Welcome back to The Node Ahead, a cryptoasset resource for financial advisors. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we will review:

- Bitcoin Mining is Reducing Methane Emissions

- Blackrock launches bitcoin investment product

- Ethereum’s merge to Proof-of-Stake

Bitcoin Mining is Reducing Methane Emissions

We have argued at length that not only is bitcoin not harmful to the environment, but it’s actually one of our best tools for incentivizing innovation in renewable energy technologies. A perfect example is using bitcoin mining to reduce methane emissions. According to the Climate and Clean Air Coalition, “cutting methane is the strongest lever we have to slow climate change over the next 25 years.” It turns out that two of the largest methane producers are oil fields and landfills.

Let’s start with oil drilling sites, which create methane as a byproduct of their operations and typically dispose of it by simply burning it (aka flaring). Instead of burning the methane, which is a waste product and releases CO2 when burned (which still isn’t good for the environment), miners are taking that excess methane and using it to cleanly power bitcoin mining rigs thereby eliminating methane and carbon emissions. This has been so successful, even Congress is getting behind the idea. As part of the Inflation Reduction Act (IRA), the government has committed $1.5 billion to “deploy equipment that reduces methane emissions and to support innovation in reducing methane emissions.” This could potentially spur further investment in bitcoin mining especially given the government has also previously deemed flaring is not “green” or in line with the ESG policies.

Now another bitcoin-inspired innovation has been developed to curb methane emissions in landfills. According to the US Environmental Protection Agency (EPA), a third of US methane emissions are generated by landfills. Landfills created in the 1970s are still emitting methane today and will continue to do so for the foreseeable future. Even worse, dealing with landfills is often neglected because it can cost state and local governments millions of dollars (money many local governments simply do not have) to install the proper infrastructure to capture the methane these landfills produce. This is why over 1,400 landfills in the US alone do not have the infrastructure in place to capture or flare the methane they produce.

Now imagine you are a municipal official responsible for such a landfill and someone came along and said that they would handle the landfill for you, convert the methane emissions in an EPA-compliant way, and pay you for the privilege of doing so. That’s exactly what a new startup called Vespene is doing. Vespene converts the methane emitted from landfills into electricity to power bitcoin mining rigs in an environmentally friendly way, thus eliminating the methane emissions. They then split the revenue made from mining bitcoin with the local government responsible for the landfill, thereby turning the waste from a liability, into an asset. If you would like to learn more about this company, the founder recently did an interview on the What Bitcoin Did podcast that is worth a listen.

The bottom line is bitcoin, which already runs on a much cleaner mix of electricity than our traditional electrical grid, is spurring innovation in clean and renewable technologies.

$10 Trillion Now Has Easy Access to Bitcoin

Last newsletter we mentioned that Blackrock, the world’s largest asset manager with nearly $10 trillion under management (yes with a “T”), had partnered with Coinbase to provide institutional investors access to crypto trading, custody, prime brokerage and reporting capabilities. Well, just a week after our newsletter went out, BlackRock also announced it has launched a spot bitcoin private trust enabling direct exposure to bitcoin for all of its U.S.-based institutional clients. In a statement from the company, BlackRock said that “Bitcoin…is currently the primary subject of interest from our clients within the cryptoasset space.” That’s quite a statement coming from the largest, most recognized asset manager in the world especially during a time when prices have dropped nearly 50% year to date. Regardless of price action, BlackRock is getting so much demand from its customer base (a customer base who holds a lot of capital by the way) that they decided to launch a brand-new product.

Even more encouraging, BlackRock said in that same statement that they are “encouraged that organizations such as RMI and Energy Web are developing programs to bring greater transparency to sustainable energy usage in bitcoin mining.” Since 2020, BlackRock has made a strong commitment to incorporate ESG policies into its investing practices. By giving its stamp of approval for bitcoin, BlackRock is not only further legitimizing the crypto industry among institutional investors, but it is also emphasizing to the rest of the financial market that bitcoin is ESG friendly.

