Welcome to our new series, Node Notes, where we’re spotlighting topics from our bi-weekly research piece, The Node Ahead. If you want to read the full piece, you can check out our blog or sign up to receive The Node Ahead straight to your inbox. This edition of Node Notes is an excerpt from Node Ahead 55.

The world is adopting crypto for its inherent attributes

For the last four years, crypto forensics firm Chainalysis has released an annual study looking at global crypto adoption using on-chain data. The study isn’t simply a measure of which countries have the highest crypto transaction volumes but instead aims to highlight the countries where everyday citizens are embracing crypto the most. The report segments crypto adoption by region and country and aims to reveal how people in various regions are using crypto. The report is always long, dense, and chock-full of great insights into the real-world use of crypto. This year’s version is no different, but if you don’t want to spend your weekend reading 97 pages of crypto data (yes, I realize it’s weird I find that to be an enjoyable way to spend a Sunday), we have you covered with some of the key highlights below.

A long-running theme throughout the Node Ahead newsletter has been an attempt to show that while crypto is mostly viewed as a speculative financial asset in the U.S., crypto is used for very different purposes in other countries. It turns out the 2023 Chainanalysis crypto adoption report has the data to back that claim up. To understand why different regions are using crypto, we have to understand who is using crypto in the first place. The World Bank classifies countries by wealth level based on gross national income (GNI) per capita and then groups countries into four categories as follows:

We can track this trend in another way. Hodler Net Position Change is a metric that shows the daily net position change from wallets identified as long-term holders (aka wallets that historically rarely, if ever, sell their bitcoin). When this metric is negative, it means long-term holders are cashing out of their position and selling their bitcoin back to the market. This has historically coincided with the tail end of a bull market when the price has risen high enough for some participants to take some profits off the table. However, that’s not what is happening now. Hodler Net Position Change has been positive since December of last year, the longest such streak since 2015. And other than a brief panic moment caused by FTX in November last year, Hodler Net Position Change has basically been positive dating back to July of 2022, meaning more and more supply continues to be gobbled up by long-term-oriented market participants. The conviction of long-term oriented holders of bitcoin has arguably never been higher.

A similar story is playing out in Pakistan where a need for wealth preservation in the face of high inflation and currency devaluation has vaulted Pakistan into a world leader of grassroots cryptocurrency adoption. The country comes in at number 8 on Chainalysis Global Adoption Index. And that is despite the fact that crypto trading is formally banned in Pakistan (more evidence that any time governments try to ban crypto, usage inevitably increases because tight capital controls only highlight the need for censorship-resistant money). Pakistani citizens are also barred from holding physical foreign currency which makes crypto the only option many citizens have to preserve any wealth outside their failing economic system.

