Cryptocurrency questions and solutions exist in essentially every area of financial planning. Clients are investing in cryptocurrency regardless of whether or not they tell their advisors. Advisors, at the very least, need to understand the cryptoasset class to meet the basic requirement of understanding the client’s full picture. This proficiency is needed to guide clients to their previously stated risk tolerance, determine implications, and to appropriately model volatility in simulations. Beyond simply gathering information retroactively, cryptoassets solutions can be suggested and/or applied to various steps of the planning process to help clients achieve goals related to debt management, high interest savings, tax strategy, estate planning and more. Potential strategies exist within the cryptocurrency space in areas beyond what many advisors think of as “speculative” investments including potential debt management solutions for clients with low credit scores or higher interest savings accounts through stable coins (see discussions below). Even if cryptoasset solutions are not ultimately chosen by the client they should at least be presented in an unbiased manner when analyzing options in order to best serve the client.

Financial Planning Process

First, let’s outline the 7 step financial planning process:

- Understanding the client’s personal and financial circumstances

- Obtain qualitative and quantitative information

- Analyzing information

- Addressing incomplete information

- Identifying and selecting goals

- Identifying potential goals

- Selecting and prioritizing goals

- Analyzing the client’s current course of action and potential alternative courses of action

- Analyzing current course of action

- Analyzing potential alternative courses of action

- Developing the financial planning recommendations

- Consider the assumptions and estimates used to develop the recommendations, the basis for making the recommendations (including how the recommendation is designed to maximize the potential to meet the client’s goals), the timing and priority of the recommendations, and whether the recommendation is independent or must be implemented with another recommendation

- Presenting the financial planning recommendations

- Implementing the financial planning recommendations

- Addressing implementation responsibilities

- Identifying, analyzing, and selecting actions, products, and services

- Recommending actions, products, and services for implementation

- Selecting and implementing actions, products, or services

- Monitoring progress and updating

- Monitoring and updating responsibilities

- Monitoring the client’s progress

- Obtaining current qualitative and quantitative information

- Updating goals, recommendations, or implementation decisions

Cryptoassets fit into all categories of the financial planning process. Advisors begin this process by obtaining quantitative information on a client’s held-away cryptoassets. The CFP® Board states “if an advisor is unable to obtain information necessary to fulfill the scope of engagement, the CFP® professional must either limit the scope of engagement to those services the CFP® professional is able to provide or terminate the engagement.” As of today, many advisors are not yet taking the steps necessary to see their client’s non-discretionary cryptoassets. In this case, if the client is holding material cryptoassets away from an advisor who is unaware of these holdings, fulfilling the financial planning requirements could be substantially limited.

As mentioned previously, when developing financial planning recommendations, advisors must establish a framework for forward looking assumptions and estimates of cryptoassets. In traditional asset classes such as equities and fixed income, it is common to use rolling historical risk and return data for planning assumptions. Given that cryptoassets have limited historical data, further analysis will likely need to be completed to determine an appropriate risk and return assumption. This will fall under the discretion of the advisor, but should be backed up with evidence similar to any other assumption adjustments.

Implementation of cryptoasset planning strategies could look quite different for advisors. Contrary to traditional portfolio management, crypto investors could be more likely to invest on a “do-it-yourself” basis rather than through an advisor. Due to this key difference, advisors may need to require additional follow-through steps to ensure financial planning recommendations are implemented by their client in a timely and thorough manner. Keep in mind, this trend could shift as advisors educate themselves on cryptoassets and become more aware of the option to allocate their clients to cryptoassets on a discretionary basis.

Advisors may need to reduce the timeframe for monitoring a client’s progress if the client invests in cryptoassets. Given the historic volatility (upward and downward) of cryptoassets, planning opportunities such as rebalancing or tax planning strategies may arise more frequently. It will be important for advisors to establish a cadence for monitoring these assets.

Financial Planning Statements

As with any asset, cryptoassets should be included in a client’s balance sheet. Advisors will need to navigate the complexities of cryptoasset liquidity when evaluating the client’s statement of financial position.

