Welcome back to The Node Ahead, a cryptocurrency and digital asset resource for financial advisors. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we will review:

- Institutional adoption of crypto continues

- Ripple’s lawsuit with the SEC

- Understanding the Taro Network

Crypto adoption is not slowing down

In our last newsletter, we highlighted a number of traditional financial institutions that have been releasing crypto products for their clients and becoming more active in the space. This trend continues to gather more momentum as Nasdaq reportedly prepares crypto custody services for financial institutions. According to the story, the firm created a new group focused on digital assets and hired Ira Auerbach, who previously worked at Gemini, to lead the unit. Then came word that the $33 billion digital bank Revolut received approval to offer bitcoin and crypto to its 17 million customers in Europe. Lastly, as the dollar continues to strengthen and the pound has fallen 25% year to date in dollar terms, trade volume for the GBP/BTC pair increased 1,150% last week. As major fiat currencies continue to be stressed, we are seeing more and more people turning to bitcoin as an escape hatch from the traditional financial system.

Legendary investor Stanley Druckenmiller and JP Morgan apparently also picked up on this trend. Speaking at a conference last week, Druckenmiller stated that crypto could see a “renaissance” if trust in the central banks continues to erode, and JP Morgan released a report last week predicting that bitcoin would have the highest expected returns of any asset class in the coming years. It forecast bitcoin with a projected excess return rate of 38.1%, far higher than private equity (21.0%), global equities (20.1%), private debt (5.6%) and global government bonds (2.1%).

And if all that wasn’t enough over the past two weeks, last Thursday, representative Byron Donalds introduced a bill that would allow bitcoin to be included in 401(k) plans. The bill would prohibit the Department of Labor from restricting the type of investments self-directed 401(k) account investors can choose to invest in through a brokerage window. Several politicians have already come out publicly in favor of the bill including Senator Tommy Tuberville, Congressman Tom Emmer, and Congressman Warren Davidson.

Although we might sound like a broken record, it’s worth repeating; even though the price continues to stay suppressed, the adoption of bitcoin and crypto continues to increase, and this may bode well for the long-term outlook of the industry.

Ripple’s lawsuit nears conclusion

Over the last two weeks, XRP shot up 39%. This came as a result of news that Ripple’s court case with the SEC is likely to come to a close soon. Should the judge rule in favor of XRP, as most experts are now anticipating, it could significantly undermine the SEC’s enforcement capabilities over the rest of the crypto market. Before we get into details, we need to understand what Ripple is, what XRP is, and why the SEC sued the company in the first place.

Founded in 2012, Ripple is a traditionally structured enterprise software company (in other words, not DeFi). The company provides a real-time settlement system, currency exchange, and remittance network to facilitate low cost, instantaneous transactions between traditional financial entities. It just so happens that Ripple uses blockchain technology to improve the operations of its clients because it allows them to settle accounts between various financial institutions around the world much faster and much cheaper than the current legacy infrastructure. Today, Ripple’s global payments network now includes over 300 customers (including well known entities such as Bank of America) across 40+ countries and six continents.

To facilitate this transfer of value over the blockchain, Ripple created its own cryptocurrency called XRP that can be settled and cleared in real time. The role of XRP is a topic of much debate among the crypto community, given that settlement can happen over Ripple’s network without using the token—but that topic is for another time, and outside the scope of this post. What is important to know is that XRP grew beyond its original application over time, as the founders used XRP to raise $1.38 billion in 2013 by selling it on the open market. However, the company never registered the sale of XRP with any regulators, did not qualify for any exemption from registration, and did not provide any disclosures or information regarding XRP. Thus, the SEC believes Ripple was in violation of federal securities laws and in 2020, the SEC charged Ripple with conducting an illegal, unregistered securities offering.

Ripple, on the other hand, does not believe that XRP is a security but rather a virtual currency. Thus, they argue, the securities laws do not apply.

The lawsuit essentially boils down to whether or not XRP is a security. Because the guidelines for determining whether various cryptocurrencies are securities, commodities, or something completely different has never been clearly established, this case could have significant ramifications for the entire crypto market.

A security is a traded financial instrument representing ownership in a corporation or similar entity. That Apple stock or interest yielding bond you own in your portfolio, that’s a security. In contrast, bitcoin has been universally deemed not to be a security by every financial regulatory body in the US including the SEC. The main reason is that there is no central entity behind bitcoin. The fact that bitcoin is decentralized means regulatory bodies view bitcoin as more akin to owning a commodity (ie: piece of physical gold) rather than owning stock in a corporation.

