By Brett Munster, Director of Research at Onramp

Welcome back to The Node Ahead, a cryptocurrency and digital asset resource for financial advisors. Every other week, we discuss the latest crypto news and the potential impacts it may have on you and your clients.

In this edition, we’ll cover the following:

- Why bitcoin could see greater price appreciation in 2024 than it did in 2023

Although bitcoin has risen more than 150% this year, there is a lot of data that suggests we are still in the early stages of the cycle and much greater value appreciation is still ahead of us. Let’s dive into why we believe in 2024, bitcoin and crypto are likely to outperform 2023.

Bitcoin’s Supply Squeeze

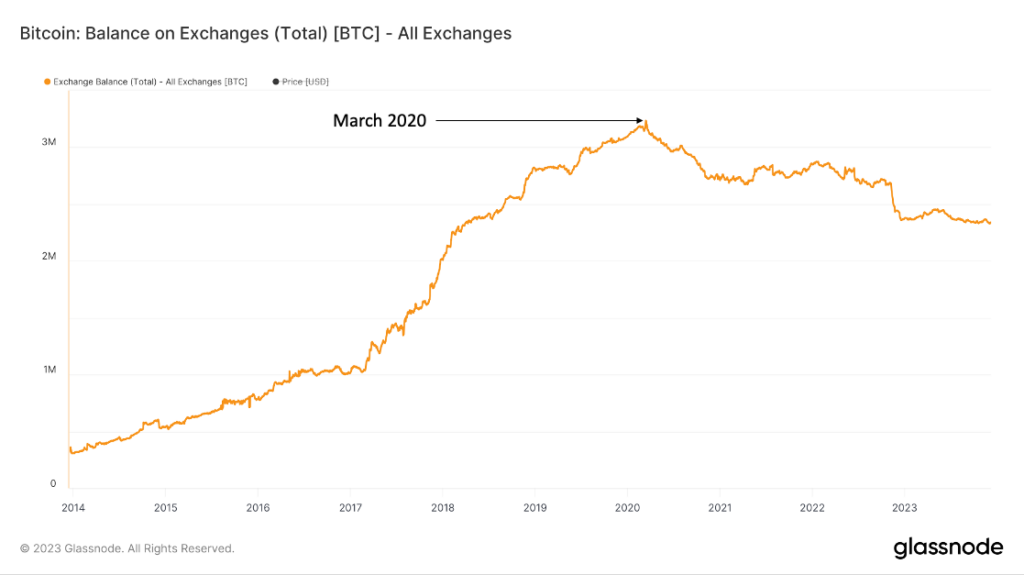

For the first 11 years of bitcoin’s existence, there was an ever-increasing number of coins available to be traded on exchanges. Miners needed to sell their block rewards to finance operational costs and early bitcoin adopters often sold many of their initial coins, happy to have made a substantial profit. As bitcoin’s network grew and more tokens were mined, more and more supply found its way onto exchanges, making the tokens available to be bought and sold.

In March 2020, that trend sharply reversed. Although it’s impossible to know for certain why this trend changed so abruptly, it’s interesting that it coincides with the massive financial stimulus due to COVID. Just saying… Regardless of the reason, for the past 3.5 years, the total number of bitcoin available to be traded on exchanges has been dwindling. That figure across all exchanges is only 2.3 million (less than 12% of all bitcoin currently in existence), the lowest level since early 2018.

Every previous bitcoin cycle in history came during a period in which the number of coins on exchanges was growing. More supply coming onto the market eases demand pressure during bull phases and dampens price appreciation. And yet, despite supply increasing on exchanges, bitcoin’s price still rose triple-digit percentages or more in numerous years. Contrast that to today. This will be the first full cycle in which the available supply on exchanges will decrease. Rather than easing demand pressure as in past cycles, the shrinking available supply is going to intensify the upward pressure on price in 2024.

