Welcome back to The Node Ahead, a cryptoasset resource for financial advisors.

Welcome back to The Node Ahead, a cryptoasset resource for financial advisors. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we will review:

- On-Chain Analysis

- Fidelity, Goldman and Morgan Stanley Are Bullish on Bitcoin

- The Truth Behind Bitcoin’s Environmental Impact

- In Other News

On-Chain Analysis

The past two weeks saw some of the least volatile price action within the crypto markets for quite some time as bitcoin hovered right around the $40,000 mark. Historically speaking, behavior such as this tends to indicate a consolidation phase, which is something we have been highlighting for the past several newsletters. We examine how strong this accumulation has been in recent months below.

In our March 22 edition of the Node Ahead, we highlighted the fact that the percentage of total outstanding supply that hasn’t moved in over a year was approaching all-time highs and predicted at the time that we would break the previous record. Sure enough, last week set a new all-time high of coins on the market that have been dormant for at least 365 days.

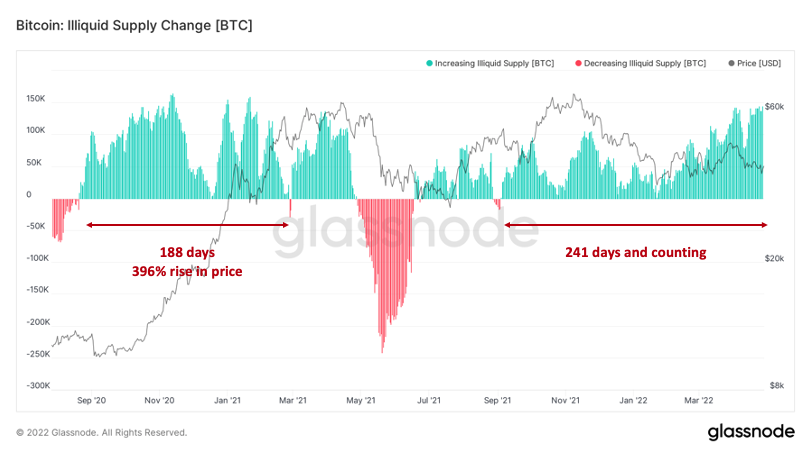

Another metric we can look at is the illiquid supply change. This measures the 30-day net change of supply held by illiquid entities. Green bars indicate more coins flowing to entities that historically very rarely sell their bitcoin, while red indicates coins flowing out of these addresses. As of this newsletter, we have had 241 consecutive days of coins flowing to illiquid entities in aggregate. The last time this occurred for more than 100 consecutive days was the end of 2020, during which the price rose 396% from the start of that streak to the peak in April 2021.

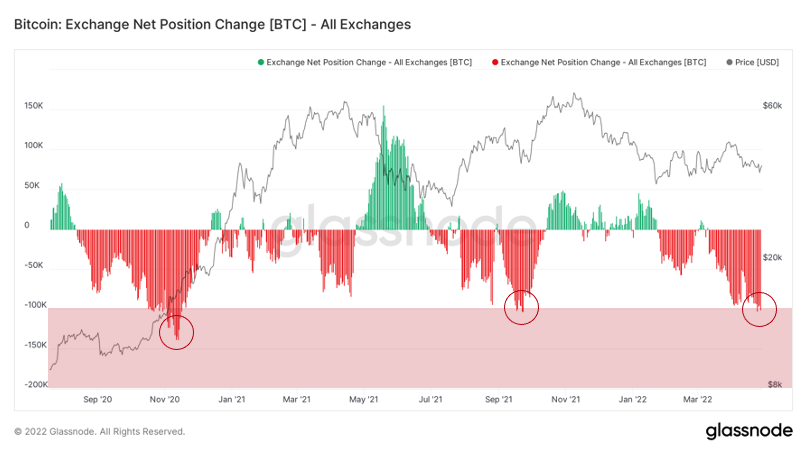

The flip side of this same argument is to look at the net position change on exchanges. Coins flowing onto exchanges (green bars in the chart below), is a strong sell signal from the market. However, in periods of strong accumulation, coins are taken off exchanges (red bars) and held in cold storage. This reduces the available supply of bitcoin to be traded on the market. Since 2018, we have only hit the 100,000 mark of supply leaving exchange wallets three times. The first two occurrences preceded large upward price movements. The third time that this happened was last week.

