The regulatory environment of cryptoassets and DeFi is ever changing. As trusted fiduciaries, it is imperative that prudent advisors keep up with changes as they occur. In this post we will look into a few current events related to cryptoassets including the following:

- U.S. banks have formed a group to develop the USDF stablecoin to tackle concerns about the reserves backing non-bank issued equivalents

- The Federal Reserve recently issued a report outlining the potential risks and benefits of a central bank digital currency (CBDC)

- The Biden administration is preparing an executive order to outline a government strategy on cryptoassets

Stablecoins have become a key topic of interest recently for advisors, investors, and regulators alike. Investors are using stablecoins for a variety of reasons. Some of these include earning a higher yield on dollars, fast money movement, and borrowing and lending solutions, among others. With this interest comes investor protection concerns about how these assets are regulated and whether the stablecoin reserves can be proven. Learn more about the basics of stablecoins here.

USDF Consortium

In an effort to bring stablecoin and blockchain capabilities to the banking industry, The USDF Consortium was recently formed by a cohort of FDIC-insured bank members. The group appears focused on utilizing public blockchain technology to improve traditional banking functions and provide their customers better service offerings. This includes minting their own stablecoin, USDF, in a regulatory compliant manner.

Given the regulatory concerns surrounding non bank-issued stablecoins, these banks are looking to provide a viable alternative. The plan is for USDF to be exclusive to U.S. banks for the time being, with full redeemability on a 1:1 basis for US dollars. USDF will operate on the Provenance Blockchain, a public blockchain that is focused on more cost effective ways to complete financial transactions. This week, two founding members completed a transaction using this form of money movement by sending USDF from one bank to another.

The adoption of USDF by the U.S. banking industry is to be determined, however it appears the Consortium is off to a good start on the regulatory side of the equation. In December 2021, Federal Reserve Chairman Jerome Powell stated that “Stablecoins can certainly be a useful, efficient, consumer-serving part of the financial system if they’re properly regulated, and right now, they aren’t.” He followed that up with a statement to Senate legislators earlier this month that nothing would prevent privately issued stablecoins from coexisting with a prospective central bank digital currency (CBDC).

