Summary

Welcome back to The Node Ahead, a cryptoasset resource for financial advisers. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we will review:

- Onchain Analysis

- Politicians Embracing Crypto

- Corporations Embracing Crypto

- How Token-Based Business Models Can Disrupt Legacy Businesses

- In Onramp News

- In Other News

Let’s jump right into it.

Onchain Analysis

Last newsletter, we explained why we believe the price drop over the past two months was primarily driven by the derivatives market and likely a short-term correction within a larger cycle. Last week bitcoin seemed to provide early validation of this hypothesis as it bounced back above $40k. Moreover, some on-chain indicators are reaching points that historically have signaled we may have reached market bottoms in January.

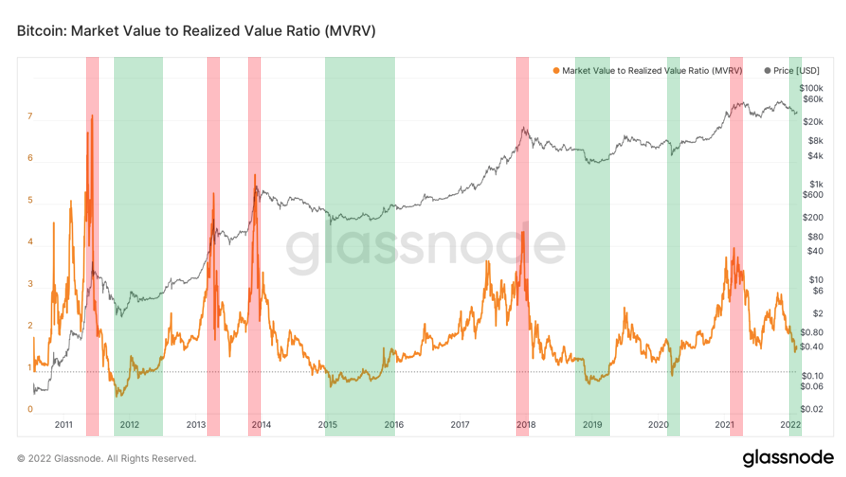

One of the most historically reliable metrics is MVRV, which we have covered in previous editions of the Node Ahead. To quickly recap, MVRV is a ratio of Market Value (aka market cap) to Realized Value (aka cost basis). A high ratio indicates that the price has appreciated to a point where holders are sitting on a lot of potential gains and may look to sell soon. Thus, as MVRV rises, the odds that we are nearing a market top increase. An MVRV of greater than 3.7 has historically correlated with a market top for bitcoin. The reverse is true as well; MVRV has historically bottomed out at roughly the same time as the price has bottomed out. In the past, some of the best buying opportunities have been when MVRV has reached levels around or below 1. At bitcoin’s January low of $33k, MVRV had fallen to its lowest level since 2000, and has since started to trend back up. Though it’s possible MVRV could reverse and fall lower, should MVRV continue to rise in the coming weeks, that would suggest that January was the bottom of this most recent correction.

