Welcome back to The Node Ahead, a cryptocurrency and digital asset resource for financial advisors. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we will review:

- More institutional adoption of crypto

- The Merge is successful

- Bitcoin moving towards carbon negative

- The White House releases a crypto regulatory framework

- The Senate Agriculture Committee hearing

There is a lot to cover this week, most notably Ethereum’s Merge to proof of stake, but there’s one macro note to cover before we get to our Merge analysis.

Institutional Adoption Is Picking Up

Though largely overshadowed by Ethereum’s Merge, there were several important announcements from large financial institutions over the past couple of weeks. KKR, a global investment manager with $490 billion under management, has decided to tokenize one of its healthcare funds on the Avalanche blockchain. Investors will own a token that represents a share of the $4 billion fund that invests in North American and European-based pharmaceutical, medical device, and life sciences companies. The tokenization of limited partner interests lowers investment minimums, improves investor onboarding and compliance protocols, and should increase liquidity by enabling a once illiquid investment to be publicly traded. It’s just another example of how digital assets are more than just BTC and ETH. In time, it’s likely all assets (including real world assets) will be tokenized and traded on a blockchain.

Then came news that global asset manager Franklin Templeton, which manages $1.4 trillion, is now offering institutional crypto accounts to its clients. If that wasn’t enough, Fidelity, which already offers bitcoin custody services and bitcoin for 401k plans, announced it will launch a bitcoin trading platform for retail customers in November. Fidelity is one of the largest investment managers with over $4.3 trillion in assets and now all 34 million retail clients will have easy access to bitcoin. Finally, Citadel Securities, Fidelity Investments, and Charles Schwab announced they are launching a cryptocurrency exchange called EDX aimed at serving individual and institutional investors. It’s often said that most progress and development happens during downturns and lays the foundation for future growth. Given the number of intuitions who have built crypto offerings over the past year designed to make access to the ecosystem more ubiquitous, I would argue that is likely to be the case once again.