In an economy facing high inflation and decreasing GDP, many institutions are looking at their portfolios, which are full of negative yielding bonds and overpriced equities. BlackRock now just gave them access to the best performing asset of the past decade. Bullish is an understatement.

The Merge

In less than a month, Ethereum plans to transition its blockchain from a proof-of-work consensus mechanism to a proof-of-stake model. This event, known as The Merge, represents one of, if not the most significant, protocol upgrades in the history of the crypto industry. Given its significance and fast approaching arrival, I figured it’s worth exploring in today’s newsletter.

Because blockchains are distributed systems, each transaction needs to be verified by the network to ensure there is no fraudulent activity. To guarantee that all participants in a blockchain network agree on a single version of history, blockchain networks such as Bitcoin and Ethereum use what is known as a consensus mechanism. A consensus mechanism is simply the method by which a blockchain validates transactions and ensures all network participants remain in agreement.

Today, there are multiple different types of consensus mechanisms. When Ethereum first launched in July 2015, it was initially designed using the same consensus mechanism as bitcoin, otherwise known as “Proof-of-Work” (POW). Proof of work was the first consensus mechanism created and widely regarded as the most reliable and secure method. However, without getting too into the technical details, there are limitations to the number of transactions a Proof-of-Work based blockchain can handle per block.

This is important for Ethereum because it aims to be a globally decentralized operating system that developers can build apps on, like how developers build apps for smartphones. Therefore, being able to execute a greater number of smart contracts is critical to the protocol fulfilling its potential. Hence, even in Ethereum’s original roadmap, there were plans to eventually transition to a consensus mechanism that would enable a greater throughput of transactions. That method is known as “Proof-of-Stake” (POS).

Whereas POW relies on miners contributing computing power to validate and secure the network, POS is operated by validators who deposit cryptoassets (ie “staking”). In the Ethereum POS system, anyone can pledge a minimum of 32 ETH and then be randomly chosen to validate transactions. Like a lottery, the more ETH one stakes, the better the odds of being chosen as a validator. Once a participant has validated the latest block of transactions, other nodes on the network then confirm (aka attest) the block is valid. When enough attestations are made, the network adds a new block, and the validator receives a transaction fee as a reward. If the validator does not verify the transactions correctly, the validator loses their stake thus providing an economic incentive for all validators to adhere to the rules. Thus, validators take over the role of block production from miners, thereby transferring operating structure from one based on real world energy input to one based on capital in the form of staked ETH.

As alluded to earlier, the main reason for switching consensus mechanisms is to improve Ethereum’s throughput capabilities. However, the merge doesn’t directly increase the number of transactions Ethereum can handle nor will it improve transaction speeds to a noticeable degree. What the merge does accomplish is it paves the way for numerous protocol-level upgrades (such as Sharding) that will be far easier to implement in a POS system. In the last couple of years, the Ethereum developers have embraced a modular approach of letting separate blockchains built on top of Ethereum (aka Layer 2 networks) handle the execution of transactions and focusing the base layer blockchain on data availability. By offloading the execution function to Layer 2 networks, this frees up space on the base layer and allows Ethereum to focus on improving the architecture to be more compatible with Layer 2s. The end product is a modular architecture structure that allows blockchains to scale transactions and throughput without sacrificing security. If you would like to learn more about Layer 2 technology, Blockforce Capital published an in-depth piece on our Layer 2 thesis.

Another compelling reason for the move to POS is energy efficiency. POW blockchains such as Bitcoin derive their security from the amount of computational power on the network and as such, end up consuming a relatively large amount of electricity. However, as we have covered in the past, that doesn’t mean POW is bad for the environment. In fact, bitcoin is a great tool for improving our energy grid, absorbing wasted energy, and incentivizing the adoption of clean technologies. However, the message requires a nuanced understanding of the technology and thus gets muddled in the media and among those who haven’t taken the time to study the technology. POS bypasses this whole debate by using significantly less energy because there are no miners contributing computational power. No miners mean no large energy-intensive compute facilities. By relying on financial incentives rather than computational power to operate the network, validators consume as much as 99.9% less electricity than a POW model. By significantly reducing Ethereum’s energy consumption, the Merge should alleviate concerns about its environmental impact (even if it’s largely superficial).

