Welcome back to The Node Ahead, a cryptocurrency and digital asset resource for financial advisors. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we’ll review:

- The collapse of FTX.

There have been some wild days in crypto but last week was perhaps one of the wildest. On November 6th, Binance CEO Changpeng Zhao (otherwise known as CZ), launched what proved to be a monumental grenade when he took to Twitter to declare that his company would sell its entire $530 million position in FTT. In a matter of 72 hours, FTX went from the second largest crypto exchange in the world to insolvent. To understand the chain of events that caused such a rapid collapse, what FTT is, its role in bringing down FTX, and why that one tweet led to the collapse of Binance’s largest competitor, we have to start 5 years ago.

Binance burst onto the scene in 2017 and quickly became the largest crypto exchange in the world, and it’s held the top spot ever since. However, in 2019, a new crypto exchange called FTX experienced its own meteoric rise, quickly overtaking competitors such as Gemini, Coinbase, and Kraken. FTX was founded by Sam Bankman-Fried (otherwise known as SBF) who had already become one of the world’s youngest billionaires through his trading firm, Alameda Research. Alameda was essential in FTX’s early growth, providing much of FTX’s initial liquidity. In addition to Alameda’s support, FTX also released its own token called FTT. The token allowed FTX customers to receive discounts on trading fees and other perks. Over time, the price of FTT became the de facto measurement of FTX’s value.

Binance owned a stockpile of 23 million FTT, valued at $530 million, at the time CZ tweeted he was going to sell all of it. So, why did CZ, who had been holding onto these tokens for well over a year, suddenly choose to publicly announce they were about to dump over half a billion dollars worth of FTT even though the announcement was sure to cause the price of FTT to drop before they sold their position? Likely because CZ saw an opportunity to weaken his competition. Also because CZ has a personal vendetta against SBF.

CZ and SBF

It’s worth digging into the relationship between these two because there was likely personal motivation behind CZ’s move, beyond just trying to squish a rising competitor. CZ was the first investor in FTX back in 2019, but within 18 months of that investment, their relationship had soured. By 2021, SBF offered to buy CZ out for a mix of cash and FTT which was how Binance ended up with the 23 million FTT tokens in the first place. But there’s more. Although FTX is technically headquartered in the Bahamas, SBF was born in the US, attended MIT, and the investment firm that made him a billionaire is based in California. It’s no surprise that SBF had a much better relationship with US politicians than the Chinese born CZ. In fact, SBF was a very large political donor who contributed $50 million during the past U.S. election cycle, spent considerable time in Washington DC speaking with policy makers, and isn’t shy about using his influence to push for favorable regulations. According to Representative Tom Emmer, SEC chairman Gary Gensler was “helping SBF and FTX work on legal loopholes to obtain a regulatory monopoly.” It’s likely CZ not only saw SBF’s relationships in Washington as a threat to Binance but also believed SBF was quietly lobbying against Binance in the background. CZ said as much during his explanation about why he was dumping FTT in the first place, saying “We won’t support people who lobby against other industry players behind their backs.”

The tweet

With their personal relationship as the backdrop, it’s time to dig into the events. Though Alameda (the hedge fund) and FTX (the exchange) are technically two separate businesses, the two entities were very much intertwined (more than anyone really knew prior to last week). On November 2nd, a leaked balance sheet showed that Alameda had $14.6 billion worth of assets against $7.4 billion worth of loans. That in of itself isn’t cause for alarm except for the fact that a large portion of Alameda’s assets were held in FTT rather than an independent asset like USD or bitcoin. It would have likely been fine for Alameda to hold a lot of FTT on their balance sheet so long as the company didn’t borrow against it. However, Alameda was using the volatile token as collateral for its loans. Thus, if the price of FTT were to fall far enough, Alameda could be at risk of not being able to meet its debt obligations and become insolvent.

