Onramp Academy

DECEMBER 28, 2021

Summary

Welcome back to The Node Ahead, a cryptoasset resource for financial advisers. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients. Today’s edition is a bonus! As we will review the top five crypto stories of the year.

Before we get started, we are excited to share that our CEO, Tyrone Ross, has been hand-selected by Barron’s for their article, 10 People to Watch in Wealth Management in 2022. Thank you for all of your support, we appreciate you!

Also, if you have enjoyed reading the Node Ahead this year, join us for our upcoming live presentation on January 5th at 10am PT / 1pm ET with Eric Ervin, Co-Founder at Onramp and CEO of Blockforce Capital, and Brett Munster, Director of Research at Onramp and Portfolio Manager at Blockforce Capital. Click this link to secure your seat.

Top 5 Stories of 2021

2021 was another amazing year for the crypto industry. Bitcoin hit $69,000, DeFi grew to a $100 billion a year industry, stablecoins grew to more than $140 billion (nearly 400% growth), Coinbase went public, the Lightning Network hit an inflection point, Elon Musk tweeted…a lot, pension funds began holding BTC and ETH directly, there was the fight over the infrastructure bill, a bitcoin ETF was approved, mayors starting taking their paychecks in bitcoin, the Taproot upgrade went live, a DAO almost bought a copy of the constitution, play-to-earn gaming took off, and of course, inflation continues to highlight the need for sound money. Yet none of these were the top stories of 2021. Here are the five biggest stories from this past year.

The Great Chinese Miner Migration

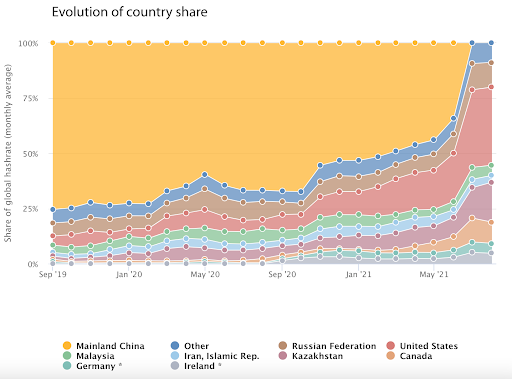

The single most important bitcoin-related story of the year had to be the story that never was. At the start of 2021, one of the few systemic risks of bitcoin was the concentration of mining power in China. At its peak earlier in the year, roughly 71% of all computing power on the Bitcoin network came from Chinese miners, according to estimates by Cambridge Bitcoin Electricity Consumption Index (CBECI). By comparison, the US had roughly 10.5% in January 2021.

This was a concern because Bitcoin’s blockchain works on a consensus mechanism, meaning that a majority of the network must agree in order to validate a block. Should any one actor control at least 51% of the computing power, he or she would be capable of influencing which transactions were validated, thus undermining the entire system. There were numerous mining operations previously located in China and, while none of them controlled a majority of the computing power by themselves, there was always a fear that the Chinese government could one day confiscate all these independent miners and take control of the Bitcoin network for itself.

Instead of embracing bitcoin and trying to consolidate the mining power, China decided to do the exact opposite. On June 18, the Chinese government made bitcoin mining illegal. Those of us who have been involved in the crypto industry for some time know that China banning bitcoin has become an annual tradition. The Chinese government instituted some form of crypto ban in 2013, 2014, 2015, 2016, 2017, 2018, 2019, 2020, and twice in 2021. China has publicly attempted to crack down on crypto usage 10 times in the last 9 years.

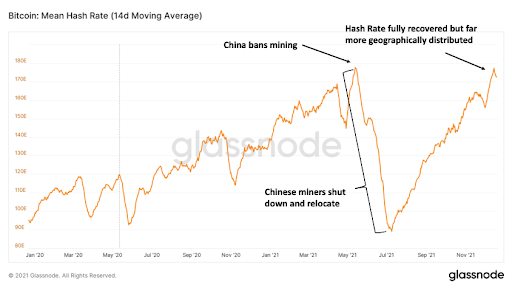

The number of failed attempts to ban crypto over the years is likely why the Chinese government decided to get serious in 2021 by eliminating the source, making mining illegal. In response, miners shut down their mining rigs, packed up their equipment, and moved to friendlier jurisdictions (the US wound up being the biggest beneficiary). In July of this year, the hash rate on the Bitcoin network plummeted over 50% during a two-month span as miners took their rigs offline to be shipped elsewhere.

