Summary

Welcome back to The Node Ahead, a cryptoasset resource for financial advisers. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we will review:

- Onchain Analysis

- Results From the Congressional Hearing on Bitcoin Mining Energy Use

- One of Crypto’s Biggest Supporters in Congress Wants to Ban Central Bank Digital Currencies (CBDCs)

- Jack (Dorsey) in the Block

- In Onramp News

- In Other News

Before we jump into this edition’s topics, Blockforce Capital has been nominated for two awards based on our performance in 2021. We would greatly appreciate it if you would take a minute or two to go vote for us in the “Fund Manager” section using the link below. Voting closes tomorrow, January 26th, so please go vote today. Thank you in advance for your support.

Onchain Analysis

In our last newsletter, we made the case for bitcoin’s long-term prospects but argued that we could see some increased volatility over the short-term. This past week, that volatility came to fruition as bitcoin broke below $40k and the wider crypto markets fell by double-digit percentages. Bitcoin is now down roughly 49% since it hit an all-time high in November.

Before anyone begins to panic, it is important to note that this behavior is not uncommon in the crypto markets. Bitcoin had at least one price drawdown of 50% or more in 2020 and 2021. Bitcoin also finished each of those years up 309% and up 60% respectively. Furthermore, as we covered in the December 7th edition of The Node Ahead, both the 2013 and 2017 bull runs each had at least 5 separate drops of 20-50% on their way to the final market cycle top. Those cycles saw returns of over 8,000% and 4,000% respectively.

We continue to emphasize that price is unpredictable in the short-term and, as a result, is likely a poor signal for the long-term outlook for the asset class. Instead, we encourage investors to understand what is going on within the network. Based on the underlying data, despite this last week, we believe we are still in the middle of a larger macro cycle and that this recent drop was caused by the derivatives market, not by a break in the underlying fundamentals or health of the network.