Market behavior is also noticeably different this cycle. According to on-chain data analytics firm Glassnode, over 70% of all bitcoin in existence has not moved in over a year (an all-time high), over 57% of all bitcoin has not moved in over 2 years (also an all-time high) and nearly a third of all bitcoin hasn’t moved in over 5 years (again, an all-time high). Despite the recent price rise of 60% this year, the vast majority of bitcoin holders are simply not interested in selling at current prices.

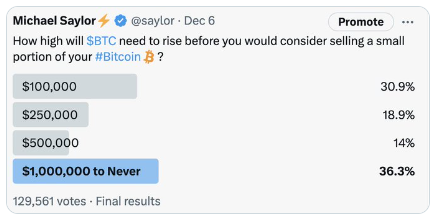

How high would the price have to rise to incentivize these long-term holders to start selling their coins? It’s impossible to know ahead of time but we will be able to see that change clearly in the on-chain data when it happens. However, a recent poll by Michael Saylor might provide some insight. The CEO of Microstrategy asked this very question on Twitter to which he received 129,561 votes. The answer with the most votes was “$1,000,000 to Never.” Now take this result with a grain of salt because this poll is hardly scientific and it’s impossible to know how many bitcoin are owned by those 129,561 responders. However, the fact that nearly 70% of them said they would not sell for anything less than $250,000 per bitcoin and over 1/3 claim they won’t sell for anything less than $1 million per bitcoin goes to show how little appetite there is among bitcoin holders to sell their coins any time in the near future.

And if the current lack of available BTC to buy wasn’t enough, in about 4 months, supply will become even tighter. Every 210,000 blocks (which equates to roughly every four years), bitcoin’s block rewards (the amount of BTC miners earn for mining a block) get cut in half in what is known as “The Halving.” April 2024 will be bitcoin’s fourth halving event cutting the block reward down from 6.25 BTC to 3.125 BTC per block.

What do you think would happen to the price of oil if overnight, half the world’s oil wells went offline? Oil prices would surely rise. Bitcoin is no different. All prior halvings preceded impressive market performance in the 365 days that followed.

And so far, this cycle is not only following the same pattern as previous years, it’s ahead of schedule. As of publication, we are an estimated 126 days out from the next Halving event. At 126 days prior to the 2012 halving event, BTC was still down 79% from its previous all time high. In 2016, BTC was still 65% below its previous all-time high at the same point in the cycle and in 2020, BTC was 61% below its all-time high with 126 days until the halving. As of publishing this article, BTC is only 39% below its previous all-time high meaning price is following a similar pattern but its recovery is happening faster than previous cycles.

Keep in mind that although the daily issuance of new bitcoin was halved in each of those years, which significantly reduced new supply, those price gains were all in an era when the total number of bitcoin available to be traded was still growing. 2024 will be the first halving to ever occur in conjunction with supply on exchanges decreasing. The halving in April will only further intensify the largest supply squeeze in bitcoin’s history.

The bottom line is we have never experienced a bull market in which such few BTC were available to be traded. This increasing lack of liquidity in the circulating supply creates a positive feedback loop as price increases because it takes less net new dollars to move the price upwards in the future.

Speaking of net new dollars…

Bitcoin’s Demand Catalysts

There are no less than 3 potential catalysts that each by themselves, let alone collectively, could lead to a massive influx of net new capital into bitcoin in 2024. Let’s start with the most likely.

1. Bitcoin Spot ETF

Last newsletter we covered why a spot bitcoin ETF instantly creates access for mainstream investors such as registered investment advisors (RIAs), retirement funds and other institutions that have historically been precluded from this asset class. The combined wealth managed by the ETF applicants and RIAs is over $35 trillion. Roughly 50 million Americans already own cryptoassets but 160 million Americans have stock investments. What happens if the number of Americans who own bitcoin triples over the next couple of years simply because access to the asset class becomes so much easier? A mere 1% allocation from RIAs could result in $50 billion worth of inflows into bitcoin. It’s possible that once the ETF is approved, we could see tens of billions of dollars flow into bitcoin over the course of 2024.