Unlike bitcoin, XRP is issued by a private company, and although the network is open, it is owned and operated by Ripple. Whereas bitcoin is mined by network participants and new tokens are released over time in exchange for operating and securing the network, XRP had 100 billion units initially created that are periodically released by Ripple. Of the 100 billion tokens, 80% were originally granted to the company as a tool for it to help grow the network over time while the other 20% was reserved for the founders. If that sounds awfully like a stock option plan a traditional company might have, well…that’s because structurally it is very similar.

That’s why the SEC filed the lawsuit in the first place. The SEC believes that investors bought XRP because they believed the price of XRP would climb due to Ripple’s activities and thus satisfies the requirements of a security. And yet, by all indications, it appears the SEC has not been able to make a strong case that XRP is, in fact, a security.

The 1933 Securities Act says that you must have an investment contract in order to be deemed a security. However, Ripple argues that it does not have a written, oral, or implicit contract that would grant rights to any investors of XRP, and thus cannot be considered a security. Stuart Alderoty, the company’s general counsel, stated that, “after two years of litigation, the SEC is unable to identify any contract for investment (that’s what the statute requires).”

Then there is the issue of Ethereum. Back in 2018, Director of Corporation Finance at the SEC Bill Hinman, declared that ETH, despite its well-publicized initial coin offering in 2014, had evolved from a security to a non-security due to Ethereum becoming “sufficiently decentralized” over time. Ripple cited this speech numerous times arguing that the Ripple network is also decentralized and thus XRP, by the SEC’s own standards, cannot be classified as a security. The SEC has tried to argue that the comments made by Hinman were his personal opinion and not representative of the agency’s stance on the matter. However, despite being ordered by the judge five separate times, the SEC has refused to hand over notes and emails from Hinman’s tenure that could prove Hinman collaborated with other SEC lawyers and staffers when drafting that speech. If he did consult with others at the agency, the SEC’s objection falls apart which is why the judge stated the SEC is acting hypocritical by hiding the documents.

“The hypocrisy in arguing to the Court, on the one hand, that the Speech is not relevant to the market’s understanding of how or whether the SEC will regulate cryptocurrency, and on the other hand, that Hinman sought and obtained legal advice from SEC counsel in drafting his speech, suggests that the SEC is adopting its litigation positions to further its desired goal, and not out of a faithful allegiance to the law.” – Judge Sarah Netburn

But that’s not the only positive development in the case for Ripple. Cryptocurrency lobby group Chamber of Digital Commerce (CDC) received approval to submit an amicus curiae brief. An amicus curiae brief is written testimony by a person or organization that is not part of the case but is granted permission to submit an opinion to the court in order to influence the court’s decision. Although the CDC says it does not take a view on whether Ripple’s XRP sales are securities transactions, they do argue that the SEC is using this case against Ripple as a novel application of security contract analysis, and expects market participants to determine whether or not an asset is a security even though the SEC has yet to provide guidance to them on how to determine that. Allowing the CDC to weigh in on the case bodes well for Ripple’s chances.

According to Brad Garlinghouse, CEO of Ripple, “The lawsuit has gone exceedingly well, and much better than I could have hoped when it began about 15 months ago.”

If Ripple wins this case, the SEC’s authority over the crypto markets will be substantially weakened. XRP was issued by a centralized, software company. If XRP is deemed not to be a security, then it’s highly unlikely that any DeFi token that doesn’t have a central entity can be considered a security. While not all cryptoassets would escape this label, there are an awful lot of tokens that are far less security-like than XRP. Every one of those projects would be able to point to this case and claim that if their token is equally or more decentralized than XRP, they should not be classified as a security either.

Regardless of what you think about XRP as an asset, we can all agree that, should Ripple win, this court case could prove to be a landmark win for the crypto industry and a crushing blow to the SEC.

