A Crypto Review of the CFP® Curriculum: Investment Planning (Part 4 of 8)

Institutional dollars are being poured into cryptoassets and, as such, crypto is widely considered to be gaining institutional acceptance as an asset class. While inherently volatile and largely unregulated, main benefits of the asset class are that it has historically shown to be fairly non-correlated to other asset classes and, as a whole, has significantly outperformed other major asset classes since its inception. Some major financial institutions are now allocating small percentages (1-5%) of model portfolios to the cryptoasset class. As space is being carved for the crypto asset class in institutional portfolios, it will be imperative for the advisor to consider what percentage of their clients’ portfolios (if any) should include cryptoassets, how to monitor and invest in the asset class (indexes, held-away accounts, ETFs, SMAs and more) and the resulting return and volatility projections, among other considerations discussed in this principal knowledge topic. Even for advisors that decide to allocate 0% cryptoassets to their portfolios, an understanding of the asset class is encouraged now that it is making its way into the traditional financial system, primed to create ripple effects in the overall market. As previously noted, even if your clients are not getting cryptoasset recommendations from you, it is becoming increasingly likely that they are passively obtaining information on the space through conversations with peers and via the media. As trusted fiduciaries, financial advisors have the opportunity to lead conversions moving forward.

Employing a diversified asset allocation strategy applies to cryptoassets as it would other asset classes. One of the main goals of diversification is to maximize “risk-adjusted” returns. In traditional asset classes, advisors tend to base their diversification strategies on historical risk and return metrics of a particular asset. In an asset class that is 13 years old, it could be difficult to determine the long-term “winners” and “losers”. Do the majority of crypto investors assume that Bitcoin and Ethereum will be around for the long haul? Possibly. With that said, disruption happens in every industry; a broad-based, passive indexing solution could make sense for some crypto investors. This approach could potentially capture upside from emerging ecosystems in the crypto space. In 2022, we may see a variety of index solutions built for crypto investors who are seeking a passive allocation to the asset class. If so, it will be important for advisors to have discussions with their clients on what portion of their cryptoasset portfolio will be actively managed versus passively managed, who is responsible for this management, and the pros and cons associated with each, should they choose to invest in the asset class at all. As cryptoassets find their way into discretionary investor portfolios, it is likely that passive crypto indexes will play a role in this category.

Investment Policy Statement

If a client is investing in cryptoassets, whether on a non-discretionary basis or through an advisor, it will be important for advisors to update the client’s Investment Policy Statement (IPS) to include this new asset class. The IPS typically includes investment objectives, allowable asset classes, benchmarks, rebalancing protocols, special constraints, and more.

Goal Based Investing

Given that clients have varying time horizons for their investment portfolios, advisors may look to implement a “bucket” approach for their client’s cryptoassets. For short-term goals, advisors may consider recommending stablecoin yield products, if suitable. On the other hand, cryptoassets such as Bitcoin or Ethereum could be used to supplement alternative asset strategies within long-term growth portfolios. By using this bucket strategy and assigning investment accounts to specific goals, clients could potentially have varying risk tolerances associated with each bucket. Generally speaking, the key is for advisors to have open dialogue around the expectations for each portfolio, including rates of return and historical risk metrics.

Monte Carlo Analysis

Monte Carlo simulations are a popular method of evaluating the overall success probability of a client’s financial plan. As cryptoassets are included in these simulations, advisors may need to manually adjust the historical return metrics in order to take a more conservative approach. When historical returns data is projected over the course of decades, a small allocation to cryptoassets could significantly sway the success rates. Advisors should examine this data and make appropriate adjustments as they see fit.

Rebalancing

As mentioned previously, cryptoasset volatility remains much higher than traditional asset classes. Due to this, advisors may consider shortening the rebalancing time intervals for a cryptoasset portfolio. Ad-hoc rebalancing could provide additional tax alpha in the event of a sudden market correction. It will be important for advisors to communicate to their clients a game plan for rebalancing strategies prior to implementing them. In the event that a client chooses to manage their cryptoasset portfolio on a non-discretionary basis, advisors should seek the tools necessary to monitor these portfolios.