Finally, the Merge represents a potential economic catalyst for the underlying token, ETH. In a POW model, miners are primarily incentivized through block subsidies (ie: issuance of new tokens every time they mine a block). However, in a POS, there are no miners and validators are incentivized mainly through transaction fees. Thus, the transition to POS will drastically reduce the issuance required to secure the network. According to the Ethereum Foundation, the annual issuance of new ETH is estimated to drop from 4.6% per year to 0.5%. When taken in combination with the fee-burning mechanism implemented last year (EIP 1559), the Merge is likely to lead to more ETH being destroyed than created per day turning ETH into a deflationary asset.

There is a second factor that should further decrease the supply of available ETH to be traded. Once the switch to POS is initiated, the amount of ETH that will be staked on the network is likely to increase significantly. When ETH is staked, it’s essentially locked up and not available to be traded. The combination of reduced supply of new ETH, more ETH being locked up over time through staking and transactional base fees being burned should drastically reduce the actively traded circulating supply and put upward pressure on the price of ETH.

As exciting of a development as this potentially could turn out to be, it’s no small task to change how the entire network operates. To successfully pull this off, the development team has embarked on a two-step process.

The first step was the launch of the Beacon Chain in December 2020. The Beacon Chain is a separate, parallel Ethereum network currently running on a Proof-of-Stake Model. By creating a parallel chain, it has given developers ample time to test the system without risking the original Ethereum chain. It also allowed people and organizations to start staking and building up a sufficiently large enough pool of capital to secure the network prior to the merge. As of writing this, about 414,000 validators have already staked approximately 13.2 million ETH (11.1% of total ETH in existence) on the Beacon Chain.

The second step will be to combine the main Ethereum chain with the Beacon Chain into one chain that runs on a POS model (hence why it’s called “the merge”). The goal is to pull this off without Ethereum experiencing any downtime or stopping the blockchain from processing transactions. This is akin to changing the engine of a car while driving down the highway without ever stopping or slowing down. However, if all goes according to plan, casual users should not notice when the merge takes place.

To prepare to merge the Ethereum blockchain to a POS model, the Ethereum developers have been practicing. Back in June, the Ropsten network was the first of three testnets to be successfully merged from its POW execution layer with the Beacon Chain’s POS consensus chain. Despite a few minor issues, the Ropsten merge was generally considered a major success, setting the stage for the second practice run. The second testnet, Sepolia, went live in July. Like the first practice run, no significant problems were encountered, and the merge was considered successful. Finally, Ethereum developers successfully merged the third and final testnet, known as Goerli, at the beginning of August. Now that all three practice runs have been completed, the last step is to convert Ethereum’s mainnet to Proof-of-Stake.

However, just because the tests have gone well that does not mean there aren’t any risks associated with the Merge. The first has to do with the consensus mechanism itself. We know that POW works (no pun intended). Bitcoin’s blockchain is by far the largest and oldest chain and it has operated since 2009 with no major issues, hacks and is getting more decentralized as time goes on. The same cannot be said for POS. While there are several other blockchains that have operated on a POS model in the last couple years, none of them come close to the size of Ethereum. POS simply hasn’t been tested at scale yet. That’s not to say it will or will not work, but it is simply unknown at this point. Furthermore, POS is a far more complex architecture, which increases the odds of bugs or vulnerabilities. Whereas bitcoin’s POW algorithm is only a couple hundred lines of code, Ethereum’s POS algorithm consists of hundreds of thousands of lines of code.