The Taro Network

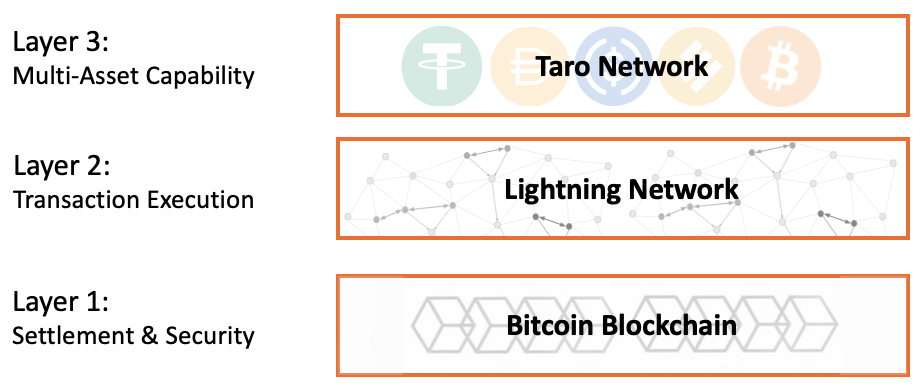

In the first ever edition of The Node Ahead, we discussed the Lightning Network and the rapid growth it was experiencing. As a quick refresher, Lightning is a network of payment channels built on top of Bitcoin’s base layer blockchain that enables instant, nearly-free bitcoin denominated payments to anyone in the world. Then, in November of last year, we covered the Taproot upgrade that went live on the Bitcoin network, improving the network’s privacy and programmability while making transactions faster and less expensive. The combination of those two developments led to a new protocol in the bitcoin ecosystem called Taro.

Taro is a new protocol made possible by the Taproot upgrade, which allows developers to issue assets other than BTC on the Bitcoin blockchain. Taro also leverages the Lightning Network to transfer those assets instantly and with very low fees. In other words, it transforms Bitcoin’s blockchain from only being able to transact in one asset (BTC) to being able to transfer an unlimited number of assets over its network, utilizing the security and stability of the Bitcoin network and the speed, scalability, and low fees of Lightning.

Incorporating other cryptocurrencies into the bitcoin and Lightning ecosystem should, in theory, bring in more users to the network and expand bitcoin’s reach and liquidity. The most obvious and first use case for the Taro network will likely be stablecoins.

The stablecoin market grew from $3 billion to over $150 billion over the last three years. Stablecoins have several of the same advantages of other cryptocurrencies, such as being open, global, and accessible to anyone on the internet without the need for a bank account. An additional advantage of stablecoins is that they maintain a constant price (typically pegged to the dollar). Stablecoins let users send money across borders without having to pay exchange fees, and consumers can earn a much higher yield holding stablecoins compared to traditional savings accounts (most of which from common consumer banks offer around 0.01%). Stablecoins also provide the ability for merchants to accept payments without paying the 3% fee that credit card companies charge on every transaction.

Until now, none of that has occurred on the Bitcoin blockchain. Most stablecoin activity happened on Ethereum and Tron, each of which experienced its own set of challenges. In the past, Ethereum experienced high transaction fees and Tron had security issues. Taro bridges this gap by providing the best of both worlds, enabling the distribution of assets like stablecoins on the most decentralized and secure blockchain (Bitcoin) and allowing users to transact on the fastest global payments network with the lowest fees (Lightning Network). Thus, Taro has the potential to make using the Bitcoin network for commerce more attractive, further increasing its use as a payment network and not just as a savings technology.

Even prior to Taro, we’ve seen an explosion of growth in the Lightning Network over the last year, especially in Latin America (El Salvador, Guatemala, Argentina, Brazil) and West Africa (Nigeria, Ghana). This is because users in emerging markets do not have access to the same level of financial services, or access to the global economy that we are accustomed to in the United States. Bitcoin and the Lightning Network have increased that accessibility by enabling anyone with an internet connection to send, receive, and store value without the need for a bank.

Taro takes this a step further by enabling even more financial services to be built on the Bitcoin network. By bringing other assets to the Bitcoin network, users can engage in global commerce using more stable assets such as USDC. In the near future, it will likely be possible to take out a loan and have it entirely facilitated on-chain without any middlemen. Credit worthiness and rates will be determined in real time by using on-chain data (collateral, transaction history, etc.) without the need to disclose personal information (name, address, social security, etc.), reducing the default rate and minimizing any inherent demographic biases. Don’t be surprised to see the Bitcoin network being used to take out loans for a car, a mortgage, or business startups in the future. And anyone will have the ability to lend out their assets to earn a passive income. All of this and more could be done on the Bitcoin network using an app (or suite of apps) on a phone and without any bank or middlemen extracting fees.

In time, these financial services are likely to become a seamless experience because Taro enables users to hold BTC, USDC, dollars, and any other asset in the same wallet. By enabling developers to provide users with a dollar-denominated balance, a bitcoin-denominated balance, and any number of other assets in the same wallet, it will become trivial to send and receive different assets across the globe. This could potentially drastically increase financial access and innovation for these communities, because financial services could be built without the need for banks or third parties. An interoperable ecosystem of assets where users can easily swap between them all could become the catalyst for the next billion or more people to adopt and use the Bitcoin network.

