By Brett Munster, Director of Research at Onramp

Welcome back to The Node Ahead, a cryptocurrency and digital asset resource for financial advisors. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we’ll cover the following:

- Chamber of Commerce backs Coinbase against the SEC

- The banking crisis and bitcoin

- One year away from the Halving

Brian Armstrong and the Chamber of Commerce (does that make Gary Gensler Voldemort?)

Last newsletter, we covered how after receiving a Wells Notice, Coinbase pulled a reverse Uno card and sued the SEC first. Two days after we published that newsletter, the US Chamber of Commerce filed an amicus brief in the Coinbase vs. SEC case and didn’t hold back on its scathing criticism of the SEC.

This isn’t another crypto company or industry lobbying group backing Coinbase. The U.S. Chamber of Commerce is the world’s largest business advocacy organization representing the interests of more than 3 million businesses throughout the country in all industries, not just crypto. And they don’t seem very pleased with the SEC.

The very first line of the brief directly contradicts Gary Gensler’s position by stating that “nobody knows for certain which digital assets, if any, are ‘securities’ under federal law.” It goes on to argue that the SEC is destabilizing the digital assets regulatory environment on purpose which in turn is killing innovation in the US. “The SEC has deliberately muddied the waters by claiming sweeping authority over digital assets while deploying a haphazard, enforcement-based approach. This regulatory chaos is by design, not happenstance.” You expect this type of rhetoric from Coinbase, but it hits a little different coming from an organization with a broad mandate, such as the Chamber of Commerce.

The brief also argues that because the agency never provided guidance to market participants prior to taking action against them, the SEC has violated Constitutional due process and fair notice rights. “The SEC’s actions are not just harmful policy; they are unlawful.” Given the organization this is coming from, there is a high probability that the courts take these claims seriously.

The criticism of the SEC didn’t stop there. Representative Patrick McHenry, the chairman of the House Financial Services Committee that oversees the SEC, accused the agency of failing to provide answers to congressional requests for information regarding the SEC’s interactions with crypto companies. In April, congress asked the SEC for a list of companies that met with the agency to discuss registration which the SEC has yet to provide. In a draft resolution released last week, the House Financial Services Committee suggested that the SEC has been doing an inadequate job and needs to await direction from Congress.

Analyzing the banking crisis

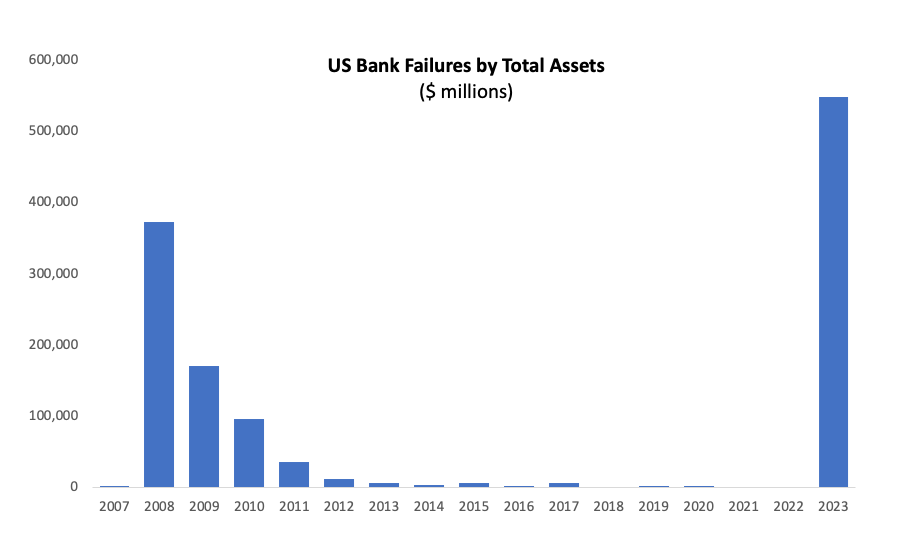

Three of the four largest bank failures in US history occurred in just the last couple of months due primarily to two factors. The first is the Fed’s interest rate policy. From 2008 to 2022, interest rates remained historically low, often near zero. The way banks make most of their money is by taking in deposits, which they pay a small interest rate to customers, and use that money to lend out at a higher rate. That difference in rates they pay depositors vs. the rate they receive through lending is profit for the bank. During the low-interest rate period that lasted 14 years, banks began taking on longer-term duration loans because those paid higher interest rates that would, in turn, make them more money.