The Ethereum Merge

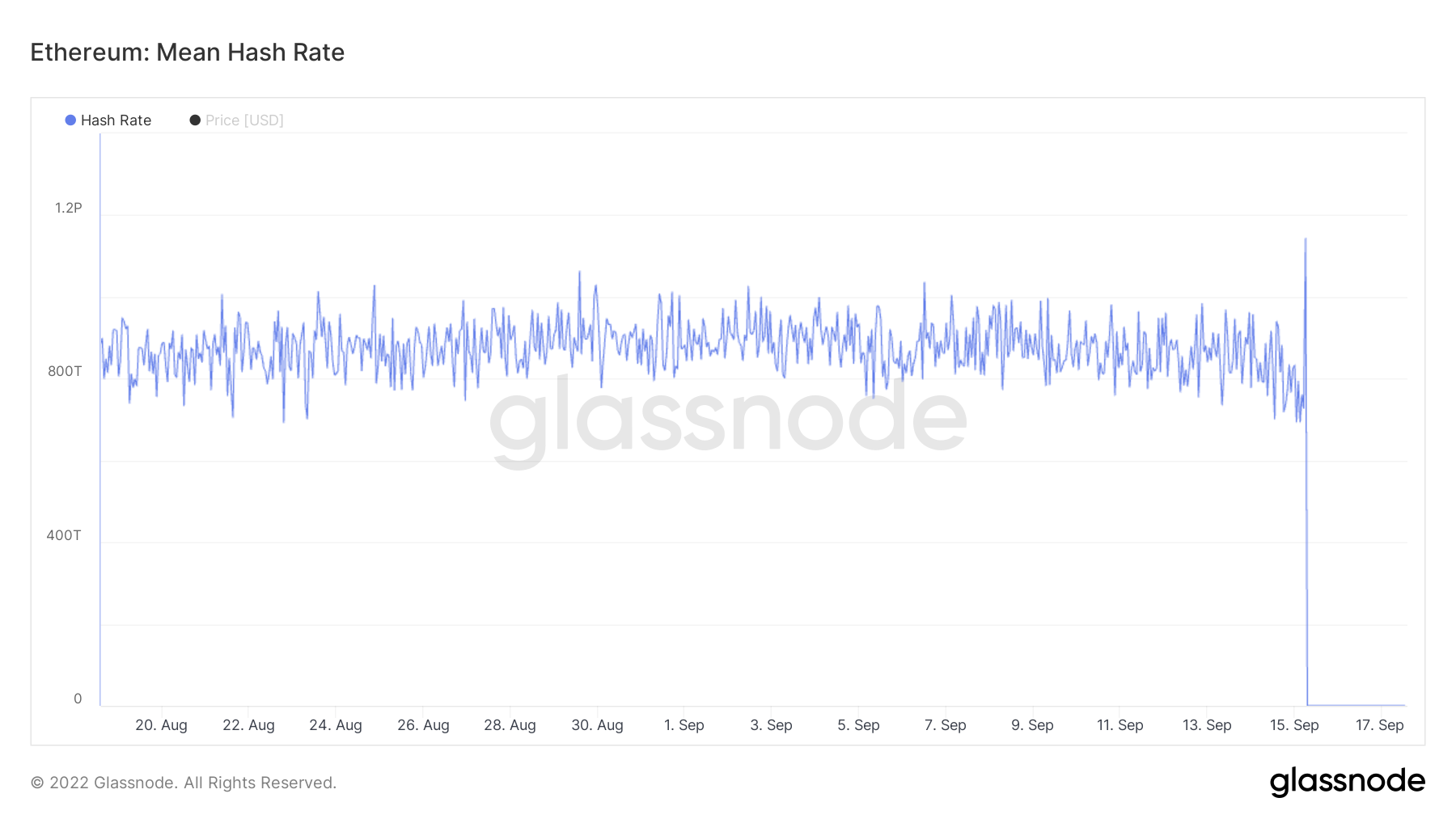

At 2:45am ET on Thursday September 15th, Ethereum successfully transitioned its consensus mechanism for validating transactions from Proof-of-Work to Proof-of-Stake. The quick overview is that rather than GPU miners contributing computational power to the network, validators who pledge ETH to the network (aka “stake” it) are now responsible for validating transactions. As we can see in the graph below, the hash rate (measure of computing power on the network) suddenly went to zero as the Merge to Proof-of-Stake removed the need for miners.

Source: Glassnode

If you would like more details on the Merge, what it means for the future of Ethereum, and the potential challenges the network might face because of this change, our last newsletter covered all these issues.

Thanks to years of planning, rigorous testing, and numerous trial runs on separate test nets, Ethereum developers accomplished this feat without a hitch. Block production was successfully passed over to validators on the consensus layer without any disruption to transactions or coordination issues. Validator uptime was near perfect and the network has remained steady as blocks continue to be produced by validators without issue. This transition is one of the most impressive engineering feats ever accomplished and will likely be remembered as one of the most historic events in crypto’s history.

However, the market was apparently unimpressed. 24 hours after the Merge, ETH was down 8.4%, significantly more than bitcoin and other cryptocurrencies. This move down is most likely a short-term blip due to trading activity prior to the Merge rather than a change in the underlying fundamentals of Ethereum. In anticipation of the Merge, ETH futures soared as many traders hedged their positions in case the Merge was unsuccessful. In fact, ETH derivatives set new all-time records in the weeks leading up to the Merge. After the Merge completed, ETH futures experienced $127m in liquidations causing a fair amount of forced selling on the market which was likely the cause for ETH’s price drop.

The good news is that this dip is likely a short-term phenomenon whereas the dynamics created by the Merge should bode well for ETH in the long run. Unlike a proof-of-work model where miners are primarily incentivized through block subsidies (ie: issuance of new tokens every time they mine a block), there are no miners in a proof-of-stake model. Validators in a proof-of-stake system are incentivized mainly through transaction fees meaning there is no reason to issue new ETH every time a block is mined. Thus, the transition to proof-of-stake is likely to reduce the issuance of new ETH by around 80-90%. That decrease in new issuance, combined with the burning mechanic based on network usage, should result in the total supply of ETH decreasing and the price appreciating over time.

It’s also likely that many market participants were waiting to see if the Merge would be successful before investing in ETH. It’s possible that because the Merge is now finalized, we could see an influx of capital into the ecosystem in the coming months.

