Welcome back to The Node Ahead, a cryptoasset resource for financial advisors.

Welcome back to The Node Ahead, a cryptoasset resource for financial advisers. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we will review:

- Bitcoin Mining and Why Margins Are Getting Squeezed

- Regulatory Recap From the First Half of the Year

- In Other News

On Chain Analysis: Miners

In past newsletters, we have covered the 2021 Chinese mining ban and why many of the claims about bitcoin mining’s impact on the environment are false. However, we have never covered what mining is and the business model of bitcoin miners. To do that, let’s start with the basics.

Transactions that occur on the Bitcoin network are bundled together into “blocks.” Computers connected to the network (aka miners) use a cryptographic process to validate that all the transactions within the block followed the rules and that no fraudulent transactions were attempted. That cryptographic process of validating the transactions and confirming a block is called mining. These blocks are created in chronological order thus creating a chain of blocks. That is why it’s called a blockchain.

Because the cryptographic process requires a fair amount of computational power, miners incur real-world costs such as electricity, computing equipment, maintenance, etc… Thus, Satoshi, the creator of Bitcoin, needed a way to economically incentivize miners to invest the resources that go into mining. This is where bitcoin the asset comes into play. Every time a miner successfully “mines” a block, she is rewarded with a combination of newly issued bitcoin (otherwise known as a block subsidy) and a transaction fee. Together, block subsidies and transaction fees make up a miner’s revenue though today, about 98% of a miner’s revenue comes from the issuance of newly minted bitcoin. Only one miner is awarded the block subsidy and transaction fees per block, so miners compete to be the first to successfully solve the complex cryptographic process. Once a block is finalized and a new bitcoin is issued (which takes on average 10 minutes), the process starts all over again.