What were the consequences? Well, there weren’t any; no downtime, no fraudulent transactions, and no security threats. The network carried on as usual. One of the most amazing characteristics of bitcoin is that should computing power on the network increase, the difficulty to mine bitcoin increases to maintain a constant block time of approximately 10 minutes. Should computing power on the network drop, the difficulty adjustment mechanism kicks in making it easier to mine bitcoin – and it did in fact adjust. Bitcoin continued working at its normal pace, verifying blocks on average every 10 minutes, even as miners relocated.

Over the following five months, miners previously located in China started to return online from new geographies. By December, the hash rate had fully recovered to its previous all-time high just prior to China’s ban.

Just to reiterate how truly amazing this was, half of the industry’s production was shut down by one of the most powerful countries in the world, and five months later it’s as if nothing ever happened. We witnessed one of the largest, most powerful countries on Earth do everything it could to kill the Bitcoin network, but to no avail. Imagine what would happen to the computer industry if China banned the production of semiconductors and electronics, or if the Middle East banned the production of oil. The entire world would come to a screeching halt. Heck, one wrong move by a cargo ship in the Suez Canal caused significant disruptions to global trade. With a fully decentralized system such as bitcoin, the same roadblocks would not occur.

There are numerous examples of governments trying to restrict, ban or even shut down bitcoin throughout the world. Every time, the industry simply relocates to friendlier jurisdictions and picks up right where it left off. Ironically, the regions where anti-crypto policies were implemented have seen demand increase from their citizens following the laws being enacted. Crypto is a global industry with no central figure or organization to go after. As a result, any attempt to restrict the use of cryptoassets has had no long-term impact on the growth of the industry.

2021 was the year that the myth of governments having the ability to shut down bitcoin was finally laid to rest.

One of the few systematic risks to bitcoin has now been eliminated; hash rate not only returned, but it’s now more distributed throughout the world. No longer does the threat of Chinese influence on the network exist. While the US was the biggest beneficiary of the migration and is now the single largest geography in terms of hash rate, no single country controls more than 35% of the network’s computing power. Not only was bitcoin not hurt by China’s ban, but it emerged stronger, more decentralized, and more secure.

Source: https://cbeci.org/mining_map

The Chinese ban in June had an immense amount of media coverage but little has been written about what happened since. That is because the ban turned out to be a non-story, which is exactly the point.

Nation-State Game Theory Kicks Off

Many in the industry, including our Director of Research Brett Munster, have long theorized that governments would eventually become large accumulators of bitcoin and other cryptoassets. Due to the fact that there is only 21 million bitcoin available, it would then become a matter of national self-interest for governments around the world to accumulate as much of that pie as possible once other countries started buying. In other words, game theory dynamics would kick in once the first domino fell, leading to this century’s version of the arms race.

On June 5, 2021, the first domino fell.

During the Bitcoin 2021 Conference in Miami, El Salvador’s president Nayib Bukele announced that El Salvador would become the first country to make Bitcoin legal tender, recognize it as a world currency and hold it as a national reserve asset.

On September 7th, bitcoin officially became legal tender in El Salvador in what was referred to as “Bitcoin Day” in the country. By putting bitcoin on equal footing as the dollar, companies now must accept bitcoin as payment. That includes local El Salvadorian businesses as well as large, multinational corporations that do business in El Salvador. Case in point: McDonalds, Starbucks, and Pizza Hut. You can now purchase your latte, Big Mac or pepperoni pizza with bitcoin in El Salvador, which means that large, international corporations are being forced to transact, store, and understand bitcoin.

However, El Salvador didn’t stop at merely allowing citizens to purchase goods and services with bitcoin. Over the course of the next four months, the El Salvadoran government accumulated over 1,100 bitcoin to hold as a national treasury asset. The government launched a bitcoin wallet, which over 50% of its citizens downloaded and actively use; more El Salvadorian citizens are using bitcoin than have a bank account. The country also built a 100% renewable bitcoin mining facility powered by geothermal energy from a volcano, and announced its intention to build a fully functional city called “Bitcoin City.” Rather than resorting to taxes to fund the building of this new city, El Salvador will be issuing a $1 billion tokenized bond in which half of the proceeds will go towards building the city, while the other $500 million will be invested directly in bitcoin.

The pace of innovation that El Salvador displayed in 2021 was truly astounding and many other countries started to take notice. Since El Salvador’s announcement in June, Panama recognized bitcoin as legal payment within the country, Ukraine legalized bitcoin, Cuba legally recognized cryptocurrencies, and both Brazil and Tonga announced it will make bitcoin legal tender – that all happened in a span of five months!