Below are a few example liquidity items that may need to be considered:

- Are the cryptoassets held in non-qualified or qualified account

- Are the cryptoassets staked? Is there a timeframe for unstaking the assets?

- Are the cryptoassets lent out via a liquidity pool?

- When receiving an airdrop, are the cryptoassets available today or is there a vesting period?

- Are the cryptoassets held in cold storage or on an exchange? Are there approximate timeframes in the event of liquidating the cryptoassets?

- What is the volume for the cryptoasset? How many marketplaces provide liquidity for the cryptoasset?

- In the case of a Non-Fungible Token (NFT), how liquid is the market? Does the advisor have a reasonable valuation method for the NFT?

Financial planning statements could look quite different when cryptoassets are included. A variety of factors such as the above will need to be considered. The CFP® Board states that advisors should “evaluate client financial statements using ratios and growth rates and by comparing them to relevant norms.” Advisors will include cryptoassets in ratios such as liquidity ratio, net worth, debt-to-asset ratio, savings ratio, and more.

Cash Flow Management

Cash flow management is an essential part of a client’s financial plan. Advisors work with their clients to gather paystubs, expense reports, bank statements, and other documentation to create detailed cash flow reports. In the years ahead, income and expense flows could look different if the client chooses to utilize the crypto ecosystem. Let’s take a look at some of the changes we are seeing. Tools are being developed by major custodians such as Coinbase and Gemini that allow a client to direct deposit into these accounts. This could be tempting for clients due to the high interest rates currently available for stablecoins. Many of these custodians are rolling out credit and debit cards to spend directly from a crypto account. The spending accounts tend to offer cash-back features similar to traditional payment methods. As an example, Coinbase has partnered with Visa on a debit card that allows clients to pay at any Visa merchant with USDC, a leading stablecoin in the crypto ecosystem. This card allows for 1% “cash” back in the form of USDC, Bitcoin, or Ether. If clients begin to participate in these saving and spending tools at crypto custodians, advisors will need to factor this into their cash flow planning. Advisors may even begin to recommend certain products in the crypto ecosystem to help with a client’s cash flow needs. It is important to keep in mind that spending directly from a crypto account could continue to blur the line between “investment accounts” and “cash accounts.” These accounts are typically separated in traditional finances, so what key differences could we see in a crypto centered cash flow environment? In financial planning tools, the client’s expenses/budget are input and play an important role in determining net cash flows. When long-term invested assets (cryptoassets in this case) are held in the same account, a budget will be even more important in order to maintain appropriate levels of spending. The ease of access to tapping long-term assets makes budgeting more vital. Additionally, if clients are holding a portion or all of their liquid assets in stablecoins, it is easier for a client to “invest” those stablecoins into other cryptoassets such as Bitcoin or Ethereum. This is a behavioral phenomenon that advisor’s will need to discuss with their clients to ensure they are not taking excess risk with cash balances, especially emergency reserves. It is worth noting that spending cryptoassets triggers a taxable event, we will touch more on this in the tax planning section.

Potential crypto income sources:

Mining Staking Interest-bearing Accounts Lending Yield-Farming Airdrops Direct payment in cryptoassets As money market accounts and savings accounts offer historically low interest rates on deposits, advisors will likely need to continue to evaluate if better savings options are available. Generally speaking, advisors typically recommend anywhere between 3-6 months of liquid savings for emergency fund purposes. Clients are currently sitting on record levels of cash and cash-equivalents, while the U.S. experiences it’s highest level of inflation in decades. Based on current interest rates, clients could earn up to 8.05% APY on their USD holdings by depositing into the GUSD stable coin at Gemini. Clients can withdraw their assets instantly to their bank from Gemini Earn without withdrawal fees. Advisors must do their due diligence on these products to help their clients allocate their cash reserves appropriately.