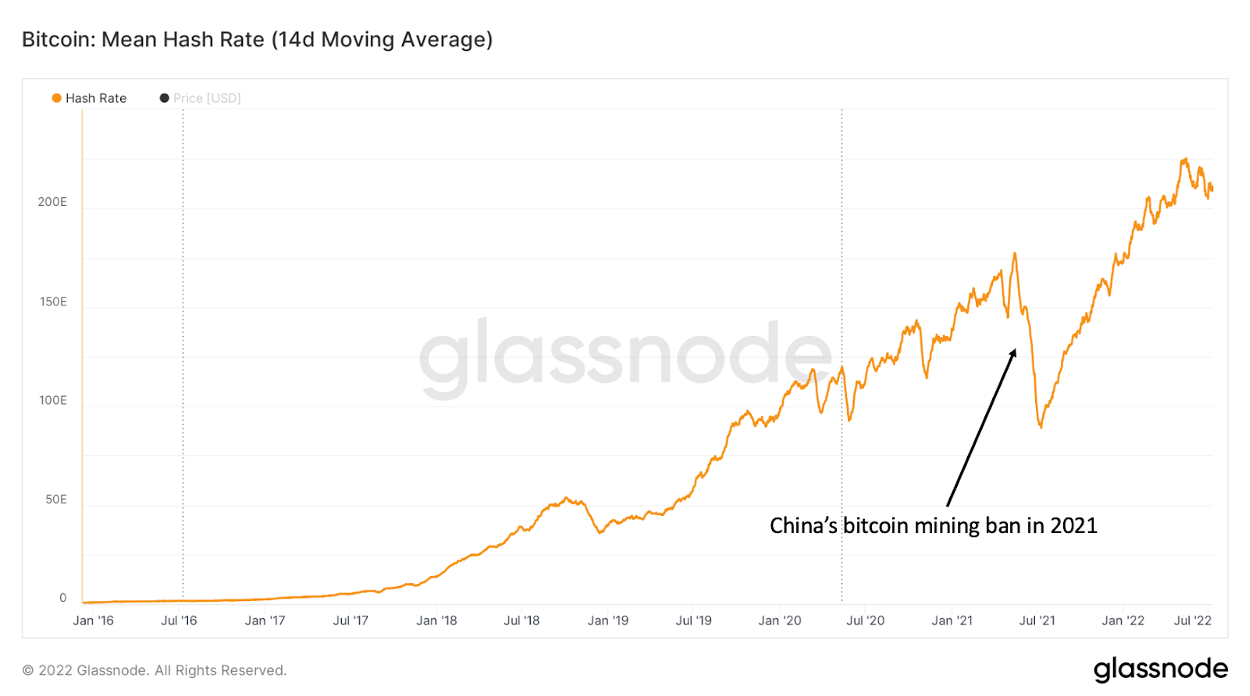

As bitcoin’s price goes up, mining becomes more profitable and attracts more miners. More miners mean more computational power on the network (otherwise known as hashrate). The larger the hashrate, the more secure the network is. Why? Because one of the few vulnerabilities blockchains have is what is known as a 51% attack. If any one entity controls a majority of the network, that entity would be able to dictate which transactions get verified and which don’t. The larger the hashrate, the more difficult and more expensive it is to accumulate at least 51% of the computing power on the network. Thus, hashrate is a good measure of the security of a blockchain.

When Bitcoin was first launched in 2009, it was very susceptible to a 51% attack because the network was small and nascent. Luckily, the project was able to grow in obscurity for several years with the only people contributing to it being those who wanted to see it succeed. Over time the network grew to the largest computing network on the planet, with more power on the network than Google, Facebook and Amazon combined. By 2018, Bitcoin’s processing power was 6-8x larger than the top 500 supercomputers combined. Thus, the network has grown so large that at this point a 51% attack is not practically possible. This is also the reason it is likely impossible to recreate bitcoin.

Because of the incentive structure, the hash rate has mostly grown over time. But just because computing power on the network has grown, doesn’t mean bitcoin’s supply issuance has changed. When the price rises for real-world commodities such as copper, silver, or gold, mining these materials becomes more profitable and mining operations increase their production. As a result, supply increases for real-world commodities until there is enough supply to meet demand and we reach a price equilibrium in the market. However, bitcoin is designed differently.

As more computing power comes onto the network, the Bitcoin blockchain increases the mining difficulty on the network. Mining difficulty refers to the complexity of the cryptographic process behind mining. In other words, the Bitcoin blockchain adjusts the amount of computational power needed to mine a new block. As computational power increases or decreases, so does the mining difficulty so that on average, a new block is mined every ten minutes. This is what keeps bitcoin’s supply issuance consistent regardless of how many resources are invested into mining operations.