Fidelity, Goldman and Morgan Stanley Are Bullish On Bitcoin

Fidelity announced that it will be the first major retirement plan administrator to allow investors to put bitcoin in their 401k plans. According to a New York Times report, the new product is expected to go live this summer and will allow all 23,000 companies that use Fidelity to add bitcoin as an option in their retirement packages. This is a big deal because not only is Fidelity America’s largest provider of 401(k) savings accounts, but a recent survey revealed that 28% of millennials believe bitcoin and other cryptoassets will fund their retirement. In fact, according to the survey, millennials are more likely to rely on cryptoassets than traditional savings accounts to fund their retirement. Given global investors made $162.7 billion on crypto last year, up from $32.5 billion the year before, it’s easy to understand why. For better or worse, younger generations aren’t as interested in holding gold, bonds, or cash as they have been in the past. Don’t expect Fidelity to be the last retirement platform to add cryptoassets to their menu.

Back in August 2021, our Research Director Brett Munster wrote about what the Lightning Network is, highlighted its growth, and how it is likely the key to bitcoin becoming a viable medium of exchange. It would seem that Morgan Stanley now agrees with him. The banking giant recently published a research paper claiming that bitcoin has reached an important milestone and could become more widely used as currency. According to Morgan Stanley, Strike (a fintech payment processor built on top of the Bitcoin Lightning Network) integrating with BlackHawk Network (the largest payment processor in the world) drastically increases the chances of bitcoin becoming a medium of exchange. The banking giant further explained that sending small payments is more practical with Lightning than with debit or credit cards as the Bitcoin second-layer network can route transactions while charging almost no fees.

Finally, Goldman Sachs issued its first bitcoin backed loan last week. Over the past few years, new companies such as Ledn, Unchained Capital and others have pioneered bitcoin backed loans by enabling consumers to borrow dollars by putting up their BTC as collateral. With a bitcoin-backed loan, a bitcoin holder can buy a house or pay medical bills without needing to sell her bitcoin. Not only does the borrower keep her bitcoin holdings (assuming she pays off the loan when it matures) but she also doesn’t have to worry about the tax implications of selling the asset. However, Goldman Sachs’ entrance into the bitcoin-backed loan business represents a watershed moment in terms of liquidity, legitimacy, and options available for consumers.

Why this matters for RIAs and their advisors – The largest financial institutions are moving into the crypto and providing an increasing number of consumer products. Over time more and more clients will have crypto in the 401ks, loans collateralized with crypto, and may be purchasing goods and services using crypto.

The Dominoes Keep Falling

Countries, cities and governments continue to adopt crypto to varying degrees. Below is a list of recent developments that happened in April alone:

- The Central African Republic passes a new law that allows the use of crypto as a form of payment for businesses.

- Bitcoin is now legal tender in a special economic zone of Honduras.

- Argentina’s adoption of crypto is increasing and it’s not because of price speculation.

- The Russian Federal Tax Authority is making amends to their digital asset bill that will allow Russian authorities to transact foreign trade in bitcoin. Given Russia is the third largest oil producer, this could be a big step in bitcoin adoption worldwide as other countries will have to consider using bitcoin when transacting with Russia.

- The Panama legislature passes a bill permitting the use of crypto.

- Cuba approves cryptocurrency services.

- Buenos Aires is allowing residents to pay taxes in crypto.

- Bahamas will allow its citizens to pay taxes in crypto.

- The Central Bank of Portugal grants the country’s first crypto license to a bank.

- Australia becomes the 8th country to approve a spot bitcoin ETF.

- Fort Worth, Texas becomes the first city government in the U.S. to mine bitcoin.

- The state of Tennessee is preparing to hold cryptoassets in its treasury.

- Virginia passed a new law that allows state chartered banks to custody crypto

Unpacking Bitcoin’s Environmental Impact

Last year a coalition of miners from around the world came together to help shed some light on the composition of energy used for bitcoin mining. Known as The Bitcoin Mining Council, this voluntary coalition of bitcoin miners contributes data about their mining practices to provide greater transparency and education. Last week this council released its most recent report on the bitcoin mining industry and we are willing to bet the data would surprise most people.