Source: https://www.fdic.gov/bank/historical/bank/

Then COVID hit in March 2020, and soon after, stimulus checks were distributed. People needed a place to put that money, and not surprisingly, bank deposits rose by 35%. Flush with excess cash, banks did what they had been doing for years: they bought long-duration treasuries. These were considered the “safest” assets to purchase, and besides, the Fed had released its public forecasts in 2020 in which it told the market it wouldn’t raise interest rates until after 2023. Sigh…

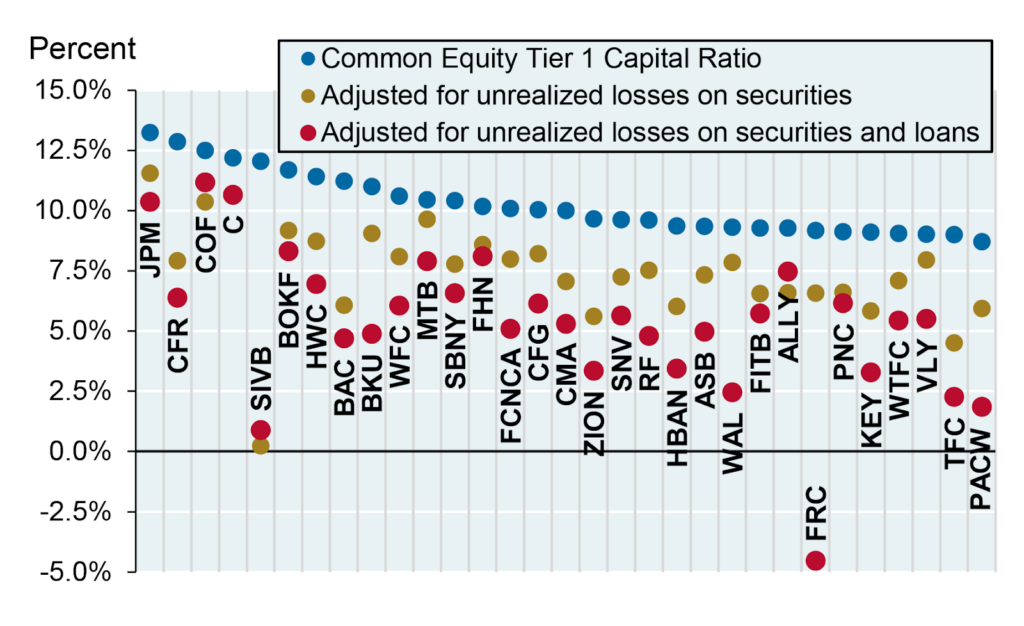

Starting in March 2022, the Fed raised interest rates 10 times—so much for those forecasts. This meant that all those long-duration treasuries that banks bought were now worth less than what they paid for them. Many banks (many more than the three that have failed thus far) currently have massive unrealized losses on their balance sheet. In theory, this bank issue could work itself out over time, assuming depositors don’t ask for their money back and allow the bank to hold those assets to maturity. But it will take years, maybe even upwards of a decade, before that maturity happens.

This leads us to the second factor that caused these bank runs: the speed at which communication and bank withdrawals can now take place. People no longer drive to their local bank on a weekday between 9 am – 5 pm, wait in line, and manually initiate a withdrawal. Thanks to 24/7/365 online banking, mobile apps, and APIs, anyone can press a couple of buttons on their phone, and their withdrawal is initiated. And don’t forget about social media, where information now spreads like wildfire, and people can act collectively with much greater efficiency. Remember Gamestop? Now when there is concern over a particular bank’s financial health, that fear can spread faster and further than ever before, and people are able to act on it instantly. Put these two together, and you get $42 million of deposit withdrawals initiated in a single day from Silicon Valley Bank. SVB literally ran out of cash before its management team had time to address the situation. Bankers are not prepared for the speed at which bank runs can happen and are just now coming to grips with that reality.

As much as I would like to be able to tell you these recent bank failures were isolated incidents, there are three reasons why that’s unfortunately not the case. First, according to the Federal Reserve’s own report on the “Impact of Rising Rates on Certain Banks and Supervisory Approach,” released in April, 722 banks reported unrealized losses exceeding 50% of their capital. Even worse, 31 of those banks reported having negative equity levels (yes, that means those banks have liabilities that exceed their assets).

