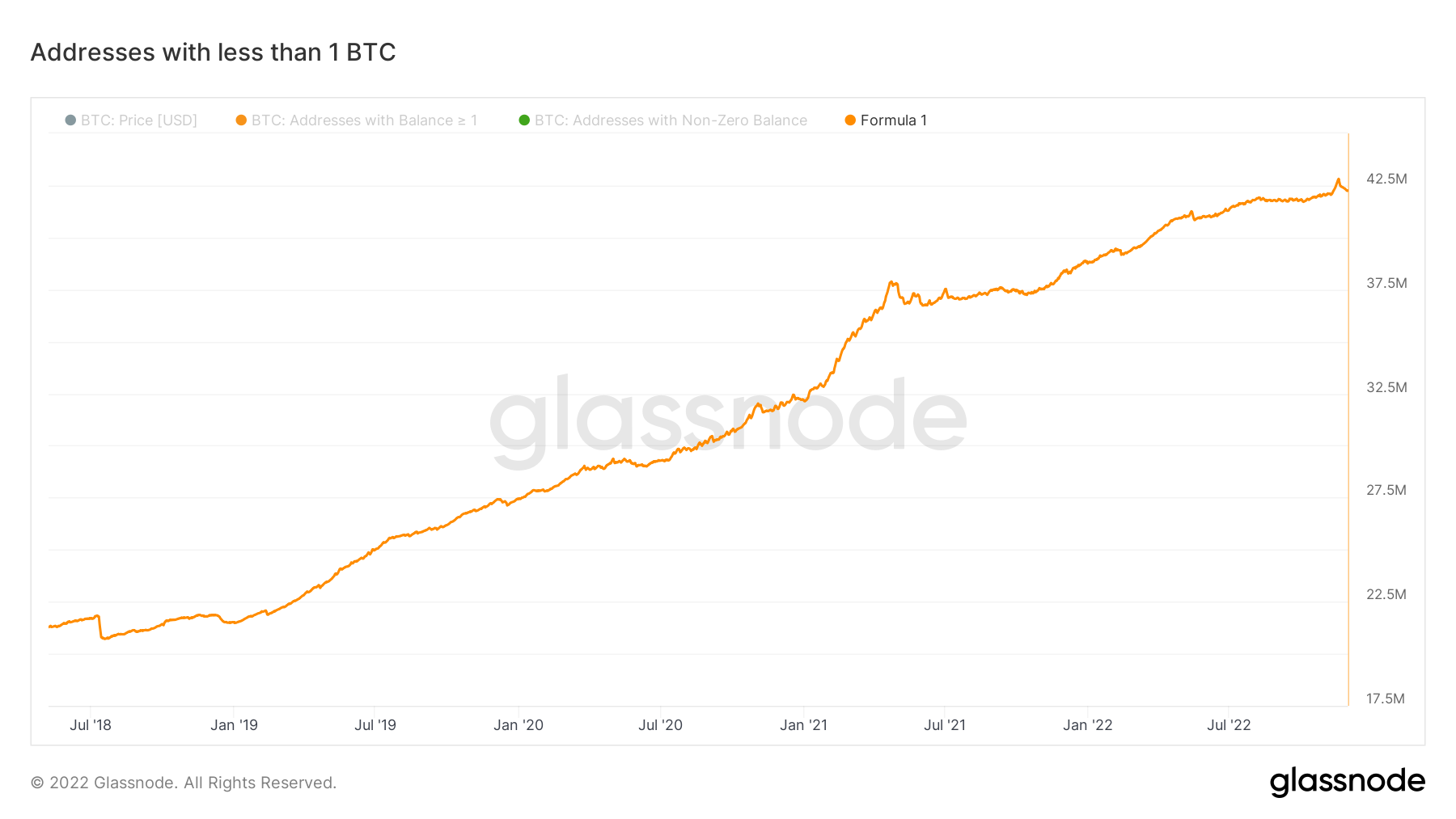

You might be thinking, maybe that’s just a small number of institutions and whales that are pulling large amounts of bitcoin off exchanges in light of market uncertainty. How do we know the average person is accumulating bitcoin and storing it themselves? Well, because we can measure it. It turns out the amount of BTC held by addresses with 1 BTC or less has grown significantly during this same time frame and now sits at all-time highs. In addition, Ledger, one of the most popular commercial hardware wallets, had its best month of sales in November. In other words, the folks buying bitcoin now and pulling it off exchanges are not whales or large investors; they’re predominantly retail investors.