Game theory long hypothesized by the crypto community has started to play out exactly as predicted. If anything, the pace of adoption is exceeding expectations. Nation-state adoption of bitcoin has begun and, if the game theory continues to play out as expected, it won’t be too long before there is a race amongst countries to accumulate as much bitcoin as they possibly can.

Ready Layer One

Ethereum had a monster year in 2021. DeFi, which is predominantly run on the Ethereum network today, continued to accelerate. Now, the total value locked in DeFi protocols is greater than the market cap of most banks. This was most evident in decentralized exchanges. DEXs went from a niche use case last year, to processing over $1 trillion in trading volume and surpassing most of the centralized exchanges this year. NFTs went from obscurity to a cultural phenomenon, as Ethereum powered 97% of that market. Layer 2 solutions were practically non-existent last year and today, Ethereum scaling projects such as Polygon, Arbitrum, Optimism and more have billions of dollars of activity.

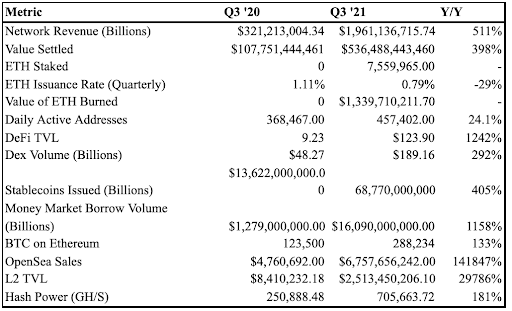

No one did a better job of highlighting the insane growth Ethereum saw than Ben Giove of Bankless. In his State of Ethereum Q3 Report, Ben highlighted that Ethereum’s network revenue grew 511%, value settled rose 398%, and Total Value Locked (TVL) in DeFi on the Ethereum network increased 1,242% from Q3 of last year.

Then, there was the EIP-1559 upgrade that launched on August 5th. This upgrade created a new mechanism that increases the scarcity of ETH by “burning” (aka destroying) a portion of transaction fees processed by the network. If the network is processing a large enough number of transactions per day, it is entirely possible for more Ether to be burned daily than minted through native issuance. Thanks to the growth previously described, over 1.2 million ETH have now been burned (an average of 9,200 per day) since the introduction of EIP-1559. Ethereum’s monetary policy changed dramatically in 2021, as ETH’s net annual inflation rate significantly decreased because of the new fee burn.

It’s no wonder why Ethereum came into 2021 at $730 and hit an all-time high in November of $4,800. If that price appreciation seems outlandish, how else would you value a company that had nearly $2 billion in revenue and was growing over 500% annually?

With great demand comes great scaling challenges, and Ethereum was pushed to its limits in 2021. There is a limit to the number of transactions the Ethereum blockchain can currently process and, as demand has grown, those blocks have routinely become full. Miners, being in the business of making a profit, tend to prioritize those transactions that are willing to pay higher fees. Thus, in order to get a transaction through on the Ethereum blockchain, gas fees rose substantially throughout the year.

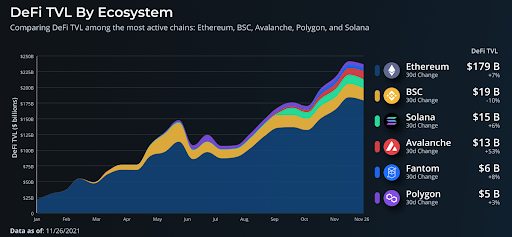

The high fees on Ethereum allowed for other base layer smart contract platforms to emerge by offering greater throughput, lower fees, and scooping up excess demand that Ethereum couldn’t handle. A wave of alternative Layer 1 platforms such as Solana, Binance Smart Chain, Avalanche, and Terra all hit new all-time highs while fostering competing ecosystems of NFTs and DeFi. Generally speaking, these newer entrants are all taking different angles towards solving the “scalability trilemma” which states that blockchains can only accomplish two out of three priorities between scalability, decentralization, and security. Whereas Ethereum is prioritizing decentralization and security, projects such as Solana are optimizing for speed and willing to sacrifice some level of decentralization to do so.

The aforementioned details bring us to the “Summer of SOL.” It is unclear whether any project in crypto’s history grew faster than Solana did in 2021. Solana started the year at $1.50 and hit a peak of $260 in November, rocketing it up to a top-five cryptoasset by market cap. The Solana chain is arguably the fastest layer one protocol in the market today, has an ecosystem of applications and developers that continues to expand at breakneck speed, is one of the most user-friendly wallets (Phantom) in the market today, and is quickly becoming a major platform in crypto gaming and NFTs. 2021 was the year Solana became the first legitimate challenger to Ethereum’s Layer 1 dominance.