Source: https://privatebank.jpmorgan.com/gl/en/about-us/safety-and-security

Second, banks are losing depositors. Why keep money in low-interest-rate savings accounts that pay on average 0.39% when you can earn 4-5% in money market funds or other investment assets? Yeah, I don’t know either. As a result, bank deposits fell by nearly $720 billion between the second and fourth quarters of 2022, leaving banks’ cash assets at their lowest levels in more than two years. This trend of deposits leaving started well before Silicon Valley Bank or First Republic failed and will continue as long as interest rates remain high. It’s hard to earn money as a bank if you are losing your depositors, especially at the exact same time you are sitting on a bunch of debt that is underwater. As more depositors leave, banks will be forced to realize the losses of those long-duration loans. Even if you believe the banking crisis is over, the reality is many community and regional banks are now simply unprofitable businesses and will likely either go under or be acquired in the coming years.

Third, the value of commercial real estate is falling in large part due to businesses not needing nearly as much office space as more and more employees work remotely. Less demand for office space translates to lower rents which result in lower value for office buildings and building owners less able to make payments on their loans. What does that have to do with banks? I’ll give you one guess as to who lent out the money for a large portion of those commercial real estate buildings. For example, almost 80% of PacWest Bank’s loan book is dedicated to commercial real estate-backed loans and residential mortgages. Numerous other banks have large commercial real estate holdings as well, which means this issue isn’t going away any time soon.

The point I am trying to make is that the banking industry as a whole may be on unstable footing, and that was before Powell raised interest rates again just the other week. This isn’t a crypto-caused problem or a tech startup issue. This is a structural issue for which there is not an easy solution. Yes, there are larger banks that are so well-capitalized that they will be just fine. But all the small and regional banks are currently facing growing pressure on their business models. And should customers start to move their money from smaller to larger banks (because the larger banks are increasingly being viewed as a safer option), that will only further exacerbate the problem and begin concentrating the banking sector.

But isn’t the money in the banks insured by the FDIC? Yes…yes, it is…sort of. FDIC insurance is only good on the first $250,000 in a bank account. Of the $17 trillion of total bank deposits in the US, nearly $7 trillion are not insured by the Federal Deposit Insurance Corporation. That’s a lot of money sitting in banks that aren’t covered by FDIC. But what about the remaining $10 trillion that is insured? Here is the problem, the FDIC fund is currently only $128.2 billion. With this in mind, the FDIC only has enough money to cover 1.3% of all “insured” deposits within the US. While bank assets wouldn’t go to zero during a bank run, and the FDIC could definitely backstop a few banks, it doesn’t have enough capital to make every depositor at every regional and community bank whole in the event of cascading failures.

Please do not take this argument the wrong way, I’m not saying our banking system is going to collapse. I’m not even arguing that bank failures are likely to accelerate in the near future. All I’m trying to highlight is that the counterparty risk of holding money in a bank, especially community and regional banks, is probably much higher than most people realize, and that risk is growing. It’s likely we will see more banks fail, but it’s also very likely the federal government will step in and backstop the deposits before things get out of hand. But if that were to happen, it would very likely mean that a significant amount of money would need to be printed by the government, which would lead to further currency debasement and likely higher inflation.

If only there was an asset that allowed you to protect your long-term purchasing power while at the same time eliminating your counterparty risk to the traditional financial system.

Bitcoin was created out of the 2008 banking crisis. The stark contrast between bitcoin’s pre-programmed monetary policy, which includes a capped supply and a 50% reduction in new supply issuance every four years, against opaque fiat monetary policies and rate-hike-induced bank failures is becoming more evident by the day. The ability to self-custody bitcoin so as not to have to rely on third-party intermediaries is becoming more valuable. Nasdaq’s BANK index, which includes dozens of US-listed bank stocks, has dropped more than 30% since the start of the year, while bitcoin is up 61% over that same period.

In past issues, we have covered the benefits bitcoin and decentralized finance provide to those living in oppressive regimes or hyperinflationary conditions. It’s why adoption and use of bitcoin as a savings and payment technology is much more prevalent in developing countries, whereas in the West, crypto is still viewed primarily as an investment. However, the US banking crisis is highlighting the value of a financial asset whose monetary policy isn’t controlled by the state, can’t be debased, and can’t be confiscated. As a result, the narrative of bitcoin’s value proposition within the US is slowly beginning to shift from a purely speculative asset to an asset whose properties provide protection against future uncertainty.