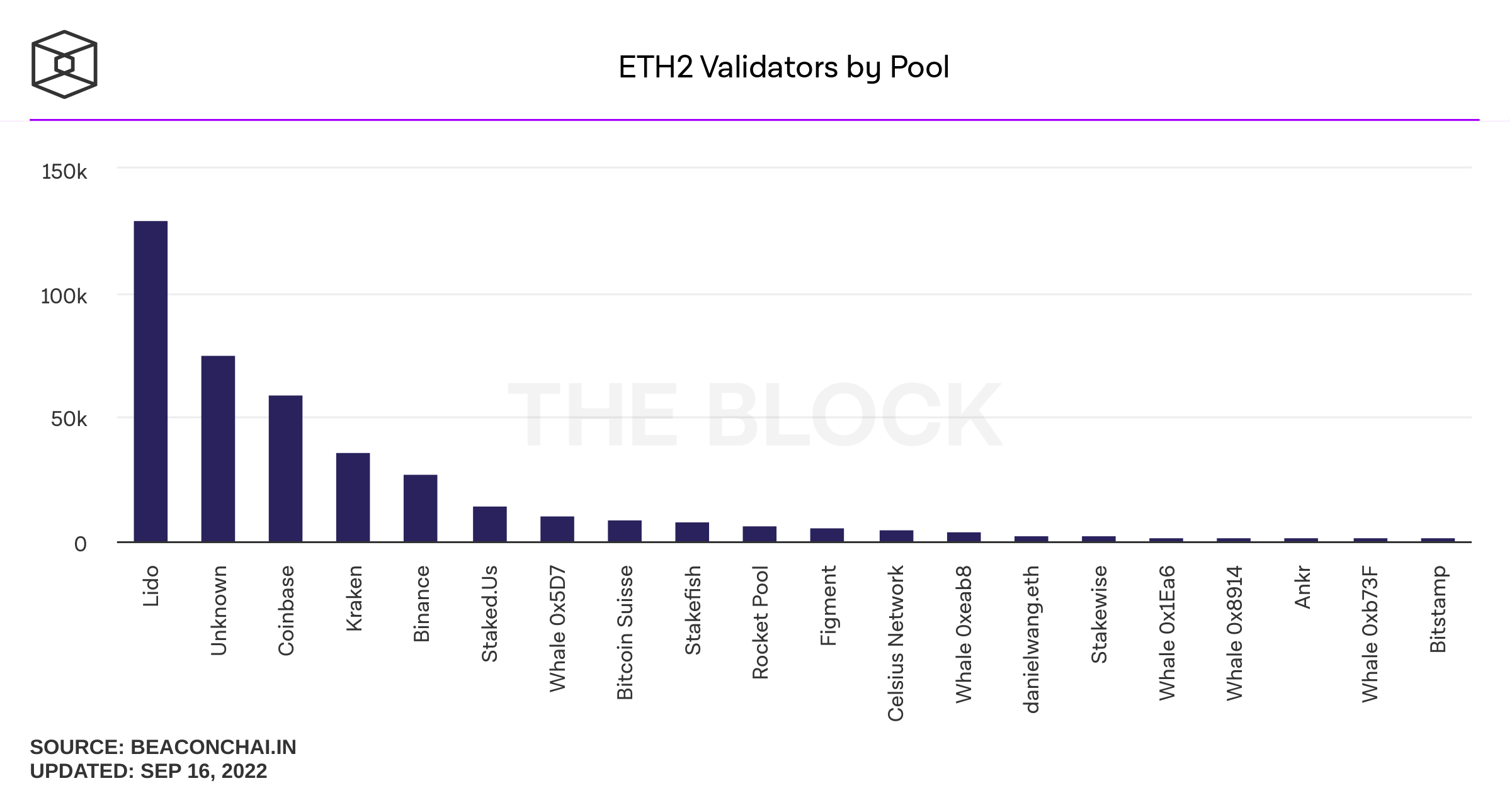

However, the transition to proof-of-stake isn’t without some long-term risks. One of the risks we highlighted in the last newsletter was the potential for centralization and in fact, we are already starting to see this dynamic unfold. Two validators, Coinbase and staking protocol Lido, added over 40% of the network’s new blocks in the first days following the Merge. In addition, the top 7 validators own more than two-thirds of the stake on Ethereum’s network. Of the top 20 groups of validators, only 7 are individual users. What this indicates is that individuals are choosing to stake through third party providers because of the technological burden of setting up a validator and the financial burden of aggregating the minimum stake of 32 ETH.