Collecting data from half of the global bitcoin network, The Bitcoin Mining Council found that 64.6% of the energy used by the network is generated from a sustainable power mix. By comparison, the US electrical grid runs on 31.4% sustainable energy. Not only is the sustainable energy mix of bitcoin mining more than double the current US grid, the use of clean and renewable energy in bitcoin mining grew 59% year over year and is likely to continue growing in the future. In addition, the efficiency of the network increased by 63%, once again reaffirming that as the network grows, it will become more efficient over time.

The bottom line is that the data continues to disprove the narrative that bitcoin mining is bad for the environment. In fact, crypto mining is likely our best chance at increasing the adoption of green and sustainable energy. So, we figured now is as good a time as any to dive into the facts about energy use as it pertains to bitcoin mining.

Not All Energy is Created Equal

Not all methods of power generation have the same impact on the environment. A common mistake many people make is to assume that all of Bitcoin’s energy consumption has equivalent CO2 emissions without considering the source of the electricity. For example, one unit of hydro energy will have much less environmental impact than the same unit of coal-powered energy.

As we alluded to earlier, the most recent data suggests that roughly 65% of the network utilizes sustainable energy sources. In fact, hydroelectric energy is the most commonly used energy source globally for bitcoin mining.

The real secret to bitcoin mining is that it’s best suited to take advantage of excess energy that would otherwise go to waste. As it turns out, there is a tremendous amount of excess energy available throughout the world. One reason energy is overabundant in certain areas is because electricity does not travel efficiently over long distances. In fact, over 8% of the world’s electric power is lost in transmission. To put that in context, the amount of electricity lost in transmission and distribution is 19.4x more than the annual power consumption of the entire Bitcoin network. Because they are just computers, bitcoin miners have this neat little feature where they do not care where they are located. Thus, bitcoin mining operations can be set up wherever there is abundant energy such as volcanos in El Salvador which run bitcoin miners using 100% clean thermal energy. Even better, because bitcoin miners can be turned on or off at a moment’s notice, bitcoin miners represent “interruptible load,” which means that when energy is in short supply, bitcoin miners can turn themselves off and allow power to flow to the households that need it most. As a result, bitcoin mining can actually be an asset in helping to smooth out global energy markets.

In addition, a growing trend is to leverage excess natural gas from oil fields to power bitcoin mining operations. In addition to gathering natural gas, these rigs also release methane gas which is about 25x worse for the environment than CO2. Methane is typically a waste product with no economic value for the operator, so they simply set the methane on fire (which is called flaring) and release CO2 instead (which is better than Methane but still not great). Even more problematic is the fact that flaring doesn’t always burn it all off (especially on windy days) so methane still leaks into the atmosphere. Rather than venting or flaring the excess gas, the oil field operators are now funneling that Methane and using it to generate electricity to power bitcoin mining servers. By incorporating bitcoin mining into their operations, they can eliminate the risk of methane and CO2 making it into the atmosphere thereby reducing the emissions. Not only are they putting to use gas that would otherwise go to waste, it’s actually a net positive for the environment and more environmentally ethical for oil companies.

In other words, bitcoin mining converts excess energy to value in the form of a cryptoasset and allows that value to be moved throughout the world. This is energy that would be generated (and wasted) whether or not bitcoin mining existed. Thus, any bitcoin miner that is utilizing excess capacity isn’t having any additional impact on the environment.