It seems the recent halting of withdrawals from multiple exchanges accelerated the trend of users taking their coins off exchanges and choosing to custody those assets themselves. This signals that more people are starting to understand the importance of self-custody and crypto’s value proposition. This trend also diminishes the quantity of liquid supply in the market, indicating that fewer people intend to sell their bitcoin any time soon. “Not your keys, not your crypto” has been a mantra within the community for a long time, and it seems more and more people are taking that lesson to heart.

Bitcoin miners are under pressure

The bitcoin mining industry has always been a very cyclical and competitive market. When times are good, bitcoin mining companies have historically been extremely profitable, but during past bear markets, we saw many miners go out of business. The current cycle is shaping up to be one of the most challenging ever due to a confluence of factors working against miners.

Though it can be very tricky to build a lasting business in bitcoin mining, it’s relatively straightforward from a business model perspective. Miners earn revenue in two ways. The first is through transaction fees, and the second is through the block subsidy (the fixed amount of bitcoin issued every block). Today, transaction fees account for only 1-3% of mining revenue. Thus, the vast majority of revenue comes from the bitcoin rewarded to miners for successfully mining a block. However, miners compete against each other for the right to mine a block on the blockchain, meaning the more computing power there is on the network, the less likely any single miner will earn a block subsidy. This incentivizes mining operations to invest in increasing the amount of computing power they contribute to the blockchain, which is great for the security of the bitcoin network because the more computing power there is on the network, the more secure it is. It also means that professional mining operations have large upfront costs (often in the tens or even hundreds of millions of dollars) to acquire the physical hardware and build out these large-scale operations. There are also ongoing costs such as maintenance and electricity, the latter being the single most important cost factor in the profitability of a mining business.

The bottom line is that when bitcoin’s price is high, and electricity is cheap, mining can be an incredibly profitable business. This often leads to a rush of new entrants or expansion of existing players, which in turn increases the hash rate on the network. This increased competition reduces how often every bitcoin miner earns a block subsidy, and thus profitability decreases over time until an equilibrium is found. But if you get a rush of new hash rates on the network at the same time, the price of bitcoin begins to fall, and the cost of electricity rises, you end up with the perfect storm of factors that could cause many mining operations to go out of business. This is exactly what is happening now.

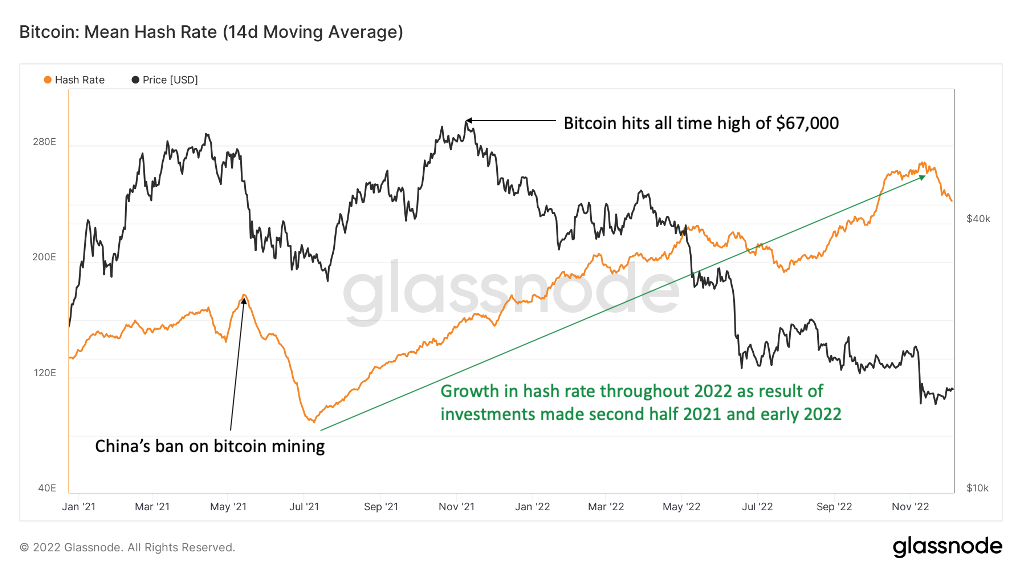

To understand why miners are under so much stress, we need to go back to last year. In May 2021, the Chinese government ordered a crackdown on crypto mining and trading. As a result, most Chinese-based miners were forced to pack up shop and move elsewhere. By June, there was a roughly 50% drop in computing power on the network. Most of those miners simply relocated and came back online in other locations (mainly Kazakhstan and the United States), but many non-Chinese miners saw this as an opportune moment to either enter the mining business or expand their current operations. Because half the network went offline, this meant miners that were still operating were twice as likely to receive a block subsidy. Revenue essentially doubled almost overnight.