Generally speaking, advisors will likely assign intended allocation targets that they will rebalance to when the portfolio deviates by a certain percentage. This will be even more important when cryptoassets are added to a portfolio due to their expected volatility to both the upside and downside.The vast majority of cryptoassets today are held within non-qualified accounts. This can be looked at as both an advantage and a disadvantage when it comes to rebalancing. Tax-loss harvesting strategies can be implemented on a one-off basis when rebalancing in a non-qualified account, however the ability to rebalance with no current tax impact is a huge benefit when done in a qualified account. We will touch more on qualified account solutions for cryptoassets in the Retirement Planning section.

Dollar Cost Averaging

Similar to traditional investment accounts, advisors may recommend that a client make contributions to their cryptoasset portfolios on a specific time frame (bi-weekly, monthly, quarterly, etc). This systematic savings strategy allows clients to potentially use the high volatility of cryptoassets to their advantage. Some exchanges such as Gemini allow a client to automate a dollar cost averaging strategy.

Asset Location of Cryptoassets

Locating assets effectively can potentially lower a client’s overall tax burden. By placing less tax-efficient investments such as stablecoin yield products, that tend to produce gains subject to income tax in a tax-deferred or tax-free investment vehicle, a client could lower their tax liability. In the years ahead, solutions will likely be rolled out in the wealth management space for advisors to take advantage of DeFi yield strategies within qualified accounts. For non-income producing cryptoassets, advisors may likely recommend continuing to hold these growth oriented assets within non-qualified accounts.

Risk Tolerance Questionnaire

If advisors know that their client is investing in cryptoassets on a held-away or discretionary basis, they will likely want to send out a new risk tolerance questionnaire to gauge the client’s overall risk profile. Monitoring each unique client’s risk tolerance and capacity will be essential to ensure that the client remains on track to reach their goals.

Concentrated Cryptoasset Positions

As many advisors know, there is substantial risk involved with maintaining a concentrated position in any asset, including cryptoassets. This will be one of the biggest challenges advisors face in navigating cryptoasset portfolios. Many investors who have been involved in crypto for years have accumulated significant wealth through concentrated investments. In a recent survey by CNBC, the majority of millennial millionaires have over half of their investments in cryptoassets. Advisors may want to consider an open-minded approach when talking with these clients about their concentrated portfolios. By thoroughly explaining the risks associated with overconcentration, advisors may be able to assist these clients in diversifying their wealth across asset classes or within the cryptoasset space.

Options Strategies

While most centralized cryptoasset exchanges have not yet implemented options as a part of their core offering, decentralized exchanges have made options readily available to investors. Advisors should do their due diligence on these offerings and determine whether clients could be suited to implement an options strategy on their cryptoasset holdings.

Cryptoasset Risk & Return

As part of the CFP® curriculum, advisors are required to learn, describe, and compare the risk and return characteristics of all asset classes in order to provide sound investment advice to clients. This includes advising clients on the tax implications of holding and disposing of each security type or asset class. Broadly speaking, cryptoassets risk and return metrics vary significantly compared to traditional asset classes such as stocks, bonds, real estate, and other alternatives. Additionally, one cryptoasset’s risk and return profile could look much different compared to another.

The overall makeup of crypto as an asset class is changing by the day. As of December 2021, CoinMarketCap listed 400+ cryptoassets with market capitalizations greater than $100 million. The overall crypto market cap has increased from ~$765 billion in January 2021, to north of $2.2 trillion at the beginning of 2022. Of this $2.2 trillion, Bitcoin and Ethereum remain the two largest cryptoassets by weighting, with market caps of ~$930 billion and ~$475 billion, respectively. These two alone make up a combined ~60% of total crypto market cap.

Throughout crypto’s existence, investors have been able to gain most of the upside from the asset class by simply allocating to the top few cryptoassets. However, as the crypto ecosystem develops, this will likely no longer be plausible. Why? In 2021 alone, Bitcoin’s market cap dominance has fallen from 70% to 40%; with a massive shift in market structure could come shifts in investment strategies as well.