According to Coinshares, bitcoin saw only $1.7 billion worth of capital inflows over the course of 2023. During that time, bitcoin’s price rose more than 150% in large part because of the supply squeeze we just discussed in the previous section. There just simply isn’t much supply available to meet any increase in purchasing demand. So, what do you think will happen to bitcoin’s price if we get $10-$50 billion of inflow from the ETF in 2024 as predicted?

2. Corporations

Back in October, we highlighted FASB’s change in accounting rules for cryptoassets. As a quick refresher, historically, companies that held bitcoin on their balance sheet were forced to mark down the value of their bitcoin holdings when the price dropped but were forbidden from marking up the value when the price rose. As a result, many public companies have been hesitant about adding bitcoin to their balance sheets because the accounting standards created a negative signal for Wall Street analysts about the strength of their balance sheets.

In September of this year, FASB changed the accounting rules to require companies to disclose their digital asset holdings at fair market value at the end of each fiscal period. This means that if bitcoin’s price goes up, companies can now recognize that gain in value thereby eliminating one of the largest impediments to corporate adoption of cryptoassets. The new rules officially go into effect for all companies starting on December 15, 2024. However, earlier adoption of the new rules is also permitted, meaning companies can start using fair-value accounting immediately if they want to.

The amount of cash and cash equivalents sitting on the balance sheets of all S&P 500 companies is currently $2.6 trillion. The largest portion of that capital is owned by tech companies who issue little to no dividends and are the most likely of all large corporations to adopt bitcoin in the first place. Even if a small percentage of this capital begins to find its way into bitcoin this year, it’s more than enough to move the needle.

And why would companies add bitcoin to their balance sheets? In addition to bitcoin’s limited correlation with most other assets and its inflation hedge characteristics, companies will be looking at the positive impact we have seen it have on various companies’ stock prices. Microstrategy has been by far the leader in holding bitcoin in its corporate treasury and as we chronicled back in October, it’s also outperformed just about every other stock this year (up a cool 285% in 2023). Not only that, Microstrategy now has over $1 billion in unrealized profit on the bitcoin it bought.

If you are a CEO or CFO of a Fortune 500 company and you see the positive impact bitcoin has had on Microstrategy’s financials, stock price, and media coverage, it would be irresponsible not to at least consider it. Especially now that the accounting impediment is gone.

This is likely a trend that will play out over the next several years but 2024 could be the start of more corporations beginning to add bitcoin to their balance sheets. The bottom line is that the notion of using some percentage of corporate funds to buy and hold bitcoin is becoming an increasingly more attractive option by the day.

3. Looser monetary policy & greater liquidity

The last couple of years we have seen the Fed tighten monetary policy in an effort to fight inflation. In the back half of 2023, not only did they stop raising interest rates but in the most recent FOMC meeting, signaled that they could possibly start reducing interest rates next year. When the Fed previously finished its hiking cycle and kept interest rates at the same level for seven months in 2019, Bitcoin prices rose nearly 300%.

Truth be told, I’m no macroeconomist. I honestly have no idea what the Fed will do in 2024 (therein lies the problem because I do know with 100% certainty what bitcoin’s monetary policy will be next year). But central bankers now expect 75 basis points in rate cuts in 2024. Next year is also an election year and it wouldn’t be the first-time monetary policy was used to stimulate the economy right before a presidential election. If that happens (emphasis on the “if” because again, no one knows for certain what the Fed will do including the Fed), that should be good news for bitcoin holders because historically, bitcoin’s price has risen when liquidity conditions are eased.