By the end of 2021, all the hash rate that was lost from the China ban had come back online without a single interruption of the bitcoin network (that’s the power of decentralization). While the hash rate was recovering, bitcoin’s price doubled, which further increased mining profitability. With BTC reaching over $60,000 in November 2021, the second half of 2021 proved to be one of the most profitable times in history to be a bitcoin miner.

I’m sure you can already guess how miners responded towards the end of 2021 and early 2022. That’s right, they began investing more in their businesses. The demand for ASICs (the computers used to mine bitcoin) shot through the roof, and miners began to build multi-million-dollar facilities.

Here’s the thing about the investment in bitcoin mining – these build-outs do not happen overnight. Many ASICs were pre-paid for, but due to high demand and supply chain issues, there was a large backlog that resulted in the machines being delivered much later than they were originally paid for. In addition, these large-scale facilities take many months, if not years, until they are fully operational. Thus, the investment in mining equipment and sites that were planned in late 2021 and early 2022 have only recently come online. This is why the hash rate on the bitcoin network has been rising all year long and continues to set new all-time highs even though the price has been falling.

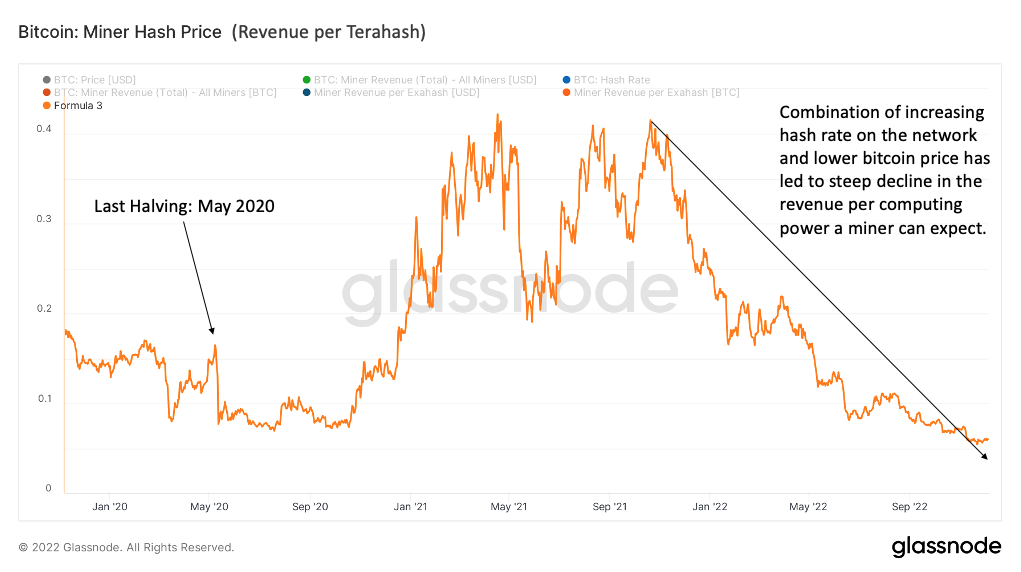

Since the start of 2022, the hash rate has been growing almost non-stop, and bitcoin’s price has fallen 65%. Not only are miners earning bitcoin less often due to increased competition, but the rewards they are earning are worth substantially less because of the drop in price. We can observe this phenomenon in what is known as the hash price. Hash price is simply the average revenue earned per computing power spent on the network, measured in Terahash per second per day. Hash price is now at an all-time low of $0.06 earned per Terahash per second per day. For context, one S19 miner produces about 100 Terahash per second per day, meaning it produces roughly $6.00 in revenue per day under current conditions, down from about $40.00 in revenue per day at the peak.