Second, as we mentioned, this merge is no simple feat. Kudos to the Ethereum community for taking its time (this has been in the works for several years), running the Beacon Chain since 2020, and conducting multiple practice runs. They have done everything they could to make sure this transition goes smoothly. However, that doesn’t guarantee that it will (this is crypto after all). There could be an unforeseen bug or an unexpected attack during the transition. The Ethereum developers are some of the best in the world but this is a monumental task with no real precedent to lean on. Because of that, the transition carries with it a high degree of execution risk.

Finally, assuming all goes smoothly and the consensus mechanism works as intended, there are still concerns from many in the crypto community about POS leading to more centralization. On one hand, POS does not require advanced ASIC computers which allows anyone with at least 32 ETH to become a validator. This is good for decentralization. However, because the more ETH you stake the more likely you are to be picked as a validator, a POS model favors wealthier entities. If you have more ETH to stake then I do, over time you will be chosen to be a validator more often thus earning you more ETH. If you reinvest those fees back into staking, you will grow faster than I will and exponentially grow your influence on the network over time. Eventually, many fear this self-reinforcing cycle will lead to a small number of market participants with an overwhelming percentage of the ETH supply. If the total amount of staked ETH becomes too concentrated, there is a risk of being able to censor transactions, the exact outcome a decentralized system is supposed to prevent.