Whereas Solana is less decentralized than Ethereum, Binance takes this to the extreme and is a fully centralized Layer 1 blockchain. The BNB token exploded onto the scene at the end of last year as its EVM (Ethereum Virtual Machine) compatible architecture made it easy to port over much of the same functionality that had already been built on Ethereum. With over 800 active projects, Binance Smart Chain now has one of the largest ecosystems. While Binance Smart Chain is not trustless by any measure, it’s affordable, faster, and offers sufficient scalability to meet demand. This makes experimenting with DeFi applications far more affordable for new users, as evidenced by the fact that 87% of BSC users are not “power users” and are still learning how to use DeFi protocols for the first time.

Ethereum still dominates all smart contract base layers with nearly $180 billion in value locked, which is over 76% of all TVL in DeFi. Other layer-1s are an order of magnitude smaller by the same metric, but that gap is rapidly closing as chains like Solana, Binance, Terra, and others accelerate the growth of capital on their respective networks.

Apeing into Bored Apes

Unless you have been living under an EtherRock, you’ve probably heard about NFTs by now. One of the core breakthroughs of blockchain technology is digital scarcity. Prior to blockchains, if anyone sent a picture to someone else over the internet, what they were really doing was sending a copy of that picture. Thus, the file then existed in two places. If that person forwarded that same picture to five other people, there would then be seven identical copies of that file in existence. However, with blockchain technology, Satoshi solved this “Double Spend” problem and, for the first time ever, created scarcity in a world of zero marginal costs. NFTs take this concept of digital scarcity to the logical extreme because they represent verifiably scarce, portable, and programmable pieces of digital property.

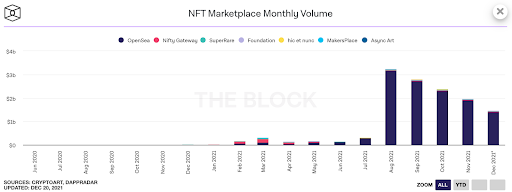

According to blockchain analysis service Chainalysis, NFTs sales grew to $26.9 billion in the first ten months of 2021. The vast majority of those sales occurred on Opensea, a marketplace for minting, buying, and selling of NFTs. Opensea’s volumes rose 141,847% year over year in Q3 to more than $6.75 billion, generating north of $162.7 million in revenue for the platform.

Along with explosive sales metrics, NFTs became a full-blown cultural phenomenon that mainstream celebrities and athletes started embracing. Earlier this year JayZ purchased a cryptopunk, put it as his profile pic on twitter and sold an NFT of his debut album at auction house Sotheby’s. NBA all-star Steph Curry purchased a Bored Ape and now uses it as his twitter profile picture. NFL all-pro Von Miller did the same. There is a growing list of actors (John Cleese, William Shatner, Mila Kunis, Ashton Kutcher, Jane Fonda), musicians (Snoop Dogg, Kings of Leon, Grimes, Steve Aoki, Eminem), athletes (Tony Hawk, Rob Gronkowski, Tom Brady) and more jumping into the NFT craze. The growth even compelled one of the world’s top talent agencies, UTA, to sign on to represent Larva Labs (creators of CryptoPunks) for film, TV, video games, and publishing projects. Universal Music Group announced that it is forming a virtual band called Kingship using four Bored Ape Yacht Club NFT avatars that are owned by a single collector named Jimmy McNelis. Even Visa bought a CryptoPunk for $150,000 saying that NFTs will play an “important role” in the future of retail, social media and entertainment.

The potential for NFTs is essentially unlimited as blockchains become global transaction ledgers for both virtual property and physical property. As Ryan Selkis explained in his annual report, “the real world version of an NFT might be something like the deed to my house. NFTs will also be the technical backbone that ports your real-world credentials and identifiers to the new world. You won’t need to enter your driver’s license every time you need to prove your identity – your digital signature will unlock access to the NFT of your license, or your health record, or your insurance, etc. We’re talking about a 1000x improvement in the portability of our identities, and the consistency and comparability of our credentials.”

However, as with most technologies, NFTs started with a simple use case in 2021. Profile pictures, otherwise known as PFPs, such as CryptoPunks and Bored Ape Yacht Club are simple jpeg images that range from thousands to millions of dollars per NFT. On the surface, buying jpeg images for this amount of money may seem irrational. However, writing off the PFP market as a fad would be completely dismissing the importance of social signaling. Displaying material possessions (and these NFTs are digital material possessions) to signal wealth and status in society is nothing new or uncommon.