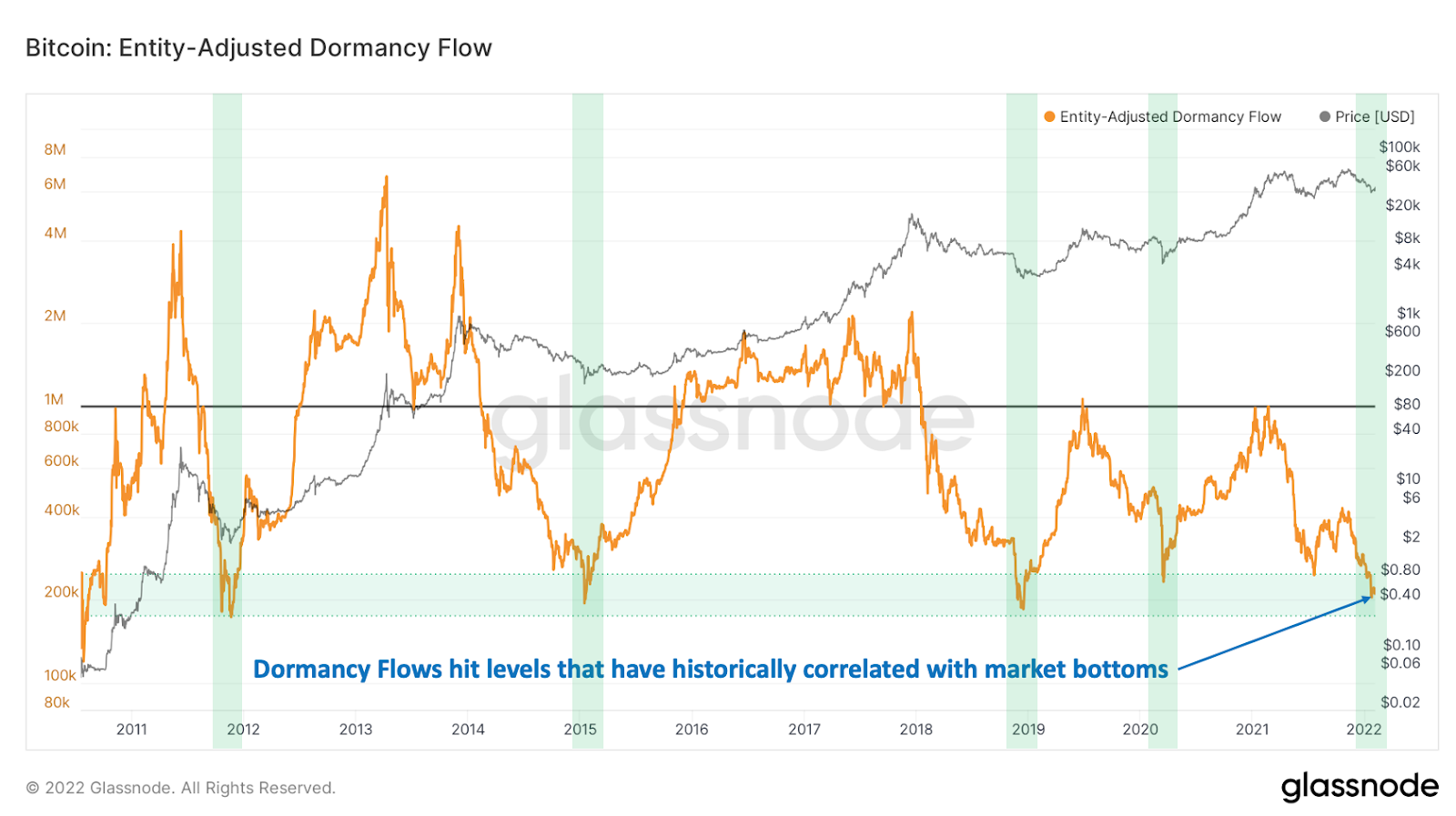

Another metric that we would like to showcase is called Dormancy Flow. Originally created by David Puell, Dormancy Flow is a ratio between the market cap of bitcoin and the annualized dollar value of all coins “spent” in a given year. Thus, Dormancy Flow is a good way of tracking spending behavior on the network relative to the value of the network. When Dormancy Flow values are low, that is an indication that the market cap of bitcoin is undervalued compared to spending behavior. Dormancy Flow bottoms have historically correlated with market bottoms and, while they are infrequent, they have previously provided a reliable indication of when BTC is a value buy. In mid-January, Dormancy Flow reached its fourth-lowest level in history. The previous three times were all cycle bottoms.