Even if interest rates don’t come down, we are all but guaranteed to see massive amounts of money printing in 2024. As we covered in November, decades of deficit spending continue to compound due to ever-increasing interest expense, thus requiring structural and perpetual high rates of monetary debasement just to keep the government functioning. The U.S. budget deficit just hit record highs this past November due to skyrocketing interest costs. We outlined why this interest payment will keep growing exponentially in previous newsletters. At our current pace, we will run a deficit of $3-5 trillion in 2024 which would be a new record for this country.

That money has to come from somewhere. Unless there are severe cuts to entitlements (no chance of that happening in an election year), the only way the government will be able to keep the lights on will be to print record levels of new money. Historically, when money printer go brrrrr, bitcoin tends to perform very well.

Given the supply squeeze that was discussed in the previous section, there simply isn’t enough BTC available to meet any significant increase in demand. Price will have to rise high enough to entice long term holders to sell. And as we saw earlier that price is likely multiples of where bitcoin’s price stands today. If any one of these three catalysts materialize in 2024, it could cause bitcoin’s price to skyrocket higher and faster than most people expect. If all three of them happen, well…I might not need to write this newsletter for much longer (just kidding, I love writing this newsletter, but you get my point).

Bitcoin’s fundamentals continue to improve

One of the recurring themes of this newsletter has been that because this is still an emerging industry, price is not a reliable signal for real world adoption. Sometimes bitcoin’s price crashes even as adoption increases (as was the case in 2022) and sometimes the price gets way out ahead of its fundamental value (as was the case in 2017). This is where analyzing the on-chain data becomes so valuable. So, let’s ignore price for a second and look at what is happening on the network.

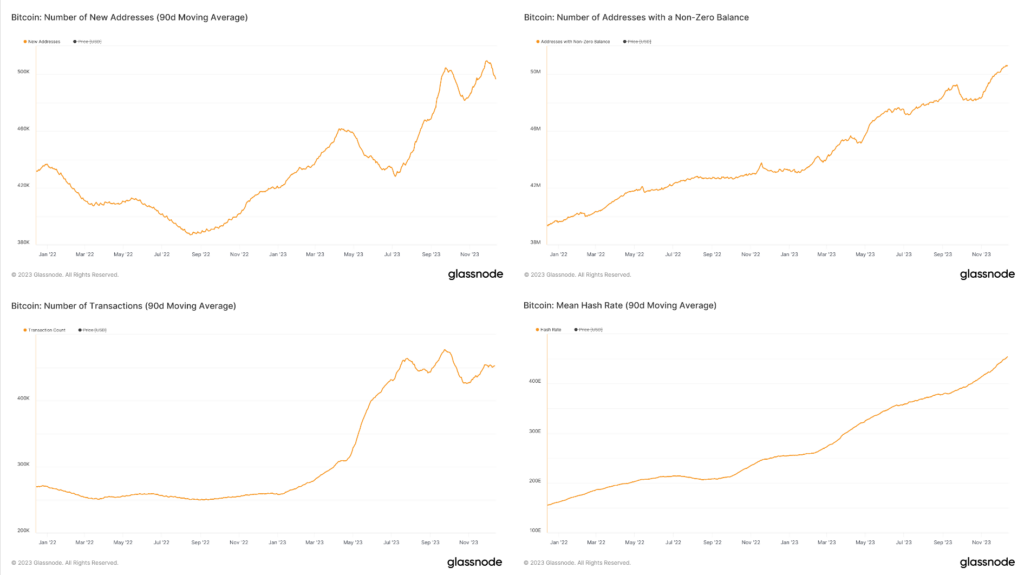

Over the last two years, just about every fundamental indicator of usage and adoption has been growing. We have seen the number of new addresses added to the network substantially increase, especially in 2023. In fact, we haven’t seen this level of new addresses coming onto the network since the peak of market prices back in 2021. The total addresses that hold some amount of bitcoin (ie: filtering out any zombie addresses), has also been on a non-stop growth trajectory. Even in 2022, when price crashed more than 60%, more addresses held bitcoin at the end of the year than the start. That trend accelerated this past year. After being flat for much of 2022, the number of daily transactions has skyrocketed in 2023. More and more people are sending and receiving bitcoin than any time in history. Lastly, the amount of computing power on the network (aka Hash Rate) has nearly tripled in the last two years. With BTC prices increasing and mining becoming more profitable, it’s likely bitcoin’s hash rate will continue to increase in the coming year.