Financing Strategies and Debt Management

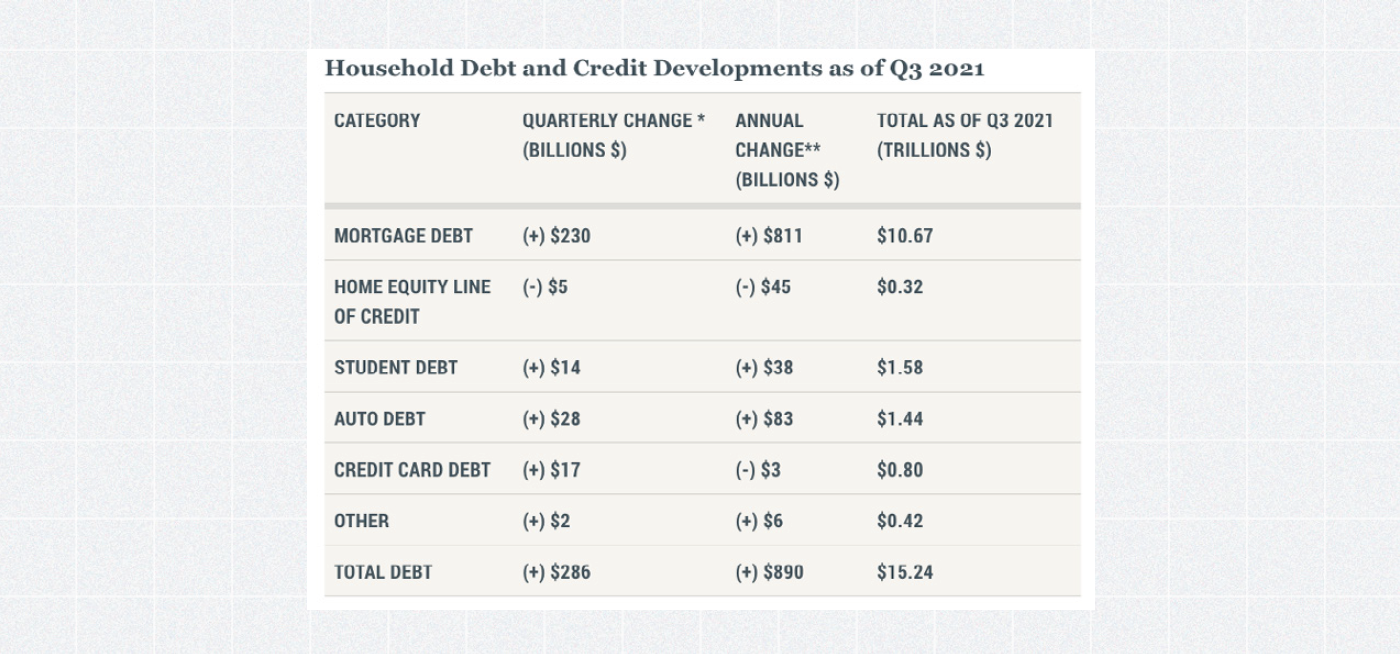

Household debt levels in the U.S. topped $15 trillion for the first time in 2021. While mortgage rates have remained at historically low levels, interest rates on other forms of debt remain inflated. For example, personal loans and credit cards each have average interest rates topping 10% annualized. While student loans interest rates remain anywhere between 5-10% annualized as well. It is no secret that we are seeing many Americans struggle with paying high sums of debt. Could decentralized finance play a role in lowering the debt burden owed by borrowers? Let’s take a look at some of the trends we are seeing.

Decentralized finance protocols such as Aave and Compound are open-source, autonomous protocols built to enable efficient lending and borrowing of cryptoassets. If clients are holding significant amounts of cryptoassets, they may have the opportunity to borrow and obtain liquidity through these types of protocols without selling their crypto. This allows the client to continue receiving the upside of the cryptoasset, potentially save on taxes, and also borrow at a low interest rate. Many financial planning opportunities could arise from these scenarios. Similar to traditional finance, fixed and variable rates are offered within DeFi. At the time of this writing, borrowers were able to access the stablecoin USDC at a 4% fixed rate on both Compound and Aave. This is offered to borrowers without a credit check, waiting period, or other forms of data collection. One of the biggest differences compared to traditional finance is that most DeFi protocols, such as Aave, do not have a fixed time period to pay back the loan. Therefore, as long as the borrow amount maintains appropriate levels of collateral, in some cases the borrower may never need to pay back the loan. There is no penalty for “missed” payments or early payoffs. These are significant advantages to borrowing within the DeFi ecosystem. Taking this one step further, platforms such as Alchemix (a future-yield backed synthetic asset platform) allow for DeFi loans to repay themselves by auto-generating yield on the cryptoassets used as collateral. As opposed to traditional banking, the “health” of these borrowing pools are open to the public’s eye. This allows both the lender and the borrower to maintain visibility into the size and utilization of the liquidity pool. These examples are only a glimpse into the full capabilities of DeFi borrowing and lending. In the next few years, advisors will need to have an understanding of borrowing capabilities using these types of protocols. In regards to debt management, the CFP® Board states that advisors must:

- Analyze the various sources of borrowing and communicate advantages and disadvantages of each

- Create a debt management plan that minimizes cost and maximizes potential to reach the client’s financial goals

- Review all types of client debt and provide recommendations on optimal management of debt within the context of the client’s overall financial plan

- Evaluate the financial effects of reducing or increasing debt on the client’s probability of success in meeting short-term and long-term goals

Decentralized finance could offer a variety of solutions for client’s to refinance their debt at lower interest rates, pay off debt in lump sum, or potentially take on debt to fund emergency expenses or cash flow goals. As mentioned above, this type of debt management could be utilized as a tax planning strategy as well. Although the world is just beginning to recognize the power of decentralized finance, this space could have a major impact on client debt strategies in the near future.

Economic Concepts

Similar to the traditional world of finance, supply and demand is a key factor in determining the “value” of a cryptoasset. The case could be made that supply and demand is all that matters in the pricing of stocks and other securities. However, there are many factors that can impact the overall demand for and supply of traditional assets. Some examples:

Leading Indicators:

- The Yield Curve (Interest rates)

- Durable Goods Orders

- Manufacturing Jobs

- Building Permits

Lagging Indicators:

- Unemployment Rate

- Corporate Profits

- Gross Domestic Product

- Consumer Price Index (Inflation data)