Unfortunately for miners, costs have also been rising in tandem with falling revenue. Remember earlier when we said that electricity was the single most important cost in determining a miner’s profitability? Well, as we all know, energy and electricity prices have skyrocketed this year. Coal and gas prices have reached historic highs, which substantially increased the costs of electricity production. According to the World Bank, energy prices have increased by 26.3% in 2022, on top of a 50% increase last year.

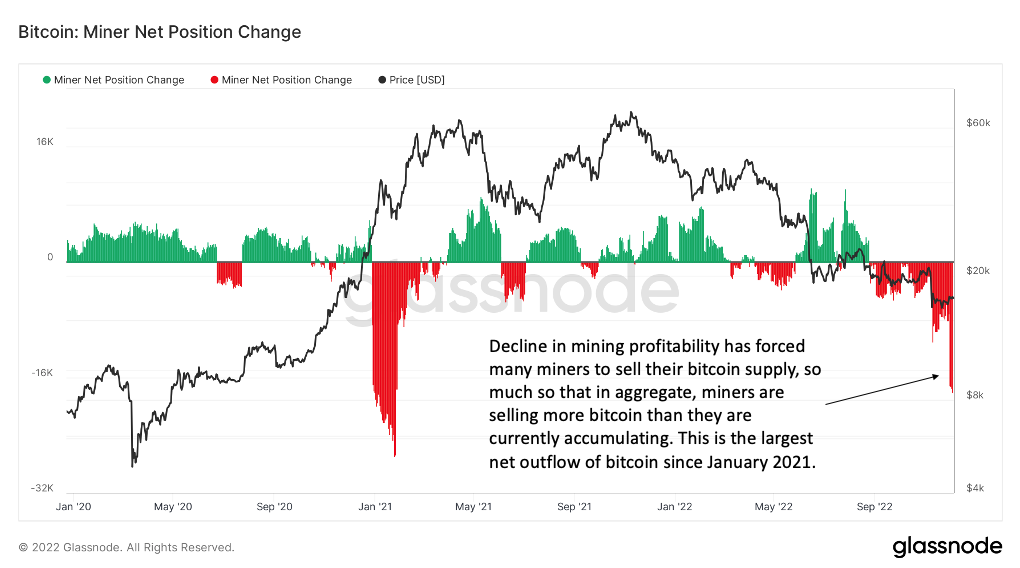

If you are a bitcoin miner, the combination of shrinking revenues and increasing costs means that mining profitability has declined rapidly. In fact, the current margins in bitcoin mining are likely the smallest they have ever been. Unfortunately, for many miners, it gets even worse. A large number of miners took on debt to finance their build-outs over the past year and a half. When they started, the terms of those loans made sense. However, as the economics of bitcoin mining deteriorated, it became increasingly difficult to make the payments on those loans. Even if miners are generating a profit in this current market, it’s likely not enough cash flow to pay the interest on the debt. As a result, we’re seeing a number of mining operations switching off their equipment, selling some of their bitcoin reserves, and even selling some of their mining equipment to cover operating costs and meet their debt obligations.