Binance, the world’s largest crypto exchange, has 150 million customers throughout the world. To put that in perspective, that’s more customers than Fidelity, Charles Schwab, E Trade, and TD Ameritrade combined. Coinbase has nearly 100 million users. That is nearly double the number of customers JPMorgan Chase has. No wonder Jamie Dimon feels threatened by the crypto industry. And that is before the ETF is approved, which will only make access easier. In the not-too-distant future, the number of people who own bitcoin and crypto assets is going to exceed the number of people who own stocks.

We are still early in the cycle

The bear market of 2014 was followed by three years of positive returns. The bear market of 2018 was also followed by three years of a bull market. Should history repeat itself again, 2023 would be just the first of a three-year bull run following the 2022 crash. Even more interesting is that in each of the previous cycles, year two of the bull market saw larger gains than the year prior. History would suggest that 2024 will outpace the gains we saw in 2023.

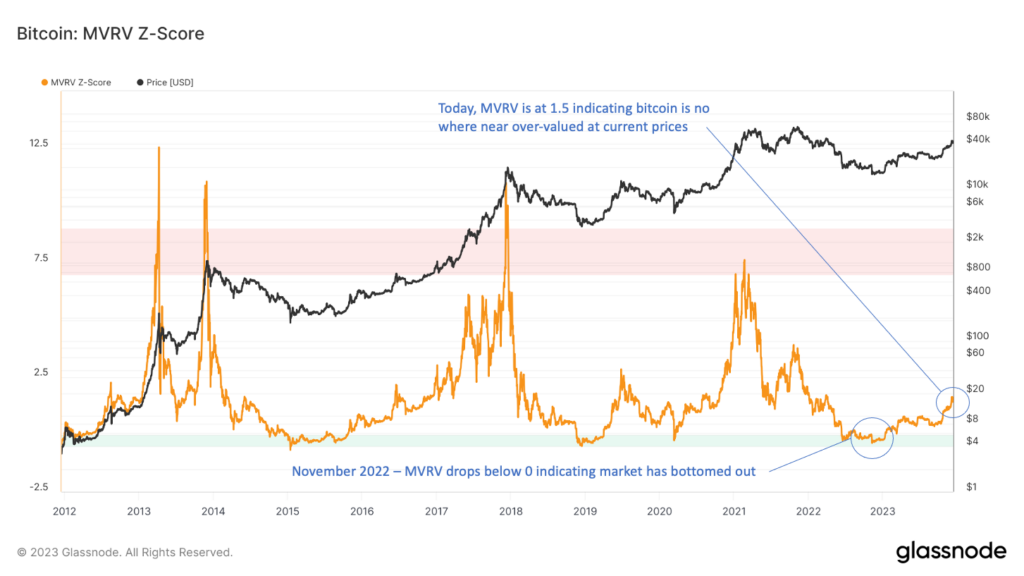

But past performance does not guarantee future results. So let’s take a more data-driven view on the topic. Early this year we published a research report explaining why we believed the market had bottomed out in November 2022 based on a number of on-chain metrics. Nearly a year later, it’s worth revisiting many of those same metrics.

We begin with one of the most reliable market cycle metrics, MVRV. MVRV has historically been a great on-chain indicator of market tops and bottoms because a high ratio indicates that the price has appreciated to a point where holders are sitting on a lot of unrealized gains and may look to sell soon. Last November MVRV fell below 0 for only the fourth time in history which was one reason why we believed the market had bottomed. Today, MVRV has rebounded to 1.5 which is no longer market bottom territory, but still very low relative to historical norms. When MVRV reaches above 6, that has historically correlated with market tops and as you can see in the chart below, we are a long way from that level.

