Now that the bitcoin ETF is approved, clients are asking a lot more about the world’s original cryptocurrency. Recently, we’ve been getting a lot of questions from advisors about the Bitcoin halving and what it means for clients.

So, here’s what you need to know:

What is the Bitcoin halving?

The bitcoin halving is a key event in the history of the Bitcoin network that occurs approximately every four years. It is programmed into the Bitcoin protocol as part of its monetary policy to control the issuance of new bitcoins and maintain a capped supply of 21 million BTC.

How many Bitcoin halvings have there been so far?

There have been three halvings since Bitcoin’s inception, with the fourth one soon to happen in April of 2024.

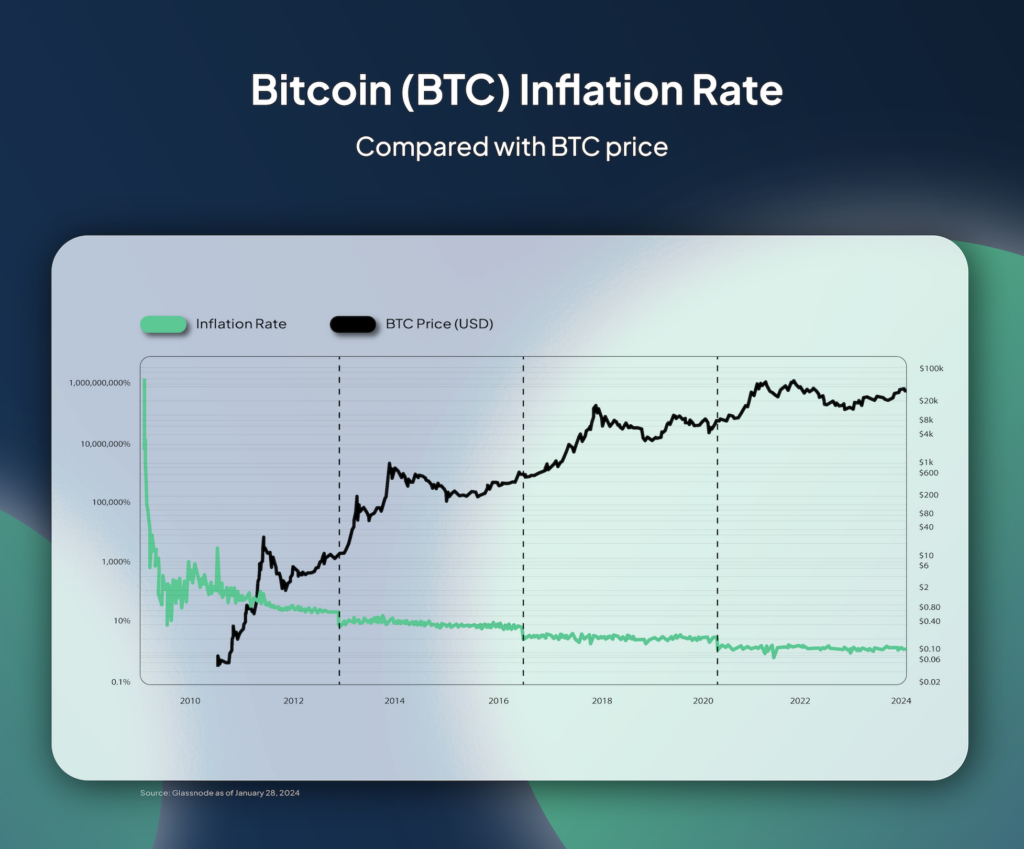

First Halving (2012): The first Bitcoin halving took place on November 28, 2012. Before the halving, the block reward for miners was 50 bitcoins per block. After the event, it reduced to 25 bitcoins.

Second Halving (2016): The second halving occurred on July 9, 2016. The block reward was reduced from 25 bitcoins to 12.5 bitcoins. This event marked a significant reduction in the rate at which new bitcoins were created.

Third Halving (2020): The third and most recent halving took place on May 11, 2020. The block reward was further reduced from 12.5 bitcoins to 6.25 bitcoins. This halving brought Bitcoin’s inflation rate to levels comparable to that of gold, making it scarcer over time.

What makes the Bitcoin halving important for client investments?

As you can see from the timeline above, each halving contributes to bitcoin’s scarcity over time. Because bitcoin is a finite resource, it’s more likely to appreciate as demand increases and supply lessens.

What makes this year’s Bitcoin halving so special?

This is the first time in history that bitcoin has had this level of exposure in the mainstream market, and bearing in mind the recent victorious bitcoin ETF approval, this year poses the potential for a bitcoin supply squeeze unlike anything we’ve ever seen before. If you want to know more about that, we have a Node Ahead that covers it.

How can I invest in and manage bitcoin for my clients?

Through Onramp. We let you view, manage, and bill on client assets while still using the tools you already know and love. Get started here.