A Crypto Review of the CFP® Curriculum: Tax Planning (Part 5 of 8)

Cryptoasset adoption has led many to wonder, “How do my cryptoasset holdings and transactions affect my taxes?” Given the wide variety of transaction types within crypto and the differences in tax reporting for each, it is important to have a clear understanding heading into tax season. Additionally, the IRS has been cracking down by sending out letters to taxpayers who potentially underreported their cryptoasset tax liabilities in prior years. The aforementioned surge of the crypto economy has continued to be driven by retail investors and, as a result, financial advisors have a unique opportunity to showcase their expertise in a dynamic marketplace that many do not yet understand.

In 2014, the IRS first released guidance through Notice 2014-21 determining that cryptoassets will generally be taxed as property at the federal level. In this notice, the IRS states: “General tax principles applicable to property transactions apply to transactions using virtual currency.” Generally speaking, this means that cryptoasset transactions are taxed using capital gains rates. However, there are a few exceptions that will be touched on below.

As trusted fiduciaries, financial advisors should make a concerted effort to educate themselves on the current landscape of cryptoasset tax provisions. In this section, we will cover what you need to know in order to ensure clients stay compliant on their 2021 tax return.

Tax Treatment of Cryptoasset Transactions

Buying Cryptoassets With Fiat Currency:

Buying a cryptoasset, like bitcoin, from an exchange does not trigger a taxable event. However, it is important to note the cost basis of the cryptoasset position at the time of purchase. This cost basis will be used at a future date in the event that the cryptoasset is disposed of.

Selling Cryptoassets For Fiat Currency:

Selling a cryptoasset for fiat currency triggers a taxable event. The tax rate on the sale falls under current federal capital gains tax rates. Depending on the client’s holding period and income, they could pay anywhere from 10-37% for short-term capital gains, and 0-20% for long-term capital gains.

The holding period for property begins the day after the trade date and ends on the day the property is sold. If this holding period is 365 days or less, the capital gain or loss from the sale is classified as short-term. If the holding period is 366 days or more, it would be classified as long-term.

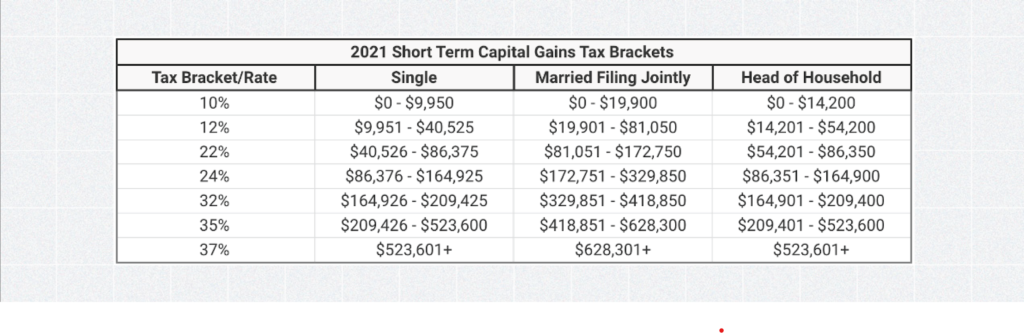

Short-term capital gains are taxed as ordinary income. Here are the 2021 ordinary income tax rates released by the IRS for federal tax reporting purposes:

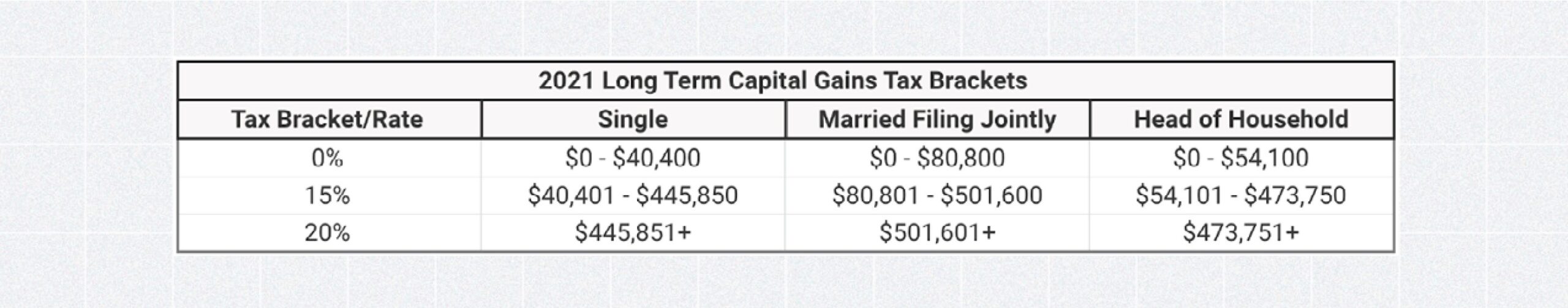

If the capital gain is classified as long-term, the client could be taxed at 0%, 15%, or 20% based on adjusted gross income. Here are the 2021 tax rates for long-term capital gains:

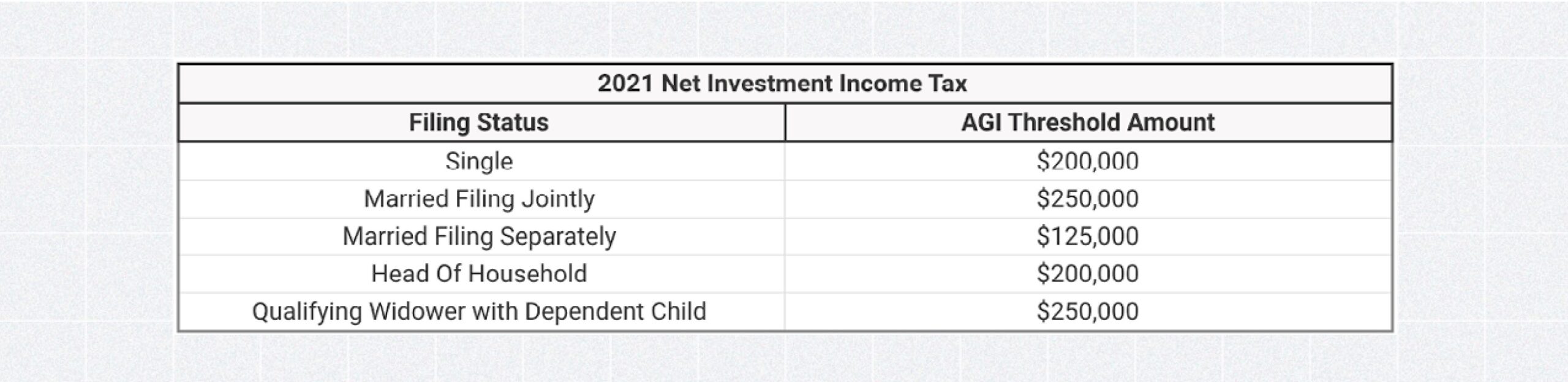

Note: Since ordinary income is taxed first, incurring long-term capital gains will not push you into a higher tax bracket. Additionally, based on the client’s income level, they could incur an additional 3.8% Net Investment Income tax, otherwise referred to as Medicare tax. The table below shows these income limits:

If selling cryptoasset holdings at a loss, the client is able to offset these losses against capital gains. In short, short-term losses are first deducted against short-term gains, and long-term losses are deducted against long-term gains. Net losses of either type can then be deducted against the other kind of gain.

Once capital losses are used to offset capital gains, if the client’s capital losses exceed the gain amount, they will be able to use the excess capital losses to offset up to $3,000 of ordinary income. Any remaining losses above $3,000 can be carried forward into subsequent years.

Swapping One Cryptoasset For Another:

Swapping one cryptoasset for another triggers a taxable event. The client will realize a capital gain or loss based on the USD market value gained or lost. This type of transaction follows capital gains tax treatment.

Note: Transferring a cryptoasset from one wallet or exchange to another does not trigger a taxable event.

Using Cryptoassets to Purchase Goods/Services:

Purchasing a good or service with cryptoassets triggers a taxable event. This type of transaction would fall under the capital gains tax treatment.

Cryptoasset Events Taxed as Income:

- Earning interest through lending cryptoassets on an exchange such as Gemini or through decentralized finance protocols

- Receiving cryptoassets through an airdrop

- Earning cryptoassets by staking or through liquidity protocols

- Earning cryptoasset mining income from transaction fees and block rewards

- Receiving cryptoassets for performing work

The income earned for tax reporting purposes is equivalent to the fair market value on the date you have dominion and control over the cryptoasset.

Taxation of Non-Fungible Tokens (NFTs)

As of the beginning of 2022, the IRS has not issued clear guidance on the tax treatment of NFTs. Two potential tax treatments are being discussed, with the majority of tax professionals taking a conservative route for reporting NFT gains or losses.