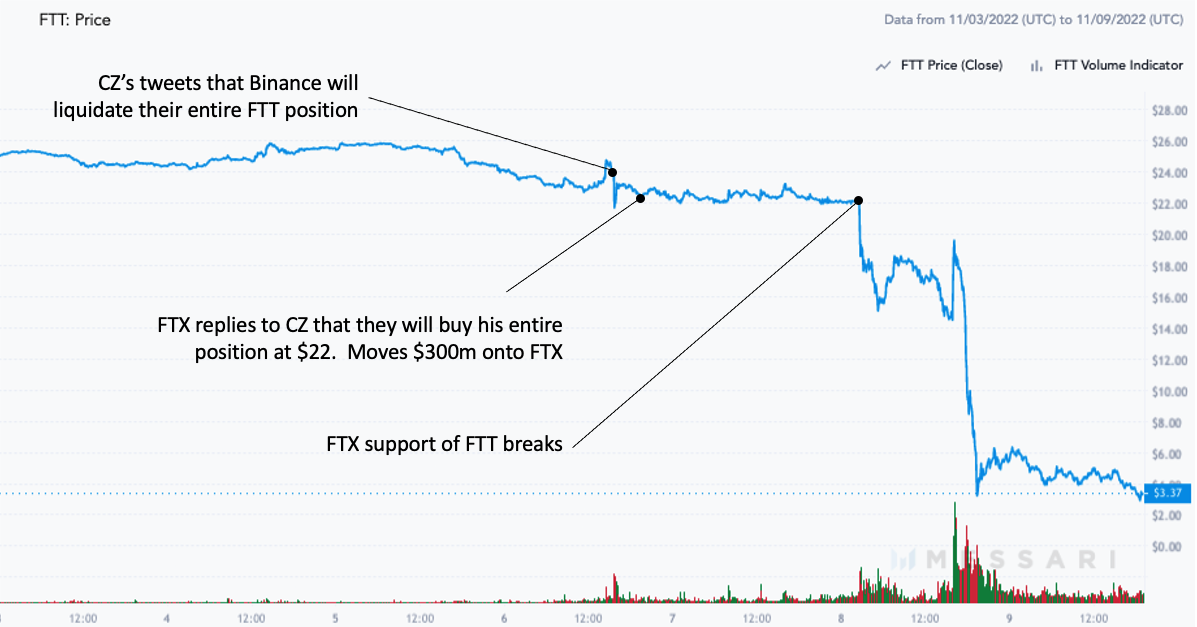

The report that came out on November 2nd began to fuel speculation in the market. Coindesk provided the kindling, all CZ needed to do was light the match. That match, it turns out, was that simple tweet released on November 6th stating that Binance would sell all of its FTT tokens. A couple hours after CZ’s announcement, Binance transferred all 23 million FTT tokens onto its exchange and started selling. Fueled by CZ’s announcement and confirmed by the on-chain flows, the price of FTT quickly fell from $25 to $22. In response, FTX publicly stated they would buy all of Binance’s FTT holdings at $22 per token. However, CZ wasn’t interested and Alameda was forced to move ~$300m worth of stablecoins into FTX presumably to provide support for the falling cryptoasset. For a period of time FTT stabilized around the $22 level. Unfortunately for Alameda, it wasn’t enough as the market continued to sell beyond what it could support. Eventually, this sell pressure was too much and the price of FTT plummeted to $3.

Source: Messari, Twitter

At this point, Alameda was screwed. It held a lot of FTT, took loans out against it and as the price of FTT fell, the fund could no longer cover those loans. Just another hedge fund taking on too much risk and getting burned, so what? Why did that cause FTX to implode? Well as we alluded to earlier, the two entities were more intertwined than anyone knew.

It turns out that Alameda suffered some big losses earlier this year around the same time Luna, Celsius, Voyager, and Three Arrows Capital all collapsed. To keep from going under, Alameda borrowed directly from FTX. Even worse, FTX used customer deposits as part of the capital it loaned to Alameda. As we later learned in a report by Reuters, SBF transferred $4 billion in funds to Alameda in June, a portion of which was customer deposits, without informing any other executives at FTX. Not only was this unethical and illegal, it violated FTX’s own terms of service which read: “None of the Digital Assets in your Account are the property of, or shall or may be loaned to, FTX Trading; FTX Trading does not represent or treat Digital Assets in User’s Accounts as belonging to FTX Trading.” In other words, though individual tokens might lose value, the expectation FTX set with its users was that it wouldn’t trade or loan out the money users deposited onto the exchange.