Source: The Block

The problem with Ethereum becoming more centralized is that it could lead to a situation where a small number of nodes effectively control the network. This would essentially create gatekeepers and potential for censorship, the exact thing crypto and DeFi were created to disrupt in the first place. It also opens Ethereum up to regulatory capture as firms such as Coinbase are subject to any laws Congress wants to implement. The centralizing nature of proof-of-stake and how the Ethereum community deals with that challenge will be a key trend to watch in the coming years.

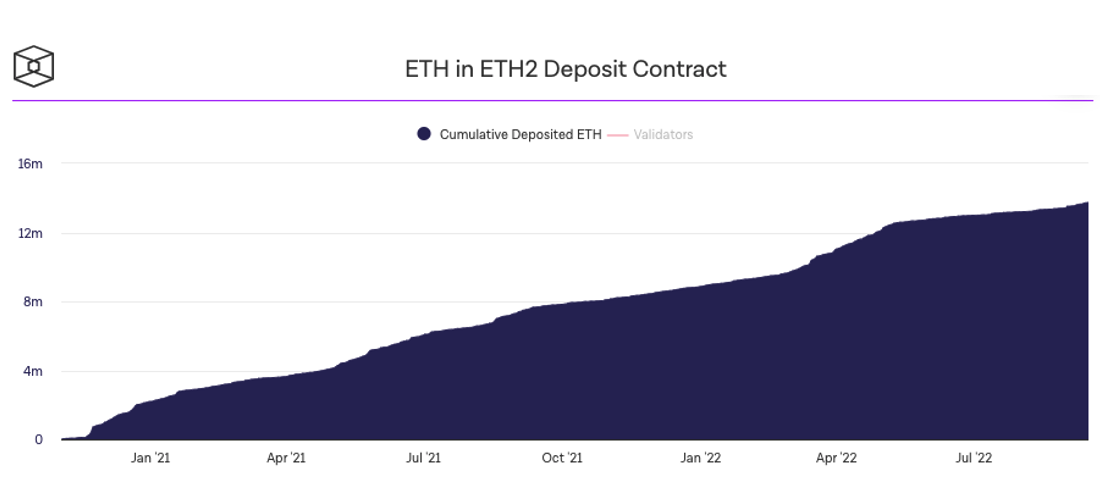

That risk does not appear to be deterring investors from staking ETH, even if most of it is being done through centralized third parties. There is nearly 14 million ETH staked (valued at $19.6 billion) at the time of this writing.

Source: The Block

“This is the first step in Ethereum’s big journey towards being a very mature system.” Vitalik Buterin, the co-founder and chief scientist of Ethereum, said in a live-stream call Thursday morning. “And there are still steps to go – we still have to scale, we still have to fix privacy, and we all need to work hard and do our part to make those other things happen as well. For me, the merge symbolized the difference between early-stage Ethereum and the Ethereum we’ve always wanted Ethereum to become.”

Executive Order & Bitcoin Moving Towards Being Carbon Negative

As we covered back in March, President Biden signed an executive order directing various federal agencies to study the state of the crypto industry with the goal of working towards the first unified federal strategy around digital assets. Those agencies were given six months to conduct their reviews and prepare a public report with their recommendations. On September 8, the first of those reports was made public. The White House Office of Science and Technology published its report on bitcoin mining’s climate impact which detailed the pros and cons of the industry’s impact on the environment and called for more research so that federal agencies can come up with standards to minimize harm.

The most notable takeaway from the report was the acknowledgement that bitcoin can “incentivize the construction of additional renewable energy capacity” and is “likely to help rather than hinder U.S. climate objectives” by reducing methane emissions. Like our past coverage, the report stated that “bitcoin mining operations that capture vented methane to produce electricity can yield positive results for the climate.”