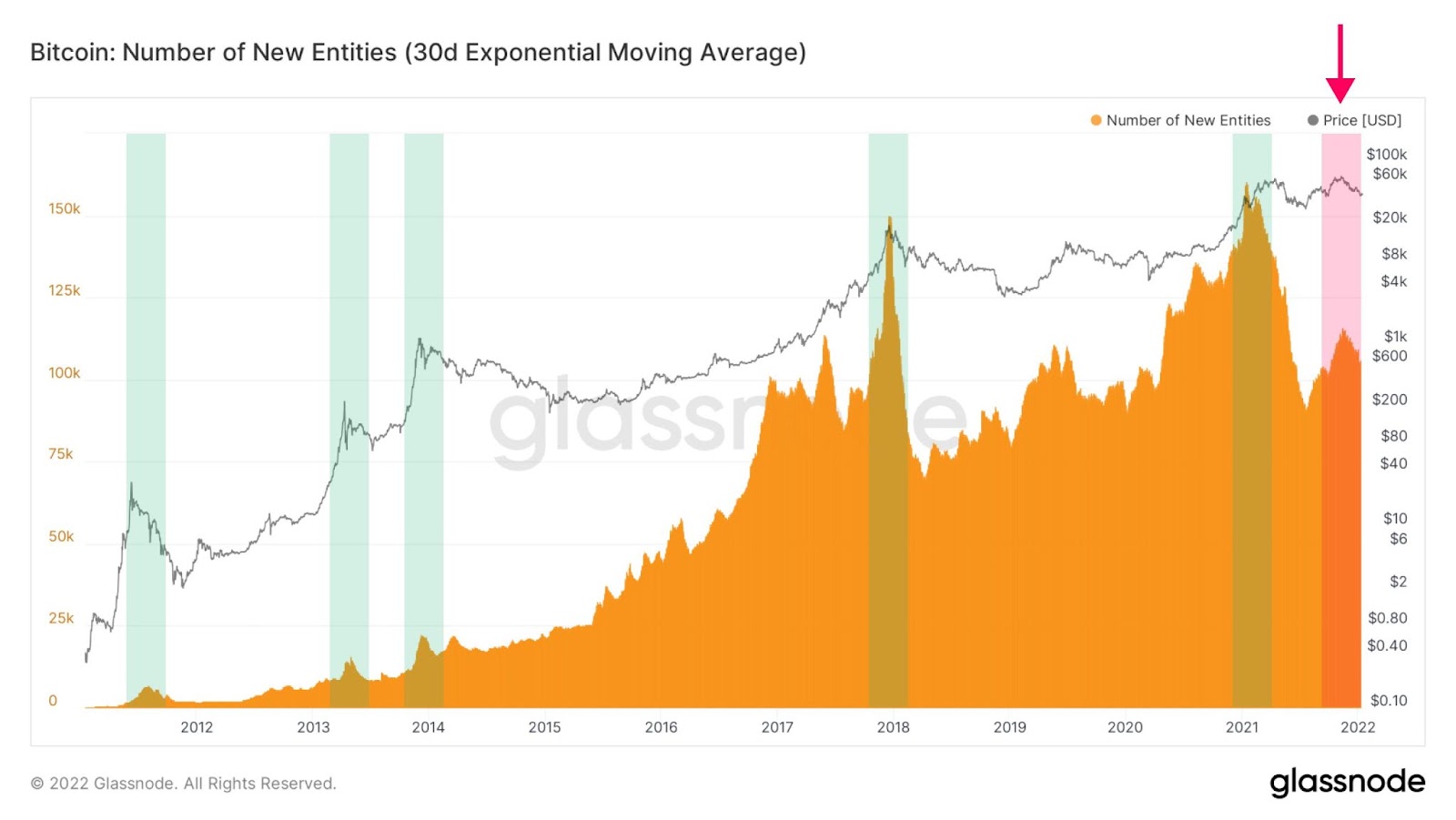

Last newsletter we covered the historical trend of new market participants entering en masse during major upward price swings. We saw this happen in January and February of 2021 when bitcoin went on its bull run. However, what we also showed in the last newsletter is that the level of new entities entering the market recently has been flat. After publishing the aforementioned newsletter, highly regarded on-chain analyst TXMC pointed out that when we hit all-time highs in November, it was the first time in bitcoin’s history that new all-time highs were reached without new highs in New Entities. This would suggest that the all-time high we hit in November wasn’t a cycle top and that we are likely still in the middle of a larger bull cycle.