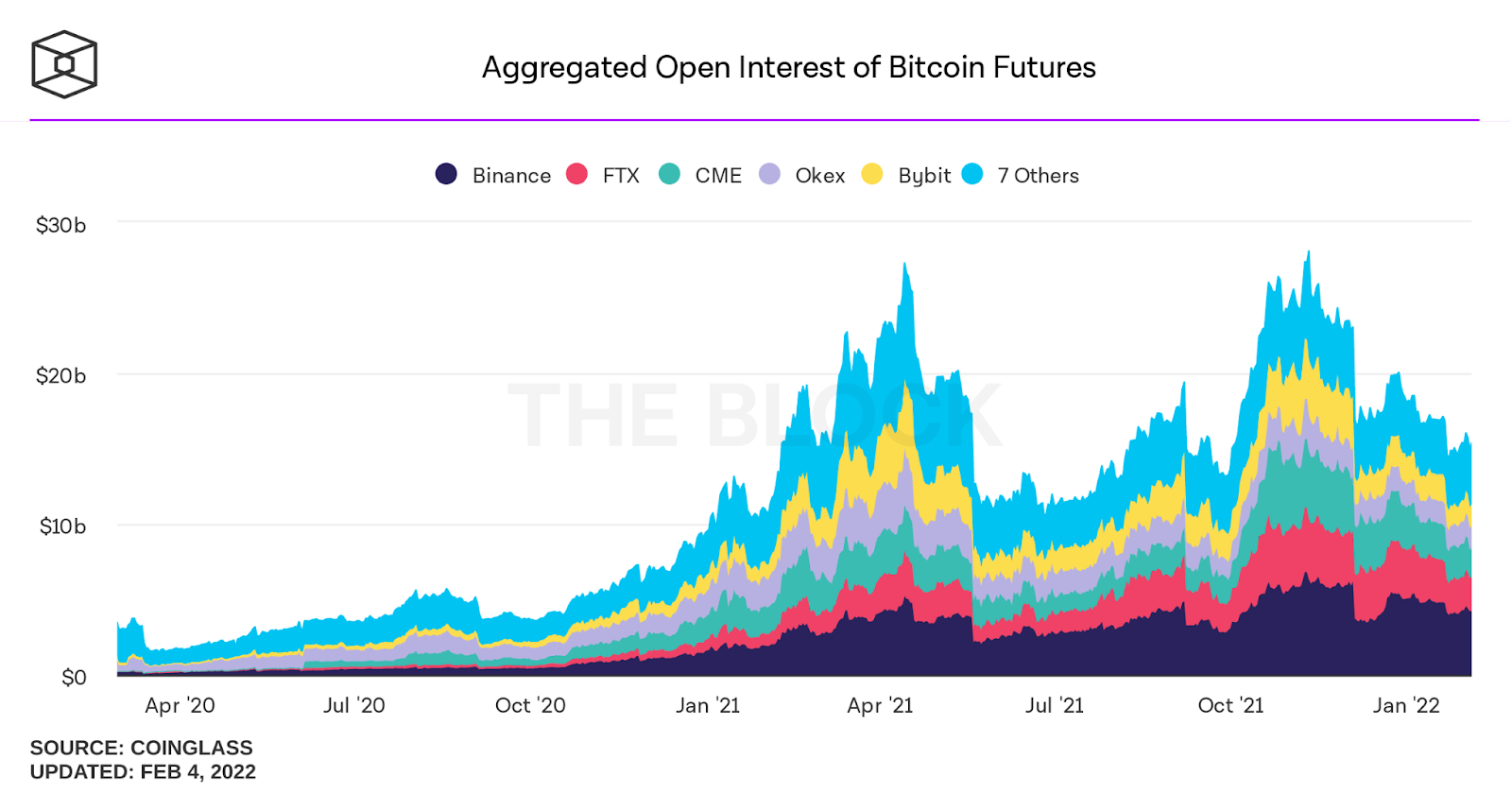

While many of the macro-signals seem to indicate we might have seen the bottom of this correction, there are several market factors that are still cause for concern. In the last few editions of this newsletter, we have covered in-depth how the perpetual futures market, rather than the spot market, has been driving the price volatility of bitcoin. While the perpetual futures open interest has trended downward, it is still at elevated levels compared to historical norms. This means that liquidation crashes and volatility remain a real possibility, and a potential impediment to larger upward movements.