Central Bank Digital Currency Update

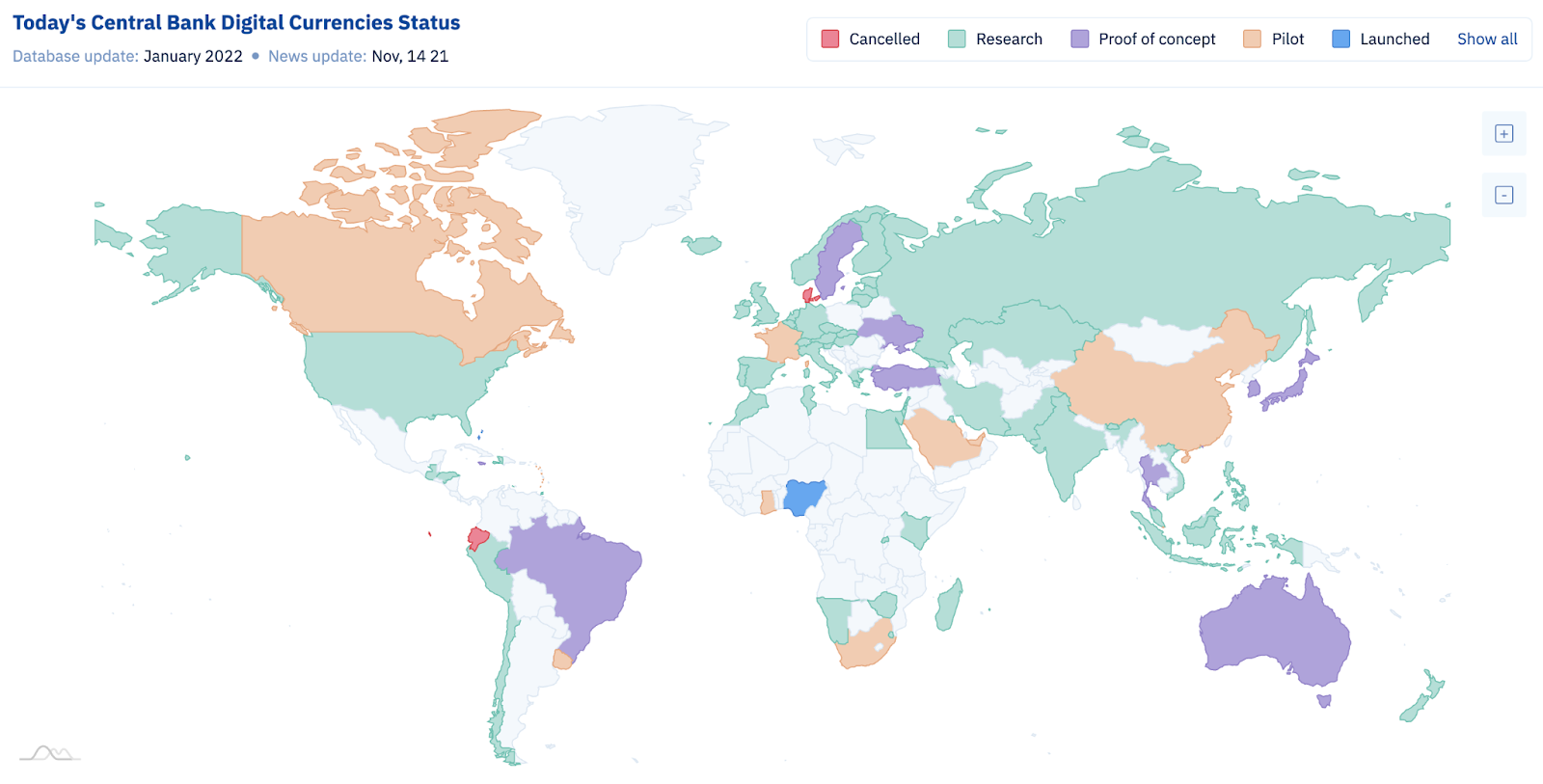

As you can see from the map below (via CBDCtracker.org), a large number of countries have started researching, testing, and piloting central bank digital currencies. This will be a development to keep an eye on going forward. Earlier this month, Congressman Tom Emmer introduced a bill that would prohibit the Federal Reserve from issuing a CBDC directly to individuals. One of the key reasons for this bill is that he believes “Any CBDC implemented by the Fed must be open, permissionless, and private. This means that any digital dollar must be accessible to all, transact on a blockchain that is transparent to all, and maintain the privacy elements of cash.”

The question remains whether stablecoins will eventually be deemed as a security versus property. This could have a significant impact on how public and private stablecoins fit into existing regulation, or if new regulation is needed for the emerging stablecoin ecosystem.

Earlier this month, the Federal Reserve issued its first report outlining what it sees as the key benefits and risks, potential use cases, and related policy considerations associated with issuing a CBDC. The paper notes that “a CBDC would differ from existing digital money available to the general public because a CBDC would be a liability of the Federal Reserve, not of a commercial bank.”

The Federal Reserve lists the following as benefits, risks, and policy considerations:

Benefits

- Safely meet future needs and demands for payments services while providing broad access to digital money that is free from credit risk and liquidity risk

- Improvements to cross-border payments

- Support the dollar’s international role as a dominant currency while lowering transaction costs

- Promote financial inclusion by facilitating rapid delivery of wages, tax refunds, and other federal payments

- Extend public access to safe central bank money

Risks/Policy Considerations

- A CBDC could fundamentally change the structure of the U.S. financial system, altering the roles of the private sector and central bank

- Access to a CBDC could make runs on financial firms more likely or more severe in a “flight to safety” market event

- A CBDC could affect monetary policy implementation and interest rate control by altering the supply of reserves in the banking system

- Privacy and data protection concerns around the general public’s financial transactions

- Operational resilience and cybersecurity threats that come with the digital nature of a CBDC

We anticipate further CBDC conversation and discussion from the Federal Reserve in 2022. The full paper can be found here.

Executive Order on Cryptoasset Regulation

The Biden administration is reportedly preparing to issue an executive order on cryptoasset regulatory oversight as early as February. The exact details are to be determined, however it is anticipated that the order could span across multiple government agencies. Per the Bloomberg report, the administration will likely outline benefits and risks associated with cryptoassets while also providing some much needed regulatory clarity on how the crypto landscape will be governed from a reporting standpoint going forward.

Conclusion

For retail investors and financial professionals alike, regulatory ambiguity is one of the most commonly cited areas of concern when it comes to cryptoassets and DeFi. As the regulatory landscape continues to evolve, financial advisors should remain abreast of updates in order to best fulfill their fiduciary responsibility to clients. Whether stablecoins or other cryptoassets such as BTC and ETH, the likelihood of client participation in the crypto economy continues to evolve, and retail investors would greatly benefit from partnering with trusted financial guides who have taken the time to understand the current state of the crypto economy. Updates such as those listed above offer advisors the opportunity to start conversations with clients about the asset class and help them to Educate Before they Allocate.

With gratitude, Your Onramp family