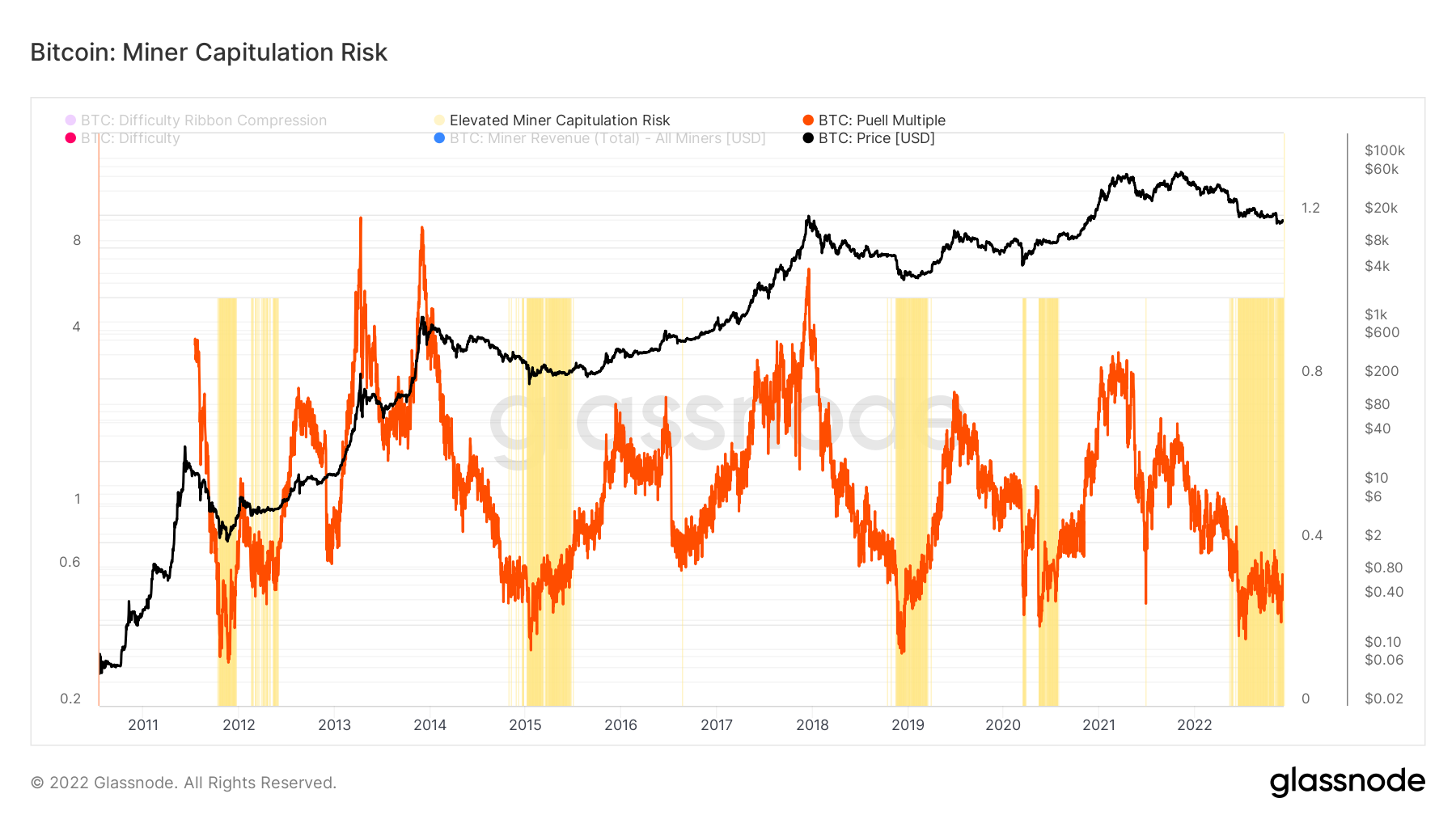

As bitcoin miners get squeezed from all sides, we have already begun to see smaller and less efficient mining operations start to sell off or shut down completely. Even some of the biggest players in this space, such as Core Scientific, Compute North, Argo Blockchain, and Iris Energy have experienced serious financial stress this year, with some of them going bankrupt or publicly stating they will not be able to continue operations without cash infusions. In addition to the headlines, we can monitor the stress miners are under on-chain as well. The chart below aims to measure when miners are at the greatest risk of forced selling or shutting down by measuring the implied miner income stress (Puell Multiple) and observed hash rate decline (Difficulty Ribbon Compression). As we can see, we are currently in a period in which the economic stress of operating a mining company has historically led to capitulation from many miners (i.e., closing down shop). This also correlates with market bottoms in the past. It will be interesting to watch how the next several months play out, especially if the price of BTC does not rebound soon.

What does this mean for the bitcoin mining industry going forward? The truth is unless the price of bitcoin skyrockets sometime soon, we are likely to see a number of mining operations go under and the total hash rate on the network decrease. But that doesn’t mean bitcoin or bitcoin mining is doomed. Not by any stretch of the imagination. Even if several major players go out of business in the coming months, all that means is there will be less computing power on the network. For the miners that are able to survive this period, less hash rate means there will be less competition, and the profitability of mining will begin to rise again even if prices stay flat. In this way, the bitcoin mining industry is self-correcting.

As always, the on-chain data is provided by Glassnode. If you would like to have access to the data yourself, you can sign up here.