The other impediment to creating more consistent momentum is the cost basis of short-term holders. The average price that buyers paid for bitcoin over the last 5 months is $47,000 which means on average, anyone who has bought bitcoin in recent months is underwater on those investments and may not be as likely to keep buying. We have highlighted on-chain cost basis as a key threshold in previous editions and the metric currently sits at $47,000. Coincidentally this is also the 200-day moving average for bitcoin, which is a widely recognized indicator for determining which direction markets are trending in both the crypto and traditional markets. This threshold could provide resistance, as recent buyers may look to recoup their investment and sell-off. However, should we break through and stay above this $47,000 threshold, it could provide those recent investors with the confidence to re-enter the market and start buying again.

Since the start of this newsletter, we have continued to stress that the underlying data provides good reason to be long term bullish. However, the last few editions of The Node Ahead have been much more cautious about the short-term price action (which has proven to be largely correct). While it’s still too early to declare with any certainty that $33k was the bottom, the data seems to suggest that the upside potential now outweighs the downside.

As always, the on-chain data used in this newsletter is provided by Glassnode. If you would like to have access to the data yourself, you can sign up here: Glassnode Sign Up Link

Politicians Are Rapidly Embracing Crypto

Over the last 12 months, the crypto industry has become a growing political force in the US. In the December 21st edition of The Node Ahead, we covered how lobbying efforts by the crypto industry have risen sharply, how quickly the industry was able to rally millions of people to oppose anti-crypto language in the infrastructure bill, and how Washington DC’s interest and rhetoric has begun to shift to a more favorable tone during recent hearings. Furthermore, states such as Wyoming, Florida, Texas, and Arizona are now competing with each other to attract crypto-based businesses.

After a record year of lobbying spending in 2021, crypto advocacy groups are continuing to ramp up their involvement in policy making. A group of crypto industry leaders recently announced the formation of a new political action committee (PAC) which will back pro-crypto candidates in federal races across the country. Also, an industry advocacy group looking to shape the debate in Washington surrounding decentralized finance (DeFi) policies recently hired four lobbying firms as it looks to make inroads on Capitol Hill.

However, arguably the most important development has been the simple fact that there are now more incentives for politicians to be pro-crypto than against it. States that have embraced the industry are proving that being pro-crypto is good for the local economy. Crypto-friendly politicians have been able to raise money from previously untapped pools of capital. Politicians that have been publicly in favor of the industry have gone viral and risen in national prominence. Lastly, as many as 50 million US citizens already own cryptoassets and that number continues to grow. Not only are their constituents increasingly adopting cryptoassets, but politicians are also quickly realizing that being pro-crypto may be good for the local economy, fundraising, and advancing their careers.

Don’t take our word for it, let’s examine some recent developments.

- Senator Wendy Rogers introduced a bill to make bitcoin legal tender in the state of Arizona. The bill would make bitcoin a lawful medium of exchange if enacted, putting it on par with the dollar. She then proposed a bill to exempt bitcoin from property taxes in the state of Arizona and claimed she wants to make Arizona the most crypto-friendly state.

- Josh Harkins, Senator from Mississippi, recently introduced a bill that would bring cryptoassets into the state code and set parameters for its recognition as legal tender in the state.

- Senator from Michigan Jim Ananich wants to make Michigan the “most pro bitcoin state in the country.”

- The Governor of Colorado Jared Polis has reaffirmed his plans to offer state tax payments in cryptocurrencies.

- Republican Josh Mandel and Democrat Morgan Harper, two leading candidates for the Ohio Senate seat, agree on very little but have both come out in favor of bitcoin and the crypto industry.