To give you an idea why using customer accounts to make loans is a bad idea, here is a link to a clip of congressional testimony less than a year ago about how this exact behavior led to the 2008 collapse. The individual giving the testimony in this video is…checks notes…Sam Bankman-Fried?!?! Are you kidding me?

So, when the price of FTT fell, Alameda didn’t have the capital to pay back the loan from FTX, which now meant that FTX had a mismatch between the amount of capital it owed its customers and the amount of capital it actually had on hand. As bad as that was, FTX might have been able to dig itself out of that hole over time so long as all its customers didn’t start asking for their money back all at once. And, at this point, I’m sure you can guess what happened almost immediately.

The run on FTX

With FTT crashing and rumors of FTX insolvency quickly spreading, FTX saw $6 billion in exchange outflows within 72 hours of CZ’s tweet. By early Tuesday morning, FTX had halted all withdrawals on the platform in an attempt to stop what was essentially a run on the bank.

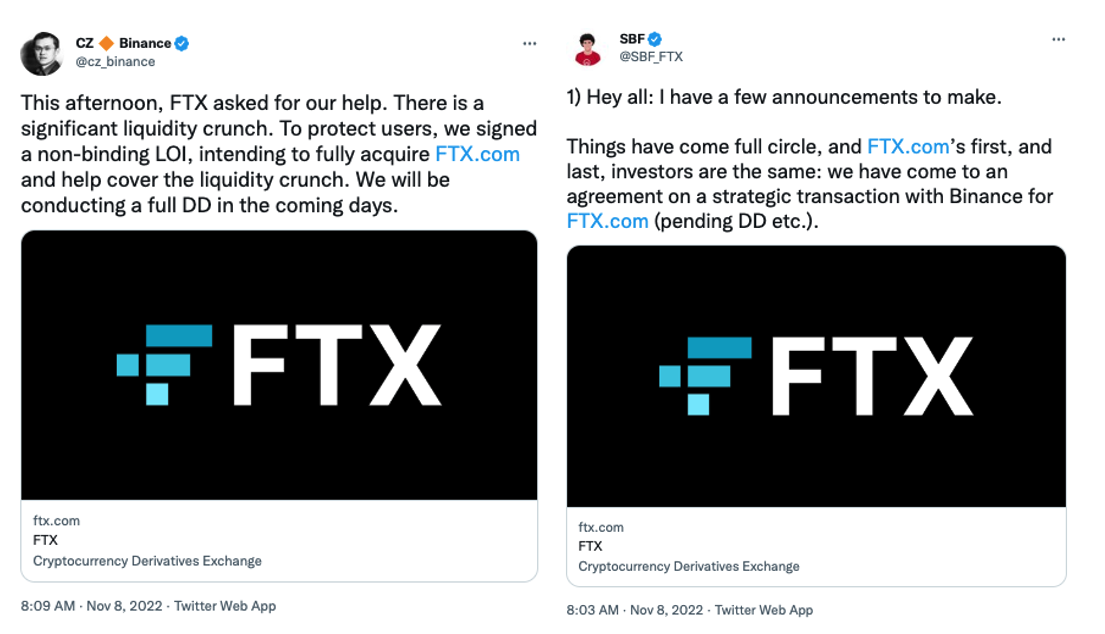

With Alameda unable to stop the bleeding and FTX in desperate need of liquidity, Sam Bankman-Fried turned to the one individual who could bail him out: CZ. On Tuesday morning, both SBF and CZ released tweets confirming that Binance had agreed to acquire FTX in order to save the exchange from insolvency. That’s right, SBF entered into an agreement to sell his company to the individual who started the crisis in the first place.