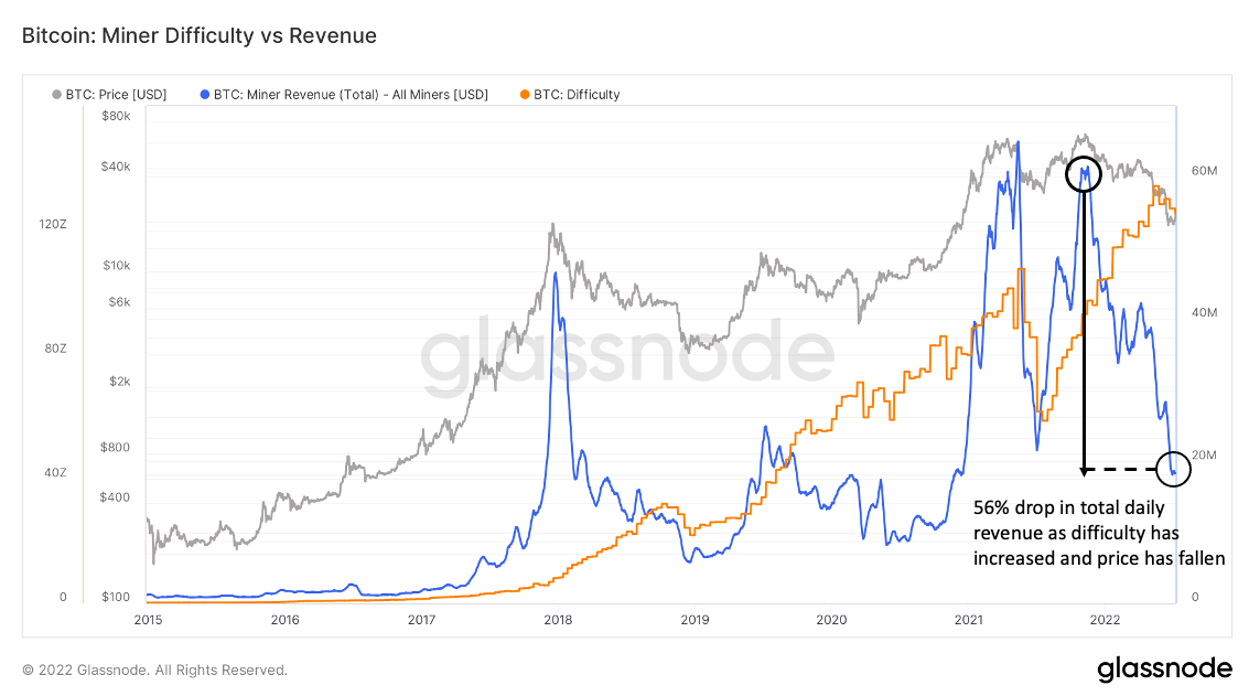

The difficulty has a direct impact on miner profitability because the odds of earning a block subsidy decrease as mining difficulty increases. As we can see in the chart below, difficulty tends to follow price movements because when the price increases, bitcoin mining becomes more attractive, and more investment goes into it. Thus, it is no surprise that difficulty has increased substantially since July of last year. However, difficulty tends to be a lagging indicator, and given the price drops since the start of the year, we are just now seeing difficulty begin to decrease as lower prices have decreased profitability for miners. We also notice in the chart below that mining revenue peaks at corresponding peaks in bitcoin’s price. In fact, daily revenue from mining has fallen roughly 56% since bitcoin hit its all-time high in November.

Another way to show this is by looking at a metric called hashprice. Hashprice is simply the amount of revenue in dollars a miner earns on average per mined block over time. When the price of bitcoin is increasing faster than hashrate, a miner’s margins increase. But when the price is steady and hashrate increases or even more extreme, when bitcoin’s price drops and hashrate continues to increase, margins really get squeezed. That is exactly what has happened over the last couple of months and as a result, hashprice is around $0.08 per Terrahash, the lowest it’s been since October 2020.