Let that sink in for a second. The US just became the world’s first country to formally state that bitcoin mining has the potential to support the country’s climate objectives.

But there were more positive takeaways to highlight from the report. First, there is a meaningful acknowledgement that the addition of bitcoin mining can contribute to grid flexibility and stability. Second, the report noted the potential to mine with stranded, renewable energy such as solar and wind. Finally, there was a distinction made between Proof-of-Work (POW) and Proof-of-Stake (POS). While Proof of Stake has been lauded recently because it uses far less electricity, the report took time to acknowledge that the two consensus mechanisms do not grant the same assurances and POS is likely not a perfect substitute for POW. Because the report made a concerted effort to highlight the positive environmental impacts the Bitcoin network can have and how it’s likely to support the development of renewable energy, it has largely been seen as a step in the right direction by many within the crypto industry.

The report also lays out several concerns the administration has about the mining industry. The most notable being the future growth of energy use, avoiding increased energy prices for households, and minimizing its impact on the energy grid. It’s worth noting though that the report stated that its possible for “clean energy to power this demand from new electrification.”

However, the report wasn’t universally favorable to the crypto industry. The authors concluded that if the new standards “prove ineffective at reducing impacts, the administration should explore executive actions, and Congress might consider legislation, to limit or eliminate the use of high-energy-intensity consensus mechanisms for crypto-asset mining.” In other words, if the concerns aren’t addressed over time, the administration may consider banning proof-of-work.

This comment about banning proof of work is deeply flawed for several reasons. First, it’s unclear if the government has the legal authority to ban crypto mining in the first place. If Congress were to do so, it would effectively be claiming the government has the right to dictate what are acceptable forms of electricity use for businesses and individuals. It would be no different than the government banning the use of clothes dryers or fridges (both of which use more electricity per year than the bitcoin network) simply because they deemed it an improper use of energy.

Second, even if they did ban crypto mining, it would only hurt the US economy and would have no long-term impact on the crypto industry. We saw this story play out already in China last year. When China banned bitcoin mining, miners simply packed up and moved to friendlier jurisdictions. Within six months, the hash rate and usage of the network was setting new all-time highs again. And to put that in context, China had 70% of the globe’s mining power at the time it banned mining, the US only has about 30-35% right now. Banning bitcoin mining would hurt the US economy (especially in Texas), transfer wealth to other nations, and have no long-term impact on the total electricity used by the bitcoin network (which would be the goal in the first place). After a few months, the bitcoin and crypto industry would keep on operating without missing a beat.