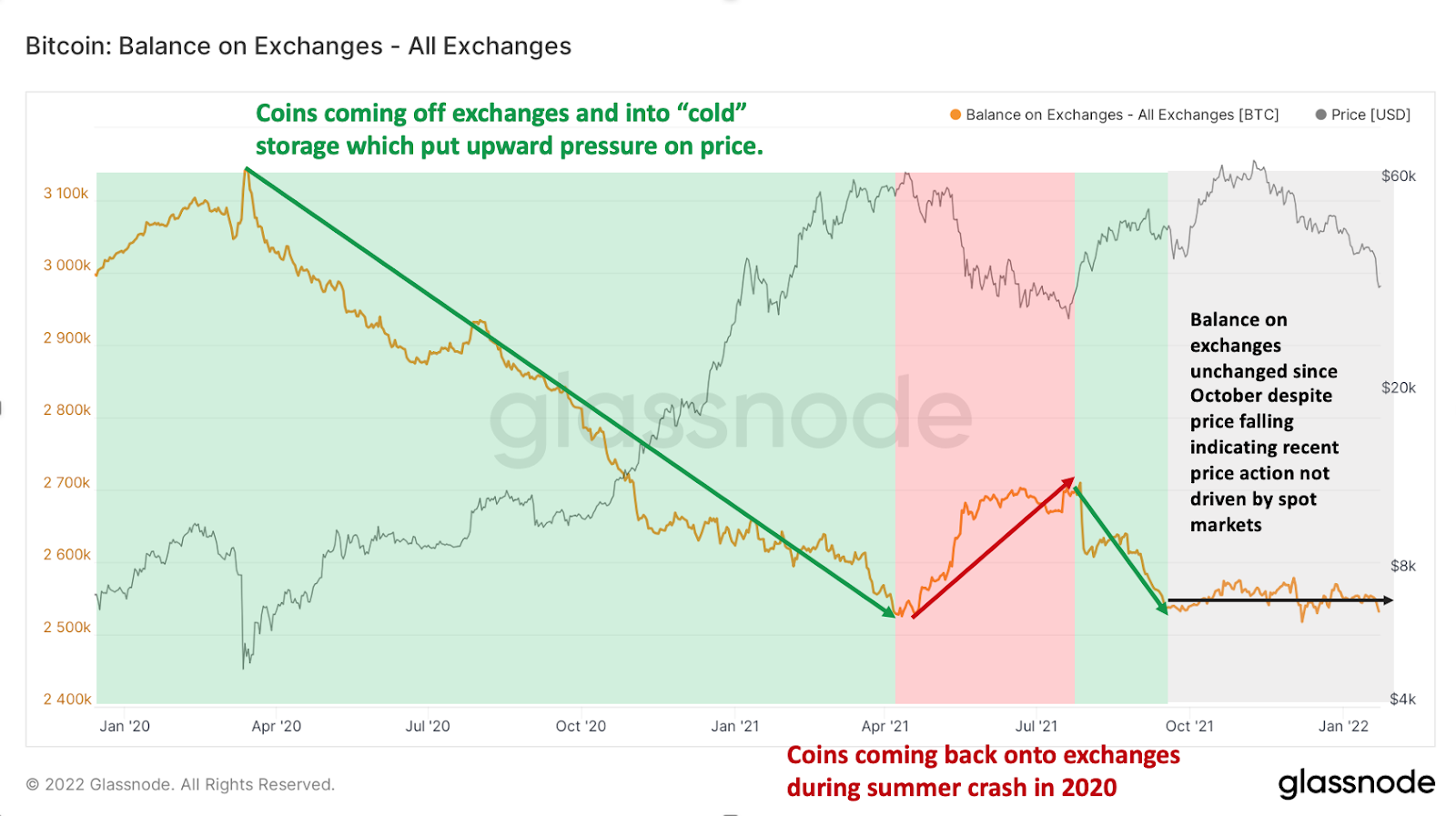

Another reason to believe that we are currently experiencing a dip within a larger bull cycle is that during a sell-off towards a market bottom, coins have traditionally come back onto exchanges. Unless you are actively trading, holding your coins off the exchange and in “cold” storage is widely considered to be a safer option (cold storage simply means a wallet not connected to the internet). We can monitor in real-time the number of coins leaving exchanges to be stored away for safekeeping and the number of coins coming onto exchanges to be traded. When the net amount is coming back onto exchanges, that has historically been a strong signal that the market is looking to sell.

In the second half of last year, we saw a strong downward trend of coins on exchanges. This means that, in aggregate, coins were coming off exchanges and the market was in an accumulation phase. Over time this behavior put upward pressure on price and, at the end of 2020 and early 2021, the price had hit a new all-time high. In mid-April 2020, Elon’s tweet and news of China’s mining ban came out and there was a little bit of panic in the market. As a result, coins came back onto exchanges as market participants were looking to sell. Not surprisingly, bitcoin’s price dropped.

All of the above brings us to this past couple of weeks. Despite the price drop, the balance of coins on exchanges is essentially flat. There hasn’t been a rush of investors panicking and looking to sell their coins; in fact, the typical spot exchanges such as Coinbase and Gemini are relatively quiet given the amount of volatility. In other words, this recent drop in price is not driven by the standard spot market or long-term holders.

Market participants aren’t coming onto the network but the ones that own bitcoin aren’t selling. So, if normal buyers and sellers didn’t cause this crash, what did?