Energy Consumption is Relative

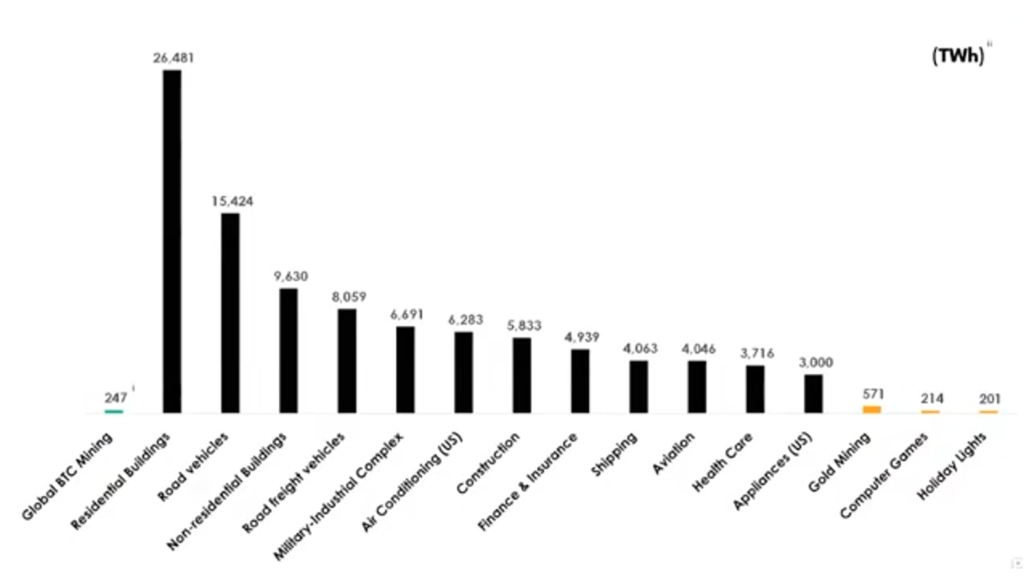

Depending on the report you read (here or here), the Bitcoin network uses roughly 110 – 150 terawatts hours (TWh) per year. On the surface that sounds like a lot of energy but in a relative sense, it’s actually far less than you might expect.

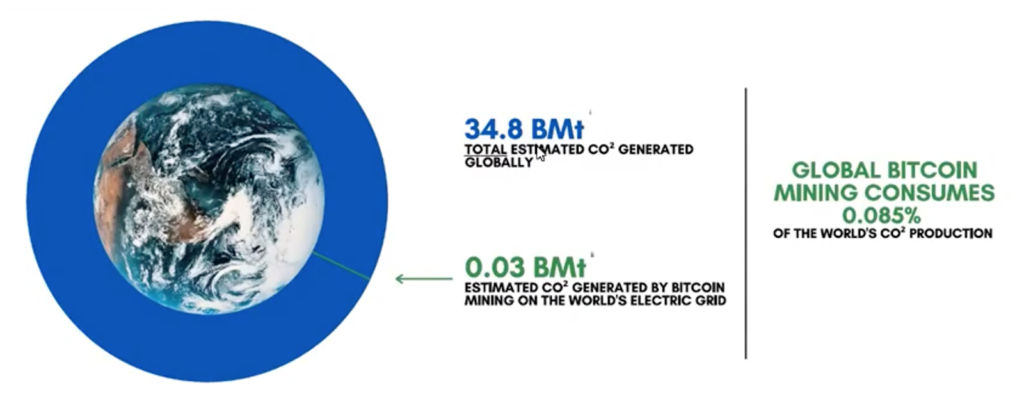

The truth is that bitcoin mining accounts for less than 0.2% of global energy usage and only 0.09% of the world’s CO2 emissions.

Since bitcoin is most often compared to gold, let’s compare their energy usage. A recent study from Galaxy Digital estimates that mining gold consumes 240 TWh per year. A different study using a different methodology estimated that gold mining accounts for 132 TWh per year. Thus, mining gold takes somewhere between the same amount of energy as Bitcoin to as much as twice the amount of energy and that’s not taking into account the energy consumed to transport gold once it’s mined.

However, where bitcoin is digital and therefore its environmental impact stops at its energy consumption, mining gold has additional negative impacts on the environment. In addition to the energy used to mine gold, modern industrial gold mining destroys landscapes and creates huge quantities of toxic waste. Simply replacing gold for bitcoin would be a net positive for the environment.

Let’s do another comparison, this time to the legacy financial system. That same Galaxy Digital report estimates that the banking industry, which consists of banking data centers, bank branches, ATMs, and card networks, uses approximately 263 TWh of energy each year. That’s roughly double the amount of energy the Bitcoin network consumes.

Turns out we can find numerous use cases that consume more electricity on an annual basis than Bitcoin. The global consumption of YouTube videos accounts for 243 TWh per year. The amount of electricity consumed every year by always-on but inactive home devices in the USA is nearly 214 TWh per year. Clothes dryers in the US use roughly 93 TWh per year and that’s not even accounting for the rest of the world.

It’s pretty disingenuous to criticize Bitcoin’s energy consumption without applying the same level of criticism towards the energy consumption of other systems. When compared side by side, Bitcoin’s total energy consumption doesn’t look nearly as harmful as the legacy financial infrastructure. Bitcoin is easier to measure and much more transparent about its energy consumption, which makes it easy for critics and journalists to attack.