With one opportunistic tweet, Binance effectively eliminated their largest competitor in less than 3 days. Now, technically the two companies only signed a non-binding letter of intent, meaning Binance had the right to pull out of the deal at any time. And sure enough, the next day, Binance did exactly that.

Why would Binance back out when it could have scooped up its biggest competitor for dirt cheap? Apparently, the financial situation at FTX was far worse than anyone imagined. According to a WSJ report released after Binance backed out, SBF confirmed FTX had lent Alameda around $10 billion in total. By the time FTX halted withdrawals, it was facing an $8 billion shortfall. Basically, CZ took one look at FTX’s books and decided he couldn’t rescue FTX even if he wanted to. In a tweet put out by Binance midday Wednesday November 9th, the company stated “As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX. In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help.”

The scramble

With the deal now dead, SBF started scrambling to find anyone who could provide FTX with liquidity. It was reported that he was looking to raise $9 billion from various parties to cover FTX’s financial gap. Before SBF could find a group of investors willing to save the company, the Bahamian regulators froze FTX’s assets on Thursday. By Friday morning, the company had filed for Chapter 11 bankruptcy and CEO Sam Bankman-Fried had resigned. FTX appointed a new CEO, John J. Ray III, the same individual who oversaw the liquidation of Enron which may give a hint at the scope of the situation.

On Sunday November 6th, FTX was the second largest exchange, and by Friday morning, November 11th, Sam was out, FTX was in bankruptcy, and Alameda was closing down. Now all that was left to do was let the bankruptcy play out in the courts, right? The story can’t possibly get any worse, can it? Sigh…

The moving millions

On Friday night, the same day FTX filed for bankruptcy, the on-chain data began to show unusual movement in many FTX wallets. Within hours, more than $600m was siphoned from FTX. While there were rumors that FTX was being hacked, that was highly unlikely because there was almost no way an outsider could have gotten root access to so many wallets so quickly. Also, because whoever was doing this was clearly not concerned about moving the funds publicly for all to see on-chain, it suggested whoever was behind this was desperate to get the money out quickly. Turns out, Sam had built a backdoor to FTX so he could change financial records and move funds in order to fool auditors. Apparently, that’s how he was allegedly able to move $10 billion from FTX to Alameda without raising any red flags. Though it has yet to be confirmed who stole the $600m, according to reports, “the clues point to a high-level insider” leading many to speculate that it was likely Sam or one of the members of his close inner circle.

Initial takeaways from last week

Though much is still unknown and I’m sure we will learn more in the coming weeks, I’ll share a few initial reactions.

First, my heart goes out to everyone that had money on FTX who, as of right now, doesn’t know if or when they will get any money back. Those customers were lied to and defrauded. Many employees may end up losing significant portions of their net worth because of the actions of one individual who decided to put the interests of his own hedge fund above everyone else.

Second, though CZ has publicly denied it, this clearly was an attack by Binance on a competitor. Binance could have just as easily sold its position quietly and over time as to not alert the market. But the fact that they came out publicly before they started selling is a clear indication that they wanted to drive the price of FTT down to hurt Alameda and FTX. CZ even compared FTT to Luna, the cryptoasset that collapsed earlier this year. Who knows how much CZ knew prior to his tweet and if he orchestrated this from the beginning to take down FTX, or if his ploy just went farther than he originally anticipated. Regardless, it looks as though Binance has cemented its position as the number one global crypto exchange.

Third, just utter frustration at the fact that selfish decisions by a few individuals have cast a dark cloud over an industry that is full of amazing people and entrepreneurs genuinely trying to create a more transparent, accessible, and equitable world. Bitcoin, Ethereum, and many of the companies and services built on those platforms are making real-world impacts on millions of people’s lives. Prior to this whole debacle, this week’s newsletter was going to discuss how in Lebanon, which is experiencing hyperinflation and where banks have imposed huge haircuts on dollar withdrawals, local citizens are increasingly saving in bitcoin and buying groceries with stablecoins. We were going to write about how central banks from France, Switzerland, and Singapore are attempting to automate foreign exchange markets using decentralized finance (DeFi) protocols to cut the cost of cross-border payments. There are so, so, so many examples of this industry making amazing progress and building meaningful products that are genuinely making a difference. But instead, here we are talking about how one bad actor, who operated in a way antithetical to the core values of the crypto industry, caused widespread devastation. This past week should be an indictment on Alameda, FTX, and SBF—not the crypto industry as a whole.