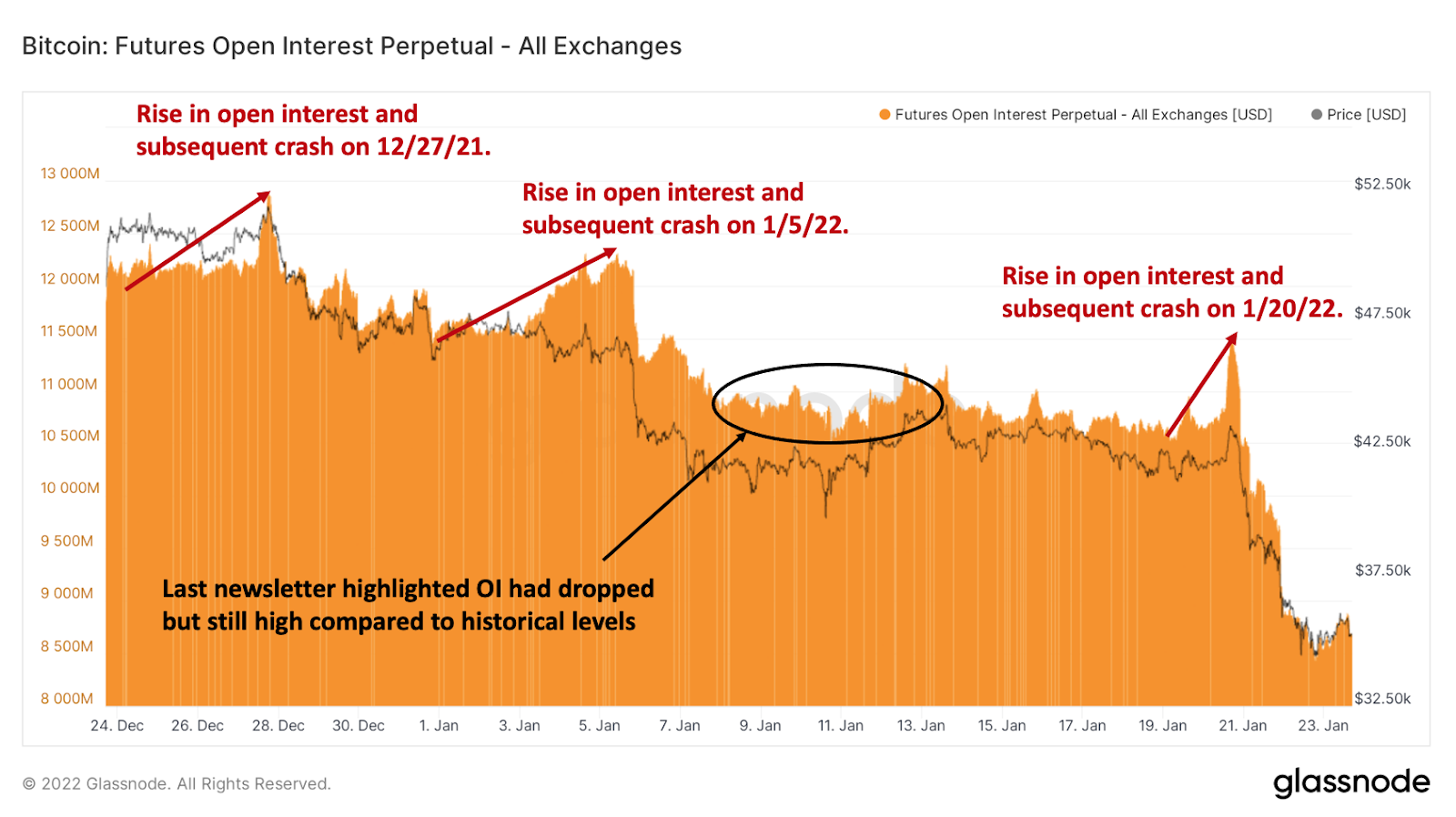

The last newsletter we highlighted the Open Interest in the Perpetual Futures Market. To provide a quick recap for everyone, a perpetual futures contract (aka Perp) is an agreement to buy or sell the underlying asset in the future at a predetermined price. A Perp is very similar to a normal futures contract, except that it does not have an expiration date. Instead, it automatically renews and runs forever until canceled or traded-in. Similar to regular futures contracts, it is common to use leverage (aka borrow bitcoin). Hence, the perpetual open interest can give us an indication of the amount of leverage in the market.

