Onramp Invest was created to provide RIAs, and consequently the end clients of financial advisors employed by those RIAs, with streamlined access to the crypto economy. This access is achieved through integrations with qualified crypto custodians and exchanges that facilitate the purchase of dozens of coins and tokens. Rather than providing financial advisors with recommendations on what to buy, Onramp simply provides an avenue for participation within this market that makes the process simple, pain-free, and connected to advisors’ legacy tech stack. By doing this, we hope to promote connectivity between legacy financial institutions and the emerging world of decentralized finance.

Check out this quick gif that shows how easy it is to buy SOL for a client.

In alignment with our mission of opening up widespread access to cryptoassets, we are excited to announce that Solana $SOL is now available for purchase by Onramp users via our integration with Gemini. Below, we provide an overview of the Solana network for those interested in taking a deeper look at the latest coin added to the Onramp platform.

What is Solana?

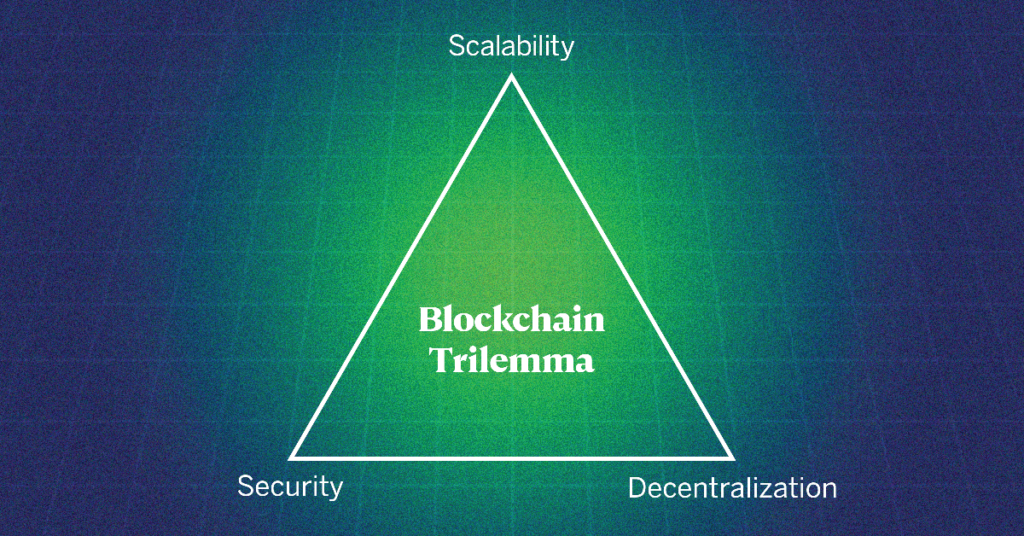

Similar to Ethereum, Solana is a base layer smart contract platform that enables developers to create decentralized applications (dApps). To understand the difference between Ethereum and Solana, we first have to understand the Scalability Trilemma inherent in all blockchains.

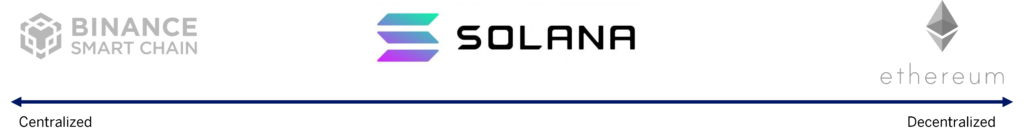

The Scalability Trilemma claims that there is a trade-off between three important distributed ledger technology properties: decentralization, scalability, and security. Whereas Ethereum prioritizes decentralization, Solana is purposefully less centralized which allows for greater throughput and scalability at the base layer.

Decentralization matters to achieve censorship resistance and greater security. We have seen the risks and challenges for companies and developers building on centrally controlled platforms such as YouTube, Facebook, Google, Amazon, and more.

However, there are diminishing marginal returns beyond a certain point of decentralization. 100 to 1,000 nodes is significant for decentralization but the amount of additional decentralization you really get going from 100,000 nodes to 1 million is unclear. So long as the chain has enough nodes and is decentralizing at a sufficient pace, then users are very likely to maintain the censorship resistance that they need.

The bet the Solana team is making is that they can create a network that is “decentralized enough” to be secure, particularly given that most users care far less about decentralization than crypto insiders do. The next billion users will want a good user experience, faster speeds, and lower costs. On those counts, Solana shines.

Solana requires higher-end computers with greater processing power to mine compared to Ethereum. These higher-end miners can validate more transactions at faster speeds. The downside is that this limits the number of participants due to the much higher costs of required computing thresholds. Thus, mining is likely to have much fewer nodes on the network than Ethereum (hence “less decentralized”).

What makes Solana attractive is that its radically different system architecture leads to dramatically higher speeds and lower costs than other blockchains. Whereas Bitcoin can handle about 7 transactions per second (TPS), and Ethereum can handle 30 TPS (until Eth 2.0 dramatically increases it), Solana can currently handle 65,000 TPS. Because the throughput is so much greater on Solana, transaction fees are also significantly lower.

While there are currently fewer users and apps built on Solana compared to Ethereum, it’s much clearer for any developer on how Solana scales. In addition, Solana runs on a different computing language (RUST) which means it can’t simply copy and paste from Ethereum. This also means once a dApp is built on Solana, they are locked into that ecosystem. (Think Apple vs Android). This provides a bigger hurdle initially but much more defensibility in the long run compared to other competing smart contract platforms.