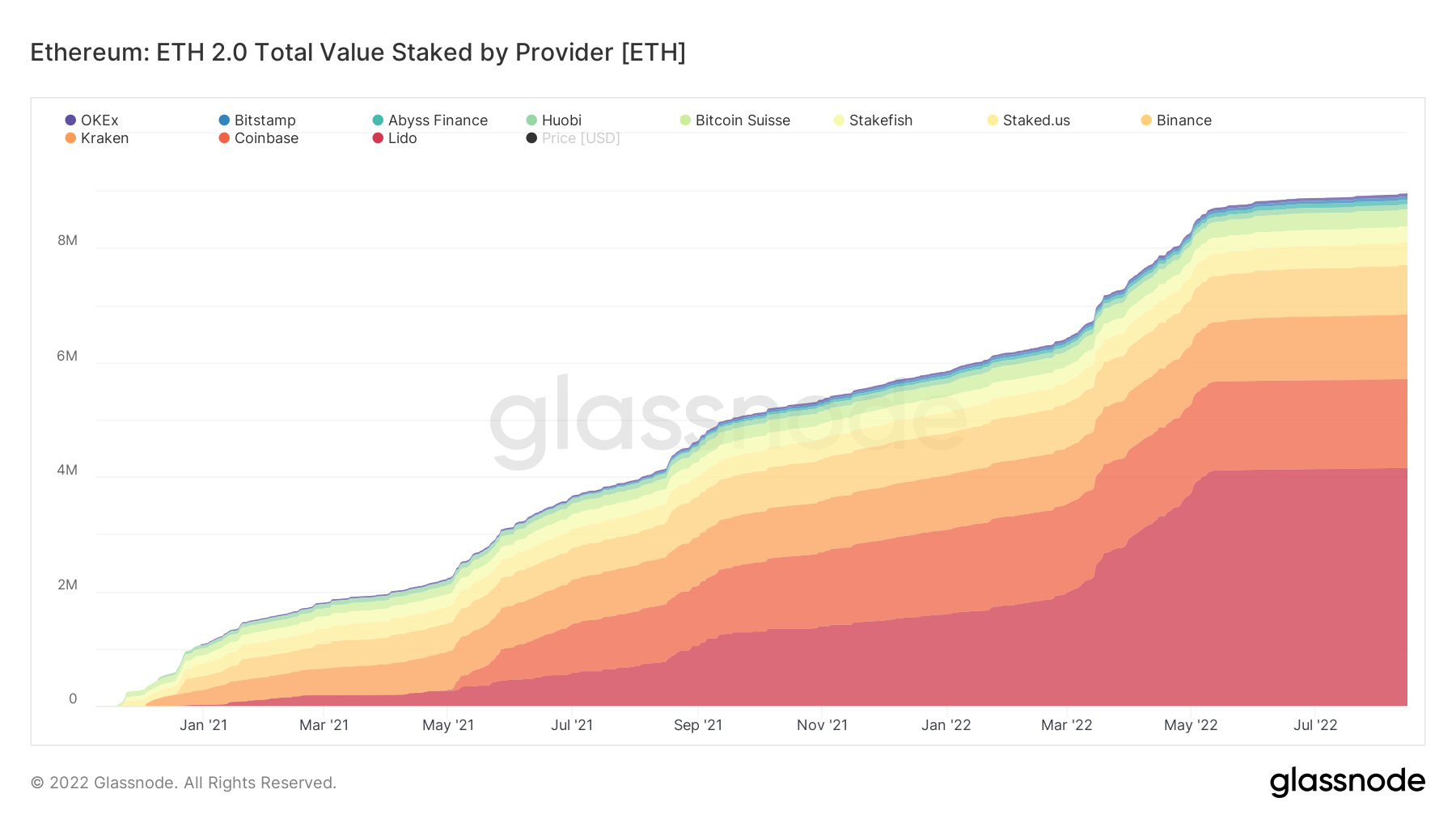

A second risk with growing centralization is regulatory capture. Staking requires both technical knowledge and a significant amount of capital (nearly $60,000 at today’s prices and that is likely to drastically increase as the price of ETH increases). Thus, most people will likely not run a validator node themselves either out of convenience or fear of technical risk. Financial institutions will likely not be allowed to stake on their own for compliance reasons. As a result, most Ethereum staking is likely to be done through 3rd party services and in fact, that is exactly what is already beginning to happen. If we look at the total amount of ETH staked today, the four biggest platforms used (Lido, Coinbase, Kraken and Binance) already account for over 60% of all ETH staked. The top 11 platforms account for nearly 70% of all ETH staked.

Source: Glassnode

Even those that are early to this trend of staking ETH (presumably crypto die-hards and tech savvy individuals) are mostly choosing to use regulated, centralized platforms rather than do it themselves. Staked ETH is likely to only get more concentrated into these regulated providers as more mass-market customers get involved in staking over time. This would give regulators greater ability to regulate Ethereum by passing laws dictating what these companies can and can’t do. Thus, it’s possible Ethereum could become much more vulnerable to political and regulatory whims versus bitcoin’s proof of work model which the data shows is becoming more decentralized over time.

While those are the main risks, there are some other interesting side effects of this event to consider as well. The change to a POS model means miners are no longer necessary and all those who are currently running Ethereum mining operations will no longer have a revenue stream. They could choose to sell their equipment or repurpose those machines for other blockchains. However, a third option has emerged. A minority of Ethereum miners have expressed their intention to continue mining on the legacy POW chain after the Merge. This would result in two Ethereum chains, one running Proof-of-Stake and the other running Proof-of-Work which many are calling ETH POW.

The first implication of maintaining the POW chain is there would be two ETH tokens. Should the proof of work chain remain operational, anyone holding ETH today would be entitled to an equivalent amount of ETHW (ETH proof of work). This wouldn’t be the first time a fork created two tokens. A similar thing happened when bitcoin cash (BCH) forked from bitcoin (BTC) in 2017 and Ethereum Classic (ETC) forked from Ethereum in 2015 following the DAO hack. Today, those forked tokens still exist but are worth a fraction of the amount as the original token. Today, Bitcoin Cash has only 0.5% the market cap of bitcoin and Ethereum Classic has 2.4% of the market cap of Ethereum.