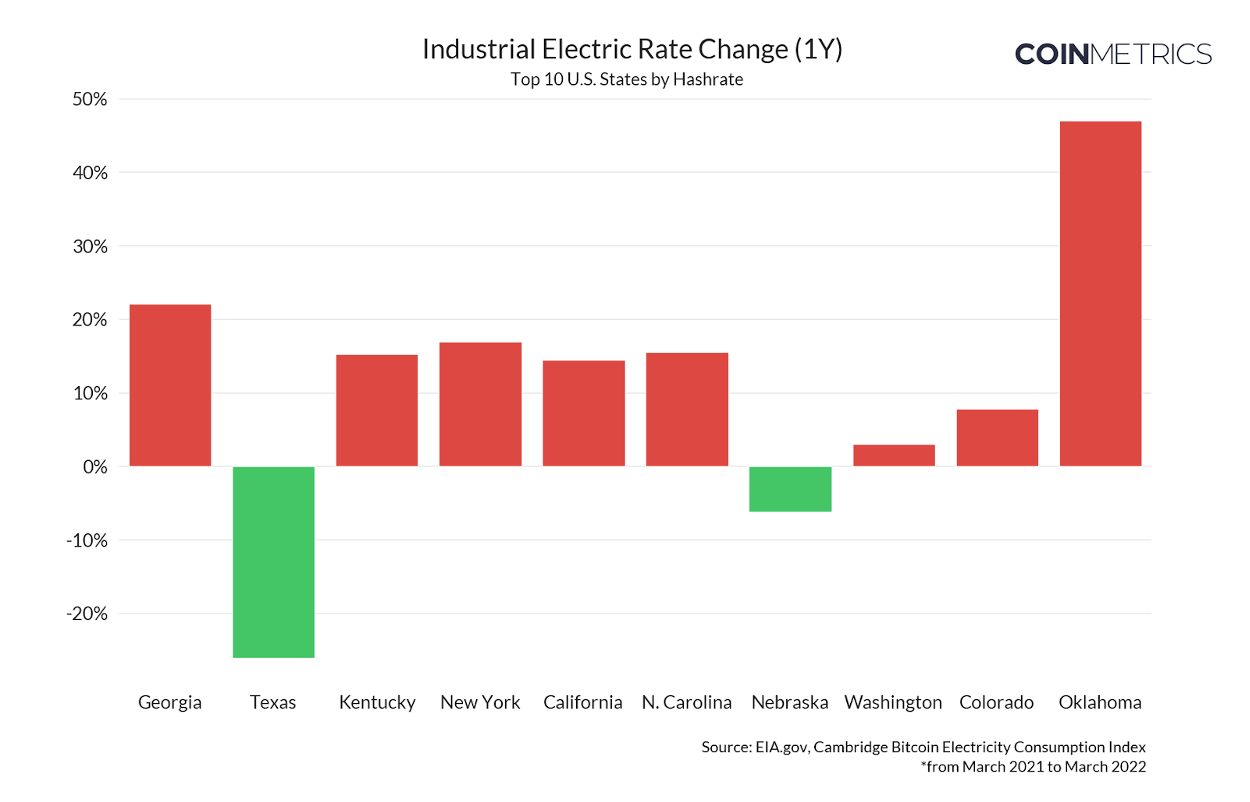

That’s what is currently happening on the revenue side for miners, but what about the cost side of their businesses? A miner’s single greatest operating expense is the cost of electricity. The chart below shows the change in the average industrial electric prices from March 2021 to March 2022 for the ten states with the most hashrate in the US. Industrial rates in some states such as Georgia and Oklahoma have increased by more than 20% year over year. This is exactly why miners are incentivized to go wherever energy is the cheapest which typically means locations with excess capacity or using renewable energy sources.

Source: CoinMetrics State of the Network: Issue 161

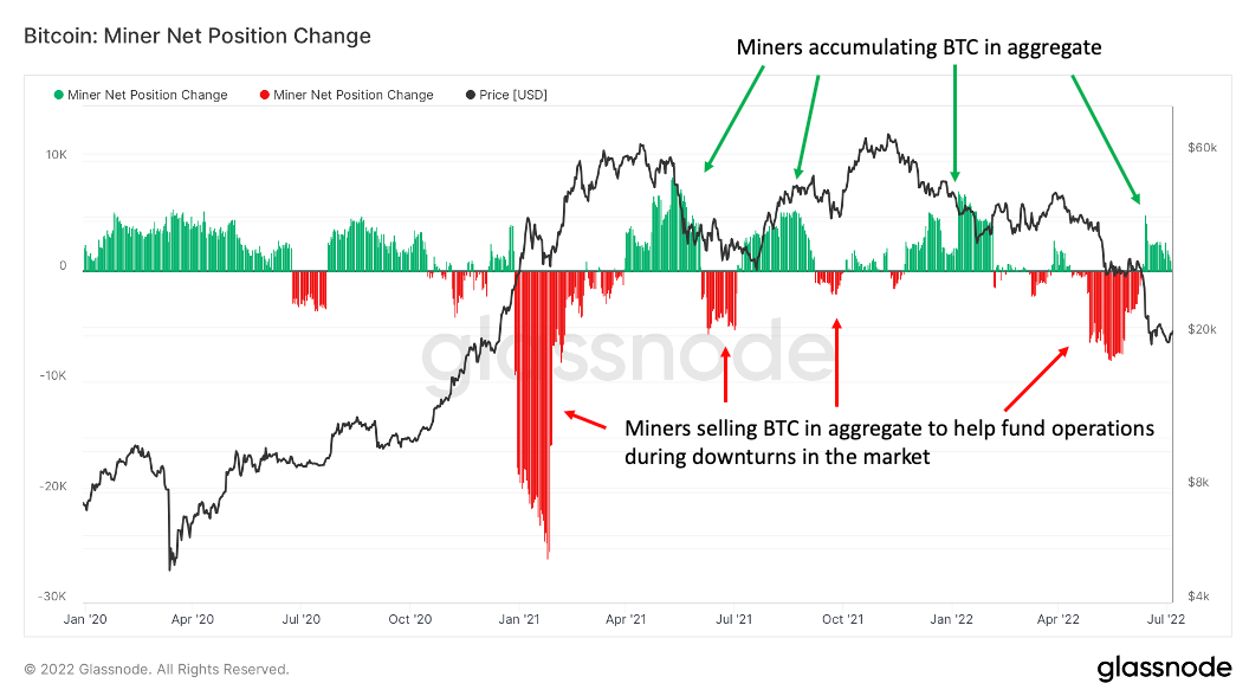

Lower bitcoin prices, higher mining difficulty, and higher energy costs have put serious pressure on operating margins for miners. From April through June, this margin compression forced many miners to start selling bitcoin they previously mined in order to fund operations. However, over the last few weeks, we have seen a reversal in this trend as miners are now accumulating bitcoin on a net basis indicating perhaps much of the capitulation is behind us.