The reality is, FTX does not change the fundamental value that crypto provides. Just like in 2008, the banks gambling with customers’ money on mortgage-backed securities did not change the fundamental value of a home. In fact, we need transparency and auditability now more than ever. Bitcoin and DeFi can give this to us. It’s instances like the ones we saw with FTX last week, Celsius and Three Arrows earlier this year, and the housing crisis in 2008 that highlight the need for truly decentralized finance. Let’s be clear—FTX is a centralized entity whose users and customers had no visibility into the true risks of using the platform. FTX had a giant hole in its balance sheet for as long as it did precisely because there was no way to publicly verify it in the way we can with blockchain-based services. No one knew the full extent of the overlap between FTX and Alameda, just like no one knew the full risks of mortgage-backed securities in 2008. The risks were hidden, and that’s the whole point.

Just because a company operates in the crypto industry does not mean it’s representative of what this industry is trying to achieve. Bitcoin’s supply issuance and monetary policy can be verified by anyone, and has not changed since it launched in 2009. Decentralized exchanges such as Uniswap and lending platforms such as Compound and Aave have continued to operate without interruption and with full transparency throughout the year. Their open design ensures that the platform’s collateralization is knowable and verifiable to all market participants at all times, and thus won’t collapse due to a single individual or small group’s choices operating behind closed doors. Exchanges such as Kraken and BitMex provide Proof of Reserves (PoR) in which users can independently verify, at any time, that the exchange actually holds the funds they claim by matching them to on-chain records. I have never been more bullish on the need and future of a non-custodial, open financial system that eliminates the need for middlemen than I am now. I think Jake Chervinsky from the Blockchain Association put it best:

Conclusion

The events of last week are a clear example of the risks inherent in participating in an emerging industry. Though as we pointed out, the technology, product, and services have the potential to solve these problems of opacity found in both crypto and traditional finance. One reason FTX’s unethical behavior happened in the first place was because the company is an offshore entity and thus falls outside of US jurisdiction. They were not subject to the same audits and financial scrutiny as US domiciled companies. This is yet another reason why Onramp has partnered with US entities such as Coinbase and Gemini, and has avoided offshore exchanges such as FTX and Binance. However, at the end of the day, the events of last week do not change anything about the long-term prospects of the industry or the likelihood that clients will continue investing in cryptoassets in the years to come. We acknowledge the risks in the crypto space and strive to be a dependable, trusted partner for financial advisors who will inevitably have to navigate this ever-evolving industry.

In Other News

Visa, PayPal, Western Union among fall flurry of crypto trademark filings.

Costa Rica could be one of the next countries to adopt bitcoin as a regulated payment method, as a bill to include the asset was introduced recently to Congress.

New survey finds that 37% of voters are considering candidates crypto positions in the upcoming election.

Britain’s new prime minister is an advocate of crypto.

Crypto exchange volumes have hit 23 month lows as most marginal sellers have exited the market.

Coinbase has requested an amicus brief (aka is seeking approval) to help strengthen Ripple’s case in its legal battle with the SEC.

Good overview from Chainalysis of the crypto legislation that has been proposed and when it likely will pass.

Fidelity Investments announced the launch of Fidelity Crypto, allowing traders to invest in Bitcoin and Ethereum commission free.

Google signals major crypto push with support for web3 infrastructure including integrations with Ethereum and Solana.

The US government seized a stockpile of bitcoin who pleaded guilty to stealing it from the Silk Road.

Binance released its reserve wallet addresses and revealed a reserve of close to $69 billion, in the form of bitcoin, ether and other coins.

As contagion from FTX spreads, BlockFi stops withdrawals.

New crypto friendly politicians are headed to Washington.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.