Whereas the token is relatively straightforward, the question of stablecoins and NFTs built on top of Ethereum is much more complex. Let’s start with stablecoins. The two most prominent stablecoins (USDC and USDT) operate on a collateralized basis. Dollars or US Treasuries are deposited into a bank, after which a stablecoin is issued with a 1:1 ratio against those dollars. When a person wants to convert their stablecoin back to USD, that stablecoin is destroyed and dollars are issued to that user. If you suddenly create two blockchains with two competing claims on those reserves, those stablecoins are no longer backed 1:1 as there would be twice as many stablecoins in circulation as there would be deposits. As a result, both USDC and USDT have publicly stated they will support the POS chain and not recognize any stablecoins on the POW fork. This effectively ensures all stablecoins and much of DeFi on the POW chain will be worth zero after the merge. Hence, Circle and Tether effectively have the power to choose which version they want to see win. This does not bode well for the long-term health of the POW fork.

NFTs, on the other hand, are a different story. Let’s say you own a Bored Ape or Crypto Punk on the original chain. After the merge, users will have two versions of the same NFT, one on each chain. Will one be more valuable than the other? If so, which one and does that cause a selloff on the other chain? Will they both retain their value? Or will the value of both be destroyed because the whole point of these NFTs is that they are unique and one of a kind? The truth is no one really knows how this will play out.

One last word of caution. These types of events tend to attract fraudsters and scammers who try to take advantage of confusion in the marketplace. For example, its likely we will see scammers masquerading as “support” for various crypto services telling you if you deposit your ETH you will receive back ETH2 (as in ETH 2.0). There is no such thing as ETH2. The ETH that you own today will continue to be the same ETH after The Merge, and there is no need to do any swaps to claim ETH or any ETH Proof of Work token that may arise because of a possible fork. Bottom line, never share your wallet seed phrase with anyone.

So, when will the Merge take place? There is no exact date per se as the developers have decided to pin the date to the total accumulated difficulty of the blockchain. Every block has a difficulty score for how hard it is to “solve” in proof-of-work. Adding up the difficulty of each block yields the total difficulty. The plan is to merge the two chains after closing the block that hits 58,750,000,000,000,000,000,000 which by all estimates should be around September 15th or 16th. That means the Merge should happen about 3 weeks after this newsletter is released. Should be an exciting finish to the year in cryptoland.

In Other News

Lyn Alden wrote an in-depth piece on bitcoin’s evolution to a medium of exchange and the growth of the Lightning Network.

The U.S. Treasury Department banned all Americans from using decentralized crypto mixing service Tornado Cash, raising key constitutional questions about privacy and speech.

Coin Center prepares legal challenge to Treasury’s Tornado Cash sanctions.

A developer of Ethereum mixing service Tornado Cash has been arrested in the Netherlands which could set a dangerous precedent for any technology company.

Galaxy Digital terminated its $1.2B acquisition of BitGo.

A recent study from Ripple found that over 75% of financial institutions intend to use crypto over the next three years.

The EU is on the verge of creating a new AML regulator that will oversee crypto.

The U.S. Federal Reserve published its final guidance for novel financial institutions to access its “master accounts” seemingly moving the U.S. central bank one step closer to allowing Wyoming special purpose depository institutions (SPDI), like Custodia (formerly Avanti) and Kraken Bank, access to these accounts so they would not need intermediary banks.

This month Schwab Asset Management also launched a crypto product, the Schwab Crypto Thematic EFT (STCE), after receiving increasing demand from their customers.

U.S. Sen. Pat Toomey wrote public a letter claiming the Federal Deposit Insurance Corporation (FDIC) improperly pressured banks against providing services to cryptocurrency companies, even though those services are legal.

Coinbase will pause all Ethereum transactions ahead of the merge.

BTG Pactual, which is the largest investment bank in Latin America, has launched a Bitcoin and cryptocurrency exchange in Brazil called Mynt.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely that of Brett Munster and do not express the views or opinions of Blockforce Capital or Onramp Invest.

167 thoughts on “The Node Ahead 25: Curbing Methane Emissions, Blackrock, and the Ethereum Merge”

Comments are closed.