Speaking of bitcoin mining—

One of the most common criticisms of bitcoin is that because mining uses a lot of electricity, it’s bad for the environment. In past issues (here, here, here, and here), we have covered in detail why this myth simply isn’t true. Among the many flaws with this critique (and there are oh so many) is the simple fact that not all electricity generation is created equal with regard to its impact on the environment. Utilizing electricity generated from a wind farm, solar panel, or hydroelectric plant has a very different impact on the environment than utilizing electricity generated by coal. As it turns out, the bitcoin network relies more on these clean, off-grid sources of energy than it relies on fossil fuels. Not only that, the degree to which it relies on fossil fuels is shrinking every year.

Why is this the case? In the previous section, we highlighted that electricity is the number one cost factor for bitcoin miners, and that cost has been rising. This, in turn, has created an incentive for bitcoin miners to find alternative, cheaper sources of energy. For example, bitcoin mining companies such as Crusoe Energy and Vespene Energy are repurposing methane (which is 25x worse than carbon dioxide) to use for bitcoin mining. Not only does this have a net positive impact on the environment by eliminating methane that otherwise would be leaked into the atmosphere, but because methane is a waste product, it’s a source of energy that bitcoin miners can obtain for free. Bitcoin mining operations can even be put in volcanoes, utilizing 100% clean geothermal heat to generate electricity—again, at no cost. There are an ever-growing number of these examples.

I highlight this because a recent report looked to quantify how much of bitcoin’s network is powered by off-grid energy sources. According to the study, because more than half of bitcoin mining is powered by off-grid sources, 52.2% of the bitcoin network is currently powered by zero-emission energy. In fact, there are at least 29 mining companies that use 90-100% zero-emission energy and another 12 that use emission-negative sources. This group alone accounts for a little over 17% of bitcoin’s total network.

Compare that to the main electrical grid in the U.S., in which only 36.7% comes from zero-emission sources. That means that nearly every other major industry within the U.S. relies on a grid, nearly two-thirds of which is powered by fossil fuels. The Bitcoin network appears to be one of the few industries, both in the U.S. and globally, that does not have coal as its primary energy source.

If that comes as a surprise to you, it gets even better. Not only is bitcoin already more eco-friendly than the current electrical grid, but it’s also becoming less dependent on fossil fuels faster than the current electrical grid. According to that same report, the amount of bitcoin’s network that is powered by zero-emission energy is growing at 4.5% per year. It’s possible that in the next decade or so, the bitcoin network might become carbon negative and actively reduce the number of global carbon emissions.

In conclusion

Though 2022 has seen steep declines in cryptoasset prices, most of the turmoil this year was caused by bad actors and fraudulent activity, acting in the antithesis of the ideals on which crypto was built in the first place. That behavior has not only hurt prices but is now causing serious stress on miners as well. However, despite everything that has happened this year, crypto adoption, especially in underdeveloped countries, has continued to increase. Brazil is a great example, but frankly, it’s one of many locations where local citizens are bypassing the traditional financial infrastructure in favor of bitcoin, stablecoins, and DeFi. In addition, more and more individuals are learning the value of self-custody while, at the same time, bitcoin mining is quickly becoming increasingly eco-friendly. Though the headlines would have you believe otherwise, there have been a lot of positive developments that happened this year.

In Other News

The House Financial Services Committee has set a date (December 13) for its hearing into what happened at FTX and apparently SBF has agreed to testify.

FTX’s collapse was a crime, not an accident.

Although it may take a while, SBF could go to prison for a very, very long time.

Centralization may have caused the FTX fiasco.

Why a divided congress is bullish for crypto.

Goldman Sachs unveils digital asset platform with EIB €100m blockchain bond.

Fidelity opens retail crypto accounts.

Crypto remains the largest investment sector in 2022, outpacing Fintech and Biotech.

Why banking uses at least 56x more energy than bitcoin.

Belgium’s financial regulator clarified that crypto assets like bitcoin and ether should be exempt from securities regulation.

Ron Wyden, chair of the U.S. Senate Finance Committee, wrote to some of the largest crypto exchanges, including Binance.US, Coinbase, Bitfinex, Kraken and Kucoin, asking for operational details.

The Senate Banking Committee and House Financial Services Committee both requested FTX’s ex-CEO Sam Bankman-Fried to testify at next week’s hearings and will subpoena him if he does not appear voluntarily.

The U.S. Department of Justice requested an independent probe of the case.

Global auditor Mazars concluded that Binance’s bitcoin reserves are fully collateralized, following a proof-of-reserves and proof-of-liabilities verification.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.