- Representative David Schweikert (Republican – Arizona) and Suzan DelBene (Democrat – Washington) introduced a bipartisan bill to exempt bitcoin transactions of under $200 from capital gains taxes. Currently, all gains obtained from the sale of cryptocurrencies must be reported as taxable income. If passed, the bill may help incentivize the digital currency’s usage as a medium of exchange.

- Aarika Rhodes, who is running to represent California’s 30th congressional district in the U.S. House of Representatives, said she plans to use her time in Congress “fighting to keep Bitcoin innovation in the US” and has begun accepting campaign contributions in bitcoin.

- Shrina Kurani, a Democrat running for a House seat in California, has actively engaged the crypto community on legislative issues as well as released NFTs as a fundraising mechanism.

Then there is the state of Texas, where you might be hard pressed to find a politician that isn’t running on a pro-crypto platform. Current Texas Governor Greg Abbot has been very vocal as to the economic benefits of the crypto industry and has made concerted efforts to incentivize bitcoin miners to move to his state. His opponent in the governor race, Don Huffines, took it even a step further and said he will try and make bitcoin legal tender in his state if he wins the election. The third candidate in the race for Texas governor is Allen West who recently said that bitcoin is “the greatest technology shift since the beginning of the internet” and wants to make Texas a world leader in crypto. That’s right- we now have three candidates for the same position all vying for the bitcoin vote in Texas.

Here is the kicker: almost everything we just covered has happened since the start of 2022. It’s been just over a month, and we had no less than 10 new politicians publicly endorse bitcoin and the crypto industry. That number is not counting the growing number of politicians on both sides of the aisle we covered in the past such as Cynthia Lummis, Tom Emmer, Darren Soto, Francis Suarez, and many more. An increasing number of politicians, especially challengers to standing incumbents, are reaching out to establish support from the crypto industry. Our guess is that we will see a lot more politicians come out in favor of the crypto industry between now and the midterm elections in November.

Why this matters for RIAs and their advisors – The regulatory and political landscape surrounding the crypto industry continues to evolve rapidly. It’s important for advisors to stay up to date so they can properly evaluate this risk factor, plan appropriately for the future of their business, and continue to have educated conversations with crypto-curious clients.

Corporates in Crypto

In past issues of The Node Ahead, we have covered the growing demand for crypto from retail investors, institutional investors, Wall Street, and even countries. However, there is one more group that has been drastically increasing their involvement in the crypto industry: corporations.

The most famous example thus far is Microstrategy, which continues to buy bitcoin to hold as a reserve asset. Microstrategy is far from the only company investing in bitcoin: over 25 publicly held companies hold bitcoin on their balance sheets. It’s not just buying and holding bitcoin; many more corporations are beginning to interact with the crypto industry in new and interesting ways.

- A group of 300 community banks has announced they will allow customers to buy and sell bitcoin on mobile banking apps.

- BNY Mellon has set up a digital asset division and has publicly said they expect digital assets to be a meaningful source of revenue for the firm by as early as 2023.

- Mastercard partnered with Coinbase so that users of the crypto exchange will be able to make purchases with Mastercard credit and debit cards. Mastercard had previously announced back in October that it’s teaming up with Bakkt to let banks and merchants in its network offer crypto-related services.

- Not to be outdone, Visa has already partnered with more than 65 crypto platforms. The credit card company shared that 100 million vendors worldwide are accepting crypto payments and crypto-linked card usage exceeded $2.5 billion in the first quarter.

- Intel is getting into bitcoin mining, announcing they will unveil an ultra-low voltage bitcoin mining ASIC to compete with Bitmain and MicroBT.

- Block (formerly known as Square) has integrated lightning network payments to allow users to send bitcoin to each other for free and near instantaneously.

- KPMG announced that they have added Bitcoin and Ethereum to their corporate balance sheet.

- PayPal confirmed it is exploring launching its own stablecoin.

- Nike and Adidas are selling NFTs. So are Disney, Walmart, Coca-Cola, Anheuser-Busch, Taco Bell, and Pizza Hut.

- YouTube is looking at how it can support the creator economy through the use of crypto and web3.