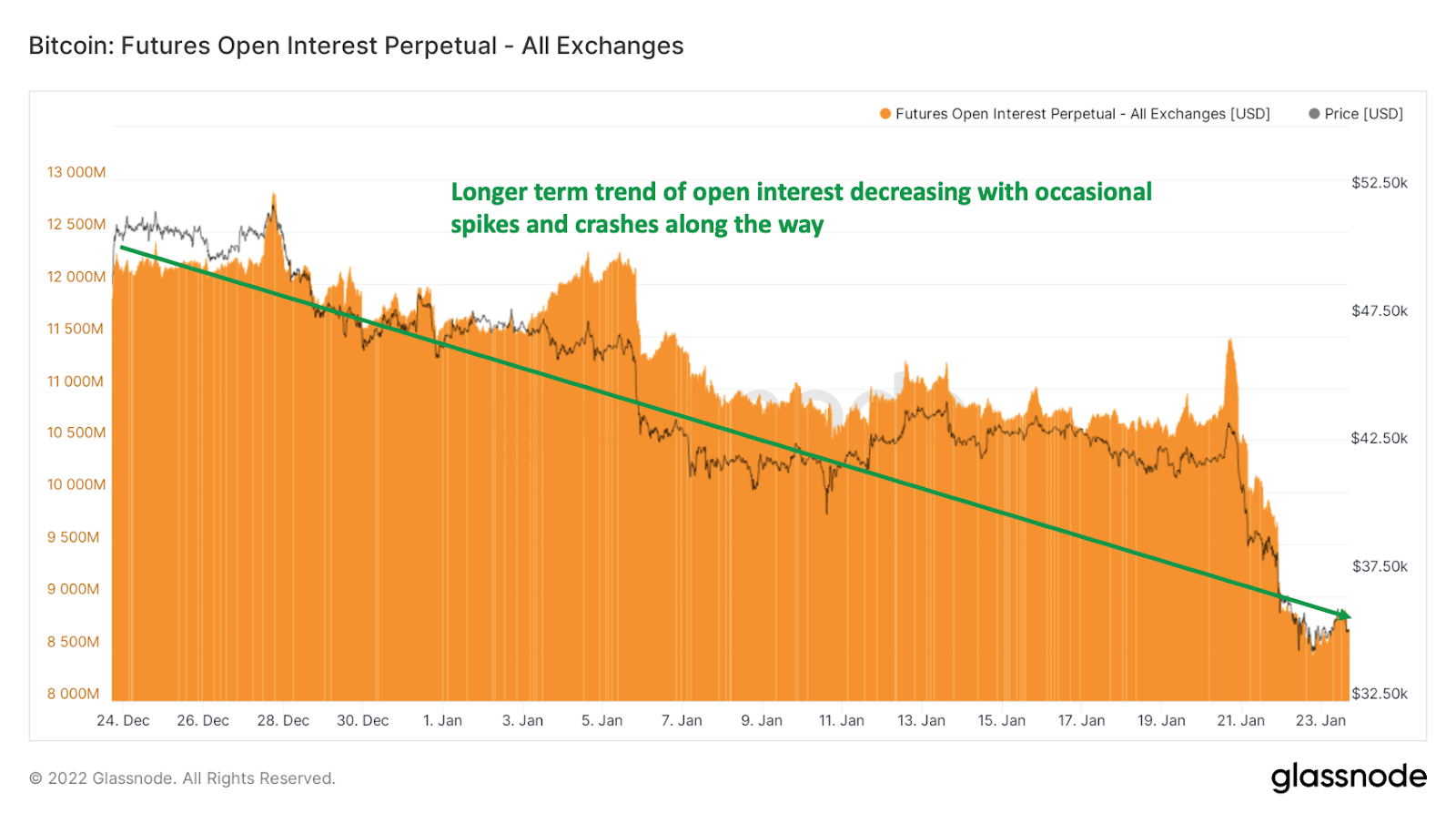

In our newsletter two weeks ago, we also explained how Perp open interest had been trending downward following two liquidation cascades in December and early January but was still elevated compared to previous levels. At that time, we warned that there was a good chance we could see more volatility. Since that newsletter, Open Interest spiked back up again, increasing the leverage in the system which then increased the potential for more downside volatility in the short-term. Sure enough, that’s what we got on January 20th.

It would appear that the derivatives market has been largely driving the price action of bitcoin over the last two months. This is the double-edged sword of institutional capital coming into the market. While they bring a lot of capital and credibility, we are beginning to see more exotic financial instruments being applied to the crypto markets that we did not have in previous cycles. This isn’t inherently good or bad, but it is another dynamic we should keep an eye on.

However, this leverage build-up seems to be trending downward. Although we have experienced these periodic leverage flushes and price crashes, the overall amount of open interest in the system has been steadily declining since December. We have effectively flushed out roughly $4 billion worth of leverage over the last month.

So, let’s recap. Price crashes as we have seen in the past couple of weeks are never fun, but there is historical precedent for price declines we recently experienced. They also do not necessarily mean doom and gloom for the market moving forward. Long-term holders have continued to hold through this correction, indicating that there is still a large base of investors providing support at these lower levels. The recent price crash was likely caused by a recent build-up of leverage in the system, not a long-term systemic issue with the network.

It’s still too early to say if we are out of the woods yet and have finally reached a bottom (especially if open interest climbs back up) or if we are in for some more volatility in the coming weeks. However with the data as it currently stands, we believe that when we look back on this moment in time, the $67k mark we hit in November could likely prove not to be the market top of this cycle. We will continue to monitor the data and report on what we are seeing.

As always, the on-chain data used in this newsletter is provided by Glassnode. If you would like to have access to the data yourself, you can sign up here: Glassnode Sign Up Link

Results From the Congressional Hearing on Bitcoin Mining Energy Use

On Thursday, January 20th, the House Energy and Commerce Committee held a hearing to examine the environmental impact of Bitcoin mining. Critics of bitcoin often try to claim that mining is bad for the environment. However, such criticisms of bitcoin mining are often superficial and based on misleading assumptions and a fundamental misunderstanding of how Bitcoin’s technology actually works. Before we jump into the hearing, here are some facts about the bitcoin mining industry.