The impact of Bitcoin’s Halving

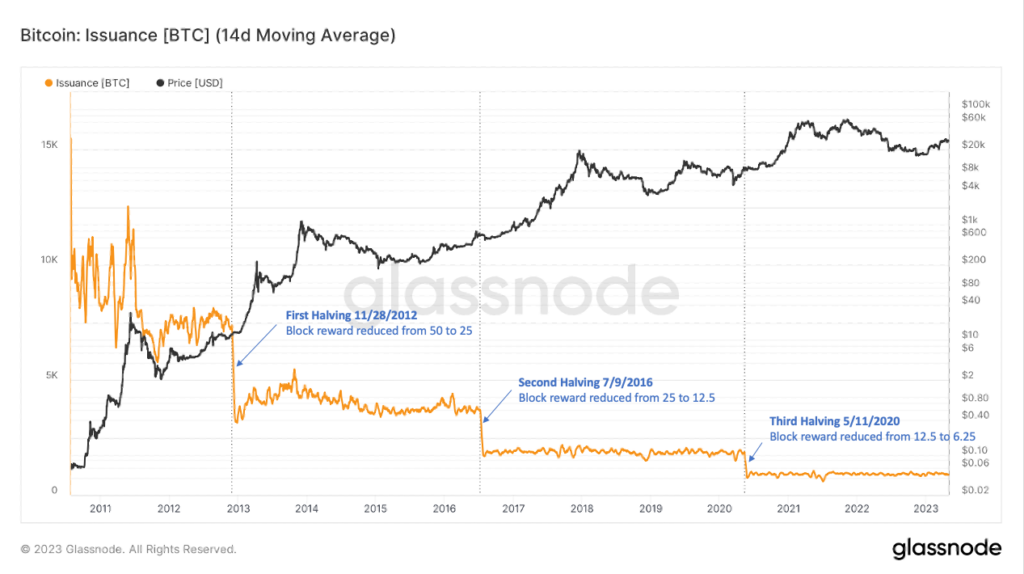

There are three pillars to bitcoin’s monetary policy. The first is the fixed supply of 21 million BTC that gives bitcoin absolute scarcity. Second is the difficulty adjustment which ensures that a predetermined amount of bitcoin is released, on average, every 10 minutes regardless of how much computational power (aka Hash Rate) comes onto or off the network. This makes bitcoin’s supply issuance completely transparent, predictable, and inelastic (an increase in miners does not increase the output of more blocks). The third pillar is the predetermined amount of new bitcoin released with each block mined.

When bitcoin was first launched in January 2009, 50 new bitcoin were released with each subsequent block that was mined. However, Satoshi wrote into the code of the bitcoin protocol that for every 210,000 blocks, which roughly equates to every 4 years, bitcoin’s supply issuance will be cut in half. This reduction in new bitcoin issued per block is known as “The Halving.” The first Halving event happened on November 28, 2012, as the number of new bitcoin released per block was reduced from 50 to 25. The second Halving occurred in July 2016, reducing the block reward to 12.5, and the third Halving event occurred in May 2020, which further reduced the supply issuance to 6.25 bitcoin per block.