- Twitter already had integrated the ability to send bitcoin and is now looking to grow its in house crypto team.

- Warner Music partnered with Sandbox to create a combination of a virtual musical theme park and music venue.

- Google is on a hiring spree to expand its blockchain business.

- Sports Illustrated is launching a dedicated sport based NFT marketplace and Gamestop is launching a gaming based NFT marketplace.

- On its most recent earnings call, Ferrari’s CEO said the company is exploring how to incorporate crypto, web3, and NFTs.

- TurboTax is now offering customers the ability to receive their tax refunds in cryptoassets.

- The NFL and Ticketmaster are giving out NFTs along with each Super Bowl ticket.

- The International Olympic Committee is collaborating with game developer nWay to launch Olympic Games Jam: Beijing 2022, a play-to-earn crypto game.

- Fidelity, in addition to their fast-growing digital asset business, admitted they have been stacking bitcoin since 2014.

And those were just the announcements made in January! Many people focus on short term price action, which can cause them to miss the bigger picture. As the above bullets indicate, adoption is accelerating, and that includes corporations’ involvement in the industry.

Why this matters for RIAs and their advisors – As more and more companies incorporate digital assets into their product offerings, the crypto industry becomes increasingly mainstream thus increasing the likelihood clients may own cryptoassets.

Enabling New Business Models

The biggest economic disruptions tend to occur when a technological innovation is coupled with a business model innovation. Just look at some of the biggest companies today. Apple not only made the iPod and iPhone (tech innovations) they pioneered iTunes and later the app store (business model innovation) that disrupted the music industry and the phone industry. Google wasn’t the first to build web search, but Larry and Sergei did build an improved search engine (tech innovation) and layered in a bidding system known as AdWords (business model innovation). Facebook created a better way for people from around the world to connect and share pictures (tech innovation), but it was the creation of the News Feed that made advertisements seamlessly integrated into other content rather than using annoying banner ads that propelled its revenue growth (business model innovation). Netflix leveraged streaming (tech innovation) to get into nearly 200 million homes, but was initially built on a subscription service that eliminated late fees (business model innovation). The cloud-enabled much better scaling (tech innovation) but also ushered in SaaS business models (business model innovation) which lowered costs and better aligned incentives between buyers and sellers.

All of the above brings us to cryptoassets and blockchain. Crypto is another technological innovation that also introduces a business model innovation. The technological innovation is the blockchain, which provides digital scarcity and immutable records of transactions without the need for middlemen. However, it’s the token associated with that blockchain that provides the business model innovation. The key is structuring the token usage relationship between the network and the user in such a way that it allows the users of the product to also participate in the economic value creation of the project.

Consider for a moment how different the business model above is from that of traditional businesses. Despite our entire economy being driven by consumers, very few (if any) benefit financially from their own consumption. If you frequently buy a certain brand of ice cream, you do not get any economic benefit from making those purchases. Maybe you can invest in that ice cream company (assuming you are an accredited investor or the company is public), but the economic appreciation comes from the investment, not your individual consumption of the product. Token based business models change this. If the tokenomics (the qualities of a crypto token that makes it appealing to investors and users) are structured properly, the incentives can encourage participation on the blockchain platform and drive demand for both the product and the token.

One of the best examples of a token-based business model disrupting real world incumbents is Helium and the HNT token. Helium aims to build a reliable, ubiquitous, global wireless network that is completely owned and operated by its users rather than a company. Anyone can buy a Helium hotspot, plug it in, and provide wifi and 5G access to other users. In return, those hotspots are rewarded with the Helium token, HNT, anytime their hotspot gets used. Thus, the HNT token acts as an economic incentive for individuals to host Helium hotspots.