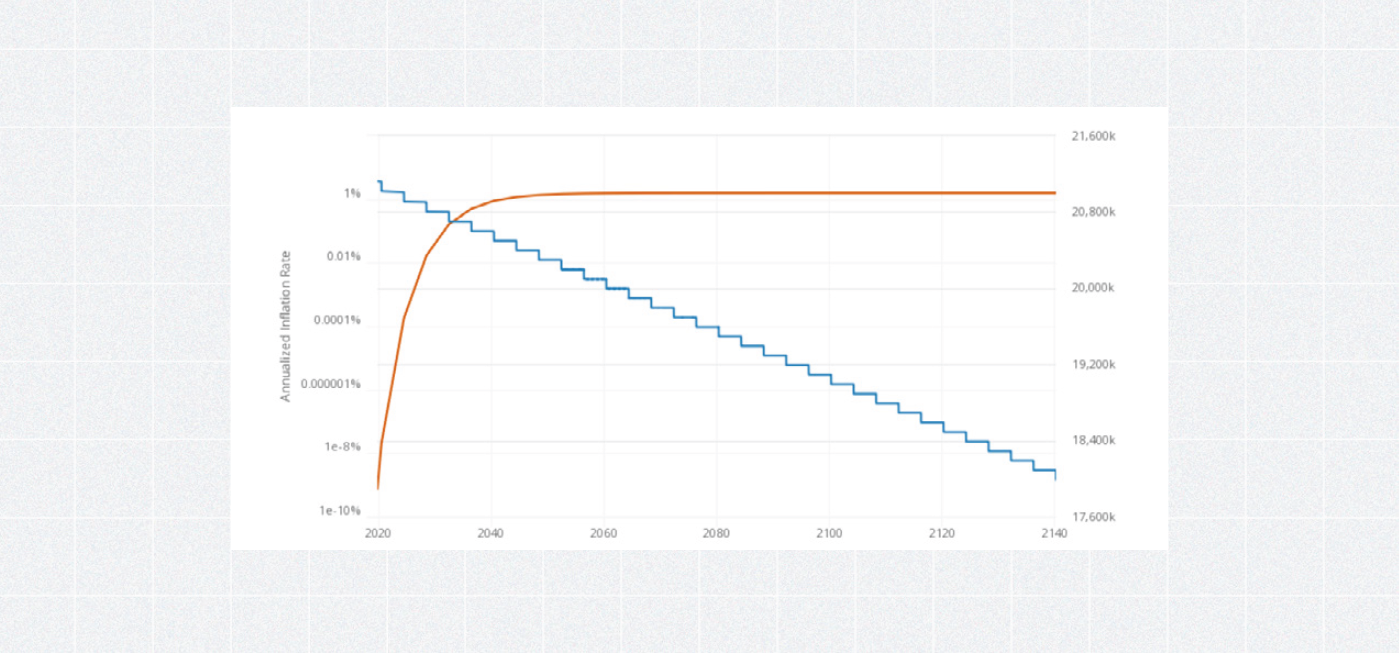

All of these economic indicators can impact the “demand” for a good or service. Additionally, companies and governments alike can shift the supply of an asset as well. In the case of a company, they could buy back shares of stock, offer additional shares, or spin-off an entity. On the other hand, governments can issue additional supply of their currency, purchase their currency back to decrease supply, or increase/decrease taxes. How do cryptoassets differ from traditional assets? It starts with a term called “tokenomics” in the crypto world. Going back to cryptoasset 101, blockchains determine the supply and demand rules for specific cryptoassets. Cryptoassets can be digitally programmable, potentially leading to less “manipulation” of the asset.

Take Bitcoin for example:

Bitcoin has a maximum supply of 21,000,000. Approximately 90% of this supply is already in circulation. Every four years or so, bitcoin experiences a “halving” where the rate released to network validators gets cut in half. This is a major difference compared to centralized currency supply, where currency can be added or removed from the supply at the decision of government officials. In the case of Ethereum, the circulating supply is around 119 million. There is no “cap” on how much ETH can exist, but Ether has a “burn” mechanism to potentially stabilize the amount of ETH being created. This could lead ETH to be a deflationary asset if the network usage remains high, but this is yet to be determined. Tokenomics will likely continue to transform the way we view incentive structures. All types of tokens exist in the crypto ecosystem today; payment tokens, utility tokens, security tokens, governance tokens, and non-fungible tokens to name a few. As advisors evaluate a cryptoasset, it will be important to analyze the supply and demand structure of the asset just as they would with traditional assets.

Education Savings Vehicles

Earmarking funds for education goals often requires a balance between tax-advantaged savings and maintaining liquidity of the funds. A few of the most common savings vehicles include 529 Plans, Coverdell Education Savings Accounts, custodial accounts (UTMAs/UGMAs), Roth IRAs, and non-qualified investments. At this point in time, there are minimal options to allocate to cryptoassets within tax-advantaged education savings accounts. Progress is being made in this area, however. DirectedIRA allows clients to set up and fund a crypto Coverdell ESA account using Gemini as the custodian. There are income phase out limits associated with these types of accounts. In the coming years, other tax-advantaged education savings accounts could include cryptoassets as an investment option as well. Occasionally, advisors will recommend using non-qualified assets to fund a portion of a client’s educational goals. This allows the client to maintain a certain level of liquidity and flexibility in the event the funds aren’t needed for educational purposes. Given the current volatility of cryptoassets, it will be important for advisors to consider frequent rebalancing and have a clear understanding of the timeframe for when the funds are to be used.

Access the Full Report

Our full report is available for all Onramp Academy users. The intent of the report is to provide financial advisors with a resource to compare their current credentials with the potential credential curriculum of the future. The report is 55 pages in length and includes cryptoasset commentary on each of the eight sections of the CFP® exam (including the newly minted Psychology of Financial Planning section). In our opinion, it’s a must-read for every financial professional as the space evolves in the digital realm!

If you are not an Academy member, use the form below and we will email you the report.

As always, educate before you allocate!

With gratitude, Your Onramp family