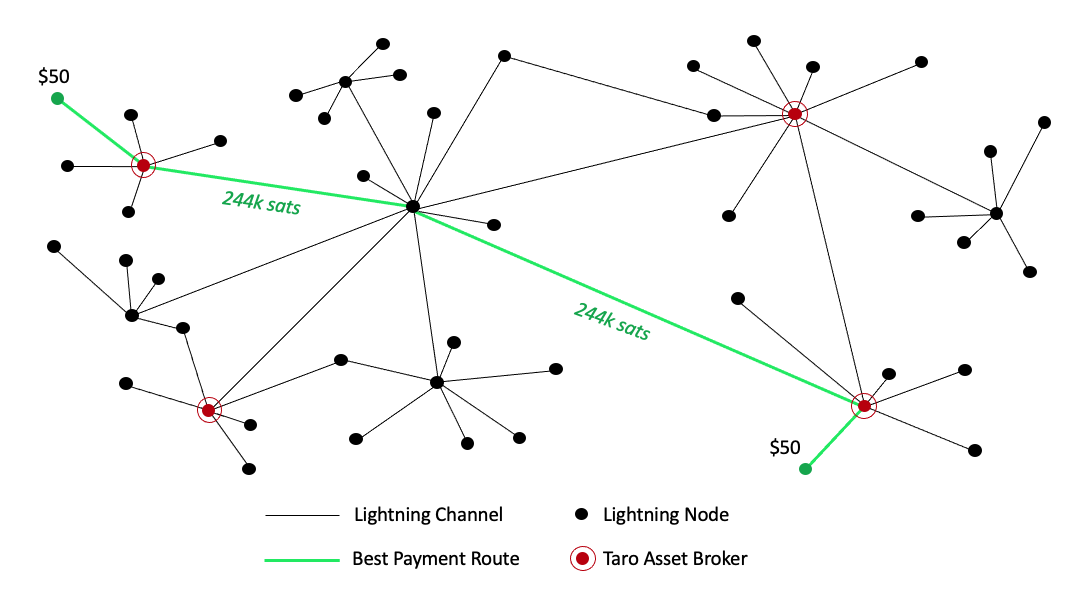

Furthermore, because the Lightning Network uses bitcoin liquidity to route transactions, an increase in use of the Lightning Network due to Taro created assets could result in greater demand for bitcoin on the Lightning platform. In other words, anyone will have the ability to route all the world’s currencies through bitcoin and seamlessly switch between bitcoin, stablecoins, pesos, euros, or yen—instantly. For example, it’s possible that, in the near future, if I have Apple stock that someone in Europe wants to buy, I could put that Apple stock on Taro, send via the lightning network using BTC to facilitate the trade and receive back dollars even though the buyer paid in Euros. This would all be done with no middlemen, no counterparty risk, with a near instant settlement rate and extremely low fees.

Because Taro uses BTC and Lightning Network as transmittal rails, any increase in demand for transactions across all assets on Taro will increase the liquidity on Bitcoin to facilitate those transactions. Should the Taro network prove to be successful, bitcoin could become the central liquidity pool that everything gets traded through. Rather than trying to incorporate bitcoin into the legacy financial system, Taro is aiming to bitcoinize the dollar (and every other currency for that matter).

The takeaway

As we have stated many times, price is a poor indicator of what is actually happening within the crypto market. Adoption continues to increase, not only from individuals throughout the world but also traditional financial institutions. More infrastructure and features are being built to improve bitcoin and the wider crypto ecosystem, making these technologies more useful and intuitive. Even the regulatory landscape seems to be evolving for the better as sentiment in Washington becomes overwhelmingly in favor of minimizing the SEC’s oversight in favor of the CFTC. While large price drawdowns are always difficult, there is good reason to be optimistic about the long term health of the crypto industry.

In other news

Recent survey of key swing states shows that far more people own cryptoassets than are members of a union.

White House OSTP department analyzes 18 design choices for a possible US CBDC.

Colorado now accepts crypto payments for state taxes.

Republican lawmakers file Amicus Brief in support of Custodia Bank’s legal battle with the Federal Reserve.

Bank of Russia and Deputy Finance Minister Alexei Moiseev agreed to allow cross-border settlements in cryptocurrency.

The House joined the Senate’s effort to install the Commodity Futures Trading Commission (CFTC) as a leading agency to oversee digital assets trading.

California Governor Gavin Newsom vetoed a bill that would have started a crypto licensing regime in the state thus averting what has been referred to as its own version of New York State’s BitLicense, considered the most onerous crypto regulation in the U.S.

Gemini is partnering with Betterment to bring crypto to its retail and advisory clients.

Bank of America states that increased stablecoin flows could bode well for crypto recovery.

FTX wins bid to buy crypto lender Voyager Digital’s assets out of bankruptcy.

Chainalysis released their annual Global Crypto Adoption Index report.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.