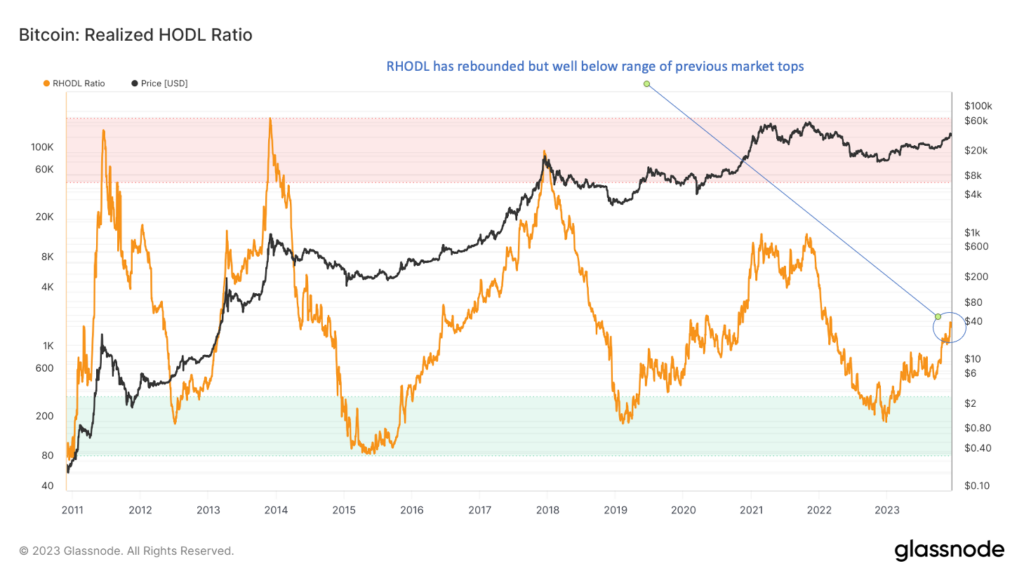

Because long term holders and short-term market participants have very different behaviors, analyzing the age of coins moving is also a valuable market indicator. The Realized HODL Ratio (RHODL) compares the movement of coins that have not moved in a long time (aka older coins) to coins moved more recently (aka younger coins). Because older coins tend only to sell when there is a large run up in price, this metric gives us a clear view into the cyclical nature of long-term holders selling to short term market participants. As a result, RHODL tends to closely track with the macro market cycles. A high RHODL ratio (red band in the chart below) is an indication of an overheated market with lots of previously locked up supply coming onto the market and has historically corresponded with cycle tops. Today, the RHODL ratio has been increasing but still at relatively muted levels indicating long term holders are not moving their coins much at all.