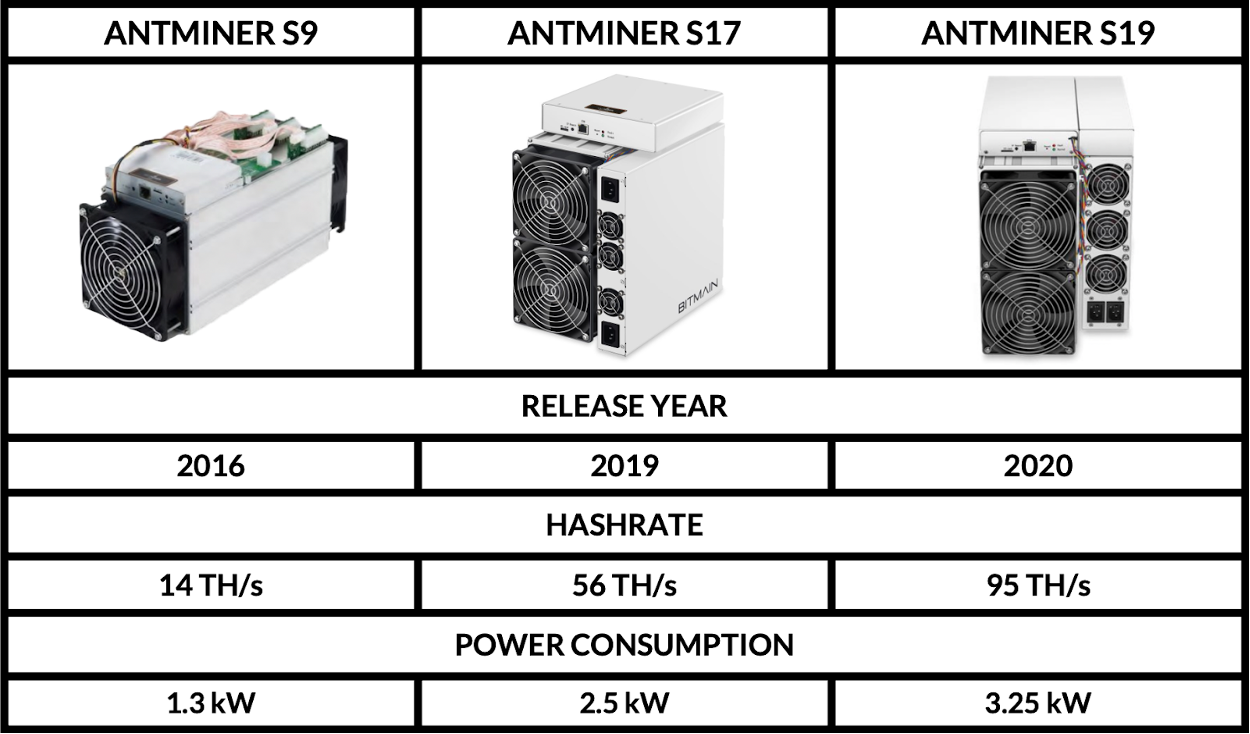

Another important cost consideration for miner competitiveness is their selection of appropriate hardware. When bitcoin first launched and the network was small, it was possible to successfully mine bitcoin using standard computers. However, as the industry has evolved, a specialized class of computers called ASICs (Application Specific Integrated Circuits) have been developed with the sole purpose of mining BTC. Even in the last couple of years, the efficiency of new ASIC models has improved. Whereas the S9 was the most popular bitcoin mining machine in 2016, it has largely become obsolete due to newer models that have been released.