It is possible that the IRS could rule that NFTs are a form of “property” and therefore, taxed in a similar manner as any other cryptoasset. In this case, NFTs would fall under the same tax treatment as discussed in previous sections.

Alternatively, and quite possibly the more likely scenario, is the IRS will rule that NFTs are a form of “collectible” and therefore taxed as such. If the IRS implements this guidance, NFTs would be taxed at the higher long-term capital gains rate of 28%. In the instance that a collectible is sold prior to a year, the gain would be subject to ordinary income tax rates regardless of whether it is classified as property or a collectible.

The following NFT transactions would be viewed as taxable events, triggering a capital gain or loss:

- Purchasing an NFT with a cryptoasset, such as ether

- Swapping one NFT for another NFT

- Selling an NFT for a cryptoasset, such as ether

Reporting to the IRS

As you can see from the above information, it is vital to keep a close track record of cost basis, date acquired, date disposed of, fair market value, and gain or loss when transacting with cryptoassets. Capital gains and losses from cryptoasset transactions are reported on IRS Form 8949. If a client earns cryptoassets, there are a few different reporting schedules based on how the cryptoasset was earned:

If the client earns cryptoassets through lending or staking, this is generally reported on Schedule B: Interest and Ordinary Dividends

If the client earns cryptoassets through an airdrop, this is generally reported on Schedule 1: Additional Income and Adjustments to Income

If the client earns cryptoassets from mining, depending on how the client is operating, this could be reported on Schedule C (if mining as a business) or Schedule 1 (if mining as a hobby). If the client is not sure which they are operating under (business or hobby), they can refer to this IRS guide.

It is important to note that many crypto exchanges do not issue 1099 forms to their customers. Therefore, it is vital that advisors and clients maintain appropriate records of cryptoasset transactions and wallet-to-wallet movements in order to file accurate tax returns each year.

Cryptoasset Tax Reduction/Management Strategies

Tax Loss Harvesting:

Similar to traditional investments, if clients have unrealized losses on cryptoasset investments in a non-qualified account, they can take advantage of tax-loss harvesting strategies. As mentioned above, capital losses on cryptoassets can be used to offset capital gains on other cryptoassets or on traditional investment capital gains. If the realized capital losses exceed the realized capital gains, up to $3,000 of ordinary income can be offset per year ($1,500 if married and filing separately). Net capital losses in excess of the $3,000 can be carried forward to subsequent years.

The most notable tax difference between cryptoassets and traditional investments is the enforcement of the wash sale rule. According to the IRS, a wash sale occurs when someone sells or trades securities at a loss and within 30 days before or after the sale: 1. Buys substantially identical securities, 2. Acquires substantially identical securities in a fully taxable trade, or 3. Acquires a contract or option to buy substantially identical securities. At the end of 2021, the wash sale rule didn’t apply to cryptoasset transactions, likely due to the classification of cryptoassets as “property” versus “securities”. This allowed crypto investors to sell a cryptoasset at a realized capital loss, and buy the same cryptoasset back immediately.

The Build Back Better Act, which has not passed through the Senate as of the end of 2021, included language that would subject cryptoasset transactions to wash sale rules. If the Build Back Better Act is passed in 2022, it is unclear if the IRS will retroactively enforce wash sale rules on cryptoasset transactions occurring after December 31, 2021. This is something to be on the lookout for in the months ahead.

Rebalancing Within Non-Qualified Accounts:

Keep in mind that most cryptoassets are currently held within non-qualified accounts. Before recommending a rebalancing strategy, advisors should consider the tax implications. Since cryptoassets can easily be transferred across various exchanges and wallets, it will be important for advisors to confirm the cost basis of these assets prior to placing rebalancing trades.

Donating Appreciated Cryptoassets:

Appreciated cryptoassets, like other traditional investments such as stocks and bonds, can be used to make charitable contributions. Generally speaking, this type of donation could offer two tax benefits: 1. Avoidance of capital gains tax on the appreciated cryptoasset, and 2. Obtaining a charitable tax deduction.

Donations of long-term appreciated assets, such as crypto, are generally eligible for an income tax deduction of the fair-market value of the cryptoasset, up to 30% of the investor’s adjusted gross income. If cryptoasset donations exceed $500, the donor is required to fill out Form 8283 and include this on their tax return. If the donation exceeds $5,000, the donee must also sign Section B of Form 8283.