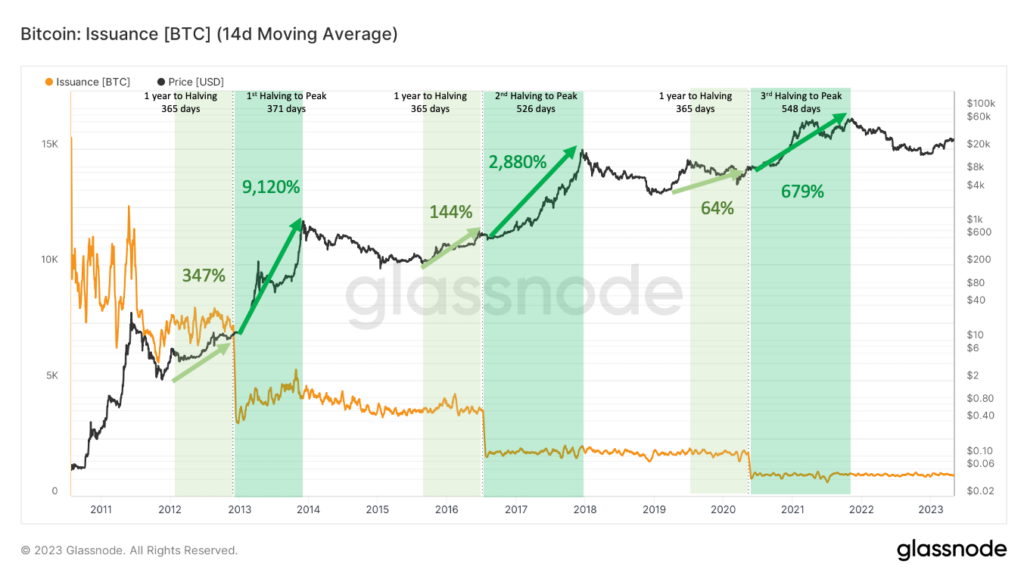

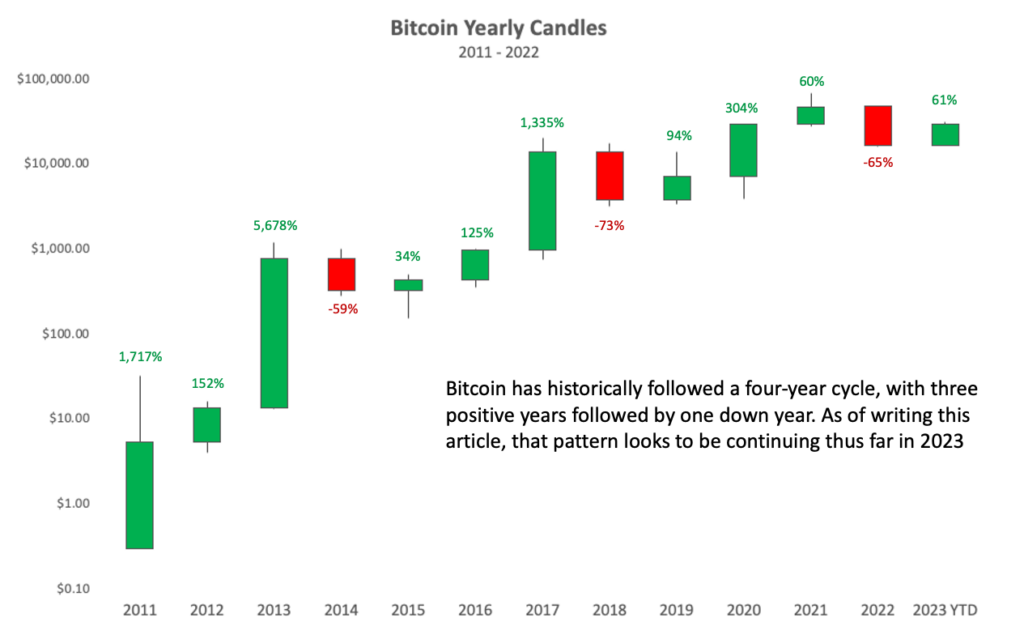

As a result of the Halving, the supply of available Bitcoin decreases every four years, which naturally puts upward pressure on the price of bitcoin. Imagine if half of all global oil production went offline overnight, the price of oil would surely rise. It’s the same phenomenon with bitcoin. Historically, this supply shock has led to enormous appreciation in bitcoin’s price following the Halving events. Interestingly, the 365 days leading up to the Halving has also been a very profitable time to own bitcoin as the crypto markets have historically bottomed out by then, and excitement leading up to the Halving starts gaining momentum. We only bring this up because, as of publishing this article, bitcoin’s next Halving event is one year away.

A decrease in supply puts upward pressure on price. Rising prices catch the attention of media, friends, investors, and more which increases the demand for bitcoin, further driving it upward. New entrants not only invest in bitcoin but begin looking to other cryptoassets starting with ETH and then eventually to more long-tail assets. As a result, the market gets overheated, often characterized by rapid price appreciation of long-tail assets, which historically coincides with the top of the cycle. As prices get too far out in front of fundamental metrics, the bubble inevitably bursts, and we get a sharp pullback like we saw in 2022. However, each cycle breeds new believers in bitcoin (aka HODLers), which creates a higher floor than the previous cycle. Through this boom and bust, we naturally have an upward trend in price over the long term. The Halving that occurs every four years is a big driver of why the crypto industry has historically moved in four-year cycles.

Bitcoin’s next Halving event is on schedule to take place in May 2024. From a historical point of view, that would indicate that we are just at the start of the growth portion of bitcoin’s four-year cycle. Thus far, this cycle seems to be right on track to follow the same pattern as each of the previous cycles.