Bitcoin mining consumes approximately 0.55% of global electricity production, roughly the same as the energy consumption of mining zinc, and far less than the extraction of copper or gold. A recent report from Galaxy Digital found that the Bitcoin network uses less than half the energy consumed by the traditional banking industry. In fact, Bitcoin mining consumes roughly the same amount of energy as clothes dryers in the US, and 1/5 the energy of refrigeration.

It’s not just how much electricity bitcoin consumes, but the type of energy. One unit of hydro-generated energy will have a much less environmental impact than the same unit of coal-powered energy. In a 2020 report by the University of Cambridge, researchers found that 76% of crypto miners rely on some degree of renewable energy to power their operations. Furthermore, a recent report from the Bitcoin Mining Council showed that bitcoin mining’s reliance on sustainable electricity and energy efficiency continues to increase. This is because bitcoin mining is a very competitive industry and, because electricity is the number one determinant for a miner’s profitability, bitcoin miners are economically incentivized to seek out the lowest cost energy which results in miners turning to widely unused or renewable sources of energy.

This brings us to a unique characteristic of bitcoin mining: it can be done anywhere. This means that miners can migrate wherever they can find abundant and underutilized energy for cheap. For this reason, prior to China’s ban, many Bitcoin miners were located in southwest China, where hydropower had been massively overbuilt and often went unused. It explains the presence of miners in former aluminum smelting plants in hydro-rich Upstate New York. It is also why West Texas, where a wind and solar boom has created a massive overabundance of energy that the grid simply cannot consume due to the distance between where the energy is created, where it’s consumed, and the insufficient transmission lines in between. As a result, the US and specifically West Texas was the biggest beneficiary of miners relocating after the China mining ban last year. In fact, because bitcoin mining is able to scoop up stranded power and improve the economics of wind and solar installations that might otherwise be uneconomical, bitcoin mining might actually prove to be the catalyst for renewable energy adoption.

Lastly, bitcoin miners have the ability to turn on and off their equipment otherwise known as “interruptible load.” This makes them perfect for so-called “demand response” programs, which are formal or informal agreements for bitcoin miners to curtail their electricity use when the grid is overtaxed. This means that when energy is overabundant, bitcoin mining can scoop up that excess supply that otherwise would go to waste. However, it also means that when electricity is in short supply, bitcoin miners can turn themselves off at a moment’s notice and allow the grid to funnel electricity to the locations that need it most. Contrary to mainstream perception, bitcoin mining is believed to be accelerating the transition to renewable energy.

All of the above brings us back to the hearing on January 20th. The hearing featured five industry executives discussing the energy consumption related to the proof-of-work (PoW) consensus model used to secure and validate transactions on the Bitcoin network. Similar to the hearing in December, this session proved to be very productive.

There appeared to be genuine curiosity on behalf of the committee to learn more about the basics of blockchain networks, how different validation models such as proof-of-work (PoW) and proof-of-stake (PoS) operate, and any potential cybersecurity concerns around blockchain technology. The committee seemed well prepared and there was depth to many of the members’ questions, including curiosity around the motivation of miners, the scalability of using cleaner and renewable energy, and the impact this industry may have on the economy and job creation.

By the time the meeting ended, there didn’t appear to be an explicit desire for any kind of crackdown on bitcoin mining, nor any imminent legislation to be passed. “Cryptocurrency’s presence in everyday life will likely continue to expand,” Representative Diana Degette (D-CO) said in her opening comments at the hearing.

In the December 21st edition of the Node Ahead, we discussed the possibility that crypto had reached a turning point with how it is viewed by those in Washington. The hearing last Thursday seemed to reinforce this idea.

Why this matters for RIAs and their advisors – There are a lot of misconceptions about bitcoin’s environmental impact. Advisors need to be armed with the facts about proof-of-work and have an understanding of potential mining regulations when discussing this topic with clients.

One of Crypto’s Biggest Supporters in Congress Wants to Ban Central Bank Digital Currencies (CBDCs)

During his confirmation hearing earlier this month, Fed Chair Jerome Powell stated that lawmakers can expect a report on stablecoins and central bank digital currencies (CBDCs) in the coming weeks. Powell first mentioned the report in July 2021, setting the original release date for September. After several delays, the Fed finally released the highly anticipated, 40 page report last Thursday. The report outlined several potential benefits and drawbacks of what could be a “highly significant innovation in American money,” but stopped short of taking a position on its implementation without the help of lawmakers.