For traditional telcos, building a large wireless network is extremely complex and capital intensive. Before telcos acquire any customers or revenue, they have enormous upfront capital costs. First, they have to buy exclusive rights to broadcast spectrum. Next, they have to develop and deploy a widespread network of proprietary hardware to operate only in that spectrum, including buying or leasing real estate to host the hardware. In parallel, these firms have to develop proprietary software to run the system. Throughout the process, companies also need to ensure regulatory compliance across multiple jurisdictions with overlapping or inconsistent requirements. This enormous upfront cost and effort have effectively made it impossible for a new startup to compete with incumbents.

However, the use of a token-based business model changes this paradigm by allowing the cost to be distributed over a large network of supporters rather than one company. It allows independent network participants to easily coordinate economic activity required to build a global network while also allowing participants to directly benefit from its success. The hotspots not only provide wireless coverage, but they also act as a network node and a miner for Helium’s Network Token, HNT. In other words, Helium is the first and only customer-owned 5G network in the world.

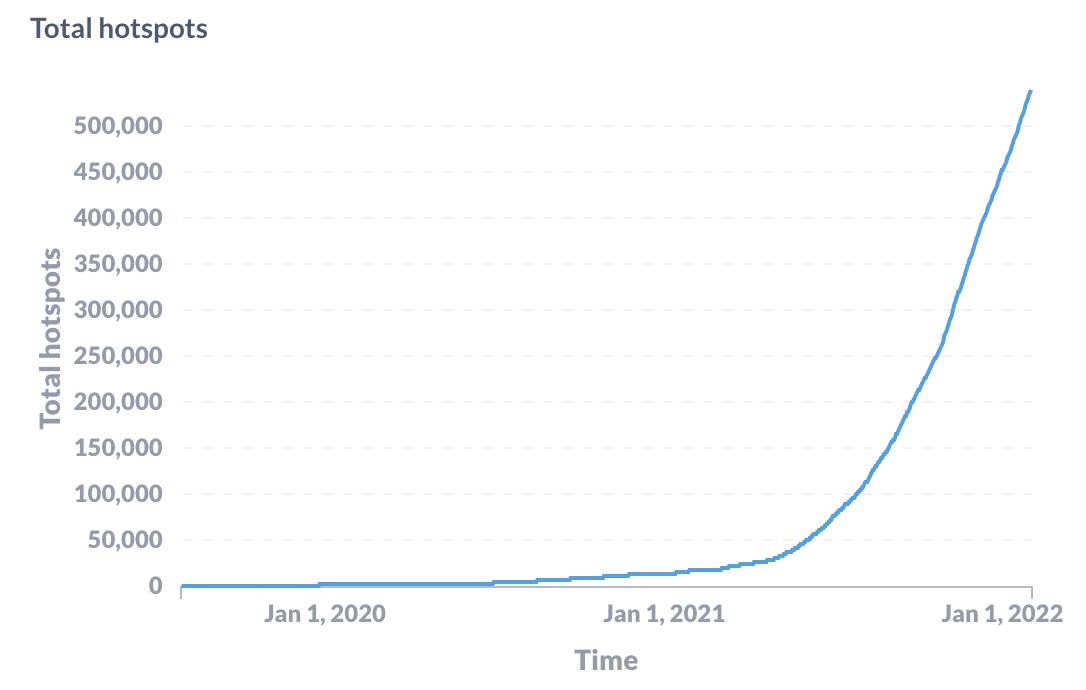

Thanks to this innovative approach, Helium’s growth is accelerating. Originally launched in Austin, Texas in August 2019, the Helium network now consists of over 500,000 hotspots providing coverage in 163 countries and over 41,000 cities. Approximately 3,000 hotspots are being added per day and over 5,000 new cities are added each month. By the end of the year, the network could exceed 2 million hotspots throughout the world. Helium is the fastest rollout of a wireless network in history and that’s only made possible from the HNT incentive model.