Source: Bitmain

Miners are some of the most bullish, long-term-oriented participants in the crypto market given that they have invested tens of millions of dollars into mining hardware, logistical setups, and power consumption. Mining is also a very cyclical business with profitability tied directly to the movements of bitcoin’s price. Thus, in good times, miners tend to hold the bitcoin they receive through mining but in times of stress, miners are often forced to sell some or all of their block subsidies. Because of this, miners tend to sell more during bear markets thus increasing the downward pressure on price. In past newsletters, we have shown that long-term holders have been buying coins but if you were wondering who has been selling during this period, part of the answer is bitcoin miners which historically tends to correspond to market bottoms.

It is likely that some miners will not be able to survive this downturn because their cost structure is too high. Only the most efficient miners will survive this period but the ones that do will be in a great position to profit when bitcoin turns back to the upside because there will be less competition.

As always, the on-chain data is provided by Glassnode. If you would like to have access to the data yourself, you can sign up here:

First Half Regulatory Recap

One of the most common questions we get asked when talking to investors about the crypto industry is regulation. Given all that has happened in the first half of this year, we thought now might be a good time to recap the regulatory landscape and discuss what to expect in the second half of 2022.

Let’s start with the fact that despite the regulatory uncertainty, fears of a crackdown, and historically bad market conditions, there were no major regulations passed in the first half of 2022. There were, however, a few major developments that were largely positive for the crypto industry.

In March, President Biden signed an executive order directing various federal agencies to study the state of the crypto industry with the goal of working towards the first unified federal strategy around digital assets. We covered the details in a previous newsletter but to quickly recap, the executive order assigned various agencies the task of writing reports analyzing crypto’s benefits & risks for six key priorities identified by the administration. Those reports are due in the second half of 2022 and given the midterm elections that will be taking place later this year, there likely won’t be any action taken on those reports until 2023. The president appears to be taking a very measured, thoughtful approach to creating regulation regarding the crypto industry and the executive order was widely considered a positive step.

Even more encouraging was the Responsible Financial Innovation Act drafted by Republican Cynthia Lummis and Democrat Kirsten Gillibrand. We have covered the progress of this bill several times in this newsletter dating back to January of this year and for good reason. This bill is by far the most comprehensive and collaborative crypto legislation proposed to date. It includes proposals for stablecoin requirements, legal and tax framework for DAOs, reporting requirements for early-stage token projects, and tax guidelines including making staking revenue non-taxable until sold and allowing for $200 purchases tax-free with the uses of cryptocurrency. However, the most notable provision of the bill outlines which digital assets would fall under the jurisdiction of the Commodity Futures Trading Commission (CFTC) vs the Securities and Exchange Commission (SEC). The new legislation provides a framework for classifying cryptoassets as either securities or commodities, with bitcoin, ether, and many other cryptoassets falling under the definition of “ancillary assets” overseen by the CFTC. If passed, the Responsible Financial Innovation Act would be the first federal regulatory framework for digital assets and provide some much-needed legal clarity and regulatory certainty for the industry.

Similar to the executive order, it’s unlikely this bill will get passed this year simply due to the midterm elections. However, expect this bill to gain much more momentum in 2023 and be the starting point of almost every piece of crypto regulation going forward.

Finally, the first half of 2022 saw a continuation of crypto becoming a growing political force that started last year. While the increased lobbying efforts of the crypto industry are an encouraging development, the bottom-up acceptance of crypto from politicians is what has been really exciting to watch thus far in 2022. We have seen Cynthia Lummis from Wyoming, Francis Suarez from Florida and Gregg Abbot from Texas lead from the front in terms of passing crypto-friendly state regulations. But we have also seen politicians from California, Arizona, Mississippi, Michigan, Colorado, Ohio, Washington, and many more states embrace the crypto industry.

Why does it seem like every week, another politician chooses to go public about their support for the crypto industry? The simple fact is that there are now more incentives for politicians to be pro-crypto than against it. States that have embraced the industry are proving that being pro-crypto is good for the local economy. Crypto-friendly politicians have been able to raise money from previously untapped pools of capital. Politicians that have been publicly in favor of the industry have gone viral and risen in national prominence. And finally, as many as 50 million US citizens already own cryptoassets and that number is growing. Not only are their constituents increasingly adopting cryptoassets, but politicians are also quickly realizing being pro-crypto is good for the local economy, good for fundraising, and good for advancing their careers. The first half of 2022 saw an increasing number of politicians, especially challengers to standing incumbents, reaching out to establish support from the crypto industry.