Owning a CryptoPunk or a Bored Ape and displaying it as your profile picture on social media allows people to signal to others that they were either early or they are rich (or perhaps both). It signals to the outside world that they are part of a specific community or “in the know.” It’s the same reason people buy Rolex or Patek Philippe watches when a Cassio watch performs the same task for a fraction of the price. It’s the same reason people buy Lamborghinis and Maseratis when a Toyota Corolla can get you from point A to point B just as easily. It’s the same reason that kids who play Fortnite spend money on skins for their characters, even though the skin has no impact on in-game abilities. We use a countless number of items in our everyday lives to signal status or display to the world something about who we are. The only difference between doing that in the real-world vs. the digital world is scale. While physical possessions will only be viewed by a limited number of people, your digital possessions such as your twitter profile picture, may be viewed by millions.

Yes, most of the current NFT projects are ridiculously overpriced and in time only a handful of these NFT collections are likely to retain their value. Even if Lazy Lions or Pudgy Penguins are specifically fads, NFTs as a whole are not. Individual projects will come and go, some may even prove to have lasting value, but the technology enabling digital scarcity will continue to power ever more creative and interesting use cases. Regardless of whether you think this current avatar craze is exciting or ridiculous, there is no question that NFTs are here to stay.

Crypto’s growing political power

2021 will likely go down as the start of the crypto industry’s rise as a significant political force within the US. Fueled by a growing population of crypto users, the maturation of crypto companies becoming public entities, and the massive amount of wealth creation that has happened in the last few years, the crypto industry started to engage with Washington in a meaningful way this year.

In the first 3 quarters of 2021, the crypto industry spent 4x what it did in all of 2020 on lobbying efforts. In August of this year, the $1.2 trillion infrastructure bill that had been in the works for many years, suddenly ground to a halt because of concerns about its impact on the crypto industry. Although the push back ultimately wasn’t successful, the effort highlighted the 50+ million pro-crypto US citizens, on both sides of the aisle, who organized swiftly and were not afraid to call out bad DC policy. It’s clear that many politicians took notice and have since expressed a desire to learn more about digital assets.

This was evident at the hearing on December 8th in front of the House of Representatives Committee on Financial Services. The tone and line of questioning during that hearing were markedly different from previous hearings on crypto. Several members brought up the prospect of the U.S. losing out on crypto-related innovation because of cumbersome regulation, praised the potential for crypto to provide lower-cost alternatives to the existing banking system and suggested the industry would benefit from a more cohesive policy from the U.S. government. The hearing was by far the most positive, constructive, & bipartisan discussion the US government has ever publicly had on crypto. In fact, several members of the Committee declared they would be working on bills to streamline crypto regulation and support the industry.

The shift in tone is likely from the realization by politicians that there are more incentives to embrace crypto than be against it. As the industry has become an increasingly viable force in Washington, its role in political funding has been on the rise and no one has benefited more from this than Cynthia Lummis. The Senate’s most outspoken crypto advocate and first US Senator to publicly hold bitcoin, has had a significant portion of her campaign donations come from the crypto industry. Furthermore, expect future announcements about the crypto industry’s efforts to create pools of capital to back crypto-friendly politicians regardless of what political party they belong to. Politicians with a pro-crypto stance will likely find it easy to raise money for their campaigns in 2022.

Miami Mayor Francis Suarez has attracted national attention over the past year due to his embrace of the crypto industry. Buoyed by the support of crypto twitter, Suarez has been the subject of glowing magazine profiles rarely reserved for mayors. This rise has begun fueling speculation that the youthful Republican could be a future presidential candidate.

Every time a politician tweets something positive about crypto, it tends to go viral. The amount of money coming into crypto lobbying groups and into pro-crypto political campaigns is accelerating. Politicians are now issuing NFTs to raise money. Crypto companies are becoming increasingly involved in Washington. The number of consumers who use crypto and advocate for it is growing. Being pro-crypto is seemingly positive for one’s political career, and that is not going unnoticed by an increasing number of politicians.

At the end of the day, there are good reasons for both conservatives and liberals to embrace crypto. We fully expect to see politicians run for office with an explicit crypto mandate and have previously argued that we will even have a bitcoiner as president in the future. There are no signs of this trend slowing down as we head into 2022.

Speaking of 2022, don’t forget to register for our upcoming live presentation with Eric Ervin, CEO of Blockforce Capital and Co-founder of Onramp Invest, and Brett Munster, Portfolio Manager at Blockforce Capital and Director of Research at Onramp Invest. They’ll share their biggest takeaways from 2021 and what they are looking forward to in the cryptoasset space in 2022. Register by using this link.

Happy New Year!

With gratitude,

Your Onramp Family