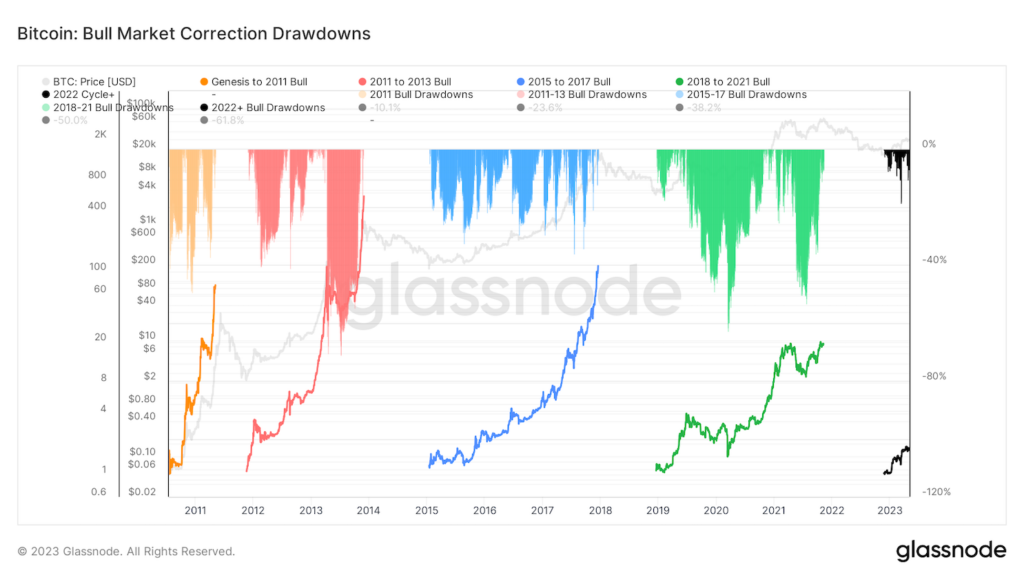

Assuming that the November low is indeed the bottom of this cycle, as we predicted in January, what might we expect during this next phase? For one, while the price of bitcoin is likely to increase significantly over the next 2-3 years, it may not be a smooth road. Each previous bull cycle included multiple corrections of 30% or more before it reached its top. The last bull cycle, in which bitcoin ultimately went from $4,000 at the start of 2019 to $67,000 at its peak in November 2021, also saw the price drawdown at least 50%, not just once, but twice.

Thus far this year bitcoin has led the rally, as has been the case during the early stages of every previous bull market cycle. Altcoin Season has not kicked off yet, as that will likely happen after bitcoin’s Halving, which has historically been the catalyst that kicks the bull market into full swing. The current cycle is playing out eerily like the previous three, and should it continue, we would likely see bitcoin (and the crypto markets at large) experience enormous value appreciation over the next 2-3 years with short periods of significant drawdowns along the way.

As always, the on-chain data is provided by Glassnode. If you would like to have access to the data yourself, you can sign up here.

In Other News

Binance temporarily paused bitcoin (BTC) withdrawals on May 7th as the blockchain fees rose due to the use of a new Bitcoin-based token standard called BRC-20.

Mastercard, PayPal, and Robinhood dive deeper into crypto.

Blockchain Association calls for revisions to SEC custody rule.

The SEC is facing criticism from JPMorgan, crypto firms, and fellow agencies regarding their recent custody proposal.

Bhutan’s secret sustainable crypto mining in the Himalayas.

The Chamber of Commerce is backing Coinbase in their fight with the SEC, claiming that the SEC “is causing great economic harm” with the lack of clear regulations for digital assets.

Franklin Templeton, which manages assets amounting to about $1.4 trillion, will launch a crypto fund for institutional investors.

Lawmakers from Texas have voted to add a provision to the state’s Bill of Rights that would recognize Texas residents’ right to possess, retain, and use digital currencies.

Revisiting the case for including bitcoin in a traditional investment portfolio.

Binance has announced that it will be exiting the Canadian market due to the new regulatory framework in the country.

The SEC has requested the court to refuse the demands in Coinbase’s petition that aims to force the agency to create a clear framework for digital assets.

What does the debt limit showdown mean for bitcoin?

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely that of Brett Munster and do not express the views or opinions of Blockforce Capital or Onramp Invest.