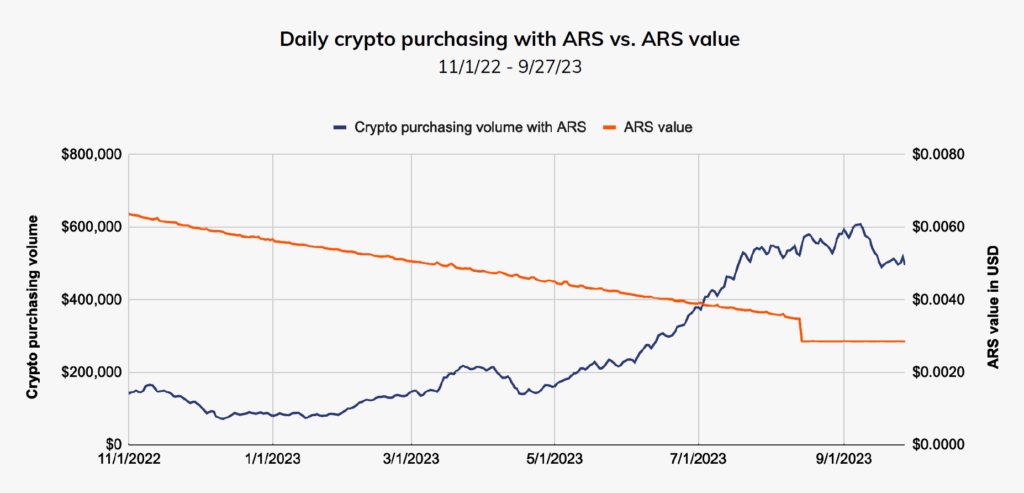

Turkey trails only the US, India, and the UK for total crypto transaction volume over the last year. Turkey has a young, tech-savvy population. It also is facing rising inflation which reached more than 55% in August 2023. That’s in addition to the Turkish Lira crash in 2021. According to Chainalysis’s report, the volume of crypto transactions in Turkish Lira across several exchanges picked up just as the Lira started falling in value earlier this year providing further support to the idea that currency devaluation is driving interest in crypto in the country.

Sub-Saharan Africa has recently become a hotbed of crypto activity, specifically Bitcoin. In Ghana, inflation reached 30% last year, the highest level in over twenty years. Many Ghanaians have since turned to bitcoin as a solution. Kenya and South Africa have also faced similar problems in recent years, and both ranked high in Chainalysis’s index of grassroots crypto adoption. But the poster child for crypto adoption in Africa is Nigeria. Nigeria boasts the largest population and economy in Sub-Saharan Africa and one of the fastest crypto adoption growth rates in the world. The biggest driver of the growth has been the recent Naira crisis which placed enormous pressure on the country’s unbanked population and resulted in record-high inflation of over 20%. Difficult financial and economic conditions are making cryptocurrency an attractive means of storing value, preserving savings, and attaining greater financial freedom for those living in Sub-Saharan Africa.

Bitcoin’s inability to be debased and therefore be a store of value (aka digital gold) is not the only inherent trait it has for citizens living in LMI countries. Crypto is also helping citizens who live under authoritarian governments.

Not only are Venezuelans facing high inflation, but under Nicolás Maduro’s regime, the country has experienced significant human rights abuses and government corruption including embezzlement from the country’s state-owned oil company. Crypto’s ability to send fast, cheap, and secure cross border payments has played an important role in enabling remittances to Venezuela. According to Chainaylsis’s report, “since 2014, there’s been a mass exodus due to the complex humanitarian emergency. Over the past ten years, about 25% of the population has left the country.” That exodus has turned remittances into a huge part of Venezuela’s economy, and many have turned to crypto and stablecoins as a way of sending money back home to their families without the government, which has control of the banks and financial system, taking a significant cut. “Crypto has provided an alternative to democracy activists, NGOs, and freedom fighters to overcome censorship and the closing of the civic space.”

Over the last two years, crypto usage has skyrocketed in Ukraine for two reasons. First, due to the war, citizens have lost access to the traditional banking system. The fact that crypto can be sent and received by anyone with internet access and without the need for a middleman such as a bank, has allowed Ukrainian citizens and the Ukrainian government to receive humanitarian aid when it would have been difficult to do so using traditional financial rails. Second, because crypto can be self-custodied, refugees fleeing the war zone have been able to take their life savings with them. In an interview with Bitcoin Magazine, a Ukrainian refugee tells the story how he was able to escape the country hours before the government closed the borders. At the time, all ATMs were blocked so he was not able to take any of his savings with him. However, he did have bitcoin stored on a hardware wallet and was able to cross the border with enough money to sustain himself and his girlfriend. “With Bitcoin, [this refugee] was able to flee to a foreign country with the wealth that he was able to save from his job, with multiple options to be able to convert that to the local currency, if necessary, as opposed to fleeing with nothing but the clothes on his back and counting entirely on the charity of the people around him when he arrived.” This refugee isn’t the only one, several Ukrainian citizens have shared how crypto is providing a lifeline.

What the Chainalysis report highlights is that the majority of countries with the greatest grassroots adoption of crypto are countries plagued with devaluing fiat currencies, corrupt governments, or in need of humanitarian aid. In other words, most of the world is adopting crypto for its inherent attributes, not as a speculative financial instrument. That bodes well for the future growth of crypto.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.