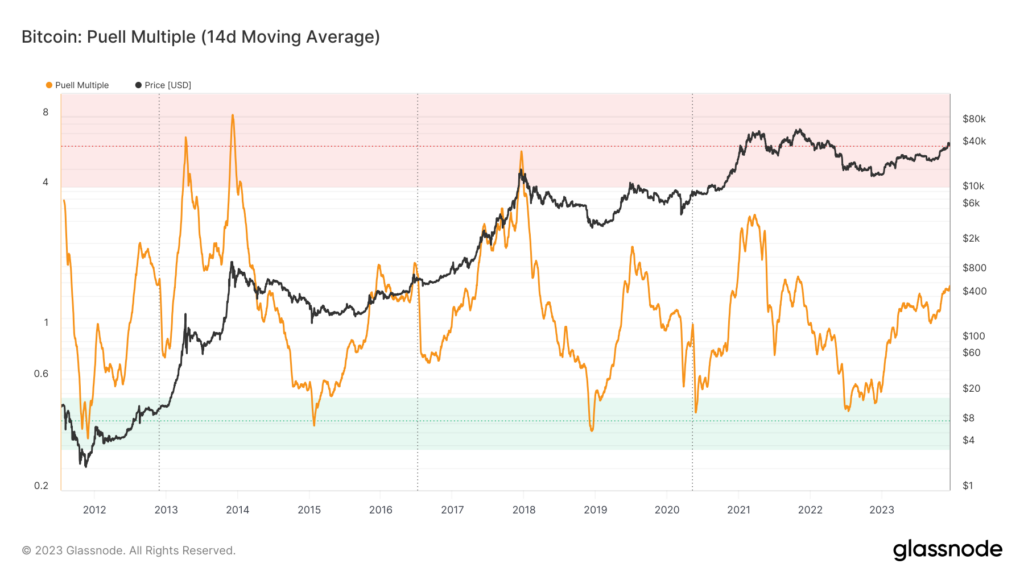

Lastly, because miners are the lifeblood of the network, it’s worthwhile tracking their behavior as well. The Puell Multiple tracks current miner revenue and compares it to the annual average income. A high Puell Multiple indicates that mining operations are more profitable at that moment in time than other periods of the year and therefore need to liquidate fewer coins to pay for operations. This allows miners to begin building reserves, decreasing supply of BTC on the market, and putting upward pressure on price. Due to these market incentives, the Puell Multiple can be a valuable indicator for identifying tops and bottoms of market cycles. Whereas the Puell Multiple bottomed at the end of 2022 and recovered in 2023, its sitting at relatively modest levels, indicating miner profitability has not reached levels typically associated with market tops.

Recap

We have the largest supply squeeze in bitcoin’s history coinciding with one of the largest demand catalysts to ever occur in bitcoin. That’s before taking into account the potential impact of corporations allocating to bitcoin, favorable macro tailwinds, and the halving event in April. The usage and adoption of bitcoin is increasing by almost every measure. The number of people who own bitcoin, the Hash Rate, and network transactions are all at all-time highs and growing. Consistently dwindling supply. Rapidly increasing demand. Doesn’t take a rocket scientist to figure out what happens next.

Despite a 150% increase in price this past year, every historical measure indicates that the majority of gains this cycle have yet to come. There will be corrections along the way, but zooming out, bitcoin is far from overvalued based on historical metrics.

This article focused exclusively on bitcoin because as the largest cryptoasset, it tends to lead the way at this point in the market cycle. Most institutional buyers coming into the space for the first time in 2024 are likely to start with bitcoin. But I could have just as easily written a similar bull case for Ethereum and other cryptoassets as well (though my editor would have killed me if I had written 120 pages on the entire crypto ecosystem, so I kept it to BTC only).

The bottom line is 2024 is shaping up to be arguably the most asymmetric set up we have ever seen, not just in crypto, but maybe in any asset class. The biggest risk you can take right now is having zero exposure to bitcoin and crypto.

As always, the on-chain data is provided by Glassnode. If you would like to have access to the data yourself, you can sign up here:

In Other News

A federal judge threatened to sanction the SEC’s lawyers after their “false and misleading” arguments prompted a court to impose a temporary restraining order on crypto firm Debt Box.

Crypto lobbying in the U.S. is on course for new highs this year.

A new pro-blockchain bill clears the first hurdle in the U.S. House.

BlackRock and Bitwise both updated their S-1 filings with the Securities and Exchange Commission for proposed spot bitcoin ETFs.

Coinbase, has rolled out a new feature to allow users to transfer crypto with a link that can be sent through social media platforms, messaging apps, and email.

Bitcoin is earning its spot in a balanced portfolio.

60 Minutes recently featured Crusoe Energy, the company that specializes in capturing wasted methane for bitcoin mining.

Disclaimer: This is not investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature and does not address the circumstances of any particular individual or entity. Opinions expressed are solely my own and do not express the views or opinions of Blockforce Capital or Onramp Invest.