Computing Power Doesn’t Scale Linearly With Increasing Transactions

There have been a number of articles written that spell doom and gloom based on Bitcoin’s projected environmental impact. While these articles make for catchy headlines, they tend to misrepresent what drives the increase in computing power on the network.

For example, a common critique is to take Bitcoin’s current energy use and extrapolate the CO2 emissions should it reach the size of Visa or Mastercard’s payment network. The argument uses the following line of logic. Measure the amount of energy consumed by the Bitcoin network today and divide by the number of transactions Bitcoin settles per day to arrive at a “per transaction energy cost.” Next, extrapolate that figure to account for all of the world’s daily transactions on the Visa or Mastercard network. When you do this, the result is an eye-popping amount of electricity consumption.

However, there is a giant flaw to this line of reasoning – energy consumption is not based on individual transactions.

Let’s start with the simple fact that Bitcoin’s base layer isn’t capable, nor ever will be capable, of handling anywhere close to that many transactions. Bitcoin is much more suited to become a final settlement layer akin to SWIFT or ACH, not Visa and Mastercard. Should bitcoin ever become a medium of exchange, it will have to leverage solutions built on top of the Bitcoin blockchain. These layer 2 and layer 3 networks would have to be, by necessity, far more energy efficient than Bitcoin’s base layer blockchain to process that volume of transactions. Thus, the extrapolation of Bitcoin’s per transaction cost isn’t applicable because the payment layer, where the vast majority of transactions will likely occur in the future, would use a fraction of the energy as Bitcoin’s base layer.

The second reason metrics like the “per transaction energy cost” are misleading is because transactions themselves do not cost energy, nor does Bitcoin’s CO2 footprint scale with transaction count.

To be clear, validating a transaction on the network costs virtually no energy. What takes energy is the computational power to “mine” blocks and blocks are a collection of transactions. Regardless of whether a block has very few transactions in it or is full of transactions, the power intensity required to mine that block is the same at that moment in time. Thus, in theory, the number of transactions validated could increase or decrease without the computing power of the network ever changing.

So, why does the computing power of the network keep increasing? Well, because when the price of bitcoin goes up it makes mining more profitable. As mining gets more profitable, more participants enter the market and the computational power (and security) of the network increases. Eventually, an equilibrium is found in which only the miners with the most cost-effective power sources (most often the miners with unused energies or renewable energies) are left. Bitcoin’s price and the availability of cheap power drive the amount of computational power on the network, not the number of transactions.

If that’s the case, wouldn’t Bitcoin’s computational power just increase forever as long as BTC’s price continues to appreciate? Not quite. Today, the vast majority of revenue earned by miners (greater than 80%) comes from the bitcoin they are rewarded for supplying computational power to the network. However, bitcoin’s supply issuance gets cut in half every four years thus naturally decreasing the amount of mining revenue.

“…the issuance component of miner revenue is structurally decaying over time. Unless you believe that the price of bitcoin is going to literally double in real terms every four years until 2140, that expenditure (and hence energy usage) is going to decline.” – Nic Carter, Coindesk Article

Thus, over time, transaction fees will have to grow to account for a much larger portion of miner revenue. Keep in mind that as of writing this, we’ve already mined over 19 million of the 21 million bitcoin that will ever exist. As miners become more reliant on fees over time, there will be a limit to how much they are willing to invest in new computing power as there is a limit to how much in fees users will be willing to pay. If fees become too high, users will look to other blockchains or solutions built on top of those blockchains. Thus, there is a natural limit to how much power will ultimately be consumed by the Bitcoin network.

Unfortunately, this misunderstanding of how blockchain technology works has led publications such as this often cited paper to claiming Bitcoin could increase global warming by 2 degrees despite the fact that no less than three separate academic articles have debunked this paper.

There is historical precedent for predictions like these to miss the mark. During the height of the dot-com boom in 1999, a Forbes article was published that claimed that it was “reasonable to project that half of the electric grid will be powering the digital-Internet economy within the next decade.” The piece accused the internet and hardware companies of “burning up an awful lot of fossil fuels” and setting the world on a dangerous trajectory of energy usage. Sound familiar?

Turns out those projections too were based on inaccurate assumptions and a misunderstanding of how technology works. It’s no surprise that a decade later these projections proved to be off by orders of magnitude. Don’t get me wrong, the Bitcoin Blockchain will still be by far the largest computing network on the planet and will require a lot of computational power, but it will not consume anywhere close to the amount of energy as some journalists have reported it will.