Donor Advised Funds (DAF) have become a popular charitable giving vehicle as clients look to maximize their charitable impact. Opening and funding a DAF allows for a few tax benefits. The donor receives an immediate tax deduction on the charitable contribution, but they aren’t required to “grant” this contribution to charities all at once. The contributions are usually invested into a diversified investment portfolio. A few of the largest DAF providers including Fidelity Charitable and Schwab Charitable are now accepting a variety of cryptoassets for DAF contributions. Additionally, DeFi protocols such as endaoment.org are making it simple to open and fund a DAF on the Ethereum blockchain itself.

It is worth noting that advisors should understand their client’s claiming status prior to implementing charitable giving recommendations. The client may consider “bundling” charitable contributions into a single tax-year in order to alternate between itemizing and the standard deduction. These strategies should be discussed thoroughly with a tax professional prior to implementation.

Crypto-backed Loans:

Numerous cryptoasset exchanges in both CeFi and DeFi are beginning to offer borrowing options to investors who hold crypto on their exchange. These loans tend to be backed by cryptoassets or stablecoins as collateral and can have significantly lower rates than traditional lending providers. Similar to securities-based borrowing on the traditional side, investors are given the capability to access liquidity for a variety of needs without selling their cryptoasset holdings and possibly incurring a tax impact.

Potential advantages of borrowing against cryptoassets:

- Participate in the potential upside of the asset while tapping liquidity

- Potential tax savings

- Most crypto-backed loans do not require a credit check

- Potential for lower interest rates compared to some borrowing methods

- Access to loan funds almost instantly

Potential disadvantages of borrowing against cryptoassets:

- Volatility of cryptoassets could lead to a margin call

- Potential to achieve a lower interest rate on other assets, such as a HELOC

- Potential for higher collateral minimums compared to traditional borrowing

- Counterparty risk on the cryptoasset loan provider, less regulatory oversight

In its early stages, one of the key use cases of DeFi is through lending and borrowing markets. Open source protocols such as Aave allow borrowers to access funds through their decentralized liquidity pools. In early 2022, borrowers could obtain a variable rate of under 4% on the USDC stablecoin. Alchemix, another decentralized protocol, is attempting to redefine the borrowing markets by offering “self-paying” loans that effectively generate yield on the collateralized assets during the loan period.

There are many developments happening in the DeFi space and advisors may want to start educating themselves sooner rather than later. At this time, security and regulation of these lending and borrowing markets remain largely unclear. However, regulators have mentioned that this will not be the case indefinitely. If clients are borrowing against their cryptoassets today, advisors should consider outlining the key risks and benefits of doing so.

Gifting Strategies:

In 2022, the annual gift exclusion increased from $15,000 to $16,000 per individual. This exclusion amount is $32,000 for married couples who choose to “split” their gifts. Cryptoassets are eligible to be gifted similar to other assets such as stocks, property, or cash. Popular exchanges such as Coinbase and Robinhood have developed simple ways for their users to gift cryptoassets.

In general, giving cryptoassets to a friend or loved one doesn’t trigger a taxable event unless the transfer exceeds the gift exclusion amount. It is worth noting that the recipient of the crypoasset will also “carryover” the cost basis associated with the holdings. Advisors may find tax and estate planning opportunities by shifting the tax liability of cryptoasset holdings through gifting strategies.

Withholding Strategies:

Clients may need to consult their tax professional about proper withholding on their cryptoasset income. In the event they are earning income through staking, lending, airdrops, mining, or other means, it is highly unlikely that any of this income will be withheld automatically. This could lead to an unexpected tax bill and potential liquidity shock for the client.

Estimated Tax Payments:

If clients are transacting frequently in their cryptoasset portfolios, they may need to consider making quarterly estimated tax payments during the year to help avoid tax penalties. Advisors and clients should work with their tax professional to determine if this is necessary.

Tax Return Amendments:

As clients become more aware of the tax implications on cryptoasset transactions, advisors may need to assist in amending prior tax returns. Prior to 2021, many cryptoasset exchanges were not providing tax forms to their users. Given the complexity of how cryptoassets are taxed, clients may not have known if their transactions were taxable events.

Access the Full Report

Our full report is available for all Onramp Academy users. The intent of the report is to provide financial advisors with a resource to compare their current credentials with the potential credential curriculum of the future. The report is 55 pages in length and includes cryptoasset commentary on each of the eight sections of the CFP® exam (including the newly minted Psychology of Financial Planning section). In our opinion, it’s a must-read for every financial professional as the space evolves in the digital realm!

If you are not an Academy member, use the form below and we will email you the report.

As always, educate before you allocate!

With gratitude, Your Onramp family