The report also said that a CBDC, which would give the central bank the ability to take advantage of the benefits of cryptoassets, could “fundamentally change” the structure of the nation’s financial system by altering the roles of the central bank and the private sector. It was also clear that the Fed is intent on preserving the dollar hegemony in the world. A “potential benefit of a U.S.-issued CBDC could be to preserve the dominant international role of the U.S. dollar…The dollar’s international role allows the US to influence standards for the global monetary system.” Lastly, the Fed stated that it “does not intend” to issue a CBDC without “clear support” from the executive branch and Congress—”ideally in the form of a specific authorizing law,” makes what Tom Emmer recently said all that more interesting.

Before we jump into Congressman Emmer’s new bill, let’s review what a CBDC is and why they are potentially problematic. Central Bank Digital Currencies are blockchain based currencies issued by a government. Think about them as digital versions of the dollar, Euro, or Yuan. Whereas bitcoin is fully decentralized, non-sovereign, and built on an open network, CBDCs are controlled by the issuing government and operate on a closed network.

As a reminder, blockchains provide an immutable record of every transaction that occurs. Bitcoin’s blockchain is open, meaning that everyone can see all historical transactions on the chain. This gives bitcoin a level of transparency and trust that no traditional currency can match. However, a central bank digital currency does not operate on a public blockchain so, while it would provide transparency into every transaction, it would only do so for the controlling entity. In other words, only the issuing government would have insight into every retail transaction down to an individual level providing that government with surveillance capabilities on its citizens never before possible.

A potentially even more problematic factor is that, unlike fiat currencies, cryptocurrencies are programmable. This means the government would, in theory, have the power to program what its citizens can and cannot do with their money. If the government wanted to stimulate spending in the economy, they could issue a CBDC that has an expiration date so that you would be forced to spend your money by a certain date or lose it. Or if they wanted to “protect” domestic companies from international competition, the money could be programmed to only be spent on companies located in that country. They could issue money directly into your bank account but just as easily take out whatever amount of taxes they believe you owe them as they see fit. And because they would have information down to an individual level, there is no reason why fiscal and monetary policy couldn’t be customized for different individuals. What Facebook and Google did for targeted advertising, CBDCs have the potential to do for monetary policy. Of course, the aforementioned scenarios are entirely hypothetical. If this all sounds rather ominous to you, the congressman from Minnesota would agree. Citing the privacy dangers potentially inherent in a CBDC, Tom Emmer introduced a bill that would ban the Fed from issuing a CBDC directly to retail investors.

Congressman Emmer has been one of the crypto industry’s most vocal supporters in Washington. He has spent considerable time researching the technology and speaking with industry experts. Emmer warned that although creating a CBDC that Americans could access via the Fed could increase convenience and efficiency, especially when it comes to paying taxes or receiving stimulus payments, a digital currency issued by the Fed could be a slippery slope. According to him, consumers could one day be forced to register with the central bank to access money, which could in turn lead to mass surveillance of their financial activity.

“Requiring users to open up an account at the Fed to access a U.S. CBDC would put the Fed on an insidious path akin to China’s digital authoritarianism,” said Emmer.

Emmer’s comments aren’t theoretical or hyperbole. China has aggressively pushed the adoption of their own CBDC while at the same time the CCP has tried for years to ban an open monetary network they can’t control (bitcoin). Even this recent report from the Fed stated that “a CBDC intermediary would need to verify the identity of a person accessing CBDCs.” In other words, banks or companies that distribute CBDCs on behalf of the Fed would need to KYC users, effectively eliminating any financial privacy from the government. And the ability to control your money was also hinted at in the paper. According to Powell’s report, the Fed could “limit the total amount of CBDC an end user could hold, or it could limit the amount of CBDC an end user could accumulate over short periods.”

Those vehemently against this idea believe that we should never allow the Federal Reserve to turn itself into a retail bank that’s able to collect information on the American people, track their transactions, and determine what they can and cannot do with their money. From that perspective, it is encouraging to see political leaders such as Tom Emmer understand the potential future infringements on financial privacy that CBDCs present. It also makes it all that more imperative that we have a different option, one that is non-sovereign and transparent in the form of bitcoin.

Why this matters for RIAs and their advisors – Understanding the differences and tradeoffs between cash, bitcoin, stablecoins and CBDCs will become increasingly important in coming years especially when it comes to how financial advisors guide their clients.