BTC May Be a Driver of Renewable Energy

The dominant narrative today is that due to Bitcoin’s level of energy consumption, it’s bad for the environment. However, as we have hopefully shown, that’s not exactly true. In fact, in time we believe the sentiment will shift as crypto mining proves to be a driving force in the energy transition from fossil fuels to clean energy.

The fact of the matter is bitcoin miners are constantly seeking the lowest marginal cost of electricity because the bitcoin mining industry is highly competitive. The cost of electricity is the single largest input in the business model thus to attain the highest profitability, bitcoin miners are constantly searching for cheap power. That usually results in the miners consuming unused and renewable power, which is historically the lowest cost power available. Flared gas in North Dakota and Texas is used to power bitcoin mining rigs, helping to reduce methane emissions. Adding bitcoin mining to natural gas and renewable energy operations makes them more profitable thus making the transition away from fossil fuels easier and faster.

Bitcoin is actually driving innovation in renewable and surplus energy as miners look to hydroelectric, geo-thermal , and excess natural gas. A recent whitepaper put forth by Square and ARK Invest argues that bitcoin mining presents an opportunity to accelerate the global energy transition to renewables by serving as a complementary technology for clean energy production and storage. “Solar and wind are now the least expensive energy sources in the world but are hitting deployment bottlenecks primarily because of their intermittent power supply and grid congestion. Bitcoin miners as a flexible load option could potentially help solve these intermittency and congestion problems, allowing grids to deploy substantially more renewable energy. By deploying more solar and wind, these generation technologies will likely fall even further down their respective cost curves, bringing them closer to zero marginal cost energy production.”

Case in point is Greenidge’s bitcoin mining operation in New York, which is a converted coal plant that now runs on natural gas and is fully carbon neutral. And then there is the recent announcement from Blockstream that it is developing a solar-powered bitcoin mining facility that will be powered by Tesla’s battery and energy technology. The solar-powered site relies on excess daylight to power bitcoin mining operations located in West Texas with a goal to achieve zero-emission energy during the mining process. “We’re interested to prove out our thesis that bitcoin mining can help fund green power infrastructure” Blockstream’s CEO Adam Back said in an interview. Not to be outdone, North Dakota announced its plans to invest another $3B to accelerate its greener crypto mining operations with a promise to create the “cleanest crypto on the planet.” More proof that bitcoin mining is spurring investment in clean energy.

Conclusion

While it’s true bitcoin does use a significant amount of electricity to power and secure the network, the source of the power generation is what determines the impact on the environment, not the total amount of electricity consumed. Bitcoin miners are increasingly using clean and renewable energy sources and leveraging unused energy that would be generated regardless. Thus, in many instances, bitcoin mining does not add any additional environmental impact that wouldn’t otherwise occur. There are even instances, such as redirecting methane gas flaring, where bitcoin mining is a net positive for the environment. Because miners are economically incentivized to find the lowest cost energy, which is often excess or renewable energy, many believe that bitcoin will be a catalyst for increasing adoption of clean energy.

That being said, Bitcoin does have some impact on the environment. However, at the end of the day, we must decide whether the benefits of having a digital asset based on sound money principles that is also non-sovereign and censorship resistant is worth the environmental impact. To make that decision, it’s imperative we understand the true impact it has, how we can lower that impact moving forward, and how those tradeoffs compare to the tradeoffs we make every day using the legacy system. Nic Carter of Castle Island Ventures summed it up best. “If you believe that bitcoin offers no utility beyond serving as a ponzi scheme or a device for money laundering, then it would only be logical to conclude that consuming any amount of energy is wasteful. If you are one of the tens of millions of individuals worldwide using it as a tool to escape monetary repression, inflation, or capital controls, you most likely think that the energy is extremely well spent. Whether you feel bitcoin has a valid claim on society’s resources boils down to how much value you think bitcoin creates for society.”

Why this matters for RIAs and their advisors – One of the biggest myths surrounding bitcoin and crypto is its impact on the environment. It’s important to understand the facts about mining especially for any ESG focused clients.

Disclaimer: The views expressed in the Node Ahead are that of Brett Munster and do not reflect the views on Onramp Invest or any of its employees, related companies, partners, or affiliates. This is not investment advice. This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.