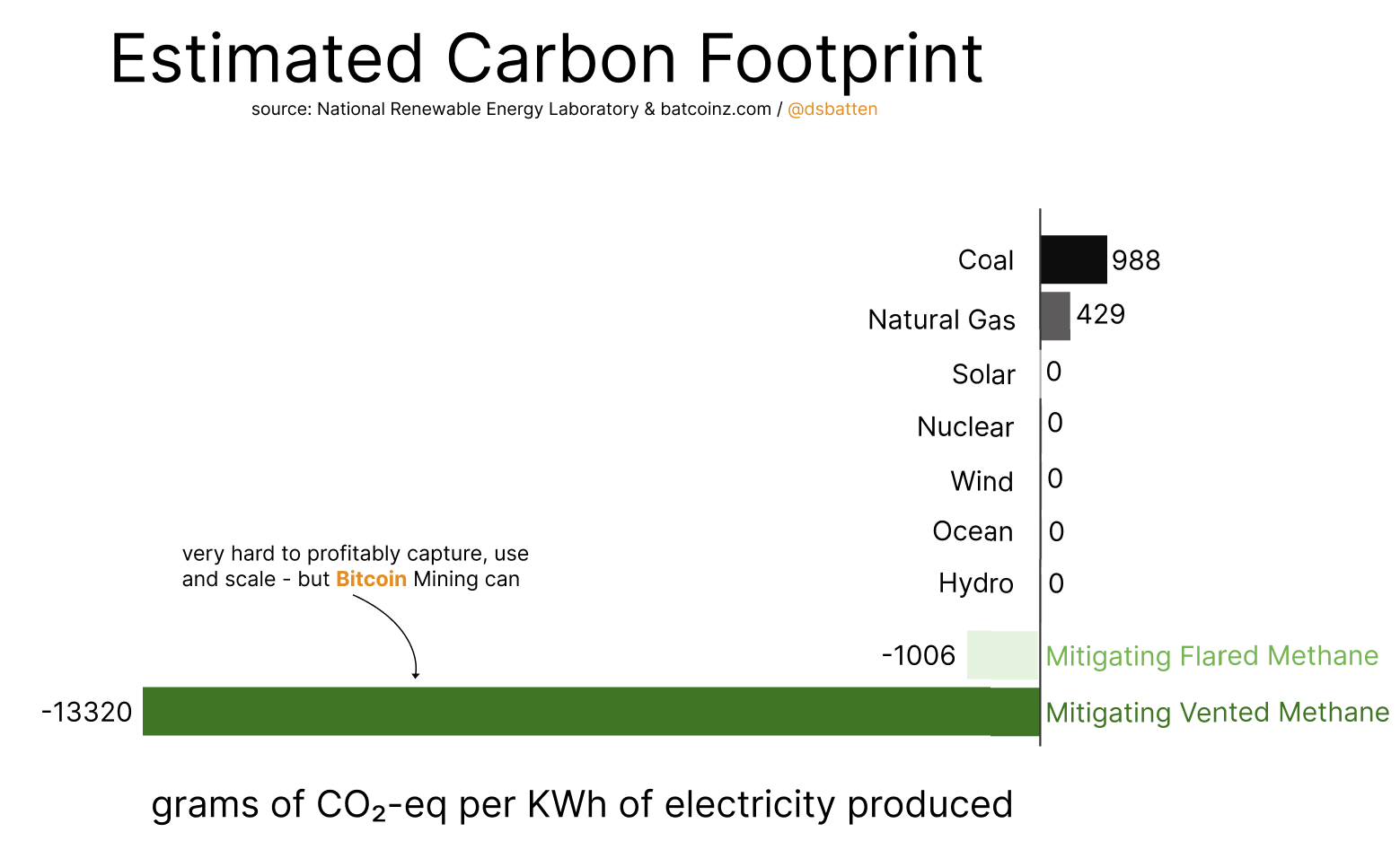

Finally, and most importantly, it’s unlikely to ever get to that extreme for the simple reason that the data and facts show bitcoin mining could become a net positive for the environment. In a recent report, the Bitcoin Mining Council found that 1.6% of the Bitcoin network uses carbon-negative sources like flared gas. However, they found that this small amount has a disproportionate impact because it has reduced the environmental carbon footprint of the Bitcoin network by 4.2%. This means that if 24% of the Bitcoin network were driven by vented-methane power, then the entire bitcoin network would be carbon neutral.

And if that seems like it will take a long time to achieve, you might be surprised. Use of flared gas to power Bitcoin mining has been growing at about 8.3 megawatts per month since May 2021. If the use of vented gas to power Bitcoin mining grows at just 6.9 megawatts per month, the Bitcoin network will become carbon negative by 2025. Yes, in a few years bitcoin mining might prevent more carbon from entering the atmosphere than the carbon emitted from creating the electricity it takes to power the network.

According to the EPA, cutting methane emissions, which are over 25x more effective than carbon dioxide at trapping heat in the atmosphere, is the “strongest lever we have to slow climate change over the next 25 years.” One of the largest emitters of methane gas is landfills and installing bitcoin mining rigs in as little as 50 landfills would be enough to make the bitcoin network carbon neutral. In the US alone, there are 1,400 landfills that are venting directly into the atmosphere (that’s just the registered ones we know about). That alone is enough to power the bitcoin network 1.5x over. In addition, according to the EPA, there are 3.2 million abandoned oil and gas wells emitting 281 kilotons of methane. That’s the climate damage equivalent of consuming about 16 million barrels of crude oil. Because bitcoin can capture all this leaked methane from landfills, gas flares and abandoned wells, it’s feasible that by 2030, bitcoin mining may actually reduce 2% of all global CO2 emissions.