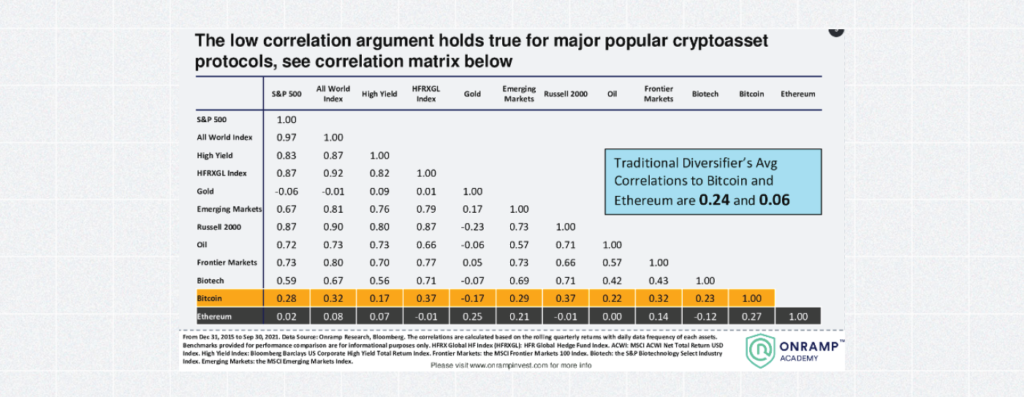

Historically, cryptoassets have had low correlation compared to traditional asset classes. This has led many investment managers to consider a cryptoasset allocation within the “alternative asset” portion of a diversified portfolio.

Take a look at the correlation data of Bitcoin and Ethereum compared to traditional asset classes below:

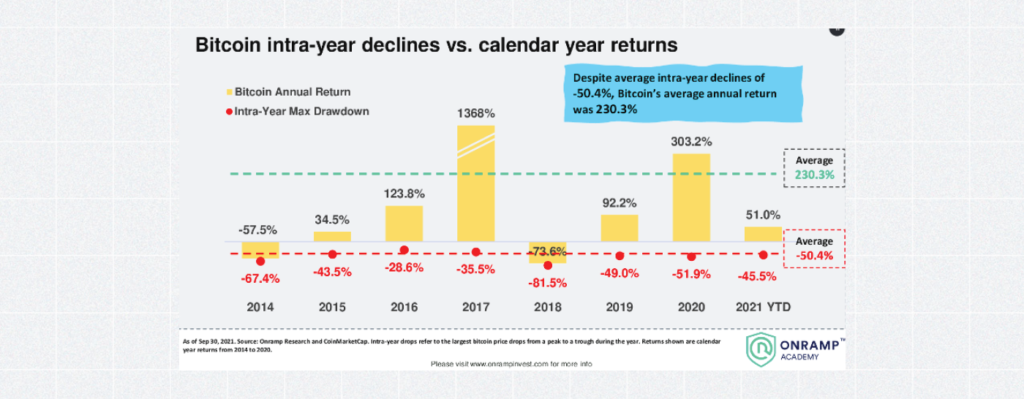

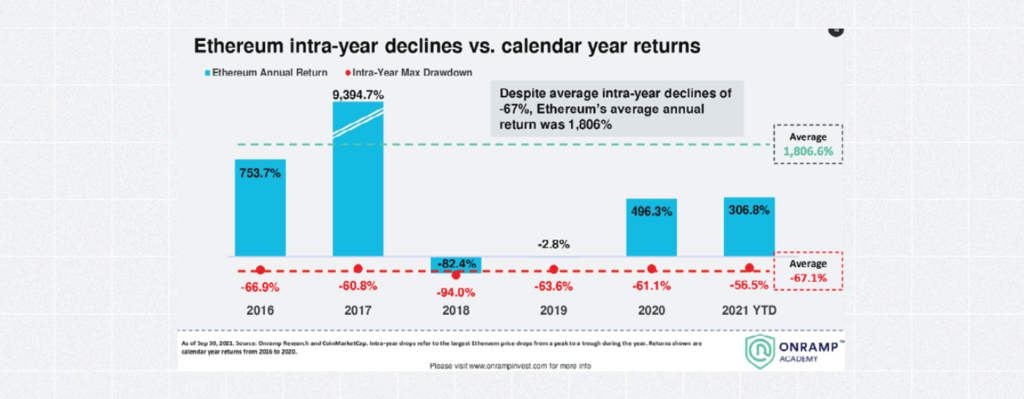

Although correlation analysis favors cryptoassets as a diversifier within a portfolio, advisors have remained hesitant on the asset class, likely due to its historical volatility. Volatility should be expected for a new and blossoming asset class. Despite average intra-year declines of -50.4% for Bitcoin and -67% for Ethereum over the last 6 years, the average annual return remains significantly higher than any other asset class.