The most negative news out of Washington during the first half of the year was the SEC’s continual denial of a spot-based ETF. Back in October of last year, we covered why a futures-based ETF was an inferior product to a spot-based one and the SEC’s inconsistent rationale for its decision (hint: it sure wasn’t for investor protection). Since then, the SEC has continued to reject numerous spot-based ETF proposals despite the fact that more than 70 crypto ETFs and ETPs in Canada and Europe have worked without manipulation or any other problems the SEC claims it is worried about. Yet the SEC did approve an ETF that allows you to short bitcoin. Yup, they have now approved ETFs that are far more costly for investors (futures-based) and far riskier (bitcoin shorting) than an ETF that simply holds bitcoin.

If you think this is ridiculous, you are not the only one. The SEC’s own commissioner Hester Pierce has publicly criticized Gary Gensler for his actions. Numerous members of Congress have publicly called out the SEC on the matter as well as brought the subject up in congressional hearings. Grayscale, which had its ETF application denied last month, is now suing the SEC arguing that the SEC has to allow products that are like other products already trading. More than a dozen staff attorneys have already quit under Gensler, an unprecedented amount of turnover for the regulating body, due to him pushing the commission into new areas of enforcement such as crypto regulation. And if that wasn’t enough, the recent EPA decision by the Supreme Court likely means it won’t take kindly to regulatory agencies like the SEC attempting to increase their own jurisdictional control beyond what Congress clearly intended. Despite the pressure, Gary Gensler seems intent on preventing a spot-based ETF and hiring more staff members to prosecute various crypto projects.

So, what does the rest of 2022 hold in store? In truth, likely not too much from a legislative perspective. As campaign season picks up, Congress is mostly done for the year with everyone’s focus turning to the election. The promising legislative proposals such as the Lummis-Gillibrand bill will be a hot topic of discussion in 2023 but until then, it’s likely nothing will pass. The good news is that across almost all government agencies, almost everyone seems to be in favor of a measured, productive national strategy that the president set forth in the EO. That is except for the SEC.

As Jake Chervinsky, Head of Policy at The Blockchain Association pointed out, the SEC will “need to prove the cost of doubling the size of its Crypto Assets & Cyber Unit is worthwhile to (rightly skeptical) appropriators. It’s also typical for the SEC & other agencies to bring a flurry of enforcement actions right before fiscal year-end to shore up their performance reports & budget requests.” Thus, don’t be surprised to see new enforcement actions filed by the SEC in the next few months.

But even if the SEC does take action before the end of the year, keep in mind it won’t be against bitcoin or Ethereum. Even Gensler recently reaffirmed BTC is a commodity and despite their hostility to the industry as a whole, it’s clear that the SEC is not going after bitcoin or Ethereum. Expect the focus to be on stablecoins, exchanges, or centralized lenders.

The crypto industry has a growing number of political supporters on both sides of the aisle. Regardless of how the November elections play out, there is good reason to be more optimistic than ever about the regulatory landscape.

In Other News

How bitcoin mining can help reduce climate change.

The 2nd largest electric power company in the U.S., Duke Energy, is studying the benefits of bitcoin mining and how to integrate it into the grid.

Bank for International Settlements to allow banks to keep 1% of reserves in bitcoin.

Mexican senator proposes a bill to make bitcoin legal tender.

Grayscale sues SEC over bitcoin ETF application rejection.

WSJ article on how Gary Gensler is blocking innovation at the expense of investors.

FTX is looking to acquire Blockfi at a 99% discount to the last valuation.

Three Arrows Capital files for Chapter 15 bankruptcy in New York.

Crypto lender Voyager Digital files for Chapter 11 bankruptcy.

FTX strikes a deal with an option to buy crypto lender BlockFi.

Despite the crypto ban, China’s tech talent rides the global web3 wave.

Bank of England calls for an enhanced crypto regulatory framework.

Trio of JP Morgan executives leave for crypto jobs as traditional financial companies continue losing talent.

The European Union pushes for mass surveillance of bitcoin and crypto transactions.