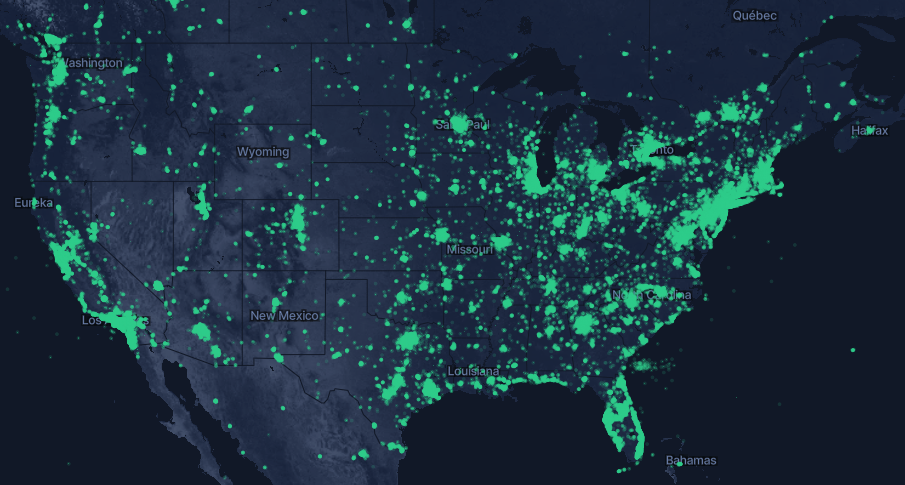

Below is a map of active Helium hotspots in the US. While not quite the same coverage as Verizon or AT&T, Helium’s coverage is impressive when you consider Helium is only a few years old, spent $0 on spectrum, paid $0 to tower companies, and has $0 CapEx because the users buy the hardware from authorized third party manufacturers.

One of the promises of web3 is that token-based models will enable new businesses to be built that were never possible. Helium is early proof of this trend but likely won’t be the last. When applied correctly, tokens can be powerful incentives that enable much more than just financial speculation.

Why this matters for RIAs and their advisors – when evaluating various crypto investments for clients, it’s important to understand how various tokens accrue value. Understanding token based business models will be vital in being able to identify high quality investment opportunities.

Disclosure: Blockforce Capital is invested in the HNT token

In Onramp News

- After three years bootstrapping, Los Angeles crypto platform raises $125 million at (post-raise) $1.3-billion valuation by creating a place to trade tax free through IRA shelter, but (so far) no RIA

- How to have ‘the talk’ with clients when crypto tanks

- Should the CFP add crypto to the curriculum?

- A Crypto Report Challenged the CFP Board. Don’t Bet on It Changing Anything.

- Crypto-Focused Eaglebrook Advisors Lands $20M in Funding

- Where Should Advisors Go for Crypto Education?

- Episode #80: Tyrone Ross Jr. on Career Trajectory & Crypto Serving Underprivileged Communities

- Advisers, Pay Attention to Stablecoins

In Other News

Fidelity released a report that claimed bitcoin is a “superior form of money.”

Bitcoin is the most ESG-friendly investment.

The Biden administration is rumored to release an executive order in February that will outline a comprehensive government strategy on cryptocurrencies.

The IRS offered a Tennessee couple a refund on income taxes paid for unsold staking rewards as part of what appears to be a settlement in an ongoing legal fight – a move that may signal a shift in the way the IRS views crypto staking.

IMF directors urge El Salvador to remove bitcoin as legal tender.

ARK Investment Management predicts bitcoin’s price could exceed $1 million by 2030. “Bitcoin’s market capitalization still represents a fraction of global assets and is likely to scale as nation-states adopt [it] as legal tender,” ARK analyst Yassine Elmandjra wrote.

The House of Representatives committee schedules hearing on stablecoins for February 8.

Bitcoin surpassed American Express in annual total volume transaction in 2021 and is growing much faster than any of the major credit card companies.

NFT trading volume has already reached a record monthly high of $6.13 billion in January, according to The Block Research. New marketplace LooksRare led the way.

Bitcoin miners are helping the Texas grid brace for winter storm impact.

Miami receives first payout from CityCoins protocol.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

With gratitude,

Your Onramp Family