And if that wasn’t enough, bitcoin mining using methane vented power is far more effective at reducing carbon emissions than any other renewable energy source we have. In fact, mining bitcoin off vented methane removes 13x more emissions out of the environment than coal puts into it.

Source: https://batcoinz.com/how-carbon-negative-are-different-ways-of-combusting-atmosphere-bound-methane/

The facts and data prove that bitcoin mining is one of our best tools for slowing climate change. As Rachel Silverstein, general counsel and senior vice president of compliance at bitcoin mining company CleanSpark, recently said in an interview, “As soon as this issue is fully studied and the rhetoric starts to fade, it will become apparent that proof-of-work mining is a boon to resilient, abundant, renewable energy.”

The White House Releases a Crypto Regulatory Framework

Though the climate report was the first report released publicly, it was one of nine reports submitted to the administration following Biden’s executive order back in March. Last Friday, the White House released a fact sheet that summed up the content of those nine reports in an effort to “articulate a clear framework for responsible digital asset development and pave the way for further action at home and abroad.”

Much of the report does not contain any new information but rather emphasizes many of the same principles and policies the White House previously laid out in the executive order. Let’s start with the positive news from the report.

This was the second time the White House acknowledged that 16% of adults in the US own cryptocurrencies and that number is growing rapidly. The White House also acknowledged that crypto represents an opportunity to reinforce American leadership in the global financial system and remain at the technological frontier. Finally, the report details how the traditional financial system has left too many behind. According to the White House, “Roughly 7 million Americans have no bank account. Another 24 million rely on costly nonbank services, like check cashing and money orders, for everyday needs. And for those who do use banks, paying with traditional financial infrastructure can be costly and slow – particularly for cross-border payments.” It’s clear from their consistent rhetoric that the administration recognizes that crypto is an emerging growth sector that is here to stay, vital to keeping the country’s global leadership position in finance and technology, and has many benefits to consumers that the traditional financial system has failed to address.

However, that doesn’t mean the administration doesn’t see a lot of risk as well. The primary concern for the White House, according to the report, centers around three main issues. The first is the growing size of the stablecoin industry and the fact that its currently unregulated. This is no surprise as stablecoins have been the primary focus of most crypto regulation proposed over the last year. Second is the volatility of the assets, especially in the wake of the recent downturn and the collapse of the LUNA stablecoin. Finally, the White House is concerned about illicit finance in the crypto industry. Of all the concerns, this is the oddest given that the data clearly shows that cryptocurrencies are far more transparent and used far less in illicit activity than the dollar on both a total amount and percent basis.

Given the concerns, the report calls for a number of different actions. While most of the actions are requests for further studies or collaboration between agencies, there are a couple worth mentioning.

First, in the name of consumer protection, the report calls for continued investigations and enforcement actions against “unlawful practices” in the digital assets space. This rhetoric wouldn’t be an issue except for the fact that neither the White House nor the SEC (who has been pursuing most of the enforcement) has bothered to issue any clear guidance on what constitutes “unlawful practices.” We don’t even have clear rules on what is and isn’t a security for digital assets yet let alone a myriad of other issues. Which brings us to the second action worth mentioning. The report encourages agencies to actually issue guidance and rules to address current and emergent risks in the digital asset ecosystem. Though the report doesn’t offer any clarity itself, it at least acknowledges that more regulatory clarity is needed.

The last, but perhaps the most controversial section of the fact sheet is dedicated to the development of a US central bank digital currency (CBDC). The report reveals the administration has already developed policy objectives for a CBDC but states that further research into the technological infrastructure is needed. Still, the intent is pretty clear. The administration is pushing for a US CBDC because in its mind, it’s necessary to keep the dollar competitive with the currencies of countries that are already experimenting with CBDCs, such as China. According to the report, a national stablecoin with instant payments using rails like bitcoin, but under central bank control, could “enable a payment system that is more efficient, provide a foundation for further technological innovation, facilitate faster cross-border transactions, and minimize risks of illicit activity.”

What the report fails to address however, are the questions about privacy, surveillance, and censorship. As we have discussed in past newsletters, a central bank digital currency does not operate on a public blockchain so while it would provide transparency into every transaction, it would only do so for the controlling entity. In other words, the US government would have insight into every retail transaction down to an individual level providing the government with surveillance capabilities on US citizens never before possible.