Bitcoin

Ethereum

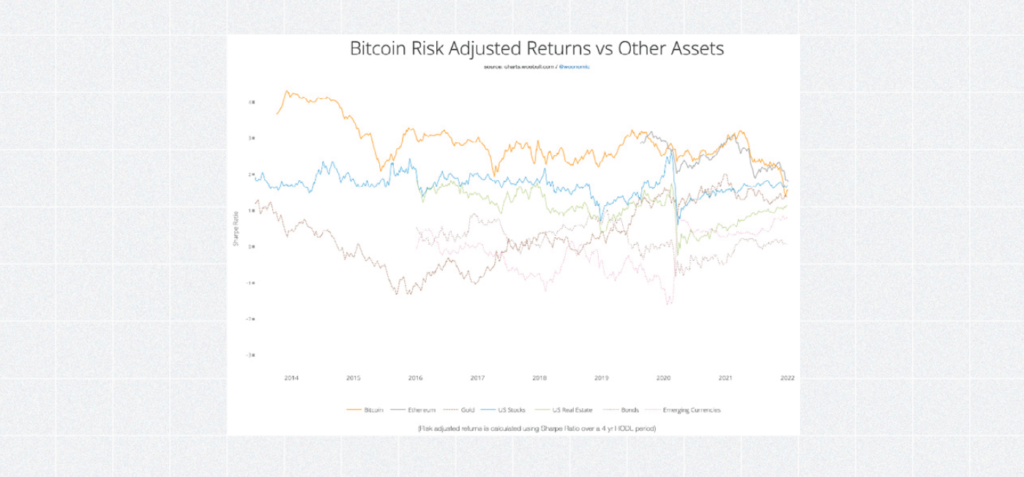

To determine if the return metrics outweigh the risk associated with the investment, let’s take a look at the Sharpe Ratios of Bitcoin and Ethereum compared to other asset classes (visual via Woobull Charts):

As you can see, Ethereum’s share ratio of 1.79 is currently higher than that of US stocks, US real estate, bonds, gold, and a basket of emerging currencies. Bitcoin ranks third on the list, right behind Ethereum and US stocks. Historically, not only have cryptoassets outperformed every asset class since inception, one could make the case they have done so on a risk-adjusted basis as well.

Types of Investment Risk

When building a portfolio, advisors should be aware of systematic and unsystematic risks that can impact the underlying portfolio holdings.

Generally, systematic risks are risks that cannot be entirely diversified away. Examples of systematic risks include: tax reform, changes in interest rates, inflationary or deflationary pressures, exchange rate risks, and more. Similar to traditional asset classes, systematic risk in cryptoassets would likely affect the asset class as a whole, not just Bitcoin.

In 2008, the U.S. economy went belly up, suffering its worst recession since the 1920’s. This systematic risk started with one sector, the mortgage market, and gradually spread across the entire global economy. A more recent example of systematic risk is Covid-19, which wreaked havoc across all industries and caused a shock to the global markets and economy. Crypoassets responded similarly to other “risk-on” asset classes during the height of the market turmoil, declining significantly in value in March 2020. With that said, cryptoassets emerged from the 2020 recession with more strength than any other asset class, leading many to commend their resiliency. Overall, it is difficult to say how cryptoassets would respond in other systematic shocks simply due to the fact that the asset class has only experienced a small number of these events. The irony around systematic risk is that some companies, governments, and individuals view cryptoassets themselves as one of the biggest systematic risks to the financial system. In 2021, the Senate Banking Committee pressed knowledgeable crypto experts about the risk crypoassets have on the global banking system. Rightfully so, as cryptoassets are sometimes viewed as a “hedge” against the legacy financial world.

Unsystematic risks are risks that pose a unique challenge to a specific company, sector or asset. Examples include: competition, political or legal risk, errors in judgement by management, or technological developments. Generally, these risks can be mitigated by using diversified portfolio strategies.