Jack (Dorsey) in the Block

Over the last 12 months, one of Silicon Valley’s most iconic entrepreneurs has gone all in on bitcoin. Jack Dorsey, the co-founder of both Twitter and Square (or, the company formerly known as Square – more on that in a minute), has both personally and professionally supported bitcoin in the past. At the Bitcoin 2021 Conference, he explained that he sees bitcoin as a way to protect against currency devaluation, expedite transfers of funds across borders and stated that he “doesn’t think there is anything more important in my lifetime to work on.” In September, Twitter became the first company to integrate with Strike’s API, thus allowing any Twitter user to send any amount of BTC to any other Twitter user in the world instantaneously and for free. Then in October, Square bought $50m worth of bitcoin to hold on its balance sheet. At the end of November, Jack stepped down as CEO of Twitter, walking away from the company he co-founded to spend more time working on bitcoin. Almost immediately after, Jack announced that Square would be changing its name to Block, a not so subtle nod to the crypto industry.

Apparently 2021 was just the beginning because, since the start of the new year, Jack has taken his involvement to the next level.

At the start of the year, Jack announced that CashApp had integrated the Bitcoin Lightning Network as a part of a new update. The Lightning Network is a network of payment channels built on top of bitcoin’s base layer blockchain that can theoretically handle millions of transactions per second and settle them all on the Bitcoin blockchain. Thus, the Lightning Network enables instant, nearly-free bitcoin denominated payments to anyone in the world. Cash App now allows its 36 million monthly users to send BTC anywhere in the world to any compatible wallet without being charged fees.

Then, on January 10th, Block posted a job opening stating that the company is looking to hire a team dedicated to launching the “next generation” of bitcoin mining ASICs. An ASIC (application-specific integrated circuit) is a microchip that is custom-designed for a particular use, in this case bitcoin mining. A couple days later, Jack confirmed that the company is moving forward with plans to build a bitcoin mining system. The project will hopefully create a more distributed and efficient way to set up, maintain, and operate crypto miners.

Believe it or not, Jack wasn’t done yet. On January 13th, Jack announced he is establishing a Bitcoin Legal Defense Fund to defend bitcoin developers by finding and retaining defense counsel, developing litigation strategy and paying legal bills. It will be free and voluntary for bitcoin developers to use if they so choose. The Fund’s first activity will be to run point on coordinating the defense of Craig Wright’s lawsuit filed against various bitcoin developers.

Last newsletter we highlighted the increasing rate of talent leaving traditional industries to work in the crypto industry. This includes software engineers as well as some of the most prolific entrepreneurs of our generation. To see individuals such as Jack go all in and really move the industry forward is another positive sign for the long-term development of this ecosystem.

Why this matters for RIAs and their advisors – As more talent and prominent entrepreneurs gravitate towards the industry, crypto continues to be de-risked over time.

In Onramp News

- Here’s how much you would have if you invested $1,000 in bitcoin at the start of 2022

- Bitcoin dropped about 50% from its all-time high—but experts warn ‘downturns like this are normal’

- This rarely used tax loophole is helping some bitcoin holders save tons of cash

- The 14 Charts That Defined 2021 With Josh Brown and Friends

- Four Financial Advisor Trends Reshaping #AdvisorTech

- Top cryptocurrencies are sliding. Is it time to try the asset class?

- State of the Union Part 2: Education, Access and Tools

- Tyrone Ross’ State of the Union: Onramp’s Story

- Bitcoin’s Swoon Deepens as Bears Begin to Test $40,000 Threshold

In Other News

Crypto funds outperformed traditional hedge funds and digital asset benchmarks.

In a new report Fidelity argued we might see more countries follow El Salvador’s lead because those that buy some bitcoin today might be better off in the future, as sovereigns might be forced to acquire bitcoin as a form of “insurance.”

Charles Schwab CEO says that crypto is significant, hard to ignore and that we want to offer it to our clients.

A Visa survey found that almost a quarter of small businesses in nine countries around the world plan to accept digital currencies as a form of payment in 2022.

Strike, the company that helped facilitate bitcoin payments in El Salvador, launches bitcoin payment services in Argentina to kick-start Latin American expansion.

Tonga to copy El Salvador’s bill making Bitcoin legal tender.

Rio de Janeiro’s mayor plans to invest 1% of the city’s treasury in crypto.

PayPal has confirmed that it is exploring a stablecoin backed by US dollars.

Bitcoin is the perfect option instrument.

A group of U.S. banks plan to offer their own stablecoin, called USDF, to tackle concerns about the reserves behind nonbank-issued equivalents.

Crypto exchanges are set to face tougher regulatory scrutiny.

According to LinkedIn, Crypto job ads surged by nearly 400% in 2021.

Ethereum burn rate hits record high as DeFi market jumps.

NFT marketplace OpenSea hits record $3.5B in monthly volume.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.

With gratitude,

Your Onramp Family