When we started offering access to private equity funds, we realized that many advisors had little to no awareness of what PE could offer their clients. The reason for this? Minimums for PE investing used to be astronomical, making investment opportunities inherently restricted by large institutions and high-net-worth individuals. In short, the average RIA wouldn’t have access to PE for their clients or even know where to look to find it. Even though, historically, PE’s performance has an excellent track record, it wouldn’t even be on their radar. Tokenization changes this.

Blockchain, at its core, represents a tool for democratization—the idea that everyone should be able to reap the benefits of proven tools in the financial market, not just institutions, hedge funds, and the ultra-wealthy. The new PE, tokenized PE, brings these financial benefits to a wider range of investors through blockchain technology and enables new, easier access points for advisors.

A quick explainer on private equity

Private equity refers to a type of investment in which funds are invested directly into privately held companies or acquire ownership stakes in those companies. It involves the purchase of shares in a company that is not publicly traded on a stock exchange. The objective of private equity is to generate substantial returns on investment by actively managing and growing the companies in which they invest. These investments can be found in a wide range of sectors, and the strategies employed by private equity firms can vary, with focuses on specific industries and geographies. The reason there are so many barriers in place surrounding PE investments is that initially, due to the high minimum for investing, the government put safeguards in place to mitigate potentially costly risks for investors.

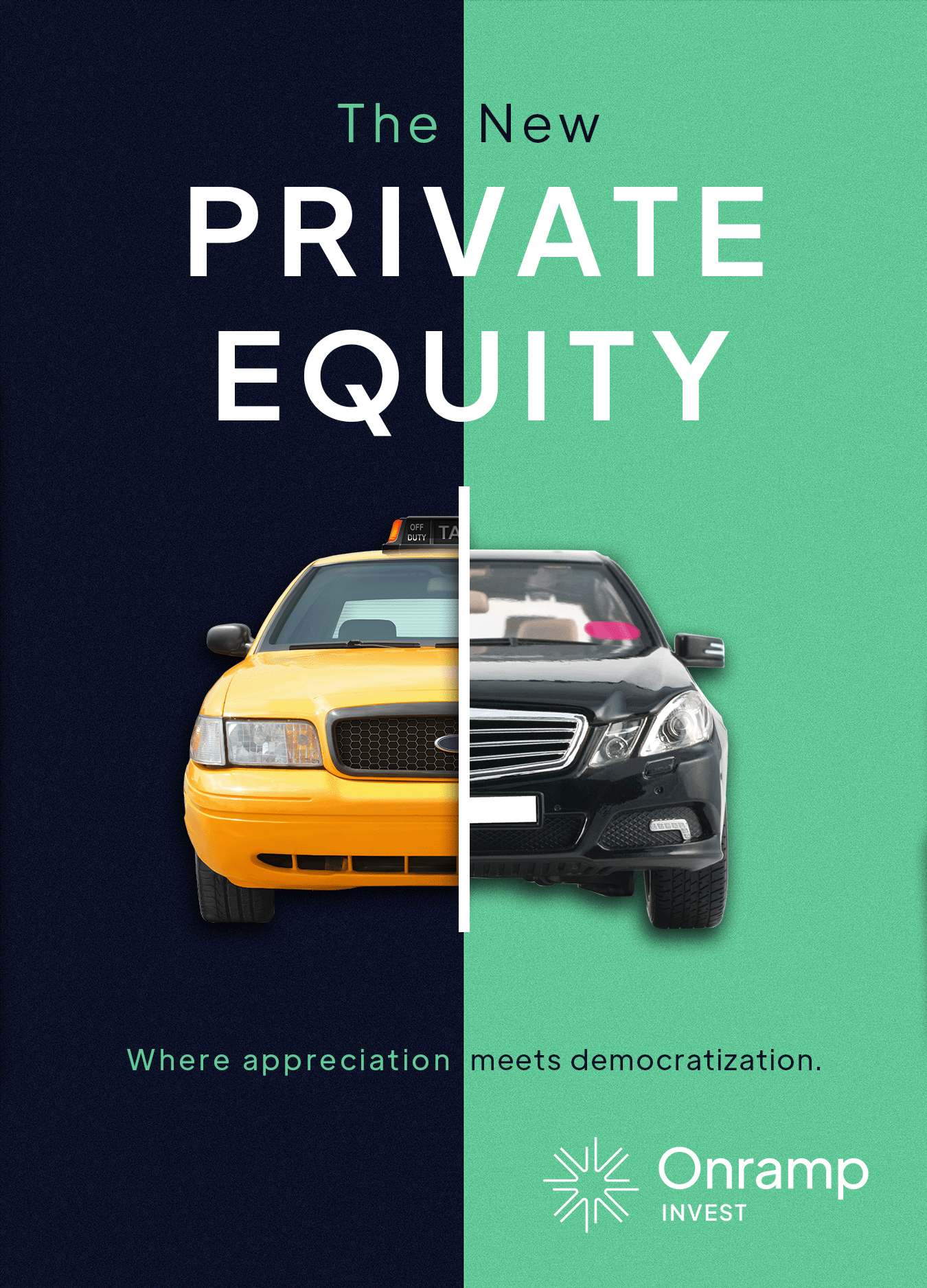

Tokenization is to PE what Uber was to taxis

If you’re not familiar with tokenization, here’s a real-world comparison to explain what we mean: Remember when you had to hail a cab or call a taxi? You had to hope you could find one, you had to be in a city that had them, they were expensive, and they were few and far between. Then came Uber. Uber increased the number of ride providers available, brought opportunity and access to smaller cities across the country, made pricing more competitive and affordable, and made the entire process faster and safer by making it digital. Traditional financial investment vehicles can be clunky and inefficient due to intermediaries and the need for things like bank wires, and the costs that come with these things make them inaccessible to the average investor. They’re taxis, and tokenization is Uber. It’s taking something that benefits people and making it better, which it does by removing the intermediaries and shifting the process to an immutable ledger (blockchain).

How to access the New PE through Onramp

By tokenizing private equity, providers are able to lower the minimum investment amounts significantly, letting more people participate. That’s why we partnered with Securitize to provide advisors with easy, secure access to this powerful investment tool. PE is known for being a strong alternative asset for portfolio diversification and wealth growth outside of the public market. From 2000 to 2020, private equity investments returned an average of 10.48% –56% better than the average return investing in the Russell 2000 over that same period. Thanks to tokenization, access to PE at lower minimum investment requirements can potentially mitigate risk seen with previous PE investments and bring more meaningful investment opportunities to your clients.

Get started accessing private equity investments through Onramp.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed do not express the views or opinions of Blockforce Capital or Onramp Invest.