It is no secret that government regulations are viewed as one of the biggest risks to the crypto economy. In 2021 the world witnessed China ban all cryptoasset transactions and possession. This was a major move by the second largest economic country by GDP and the largest Bitcoin mining hub. The U.S. has taken a relatively “hands off” approach to cryptoassets so far, however many investors anticipate some form of regulation to come in the near future. It is to be determined if increased regulation will be viewed as a positive or negative catalyst for the crypto economy as a whole.

Another form of unsystematic risk that is prevalent in crypto markets is competition. Similar to companies competing within traditional industries, cryptoassets also compete with one another for market share. When advising on cryptoassets, it is important for advisors to have an understanding of competitive risks in the space. An example of this would be “Layer 1” blockchain solutions such as Ethereum, Binance Smart Chain, Solana, Avalanche, and Terra all competing with each other for developers and network participation.

Overall, advisors should continue to educate themselves and their clients on the risks associated with the crypto economy as a whole, as well as the specific cryptoassets that their clients are invested in.

Cryptoasset Valuation Methods

One of the most common and controversial topics in understanding crypto as an asset class is assigning a proper method to valuation. Below are a few of the topics for advisors to keep in mind when thinking about cryptoasset valuations.

Demand-Side Factors

Realized demand is the simplest and most stable form of demand, and in cryptoassets this largely comes from adoption of the network as a mechanism for exchange.

Speculative demand arises primarily from the activity of speculators, which much like in foreign exchange trading freely transact using the cryptoasset and associated derivatives on exchanges. Intuitively, speculative demand both provides price formation (and hence the market agreeable price) of the cryptoasset as well correlates to future realized demand.

Realized Demand Metrics

Metcalfe’s Law – One of the most popular models for understanding adoption (realized demand) and hence valuation of a cryptoasset owes to the idea of networks. In the Metcalfe model, we can simply assume that the cryptocasset unit (for example, a single bitcoin) has no intrinsic value; its value comes from its participatory value as part of the bitcoin network.

Social Momentum – While Metcalfe’s Law can provide a birds-eye view for understanding bitcoin’s value evolution over time, it could have a few shortcomings, especially for real-time analysis. Especially in the early stages of a cryptoasset, the largest contributor to valuation could be adoption momentum, versus actual adoption.

Similarly, for later stage cryptoassets, social momentum provides a valuable proxy to understanding activity – unlike wallet addresses, for example, which may be inactive, social momentum is a continuous signal of how active the community surrounding the cryptoasset is.

Developer Community – Like most digital products, cryptoasset creation is not a one-time payment from developers, but a continuous process of iteration and development over time. Unsurprisingly, the most valuable cryptoassets do not only have trader and community demand, but a vibrant developer base continuously driving both technological and community development. This tends to be incredibly valuable for cryptoassets, historically.

On-Chain Metrics

The most direct way to measure at any given point all demand (whether realized, speculative, or structural) is simply understanding the net usage of the cryptoasset’s network. Based on observations from Metcalfe’s Law, the intrinsic valuation of cryptoassets could derive in large part from adoption. What does adoption mean?

In general, the active demand of a cryptoassets could be analyzed by observing the actual transactions occurring. This could include:

- Unique addresses used per time period for transactions

- Confirmed transactions per day

- Confirmed payments per day

- Transaction rate per second

- Estimated Transaction Value (both in fiat currency and the cryptoasset itself)

In summary, cryptoasset valuation methods can look quite different compared to traditional asset class models. Advisors who stay up-to-date with market trends in the crypto space will be more readily able to provide valuable and timely advice to their clients in a fast-changing landscape.

Access the Full Report

Our full report is available for all Onramp Academy users. The intent of the report is to provide financial advisors with a resource to compare their current credentials with the potential credential curriculum of the future. The report is 55 pages in length and includes cryptoasset commentary on each of the eight sections of the CFP® exam (including the newly minted Psychology of Financial Planning section). In our opinion, it’s a must-read for every financial professional as the space evolves in the digital realm!

If you are not an Academy member, use the form below and we will email you the report.

As always, educate before you allocate!

With gratitude, Your Onramp family