Potentially even more problematic, unlike fiat currencies, cryptocurrencies are programmable. This means the government would, in theory, have the power to program what its citizens can and cannot do with their money. If the government wanted to stimulate spending in the economy, they could issue a CBDC that has an expiration date so that you would be forced to spend your money by a certain date or lose it. Or if they wanted to “protect” domestic companies from international competition, the money could be programmed to only be spent on companies located in that country. They could issue money directly into your bank account but just as easily take out whatever amount of taxes they believe you owe the government whenever they like. And because they would have info down to an individual level, there is no reason why fiscal and monetary policy couldn’t be customized for different individuals. What Facebook and Google did for targeted advertising, CBDCs have the potential to do for monetary policy.

Because of this, there are many within Washington that are wary of the US creating a digital dollar. In fact, earlier this year congressman Tom Emmer introduced a bill that would ban the Fed from issuing a CBDC directly to retail investors. Don’t be surprised to see the creation of a US CBDC become a hot button issue in Washington in the next year or two.

The Senate Agriculture Committee Hearing

If the climate report and White House regulatory framework weren’t enough policy developments for you, you are in luck because there is more. On September 15th, the Senate Agriculture Committee held a hearing on the Digital Commodities Consumer Protection Act (DCCPA). I know you already know all about the DCCPA but just in case, it is a bill put forth designed to provide a framework for how the crypto spot markets should be regulated.

The basic premise of the bill is to grant exclusive jurisdiction over the crypto spot markets (aka trading of cryptocurrencies on exchanges such as Coinbase) to the Commodity Futures Trading Commission (CFTC). That’s right, it would eliminate ambiguity about jurisdiction (goodbye to claims from the SEC’s Gary Gensler that he can regulate all crypto assets) and put the regulatory burden squarely on the CFTC. And yes, that would be an immensely positive outcome for the crypto industry.

The bill was introduced in early August by four members of the Senate Agriculture Committee: Chairwoman Debbie Stabenow (D), Ranking Member John Boozman (R), Senator Cory Booker (D), and Senator John Thune (R). The best part is this bill indicates a bipartisan consensus that the CFTC, not the SEC, is the right regulator for crypto. To no one’s surprise, Rostin Behnam, the chairman of the CFTC, expressed his support for the bill at a Congressional hearing on Thursday. More importantly, many within the crypto community, including advocacy groups, support the bill’s premise.

The bill is far from being passed and likely will undergo several revisions before it ever is. However, it’s extremely encouraging that not only has the bill been put forth, but that the Senate Agriculture Committee is engaging with the industry to get it right.

In Other News

Tether has a new accountant, BDO Italia, and the stablecoin issuer plans to move to monthly attestations about its reserves, rather than quarterly.

Senate committee preps hearing on CFTC regime for crypto exchanges.

California Governor Gavin Newsom is set to sign a recently passed bill that would require digital asset exchanges and other crypto companies to obtain a license to operate in the state.

The Ether derivative market set several milestones, including the open interest in ether options reaching a new all-time high of $9.6 billion in August as The Merge approaches.

Britain’s new prime minister, Liz Truss, is bullish on crypto.

A crypto industry group published a report arguing there has been little basis for the SEC continuing to reject a spot bitcoin ETF.

Bank of Russia agrees to legalize crypto for cross-border payments. This follows after Iran approved bitcoin payments for imports.

Six crypto users are suing the U.S. Treasury Department for blacklisting Tornado Cash last month, claiming the department’s sanctions watchdog overstepped its authority in prohibiting all American persons from interacting with the privacy tool. Coinbase has since announced it will fund the lawsuit.

Michael Barr, the Fed’s vice chair, pushes Congress for legislation on stablecoins.

SEC’s Gensler signaled support for commodities regulator to have oversight on bitcoin and other tokens.

Starbucks offers an NFT-based loyalty program.

Bitcoin’s role in reducing climate change.

Bitcoin mining and the environment.

Coinbase is adding information about the crypto policy stances of various U.S. elected officials to its app.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.